Last weekend, my wife applied for the SPG Luxury Card. Her application was denied. The reason? She already had 5 Amex credit cards, and despite my own recent experience to the contrary, Amex is still enforcing that limit.

It turns out, that her application denial may have been a very good thing. Her regular SPG card account now displayed a 100K upgrade offer to the Luxury card:

We clicked the link and upgraded her card instantly.

In general, upgrading rather than applying new has a few advantages:

- There will be no new credit inquiry

- No new account will show up on one’s credit report (so, it won’t hurt your 5/24 status)

- Your average age of credit won’t be impacted

Usually, the main disadvantage of upgrading rather than applying new is that you’ll get a smaller welcome bonus, if any. In this case, my wife was offered the same bonus as the current public offer for signing up new: 100,000 points after $5K spend. Others have received worse offers, so keep that in mind if your upgrade offer isn’t as good.

Upgrading to the Lux card with the 100K upgrade offer has these additional advantages:

- You should be eligible to earn up to $300 in Marriott/SPG statement credits right away, and then again after your card’s anniversary date. Since the Lux card’s annual fee will be prorated, this may mean paying significantly less toward the annual fee for your first $300 in credits. Then, once you hit your anniversary date, if you keep the card, you’ll pay the usual $450 annual fee and will be eligible for another $300 in credits.The upgrade offer specifically lists the following details about the annual fee:

“Annual Membership Fee: Approximately 45 days after your account is upgraded, you will be charged a prorated Annual Membership Fee for your new Card based on the time remaining until your next account anniversary date. You will also receive a prorated refund for any annual fee paid on your previous Card.” - You will get the 50K free night instead of the 35K free night on your card account anniversary. The upgrade offer page made this clear with the following: “The redemption level for the Free Night Award benefit you receive is based on the Card product you have at the time of your renewal.“

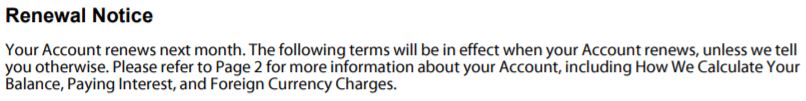

Depending upon when your account anniversary is, the above benefits could be huge. In my wife’s case, I think we hit upon the ideal scenario. Her most recent statement closed on August 19th. Within the statement, I found that her account renews next month.

And by logging into her account, we can easily see that the end date for her current account year is September 18th:

I believe this means the following:

- For this one month, my wife should be charged approximately 1/12th of the $450 SPG Lux annual fee and rebated 1/12th of the $95 SPG consumer card fee. Her total cost for the month should be just under $30.

- If my wife uses her card (or I use the authorized user card in my name) to spend $300 at Marriott or SPG properties by September 18th, she will get $300 back. Plus, she’ll get another $60 back thanks to a great new Amex Offer, if we complete that spend at Marriott properties specifically.

- Sometime after September 18th, my wife should receive a 50K free night certificate (good for any property that costs up to 50K points per night). If she hadn’t upgraded, she would get a 35K free night certificate. Amex says this about the timing of the certificate: “The Free Night Award will be automatically deposited into your loyalty member account within 8-12 weeks after your Card Account anniversary date in the form of an e-certificate.”

- Sometime after September 19th, my wife will be charged the full $450 for the next membership year.

- Beginning September 19th, my wife can qualify for another $300 in Marriott/SPG statement credits.

- Each year, upon renewal, she will get another 50K free night certificate.

In short, by upgrading instead of applying new, my wife will still get the same welcome offer, but should also get an extra $300 in statement credits and a much better free night certificate for only about $30 in extra fees!

Caution

After deciding that my wife’s upgrade made sense, I found that Doctor of Credit had already written up the same idea. In the comments of that post, though, people report that Amex customer service agents told them that they would not be eligible for the $300 statement credit until renewal. I believe that they are wrong. As Doctor of Credit points out, the terms & conditions support our view that we should be eligible for the statement credit immediately upon upgrading. He writes: “Multiple readers are reporting being told that you don’t receive the $300 credit in that first prorated year. The fine print doesn’t say this at all, so I think you should be able to get it and use it but YMMV.”

Planning

I think that the ideal time to upgrade from the SPG Consumer Card to the SPG Luxury Card is a month or two before your card’s anniversary date, especially if you have a Marriott or SPG stay planned for that time (so that you can get the $300 in credits right away).

Of course, you’d also want to make sure that you have a good upgrade offer. Our own Stephen Pepper found that the old Amex interface (which some of us use to load Amex Offers) did not show an upgrade offer at all. The regular interface (americanexpress.com), showed him an offer, but it wasn’t a good one: Only 15,000 points.

Thank you so much for the detailed post! Question on the schedule of free night certificate with upgrade –

1. Opened SPG consumer in Aug 2018

2. Upgraded to Lux in Jan 2019

Will I receive the free night after Aug 2019 or Jan 2020

You have mentioned the best time to convert is a month prior to anniversary. Just wondering if there is a miss of a free night certificate in that situation depending on the above point.

