Please see an updated version of this post, here: How to manufacture Delta elite status.

Most airlines offer extra benefits to their most valuable customers. This is usually handled through elite status. If you fly enough with an airline, you can become “elite”. Of course, not all elites are equal. Most airlines have multiple elite tiers to differentiate their valuable customers from their really valuable customers. And, of course, airlines offer the best perks to their highest tier elites.

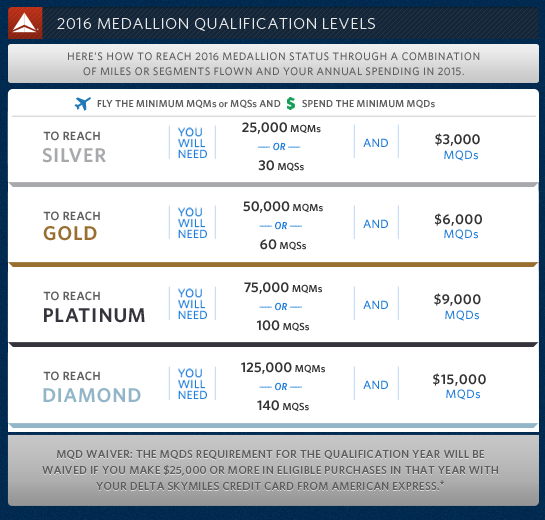

Delta is no different. They offer elite tiers ranging from Silver status (25,000 miles per year flown) to Diamond status (125,000 miles flown). Silver status perks are only marginally better than those you get from holding a Delta branded credit card. Diamond perks, though, are very nice.

Where Delta differs from all other airlines is that they offer a path to top tier elite status that does not require flying. Via certain Delta branded American Express credit cards, it’s possible to spend your way to high level elite status.

You might wonder why bother earning elite status without flying? After all, the only way to enjoy those benefits is to fly, right? True, but here are a few reasons:

- For those with lots of Delta SkyMiles, elite status indirectly makes those miles more valuable. Platinum and Diamond elites can make award changes and re-deposits for free. And, once you reach elite status, you can qualify for free domestic upgrades from coach to first class, even on award flights.

- Spending your way to status can jump you to a higher level of status than you would have achieved otherwise.

Delta Elite Requirements

Delta published the following chart to show the requirements for achieving each tier of elite status as of 2015 (towards earning 2016 elite status):

Definitions:

- MQMs: Medallion Qualifying Miles can be roughly thought of as the actual miles flown on Delta and select partner flights (although elites earn MQM bonuses and there are a few other ways to earn MQMs as I’ll explain later). It’s important to understand that these are different from redeemable miles which can be used to book award flights. MQMs are only used for earning elite status.

- MQSs: Medallion Qualifying Segments are a count of the number of Delta and select partner segments flown. Unless you fly a very large number of short flights, your are unlikely to earn elite status through MQSs.

- MQDs: Medallion Qualifying Dollars are the sum total of your spend on Delta-marketed flights.

Explanation:

In general, to reach each elite tier, Delta SkyMiles members must earn the stated number of MQMs or MQSs and spend the targeted amount of MQDs. In other words, its not enough to just fly far or often, you also need to spend a lot of money with Delta.

Fortunately, there’s an easy exception to the MQD requirement for Platinum status and below: spend $25,000 or more with Delta branded credit cards and the MQD requirement goes away. Even better, several Delta branded credit cards offer MQMs for high spend, so it is possible to tackle both requirements (MQMs and MQDs) through spend without setting foot on a plane. Unfortunately, starting in 2018, Delta has increased the spend requirement to $250,000 (across all Delta cards you have) to get a MQD waiver for Diamond status.

Rollovers

Most airlines require that you fully re-earn status every calendar year. Delta is mostly that way too, but with one exception: if you earn more than 25,000 MQMs in a calendar year, any MQMs not used to reach status are rolled over to the next year. For example, if you earn 70,000 MQMs, you’ll earn Gold status (at 50,000 MQMs) and 20,000 MQMs will be rolled over to the next year to give you a jump start towards re-qualifying.

