| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

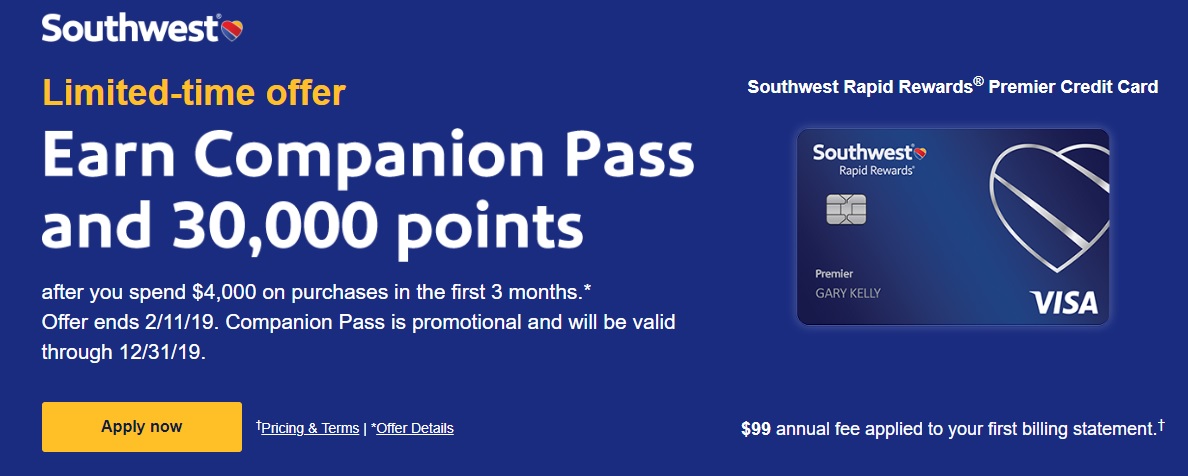

There is a new offer out all three personal versions of the Southwest Airlines Rapid Rewards credit cards, and it’s a pleasant surprise for some: Earn a Companion Pass valid until 12/31/19 and 30K points after making $4,000 in purchases in the first 3 months. That’s an awesome deal that re-opens the Companion Pass to those who do not qualify for the business card.

The Offers

- All three Southwest Airlines personal credit cards are offering a Companion Pass valid through 12/31/19 and 30,000 Rapid Rewards points when you make $4,000 in purchases in the first 3 months (click on the offers below to go to our dedicated card pages and find application links)

| Card Offer |

|---|

50K points ⓘ Affiliate 50K points after $1K spend in the first 3 months.$69 Annual Fee After clicking through, be sure to manually select the exact Southwest card in which you are interested. This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 75K after $3K in 3 months [Expired 12/11/23] |

| Card Offer |

|---|

50K points ⓘ Affiliate 50K points after $1K spend in the first 3 months.$99 Annual Fee This card is known to be subject to Chase's 5/24 rule. Recent better offer: 75K points after $3K spend in the first 3 months. [Expired 12/11/23] |

| Card Offer |

|---|

50K points ⓘ Affiliate 50K points after $1K spend in the first 3 months.$149 Annual Fee This card is known to be subject to Chase's 5/24 rule. Recent better offer: 75K points after $3K spend in the first 3 months. [Expired 12/11/23] |

Key Card Details

Here are the key details on each card:

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card can be great for its new cardmember bonus, but its ongoing perks are worth the annual fee only if fully used each year. $69 Annual Fee Earning rate: 2X local transit and commuting, including rideshare ✦ 2X internet, cable, phone services, and select streaming ✦ 2X Southwest Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year. Noteworthy perks: 3000 bonus points each year upon card renewal. 2 EarlyBird Check-Ins each year. 10,000 Companion Pass qualifying points each year |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: The combination of 6,000 points plus 2 EarlyBird Checkins each year make this card a keeper for those who fly Southwest often. $99 Annual Fee Earning rate: 3X Southwest ✦ 2X Rapid Rewards(R) hotel and car partners ✦ 2X local transit and rideshare ✦ 2X internet, cable, phone services, and select streaming ✦ 1X on all other purchases. Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 1,500 TQPs for each $5K in purchases Noteworthy perks: 6000 bonus points each year upon card renewal. 2 EarlyBird Check-Ins each year. 10,000 Companion Pass qualifying points each year ✦ 25% back on in-flight drinks, Wi-Fi, messaging, and movies. |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Great for frequent Southwest flyers - this card could easily be a long-term keeper. $149 Annual Fee Earning rate: 3X Southwest ✦ 2X Rapid Rewards(R) hotel and car partners ✦ 2X local transit and rideshare ✦ 2X internet, cable, phone services, and select streaming ✦ 1X on all other purchases. Card Info: Visa Signature or Platinum issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 1,500 TQPs for each $5K in purchases Noteworthy perks: ✦ 7,500 anniversary points each year ✦ $75 Southwest annual travel credit ✦ Four A1-15 boardings every year ✦ 25% back on in-flight drinks, Wi-Fi, messaging, and movies. ✦ 10,000 Companion Pass qualifying points each year |

Quick Thoughts

I strongly believe that the Southwest Companion Pass is the hands-down best deal in domestic travel. See our Southwest Airlines Companion Pass Complete Guide for more information about how the pass works.

