This week at Frequent Miler, we looked at a number of means of getting the best deals: from your Bank of America cash back cards, by manufacturing cheap airline elite status, utilizing a lesser-known Marriott feature, and more. Read on for some tools you can use.

BOA Platinum Honors: Different treatment for Cash Rewards vs Cash Rewards for Business

Bank of America’s Platinum Honors can be a great deal in terms of boosting your earnings on some Bank of America cards. Unfortunately, there is a key difference in how the bonuses are applied on business cards versus personal. In this post, Greg highlights this important difference that we had previously missed.

Manufacturing airline elite status, infinitely.

One of the lesser-discussed perks of the Chase Ritz and CNB Crystal Visa Infinite cards is the Visa Discount Air program. While I thought there had been some minimum instituted to be able to use the benefit, it seems that is no longer the case. In this post, see how you could theoretically use this benefit to generate elite status very cheaply. This is most realistic for those who are already part of the way there and need X number of segments on the cheap, but it could be a fun story for someone willing to fly 30 or 50 segments just to earn status.

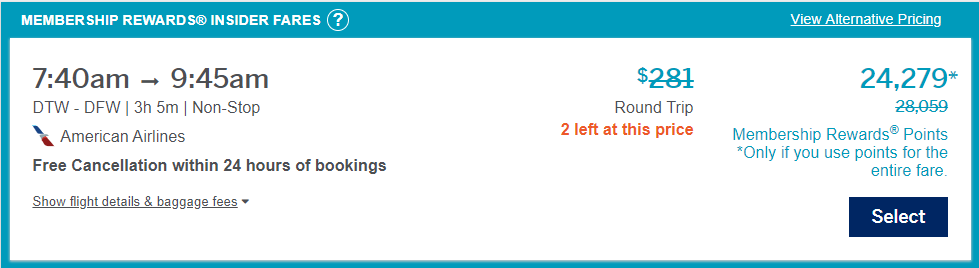

Membership Rewards Insider Fares: average 1.7 cents per point with the Business Platinum card

If you have a good stash of Amex Membership Rewards points and you have a Business Platinum card, you may just want to check Amex Travel the next time you’re booking a paid ticket. While I wouldn’t say that I often find great deals with Amex’s “Insider Fares”, Greg shows several examples where you could get solid value out of your points.

Is the Alliant Cashback Visa still worth it?

I love points and miles and all, but some things just require cash. The Alliant Cashback Visa has been my favorite all-around long-term cash back card. However, a recent change in the annual fee had me rethinking the card’s value as compared to a no-fee 2% card. The truth is that the long-term value was already questionable for many people and now I think it’s probably not worth it for most customers beyond year 1.

Bet You Didn’t Know: Maximizing Marriott’s 5th Night Free on longer stays

You know when you search online for the answer to a question and you see the date on the post answering that question is two or three years old? If you’re like me, you probably assume that page/post is no longer relevant and you look for something more recent. Turns out that’s not always the case as Greg dug up this old gem from more than four years ago. You probably wouldn’t believe that Marriott wants to save you money, but they do. See this post for how.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![Sharpening your coupon-clipping scissors, great value hotels, shopping portal myths, and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/04/Quarterly-hotel-credit-218x150.jpg)

![Qatar’s hierarchy of award access, 3% bonus offers that won’t last, tools you may be forgetting and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2024/04/hierarchy-218x150.jpg)

![Priority Pass shakeup, how to find regional first & luxury hotels for fewer points, and more [Week in Review] a roller coaster with people on it](https://frequentmiler.com/wp-content/uploads/2019/03/rollercoaster.jpg)

my Alliant card is 3% cash back.

^ What do you even say to this?

How about something like “learn how to read” or “stop being lazy and read” or “read before posting comments”?

really nice advice