Making Kiva loans is one of my favorite ways to increase credit card spend. Kiva loans help me reach minimum spend requirements for new credit cards; they help me reach credit card big spend bonus thresholds; and, most importantly, they help people around the world who need micro-loans, usually for starting or maintaining a small business.

With Kiva, you can make loans with your credit card, and the transactions count as regular purchases for the purpose of earning credit card rewards. You do not have to worry about being charged cash advance fees.

Overall, Kiva has a very low loan default rate of .95% (just under 1%). In my loan portfolio, the default rate has been an amazingly low .21%. That performance is probably due to the fact that I usually filter to “safe” loans as I’ll explain below in the tips and tricks section of this post.

The downsides

It’s not all roses and ponies in Kiva land:

- Loans take anywhere from 4 months to a few years to pay off in full, so don’t loan more than you can afford. That money will be inaccessible for quite a while.

- You will not earn interest on your loans. Borrowers do pay interest, but those payments go to the micro-lenders who are in place around the world and need that money for the good work that they do.

- Payments are made through PayPal. If you log into PayPal and you have a balance in your account, PayPal will try to use that balance before charging your credit card. You can avoid that by not logging in, or by using a PayPal account with no balance.

- Once loans are repaid, withdrawals are made manually so they can take a week or two to process.

Tips and Tricks

Make safe loans

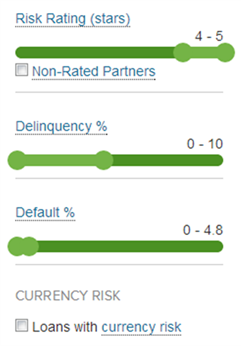

Kiva lets you filter loans to those that are most likely to pay back in full. When browsing for loans, select “advanced options” to bring up the filter options. Here’s an example of settings I would choose:

Make lots of loans at once

If you want to make many loans at once, you can turn to a web app called kivalens.org. It lets you filter loans in even more ways than shown above, sort them by earliest payoff date, and bulk load them into your Kiva “shopping cart”. Press the “++” button to add lots of loans at once. You can specify how much to spend per loan and how much total you want to spend.

Pay with the best credit card

Depending on your goals, you may prefer to pay with a new credit card to help meet minimum spend requirements, or pay with a credit card in which you’re trying to achieve a big spend bonus. Alternatively, consider using the US Bank FlexPerks or Cash+ cards which offer bonus points for charity spend. Even though Kiva loans aren’t charitable donations, Kiva is coded as a charity and therefore earns extra points with these cards (With Cash+ you would have to select Charity as one of your 5% bonus categories).

Increase credit card spend from home or abroad

Many of the techniques people use to increase credit card spend involve trips to drug stores, grocery stores, and Walmart to buy or unload gift cards and reload cards. If you prefer to stay home, or you travel often abroad, those techniques probably aren’t much use to you. Kiva loans can be a good alternative. Note that if you are abroad, it’s a good idea to use a VPN, or remote control software to make your Kiva payments appear to come from the US. Otherwise, PayPal may stop the payments because they’ll appear to be suspicious.

Getting started

- If you haven’t already signed up with Kiva, you can do so through my link: www.kiva.org/invitedto/milepoint/by/FrequentMiler. I won’t earn any referral credit or anything, but I will get an email saying that my friend has joined Kiva.

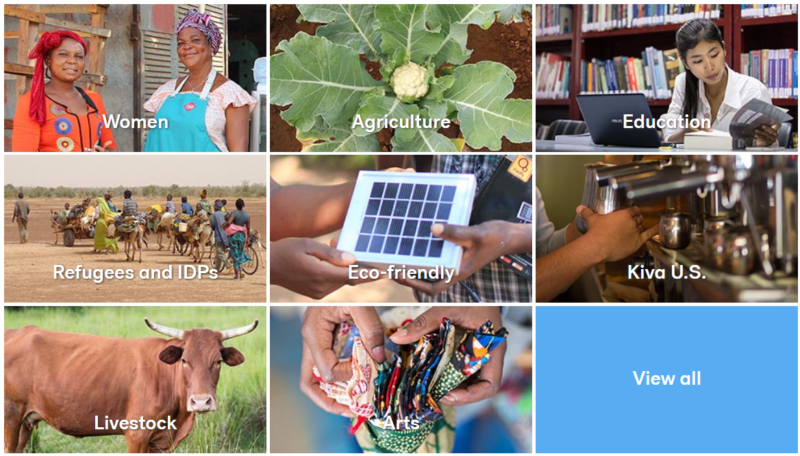

- Find a loan and finance it here: www.kiva.org/lend.

[…] plataformas, como Frequent Miler o Million Mile Secrets, también explican cómo han encontrado en Kiva a un aliado irresistible […]

[…] plataformas, como Frequent Miler o Million Mile Secrets, también explican cómo han encontrado en Kiva a un aliado irresistible […]

[…] plataformas, como Frequent Miler o Million Mile Secrets, también explican cómo han encontrado en Kiva a un aliado irresistible […]

[…] plataformas, como Frequent Miler o Million Mile Secrets and tactics, también explican cómo han encontrado en Kiva a un aliado […]

[…] plataformas, como Frequent Miler o Million Mile Secrets, también explican cómo han encontrado en Kiva a un aliado […]

[…] plataformas, como Frequent Miler o Million Mile Secrets, también explican cómo han encontrado en Kiva a un aliado irresistible […]

[…] plataformas, como Frequent Miler o Million Mile Secrets, también explican cómo han encontrado en Kiva a un aliado irresistible […]

[…] plataformas, como Frequent Miler o Million Mile Secrets, también explican cómo han encontrado en Kiva a un aliado irresistible […]

[…] plataformas, como Frequent Miler o Million Mile Secrets, también explican cómo han encontrado en Kiva a un aliado irresistible […]

[…] plataformas, como Frequent Miler o Million Mile Secrets, también explican cómo han encontrado en Kiva a un aliado irresistible […]

[…] If you’ve been meaning to make donations to your favorite charities, now is the time! Keep in mind, though, that the charity will have to pay the credit card processing fee in most cases. Alternatively, fund microloans with the hope of getting most of your money back (see “Kiva: loans, points, and miles“). […]

[…] Kiva: loans, points, and miles […]

[…] Kiva: loans, points, and miles […]

[…] allow lenders to earn interest, so the best you can do is break even. For details, please see: Kiva: loans, points, and miles. Another option is Kickfurther (if you use this referral link, you’ll earn $5 to get […]

[…] The US Bank FlexPerks card is one of my favorite secondary points programs card. The card offers 3X points for charities, 2X points for cell phone, and 2X for gas, grocery, or airline purchases (whichever is most each month). I find it particularly convenient that Kiva is considered a charity. […]