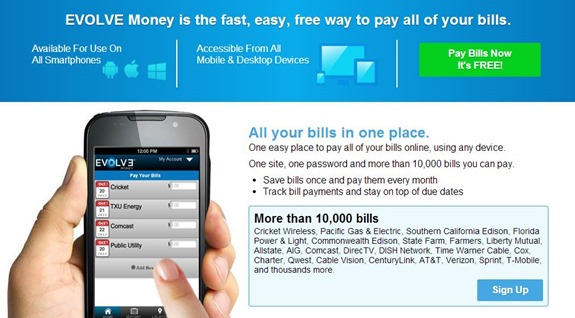

A new online bill pay service called Evolve Money launched in September of last year and evolved into something useful in November (see their launch blog post here and their November post here). This service has a few unique features that make it particularly interesting to mile and point collectors: free bill pay; pay with debit card or prepaid card; or pay with reload cards such as RELoadit Packs or EVOLVE Pay Bucks.

I’ve tested this service for a few weeks now and found that it works well if you can find the company you’re trying to pay. They do not yet publish a full biller directory, so you’re at the mercy of their barely adequate bill search function. Of the bills I pay regularly that do not allow credit card payments, I was only able to find one available through Evolve Money, but it was a good one: my mortgage (via Wells Fargo). If you’re lucky, you may be able to use this service to make car payments, loan payments, Education Savings Plan payments (529 plans), utility payments, local tax payments, and more.

Making Payments

Assuming you can find the biller you want to pay, the process of making a payment is dead simple. Select the biller, enter the amount you want to pay, then enter your debit card / prepaid card information. I’ve successfully made numerous payments with a prepaid reloadable card and with Visa and MasterCard gift cards. One great thing about being able to pay with gift cards is that you do not have to register the card first (the card does need to be activated first, though, of course). Within Evolve Money, I simply enter in my name and address along with the Visa or Mastercard gift card number and the payment has gone through fine (most of the time – see Problems, below).

Limits

UPDATED 6/11/2014:

- For each unique account that you pay via Evolve (such as a car loan, for example), you can make no more than 4 separate payments per calendar month. I’ve confirmed that it is calendar month. So, it should be possible to make 4 payments near the end of one month and then 4 more payments at the beginning of the next month.

- Even if you and your spouse have separate Evolve accounts, no more than 4 payments per month can be made to the same biller account (e.g. to the same car loan).

- If you have multiple accounts with one biller, you may make up to 4 payments per account. For example, if you own two homes and have mortgages on each with the same bank, you can make a total of 8 payments per month to that bank: 4 to each mortgage account.

- Each individual payment can be no more than $999.

- Each biller account can be paid no more than $1000 per day.

- Payments made with “cash” (via EVOLVE Pay Bucks™ or RELoadit™ Pack) are not subject to the 4 payment per month limit.

Problems

I’ve encountered a few small issues so far:

Billers can’t be found: I mentioned this earlier, but it bears repeating. I would like to use this service to pay all bills that can’t otherwise be paid by credit card, but most of my billers are not yet available through this service (or I haven’t found them through their search function).

Failed payment: One of my attempts at using a gift card to make a payment failed without explanation. For several days, the gift card showed zero funds available, but eventually the hold on the money went away. I tried again with the exact same gift card and the payment went through without a hitch.

Mortgage applied to principal: My Evolve Money mortgage payments initially show up in my Wells Fargo account as “unapplied funds”. Then, after a few days, the funds get automatically applied to my mortgage’s principal. This would be fine if my goal was to pay off my mortgage early, but it won’t help to cover my monthly required payments. I believe that I can call and ask to have the unapplied funds assigned to my monthly payments instead. That’s what I intend to do going forward.

Use for real spend, not manufactured spend

Some enterprising individuals found that it was possible to manufacture debit card spend (for the rewards) by using Evolve Money to fund an education savings account and then immediately withdraw the funds. Rinse and repeat. Not surprisingly, the powers that be are actively working to stop this practice. On Saturday, The Free-quent Flyer posted his amazing interview with a Vice President at Evolve Money. My takeaway from this interview is this: Evolve Money is happy for us to use debit cards or even gift cards to pay legitimate bills, but they will most likely shut down those who try to use the service to manufacture spend.

Other quick takeaways from the interview include:

- Free Bill Pay is a loss-leader for the company. They plan to make money with same-day payments (for which there is a fee), and by directing customers to opportunities to save money (and Evolve Money will earn an affiliate commission when the customer switches services based on their recommendation).

- Paypal’s debit card (the one that earns cash back for signature transactions) does not pay cash back for Evolve Money payments even though the transactions are listed as signature transactions.

- There are no plans to allow customers to add their own billers

- The ability to pay credit card bills is coming eventually, but they will limit how they can be paid (e.g. possibly no gift cards) and will charge a fee of some sort. Note: some “retail store cards” are already available for payment including: Amazon, Disney, Sears, and more.

