Almost a year ago, Wyndham Rewards changed how you redeem their points for reward nights. Prior to that, every one of their properties cost 15,000 points per night regardless of whether you were staying at a $40 per night Super 8 or a $300 per night property in Manhattan. That April 2019 change resulted in some properties halving to 7,500 points and others doubling to 30,000 points.

Wyndham Rewards has now announced that they’ll be making some adjustments to those categories. The 7,500 / 15,000 / 30,000 levels will remain, but 500 will go down a category and 300 will go up a level.

These category movements will come into force on February 11, 2020. If you make a reservation before that date and the property subsequently becomes more expensive, you won’t be charged more. If the redemption cost of the property you’ve booked goes down on February 11, Wyndham will automatically credit your account with the difference.

The fact that Wyndham will automatically refund you for any stays where the cost goes down is a nice touch, as is giving a two week heads-up about these changes rather than introducing these changes overnight with no notice. On the negative side though, they’ve not provided a list of the 800 properties that will be moving up or down a category which, at the very least, is something Marriott does with its annual devaluations.

When the three redemption thresholds were introduced last year, 2/3 remained at 15,000 points. About 1/3 moved down to 7,500 points and the remaining 200 went up to 30,000 points per night. Even though Wyndham hasn’t advised which properties will be changing category, they’ve confirmed that 80 properties will increase from 15,000 to 30,000 points per night and the remaining 220 will increase from 7,500 to 15,000 points. As for the reductions, there might be one or two 30,000 point properties going down to 15,000, but I wouldn’t hold out too much hope for that.

In the past I’ve always booked our occasional Wyndham stays through Hotels.com to take advantage of gift cards we’ve bought for 20% off seeing as the Wyndham Rewards program isn’t particularly rewarding. However, I recently jumped on the status merry-go-round and so am a fairly recently minted Diamond member in Wyndham Rewards. I’ve therefore been doing a few more searches on their site recently to check out my rate options and have noticed that several low cost properties cost 15,000 points per night for reward nights. It makes no sense redeeming that many points when you can book the room for $50 which is why I think most of the properties going down a category will be doing so from the 15,000 level. Besides, with only ~200 properties currently at the 30,000 level and 500 properties going down a level, it stands to reason that the vast majority will currently cost 15,000 seeing as there are only three category levels.