Elite Benefits

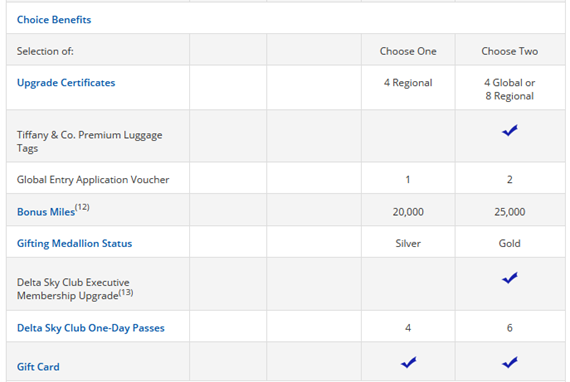

Delta’s complete chart of elite benefits can be found here. I’ve pulled out a few excerpts showing some of the best benefits:

The elite benefits I’ve personally found to be most valuable are:

- Unlimited complimentary upgrades (when available, upgrade from coach to first class on domestic flights). Higher status leads to better chance of upgrades.

- Waived same-day confirmed fees and waived same-day standby fees (switch to different flight on same day as ticketed flight). Requires Gold or higher.

- Complementary Comfort+ seats (more leg room!).

- Free award changes and cancellations. This is huge because it lets me book awards when I see availability even if I’m not sure I’ll take that particular flight. Requires Platinum or higher.

- Regional upgrade certificates. Puts you to the front of the line for regional upgrades. This is great to use for flights where upgrades are most important to you. For example, I use these for flights of about 4 hours or longer. This is a choice benefit for Platinum and Diamond status.

- Global upgrade certificates. These are fantastic. Use these to upgrade from coach to business class on any international flight when upgrade space is available. My wife is 4 for 4 this year in applying her certificates and getting the upgrade. This is a choice benefit for Diamond status only.

Manufacture Delta elite status

Thanks to a few Delta branded credit cards, its possible to earn elite status entirely through spend. The following cards make it possible to earn Delta MQMs (and MQD waivers):

| Card Offer and Details |

|---|

50K miles ⓘ Affiliate 50K miles after $3K spend in 6 months. Terms apply. (Rates & Fees)$350 Annual Fee FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 2X restaurants ✦ 2X US Supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $150 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers (ticket must be purchases on or after 2/1/24 to receive this benefit) ✦ Cell phone protection ✦ Terms and Limitations Apply. (Rates & Fees) |

65k miles ⓘ Affiliate 65k after $6k spend in first 6 months. Terms and limitations apply. (Rates & Fees)$350 Annual Fee FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 1.5X on transit, eligible U.S. shipping, and purchases of $5K or more (up to $100K per year) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers (ticket must be purchases on or after 2/1/24 to receive this benefit) ✦ Terms and Limitations Apply. (Rates & Fees) |

60K Miles ⓘ Affiliate 60K miles after $5K spend in first 6 months. Terms apply. (Rates & Fees)$650 Annual Fee FM Mini Review: Excellent choice for frequent Delta flyers who can make use of SkyClub access and companion certificate. Also a good choice for big spenders seeking Delta elite status. Earning rate: 3X Delta Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $10 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy or first class companion certificate (subject to taxes & fees) after card renewal ✦ SkyClub access (starting 2/1/25, 15 visits per year (after 15 visits have been used, additional visits can be purchased for $50 each) or to earn an unlimited number of visits each year starting on 2/1/25, spend $75K or more on eligible purchases between 1/1/24 and 12/31/24, and each calendar year thereafter. ✦ 4 Delta SkyClub one-time guest passes ✦ Centurion Lounge access when flying Delta ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Complimentary upgrades ✦ One statement credit every 4 years for the $100 Global Entry application fee or one statement credit every 4.5 years for the $85 TSA Precheck application fee ✦ Priority boarding ✦ First checked bag free on Delta flights. ✦ Hertz President's Circle Status ✦ Terms and limitations apply. (Rates & Fees) See also: Delta Reserve complete guide |