We have only once before seen an offer like this and it was targeted to residents of California. As far as I can see, this offer is open to anyone — provided of course that you qualify for a Southwest airlines welcome bonus. Remember that all three cards are subject to the Chase 5/24 rule.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Furthermore, the welcome bonus is not available if you have earned a welcome bonus on any of the three Southwest Airlines personal credit cards in the past 24 months. That clock runs from when you earned the welcome bonus (it doesn’t matter when you opened or closed the card but rather the date you were awarded the points). It is also not available to those who currently have a Southwest personal card. In other words, if you currently have a Southwest credit card open, you would need to cancel that before applying (I’d suggest waiting at least a week or two after canceling). This new offer is scheduled to end 2/11/19.

Keep in mind that if you were to apply today, your first statement would likely cut in February. If you hit the spending requirement in the first month, you’ll have the Companion Pass for about 10.5 months. That’s clearly not as slick as getting it for 2 years — typically the easiest path to the Companion Pass has been to open 2 Southwest credit cards and meet the spending requirement early in the year to earn the pass for the rest of that year and the entire next year. If you’re eligible to open a business card and a personal card when the bonuses are at / near enough for the 110,000 points for the pass, you’ll both have the pass longer and have more points to use. However, that path is harder today than it was in the past due to 5/24 and the 24-month restriction. If you’re under 5/24, this path requires less spend (update: remember that Chase business cards do not add to your 5/24 count). Furthermore, you’ll get enough points to likely book at least one free trip for you and your companion. I think that’s not a terrible trade.

Out of the three cards, I’d probably lean towards the Priority card as I think its benefits are the best bang for the buck, but the bonus is identical on all three. Whichever card you choose, this is a great deal if you’re interested in the Companion Pass.

[…] back… but this time it seems to be targeted. Just like a similar offer in 2019, you can now get a Southwest Companion Pass good through 12/31/2020 with just one credit card sign […]

[…] FM: WOW! Companion pass & 30K points with 1 card […]

[…] & a companion pass for 2019 I called the offer quite weak and a masterstroke of marketing. Nick over at Frequent Miler disagreed with me and Greg even chimed in with a FM vs DoC post. I thought a post explaining my reasoning in […]

[…] & a companion pass for 2019 I called the offer quite weak and a masterstroke of marketing. Nick over at Frequent Miler disagreed with me and Greg even chimed in with a FM vs DoC post. I thought a post explaining my reasoning in […]

[…] & a companion pass for 2019 I called the offer quite weak and a masterstroke of marketing. Nick over at Frequent Miler disagreed with me and Greg even chimed in with a FM vs DoC post. I thought a post explaining my reasoning in […]

[…] & a companion pass for 2019 I called the offer quite weak and a masterstroke of marketing. Nick over at Frequent Miler disagreed with me and Greg even chimed in with a FM vs DoC post. I thought a post explaining my reasoning in […]

Can people earn the companion pass if they use a referral link?

You learn whatever bonus you see when you click the referral link. I believe the referral link is still showing the old 60k offer, but I could be wrong.

I would have gone for this if there was a business card offer since I’m about to apply for an important premium card. And if I had another definite trip for this year

[…] these offers, our own Nick Reyes said: “Wow!” and “this is a great deal if you’re interested in the Companion […]

anyone know if other bonus offers are still available? Just got SWA business car dfor 60000miles for.$3000 spend. Was planning on a new personal for 40000 miles for $2000 spend. After that I need only 5000 miles with a maximim of $5000 spend for a total of $10,000spend to get CP for 2 years.

This new way appears to cost more: 60000miles on Business card-spend $3000; 30000miles on personal for $4000spend and I’m still short 13000miles -requiring approx another $13000 spend additional to get CP for 2years. Altogether that’s an outlay of $20,000 vs $10,000 above

help…

So if I wanted to get the Companion Pass for 2 years, are there 2 cards available that get me there (or close)? I see these new 30K+CP personal cards and 60K Business. Would we need to get a 30K+60K and then still need to spend $40K more to make up the difference? Thanks!