Never mind. I missed the obvious. It is based on the initial card opening date so thats Aug.

[…] Offers might not be the only thing you’re missing out on. I’d already noticed a couple of months ago that an (albeit terrible) upgrade offer to the SPG Lux card only appeared […]

I got 100k upgrade offer and upgraded now. I won’t be staying in Marriott soon. So can I get marriott gift card to get $300 credit ? I called some Marriott hotels nearby and they don’t sell gift card. I am not sure online purchase of Marriott gift card will be treated for $300 credit.please suggest what to do?

Keep calling Marriott hotels until you find one that sells gift cards. Or book a prepaid reservation and pay with Lux card

Just upgraded to the Lux and since it says I keep the same card number as the regular SPG, then all the spending I do now on the regular card should count toward the spend requirement for the bonus points right? So I wouldn’t need to wait for the lux to arrive in the mail.

Yes that’s right.

i bought $301 gift card on Oct 20 at marriot courtyard front desk. On Oct 22, i got $60 credit . I havent received #300 credit yet. How long i need to wait to get it? Should i contact Amex ?

In my case I got a credit within a few days I think. The question about whether to contact Amex is a tough one. Technically you’re not supposed to get reimbursed for gift cards

Am I correct that buying a $300 gift card at the front desk of a Marriott will count for the bonus?

Yep

New to this discussion and I’ve been away, so please excuse me if I am asking something stupid.

Where do I find this upgrade offer for 100K? Is it targetted?

It’s targeted. Look in your email, on the banner when you log into your amex account and in your amex offers.

Thanks. No offer at all for me.

Try logging into your account and clicking the menu, “Cards”, “View all credit and charge cards”. Look for the SPG Lux in that list. It should include an upgrade offer there if you are eligible (note that not everyone has the 100K / $5K offer….some have no offer and some have a lame offer for something like 10K or 15K points).

Checked again, the card is there but no bonus. Asked AMEX too. I guess they don’t like me – actually I know they don’t. They barely tolerate me.

If you look in your Amex Offers, you will find it there. It’s one of the offers where the logo says American Express.

Hi, appreciate some good opinions on whether or not the upgrade is worth the effort if my annual fee date is in april 2019. It basically becomes a split even proposition, correct? Because I’ll pay about $300 in fees to get $300 back and so really it’s whether or not I want the 100K bonus? And finally, if I do my stay before the prorated annual fee even posts (but do get the $300 credit), can I cancel the card and not pay the annual fee?

Hard to say. In my account, the upgrade offer said valid until 10/31/18. If that’s also the case for you, you could wait until nearer the deadline to upgrade and then that would be about 6 months before your anniversary, right? So you’d be looking at around $225 I think for $300 in credit and the 100K bonus. Based on our Reasonable Redemption Values, 100K Marriott points are worth around $700. I also assign some intangible value to the ability to earn a ~$700 bonus without it counting against 5/24.

The value proposition is not as good as if your annual fee were soon to post.

In the situation Greg outlined here, the deal is better in part because his wife will pay the $450 fee to renew. That strengthens the deal because it should mean both a second $300 credit plus a free 50K night. Basically, for under $500, she’ll end up with:

A) $300 credit for this year

B) $300 credit for next year

C) 100K Marriott points

D) 1 free 50K night

Note that we still need to gather data points to be sure that the $300 credit will post twice, but we think it will.

In your case, to get the same list of benefits, you’d pay something around $675 (assuming you upgrade close to the 10/31 deadline). That’s still a good deal in my opinion, but less exciting. If I were in your shoes, I would probably hold off and hope to see another similar upgrade offer between now and April. But if you have a valuable use for the 100K points (maybe you plan to use them at the off-the-charts properties or a place where you can get north of 1c per point…heck, I used 7500 Marriott points over the weekend for a free Cat 1 night at a property that was $132+ that night), maybe the upgrade is worth it. That’s up to you to decide.

If you have no intention to renew and pick up the 50K certificate, then it comes down to whether you’re willing to pay ~$225 for the chance to earn 100K plus the $300 in credit. That’s still not bad.

My case was similar to Greg’s wife. My $95 AF was soon to be due. If I kept my regular personal card, I’d get a 35K free night. By upgrading, the $300 + $300 Marriott credit wipes out the cost of the annual fee for me plus I get a better free night. I have a tentative trip to Japan in the works next year and there are a number of 50K properties in Tokyo. Hotel prices are high in Tokyo, so I realized that this upgrade + keeping the Ritz card will save me money / Ultimate Rewards for that specific trip as I’ll end up with a 50K cert from this card, a 50K cert from the Ritz card, and enough points (100K) for two more nights in Tokyo. That trip isn’t definite, but I’m confident I’ll put the certs to valuable use even if not, so I went ahead and did the upgrade.