75K miles ⓘ Affiliate 75k after $10K spend in first 6 months. Terms apply. (Rates & Fees)$650 Annual Fee FM Mini Review: Excellent choice for frequent Delta flyers who can make use of SkyClub access and companion certificate. Also a good choice for big spenders seeking Delta elite status. Earning rate: 3X Delta ✦ 1.5X on eligible transit, U.S. shipping & office supply store purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $10 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Domestic, Caribbean, or Central American economy or first class companion certificate (subject to taxes & fees) after card renewal ✦ SkyClub access (starting 2/1/25, 15 visits per year (after 15 visits have been used, additional visits can be purchased for $50 each) or earn unlimited visits after spending $75K/calendar year on the card ✦ 4 Delta SkyClub one-time guest passes ✦ Centurion Lounge access when you book your Delta flight with your Reserve card ✦ Earn up to $250 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Complimentary upgrades ✦ $100 Global Entry fee credit every 4 years (or 4.5 years for TSA Precheck) ✦ Priority boarding ✦ First checked bag free on Delta flights. ✦ Hertz President's Circle Status ✦ Terms and limitations apply. (Rates & Fees) See also: Delta Reserve complete guide |

Charts of MQM possibilities

The fact that there are multiple types of cards that earn MQMs, and that each person can have up to two of these cards, and that Delta Reserve MQMs are giftable leads to endless possibilities for manufacturing elite status. The following charts should help:

Delta Platinum Card (consumer or business version)

The Platinum card is fairly straightforward. MQMs earned with this card go to the primary cardholder’s Delta account. Period. Not counting MQMs that are part of a welcome bonus, you can earn up to 20K MQMs per card, or 40K MQMs if you have both the business and consumer version of the card, and you spend $50K on each card within the calendar year

Delta Reserve Card

The fact that Delta Reserve MQMs are giftable adds many possibilities. A common approach, for example, is for a married couple to each get one or more Reserve cards and gift the earned MQMs to one person or the other depending upon their elite goals. While its possible to get more than two people involved in a game like that, the following chart assumes just one person besides you is added to the mix. One person, with two Delta Reserve cards (consumer and business) can earn up to 60K MQMs in a year. With two people involved, it’s possible to earn up to 120,000 MQMs in one year!

Diamond Couple Unbalanced Strategy

Each person (or couple) should develop their own strategy based on their goals, expected MQMs earned through actual flying, etc. Here, though, is a sample strategy for a couple in which one person wants to earn top tier Diamond status and the other is happy with Gold status:

- Person 1 signs up for both the Delta Platinum and Delta Reserve card (one personal, one business). Person 2 signs up for the Delta Reserve card and adds Person 1 as an authorized user.

- Person 1 then uses manufactured spend techniques to max out the MQM bonuses on each of the three cards. Person 1 would earn 20,000 MQMs with their Platinum card plus 30,000 MQMs with their Reserve card, plus any MQMs that come with the welcome bonus when signing up for those cards. And, Person 2 would gift 30,000 MQMs to Person 1.

- In total, Person 1 would earn 80,000 MQMs through spend and signup bonuses. That’s more than enough for Platinum status, which is granted at 75K MQMs. The extra MQMs would roll-over to the next year.

One reason I like this strategy is that it avoids the duplication of benefits that happens when one person gets two Reserve cards. In the scenario presented above, both people have Reserve cards and therefore get the associated benefits (SkyClub access, improved upgrade chances, etc.).

Platinum Couple Alternating Strategy

Another option takes advantage of the fact that once you reach a level of elite status, you keep that status for the rest of that calendar year, all of the next calendar year, and through January of the year after that. If you have the ability to manufacture spend quickly, you can give two people Platinum status by alternating who gets the MQMs. Here’s how:

- Follow the steps in the previous example for year 1. Now Person 1 has Platinum status for the rest of year 1, and all of year 2, and through the end of January of year 3.

- At the beginning of year 2, person 2 signs up for the Delta Platinum card and adds an authorized user card for Person 1.

- Now, with all four card accounts, the couple would use manufactured spend techniques to max out the earned MQMs. All of the giftable MQMs this time would be assigned to Person 2.

- Just as above, person 2 should be able to achieve Platinum status during year 2. In the meantime, person 1 only earns enough MQMs to reach Silver status and to hopefully roll over as many MQMs as possible into year 3.