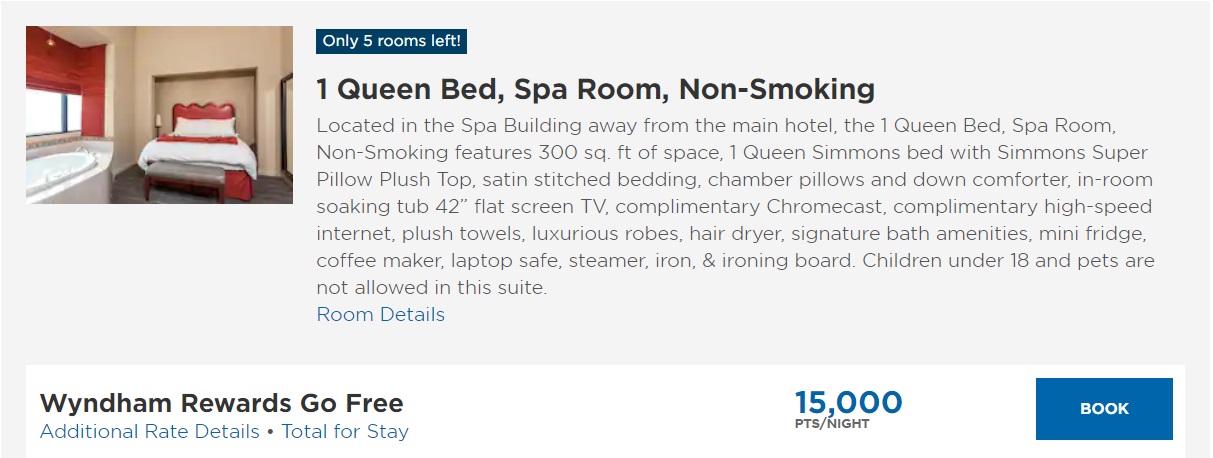

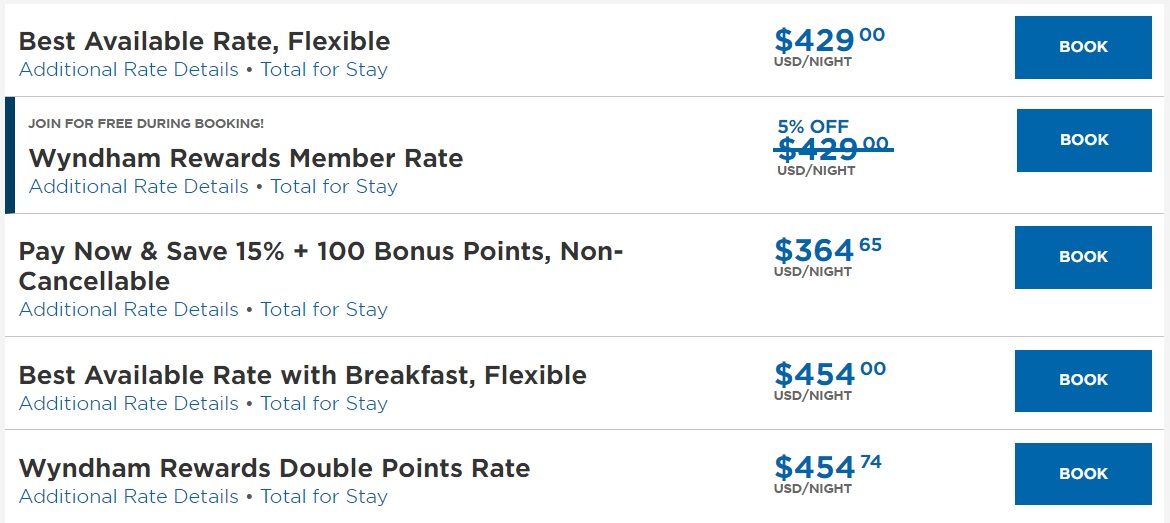

As for the 80 properties going up from 15,000 to 30,000, there are still some great value options out there for 15,000 points in the Wyndham Rewards program, so it’s not surprising some changes are being made. For example, we’ll be spending a few weeks in Arizona in March and I recently took a look at our options in Sedona. The Sedona Rouge Hotel & Spa, Trademark Collection by Wyndham stood out to me as you can book straight into a Queen Spa Room for only 15,000 points per night.

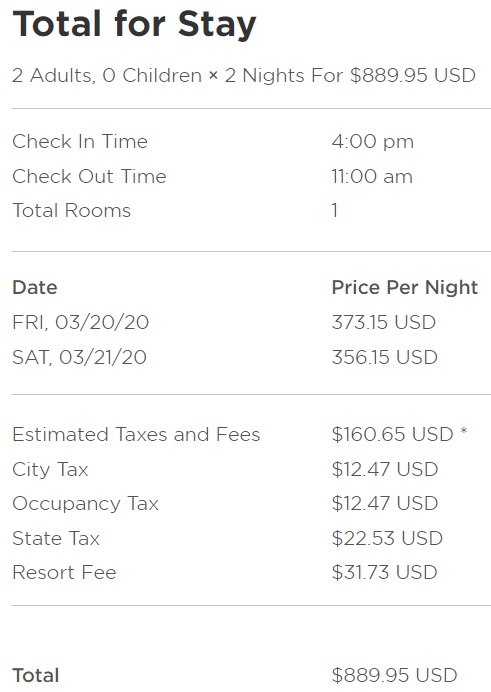

If you paid cash, that would cost $365 per night before tax which is a non-refundable rate. For a flexible rate, you’d be looking at more than $400 per night before tax.

Even if you went for the non-refundable rate, your total cost would be almost $900 for only two nights for a weekend stay in March. That means you’d be getting almost 3cpp when redeeming 15,000 points per night which is excellent value.

I find it hard to imagine that opportunities like this will last, so if you’re aware of any sweet spots like these, it’d be best to book them before February 11.

Summary

The properties going down a level will probably be places that were better value booked with cash than with 15,000 points, whereas properties going up a category were likely providing good value where they were at the 7,500 or 15,000 level. As a result, I think that these changes will result in a net devaluation, despite more properties going down a category than up.

Not devaluation related but I recently had a award booking in Hong Kong that I canceled because hotel rates were so cheap due to protests (and probably cheaper now w Wuhan). Anyway booking and canceling extended my points expiration for another year! #NoPointsExpire!

Sedona Rouge is an awesome redemption. Boutique in the high desert, spa fab. If you make it down to Tucson, so is Westward Look (Grand).

Greg, the real devaluation in this program for me and many others was losing the ability to book Wyndham Vacation Rental (WVR) one bedroom condos with Wyndham Reward Points. This change has been in the making since last fall when Vacasa acquired WVR from Wyndham. The ability to book WVR condos with Wyndham reward points been taken away as of the first of this year. When calling in to make a booking with points, the CSRs will tell you that they cannot make these bookings and that they do not know when or IF it will ever be possible. Wyndham Vacation Club condos, which are different then WVR condos, are still bookable for now, but award availability is spotty in my experience.

Great deals on Wyndham Extra Holidays for both. Cash prices often less than WR redemptions