Hi Nick,

Thanks for the reply – it’s helpful! I went ahead and upgraded yesterday after finding out I could shift a couple of high price expensable charges to the card that day. Didn’t want to wait too long bc the window of opportunity on these charges have deadlines.

The rep on the phone said that the fee would prorate in 45 days and could give me the proration for the $95 but not for the $450. I did some math and came up with $189 for the next annual fee which was better than I thought. Since I’ve got this SPG trip end of september for the $300 credit, I went ahead and did it.

I don’t know how much I value the 100K marriot points emotionally…not that much. But since I can make the $5K spend, I guess I will.

There is definite language from Amex about gaming the system, so canceling right after I get $300 credit is not an option. I’m sure they will yank the credit back and put me on some blacklist.

Also, Greg posted earlier that his wife already got the $300 credit, so I think that’s a definite data point we will receive credit this year.

Greg, we’re on a similar timeline as your wife. My husband’s card renews on Oct 7. We upgraded on Aug 29 and have already spent $300 and received the credit. The fee proration makes sense as you describe in the article. However, my husband received a letter that states, “During the billing period that closes on or after Oct 17, you will be charged a prorated annual membership fee for your new card product based on the time remaining until your next account anniversary.” This makes it sound as if we’ll be charged from Oct 17, 2018 – October 7, 2019 at that time. What about the prorated fee from our upgrade date of Aug 29 until October 7 anniversary date? If they don’t charge for that period of time, then I’m questioning whether we’ll be able to get another $300 credit after October 7. Hope that makes sense . . .

[…] days to contemplate these cards before making my final decisions. Beyond the analysis here, the upgrade offer to move my SPG card to an SPG Luxury card looms and is a further motivating factor in determining what to keep and what to toss — […]

Update: My wife already received the $300 in credit for spending $300 at a Marriott hotel. She should be eligible for another $300 late next month!

I saw 100K upgrade offer in my current Amex SPG card account. And I got Marriott Premier reward card last October. Does any one know if I am eligible for 100k bonus points through upgrade? I know I won’t be eligible if I apply it as a new card (since it’s less than 24 months)

Yes, that’s fine. The upgrade offers don’t have the same restrictions.

Signed up for the Lux card last weekend, and received it in the mail today. Primary reason for applying was to get the SPG Platinum Elite status…since I already had $75k + in charges this year – was hoping that I’d have it for a few trips this year. Then I noticed in the fine print that it will take 12 – 16 weeks to receive the status. Feeling a bit deceived!

That language is pretty typical on this like this. I think the language on the Ritz card said 8-12 weeks. Data points indicated that status usually reflected within about a week. I think the new cardmember welcome offers also have language indicating that it can take a couple of months for the points to post – but they usually post very soon after meeting spend. I wouldn’t expect it to really take that long.

@ Greg – FWIW, talked to am Amex CSR yesterday and — after putting me on hold — he also came back and said that $300 would only be available once full $450 fee hits (in January for me). I’m hoping it’s not like that and it becomes available once the prorated charge hits at the latest (mid-October for me).

Either way, would appreciate if you would post an update whenever the dust settles and we find out what is going to be the policy.

My wife already got the $300 credit, so the rep was definitely wrong

Thanks, Greg!

Got a 100K offer as well. My understanding is that without staying at Marriott chain and using those $300, this cards make no sense. Question about status – I’ll get Gold benefits with the card. If I’ll cancel say in May 2019, will benefits continue to last till the end of 2019 (like with Hilton) or will I be downgraded in a matter of days or weeks ?

I got approved and have the card. The online application asked for my rewards number so I listed my Marriott number. When the card came there was a note with a “new” number. Now, I have both an SPG old and new number and a Marriott as well. Has anyone else encountered this? Solutions?

Open a chat dialogue with Amex and ask them to change the Marriott number to the one you want.

Why do business with a company when they are incapable of answering their help emails or their telephone calls?

My wife has the SPG Lux 100k upgrade offer on her SPG card (expires 10/31/18). We have a late-Oct (25-28 Oct) Autograph Collection hotel reservation. Her SPG card renews on 9/14/18, but we have no travel plans between now and then. She also has an AMEX offer on her SPG card for $60 off a $300 Marriott stay (expires Oct 25). My questions – 1) It looks like the $300 “double dip” strategy is out (no Marriott stay before 9/14/18), correct?; 2) Can we “double dip” the SPG Lux $300 credit (assuming she upgrades immediately after 9/14/18 (we have no foreseeable use for the 50-k free nite over a 35-k free nite) and the AMEX offer (which is added to the SPG card and hopefully “rolls over” to an upgraded SPG Luxury card) by paying for the Autograph reservation (and asking the desk clerk to process the transaction) the day we check-in?

Also, is there any utility in not combining both our SPG and Marriott accounts so that we can transfer her SPG points to me prior to combining each of our respective SPG and Marriott accounts? Secondary question is, by maintaining uncombined Marriott and SPG accounts, will my wife’s SPG card earned (bonus or otherwise) points still be added to her SPG (rather than Marriott) account?