- At the beginning of year 3, the two people would use manufactured spend techniques as quickly as possible to max out the earned MQMs. All of the giftable MQMs this time would be assigned to Person 1. On this 3rd year, and as of Feb 1, person 1 will lose Platinum status until enough MQMs are earned again.

Conclusion

I’ve presented here the tools needed to obtain Delta elite status through spend. Whether or not you should do so depends heavily upon your situation. Do you fly enough with Delta to make it worth it? If not, don’t do it. In my case I live near a Delta hub, and both my wife and I do fly Delta often. As a result we have been manufacturing elite status well beyond the amounts described above. And, yes, we’re enjoying the associated perks!

[…] high level status entirely through manufacturing spend with Delta branded credit cards (see: How to manufacture Delta elite status). In this way I can enjoy the perks that go with high level status without any unnecessary […]

[…] Delta status through spend on the Delta Platinum and Reserve […]

[…] post “How to manufacture Delta elite status” steps through the details, but here is the minimum you need to […]

[…] credit cards to manufacture miles and to manufacture Delta elite status (examples can be found here, here, and here). I used to be under the impression that each person can only have one Delta […]

[…] suspect this won’t affect most readers as the spend involved is significant, but some people are/were generating high level elite status with Delta. If you’re in this situation you might want to consider another card that offers a spending […]

[…] won’t go into specifics but Frequent Miler has an incredible tactic for acquiring and keeping Delta status through product […]

[…] 1986, but his post kinda sorta almost makes me want to earn Delta Diamond status. Whether you manufacture Delta Diamond or earn it the old-fashioned way, it’s good to know the best uses of the benefits when you […]

[…] The Delta Platinum card offers 10,000 bonus Miles and MQMs after $25,000 in calendar year spend; and another 10,000 bonus Miles and MQMs after $50,000 spend. Similarly, the Delta Reserve card offers 15,000 bonus Miles and MQMs after $30,000 in calendar year spend; and another 15,000 bonus Miles and MQMs after $60,000 spend. Additionally, the MQMs earned through spend on the Reserve card are giftable to others. This makes it possible for high spenders can earn high level Delta elite status through spend alone. For more, see: How to manufacture Delta elite status. […]

[…] For an overview of how it’s possible to manufacture Delta elite status through credit card spend, please see: How to manufacture Delta elite status. […]

[…] if you have a need for the miles and/or the benefits of the cards. For example, it is possible to manufacture Delta elite status and the Platinum card(s) is key in doing […]

[…] airline and hotel elite status (e.g. AA, Delta, United, Marriott, […]

[…] it possible to secure top level elite status without purchasing a single revenue flight. See: How to manufacture Delta elite status and Mileage Running from Home II (now with an exciting 2 player […]

[…] addition to opportunistic point hoarding, I’m continuing to manufacture Delta elite status through spend. Despite blow after blow that Delta has inflicted on their (previously) loyal SkyMiles customers, […]

[…] Therefore, it allows me access to the Star Alliance, OneWorld, and SkyTeam. Not only that, if I am accumulating within an airline program, I’ll be able to redeem with their partners. Using Delta as the main point, it would allow me to fly on Virgin Australia and Virgin Atlantic with little fuel surcharges. Or if I were inclined to go to Tahiti, I now have the option of using Air France and Air Tahiti Nui. As Andy has researched, with Delta’s upgrades, it makes redeeming SkyMiles much easier. Frequent Miler has a great piece on buying status with manufactured spending techniques on Delta. […]

Out of curiosity, How many visa /master gift cards do you need to buy using the Delta AMEX credit cards and have them loaded to prepaid AMEX card? Does Target or Walmart allow you to load with that many gift cards? Or do you buy money order?

Amex RedCard can no longer be loaded with anything other than cash. Amex Serve or Bluebird may close the user’s accounts if they identify such a pattern (preload money with so many gift cards). It seems that MS does not guarantee success and is getting tougher and riskier than before. It is very likely the money may get stuck in the middle of the process.

Wow, you kind if look prophetic from today’s perspective!