$13k rather

Yep, not sure where I got $40K. Shouldn’t do math in my head! Thanks

Hmm.. Trying to figure out the break-even on this offer vs the previous 60k points. The 30,000 point difference is worth around $500, right? So you would need to use your companion ticket more than $500 worth in 10.5 months to come out ahead vs past sign-up offers for these cards?

Next year is the ideal time for me to finally go for a companion pass as husband and I will be almost empty nesters. However, I hate to miss out on this easy track because we could both get it and use it for a few trips in 2019.

So here is my question: if I get this card this year, will I still be eligible to get bonus for a SW personal card in 2020 as long as I’m okay on 5/24 and it is a different personal card (ie, I get priority card this year and premier next year)?

I’m thinking husband and I both get the one-shot deal this year, then I apply for a business and a personal at the end of this year to get a single companion pass that will work for 2020/2021.

Re-reading the above…the answer is no because I can’t have earned the bonus on any of the three personal cards in order to be eligible.

No.

“Furthermore, the welcome bonus is not available if you have earned a welcome bonus on any of the three Southwest Airlines personal credit cards in the past 24 months. That clock runs from when you earned the welcome bonus (it doesn’t matter when you opened or closed the card but rather the date you were awarded the points). It is also not available to those who currently have a Southwest personal card”

Once you get a welcome bonus on a personal card, you’re locked out for 24 months on all 3 personal cards.

Are you planning to travel with other people? You mentioned being empty-nesters. If it’s just the two of you traveling, your best bet is for one of you to get the one-shot deal now. You could then still get the business card this year for 60K. That’d give you 96K towards earning the CP through the end of 2020 (including your points from minimum spend). Pick up a couple of referrals or some shopping portal points to get to 110K and you’ve got the CP through the end of 2020 — open the business card at your leisure rather than doing all of the spend up front.

Then, have your husband apply at the end of 2020 for 1 biz + 1 personal and pick up the pass for 2021 + 2022.

It’s obviously different than earning via 2 cards at once, but I like this easy 1-year path also. Alternatively, don’t bother with the business now and have your other half do 1 biz and 1 personal at for 2020/2021 and get 3 years of CP with 3 credit cards (1 now for you and 2 later for him). Also a pretty good deal. By the time you’re done with his CP, you’ll be eligible for the welcome bonus on the Southwest personal cards again.

I just want to ensure that I understand the whole picture. I obtained the biz this past December but have not put any spend on it (bonus: 60k with $3k spend). Now, I just need the personal card. Let’s say I get the “30k + CP” today, and meet both bonuses in January, I’ll have CP for the rest of 2019 (from the personal card). However, I’ll only have 97k (63k from biz and 34k from biz)…13k short of CP for 2020. however, I have all year to spend the other 13k to get CP for 2020, correct? Additionally, what determines the date I am locked out to get another bonus? Am I locked out of the bonus til January 2021 (because I received the CP is January 2019) or locked out for the date when I received 110k? For example, if I meed both bonuses in January 2019, but I don’t obtain 110k until July 2019, am I locked out of CP til July 2021?

The date you receive the new cardmember bonus on the personal card (the 30K points and CP) is the date that matters. Assuming you meet the spending requirement this month, your statement will cut sometime in February — that statement cut date should be the date you receive the bonus and you would then be ineligible until that date in February 2021.

If and when you reach 110K has nothing to do with Chase welcome bonuses — that’s a Southwest thing that is independent from Chase.

nick, need advice on this scenario – wife got approved for biz in late dec, applied for personal earlier this mo but was pending b/c chase insisted to view her equifax rpt… so at this time, could she unfreeze equifax to apply for this 30k card? if so, she’ll get CP til 12/2019 while continually put addl spend to add up to 110k pts as u mentioned earlier for CP til 12/2020? Thx

Nick, you’re answer still isn’t clear to me. Sorry. Let’s make it yes or no answer.

I get both the SWA business card (60,000 points bonus) and also the SWA card (30,000 points bonus) discussed in the headline. After reaching 20,000 additional points through spending, do I get free companion pass through 2020.

Also, is the companion pass good for only one chosen person, or can I give it to different companions for different flights?

Thanks!

Yes.

You can change your companion 3 times per year.

More here: https://frequentmiler.com/complete-guide-southwest-companion-pass/

[…] the news of the new sign up bonus for Chase’s Southwest cards, people are understandably rushing to earn a new companion pass. The new cards all offer 30,000 […]

This is a good deal… Since I need 2 seats –or more– I’m wondering if I should get a really overweight companion too.

That would be almost like first class. Then I’ll need all of my ESA clones, one for each disability.

Two fat people with 10 cloned beagle mix dogs on your next flight ……should make it worth traveling just to see this!

.