Wrap up

Evolve Money is a terrific new service that can be used to earn rewards for paying real life bills that are not usually amenable to credit card payments. The simplest approach is to use one of the few remaining rewards debit cards to make your payments. Alternatively, you can use one of the many reloadable prepaid debit cards in which it is possible to directly or indirectly reload the card with a credit card. Or, if you find a place to buy RELoadit Packs or Evolve Pay Bucks with a credit card, you can use those. Finally, you can use your credit card to buy MasterCard or Visa gift cards and pay your bills with those.

UPDATE 6/11/2014: For updated information about Evolve Money, please read: Evolve Money talks

Hat tip: Free-quent Flyer and FlyerTalk

[…] In most cases, your total fees (for buying gift cards and paying taxes) will come to around 1.6%. While this is lower than the best current fees offered for credit card payments, it is not dramatically lower. So, I’d only recommend using Visa or MasterCard gift cards for tax payments if you have found a way to buy them with very low fees or no fees, or if you buy them at a merchant in which your credit card earns a category bonus. For example, if you have a credit card that earns 5% cash back at drugstores and you buy OneVanilla Visa cards with a 1% fee, then you have already profited by 4%, so the additional .6% fee for paying taxes in that case may be worth the cost. That said, there are other ways to use Visa and MasterCard gift cards that may be both easier and less expensive. For example, some stores will let you use debit cards to pay bills and/or buy money orders. And, at Walmart you can use debit cards to reload American Express Bluebird cards for free. The easiest option, in my opinion, is to pay bills online with Evolve Money (see “Pay bills online with debit and prepaid cards”). […]

[…] I’ve written before (see “Pay bills online with debit and prepaid cards”), the service Evolve Money can be used to pay many types of bills that can’t usually be paid […]

I have a question as far as using the Evolve Pay bucks to pay your mortgage. Where you able to call the mortgager to have those “unapplied funds” applied to your monthly payment? thanks.

I haven’t ever used Evolve Pay bucks. As to calling to apply unapplied funds to my monthly payment: when I called I learned that as long as I sent in the exact amount needed for the bill (even if it was across several payments), they would apply it to the monthly payment.

[…] other cards at Walmart, nor can they be used to buy money orders, get cash back at the register, or pay bills online or in-store. As a result, people often look for ways to buy Visa or MasterCard gift cards with […]

For the visa GC, you mention that they need to be activated first before using. Does that apply to vanilla ones bought at Office Depot/max where you set your pin on the first use (not prior)? Can those work for a bank payment if you want to use the full $200 amount on the card? Or do you already have had to use it once with an established pin? Thanks

Gift cards bought in-store are activated at the register. More importantly, since this post was written, Evolve has changed their policies in many ways: they no longer accept all gift cards and, worse, they charge a 3% fee for the ones they do accept

I just got an email today that evolve is limiting the number of payments per billet to one as of Sept 1.

[…] those that always wanted to earn miles for paying their mortgage, there are two important discussions about Evolve Money that you should read. The idea here is that you can buy gift cards, and use […]

[…] which are issued by Metabank are pin enabled, you can definitely do that. Frequent Miler has a great post which fully explains Evolve […]

WARNING: Do not try to overcome the $1K per day limit by opening multiple Evolve accounts. People are getting shut down from paying that biller when they do so.

[…] can’t usually be paid with a credit card. I first wrote about Evolve Money in the post “Pay bills online with debit and prepaid cards.” Last week, in the post “Evolve devolves,” I wrote about a rash of “shut downs” […]

[…] written a few times before about the online service Evolve Money (see, for example: “Pay bills online with debit and prepaid cards”). Evolve has been a great service for paying bills with debit cards (including Visa and […]

[…] week, a number of blogs revealed that Evolve Money accepts credit cards for payment. In my opinion, it was irresponsible to blog about it, and […]

Jana – you’d want to use DEBIT cards. Evolve doesn’t take CREDIT cards technically.

Yes, there’s discussion elsewhere that a glitch might currently be letting some get through. However, if you use your credit card, proceed with caution as folks are reporting these are hitting as Cash Advances. The interest on credit card rates on $100k would be substantial.

So if i want to pay off $100,000 on my mortgage, I can use my credit card and make $1000 payments for the next 100 days through evolve. I actually want it to credit towards my principal only. Wells Fargo

Yes. Safest way would be to use credit card to buy Visa or MasterCard gift cards and use those to pay off your mortgage.

For those of you who took advantage of the $200 Visa gift cards from Staples, how long after the cards arrived did you receive the activation codes. It’s been over a week and I’m beginning to get worried. Thanx.

The activation code letter(s) should arrive within a day of the cards. Otherwise, you should call GiftCardMall. They can activate them for you.

Thanx. That’s exactly what I did and they are activating them as we speak.