The fastest way, by far, to earn miles for free flights is to sign up for the best credit card offers. The next best option is often to earn miles through online shopping portals. The most dependable method, though, is to earn miles through credit card spend. Of course, you could earn miles by flying, but that is, ironically, the slowest and least efficient approach.

Manufactured spending

To earn miles through spend, you should start with a credit card that offers the best category bonuses in strategically useful locations such as grocery stores, drug stores, gas stations, and office supply stores. For details about finding the best card, see: How to find the best credit card for groceries, gas, restaurants, and more”.

A common approach to manufacturing spend at places like these is as follows:

- Buy Visa or MasterCard gift cards with a credit card that earns a category bonus

- Use the gift cards as debit cards to transfer their value onto prepaid products such as Serve, Bluebird, or REDbird

- Use the prepaid products to pay bills such as mortgage, rent, or even credit card bills.

- With REDbird its possible to do even better. If you can find a Target that codes as a grocery store, you may be able to use your credit card to reload your REDbird card and earn a grocery store category bonus at the same time (see “REDcard changes everything”).

Transferable points

If your goal is to earn miles for free flights (especially international flights), then you’ll also want a card with transferable points: points that can be transferred to airline miles. Transferable points programs include: Amex Membership Rewards, Chase Ultimate Rewards, Citi ThankYou, Diner’s Club, and Starwood Preferred Guest. If you have your eye on particular airline programs, you can find a complete list of transfer partners for each program here: Transfer Partner Master List.

Airline partnerships and alliances

I’ll mention this just briefly here, but it probably deserves an entire blog series of its own… The airline you want to fly is not necessarily the airline you should collect miles in. Each airline program has its own award rules and each has many partners with which you can use miles to fly.

If you have a specific destination in mind, try out the Mighty Travels Trip Planner to see which miles can get you there the cheapest. Keep in mind that the planner results assume that you’ll find low-level awards. In many real-life situations, awards are either not available or they are available at higher award prices. Also note that the results do not show expected fuel surcharges. In real life, the program that requires the fewest miles is often not the “cheapest” once taxes and fees are accounted for. To get an idea of which programs charge more (or less) in taxes and fees, please see this Travel is Free post: Master Charts to Avoiding Fuel Surcharges (YQ).

Once you have an idea of which type of miles would be best for your trip, you can pop back once again to the Transfer Partner Master List to see which type of points you can use to transfer to that airline program.

5X office supply

Chase Ink cards offer 5 Ultimate Rewards points per dollar at office supply stores. Even better, Ink cards are now issued as Visa cards, and the Visa Savings Edge program gives cardholders an automatic 1% rebate for all Staples purchases of $200 or more. This rebate program is currently set to end on December 31, 2014 but I’m hoping that it will be extended next year. Staples sells $200 Visa gift cards both online and in-store. Unfortunately, these gift cards come with a $6.95 fee. Still, the value of 5X points combined with the 1% rebate far exceeds the fee.

Ink cards earn Chase Ultimate Rewards points which can be transferred one to one to the following airline programs: British Airways Executive Club, Korean Air, Singapore Airlines KrisFlyer, Southwest Rapid Rewards, United MileagePlus, and Virgin Atlantic Flying Club.

3X to 4.5X every day

The Amex EveryDay Preferred card offers 2X Membership Rewards points at gas stations and 3X at grocery stores; plus if you make 30 or more purchases each billing cycle, you’ll earn a 50% bonus. That means that this card effectively earns 3X at gas stations and 4.5X at grocery stores. The grocery store bonus is outstanding, but it does have a significant limitation: the bonus is limited to your first $6K per year of spend within that category. Plus, as an Amex card, it is unlikely that it will earn a grocery bonus at Target (see: “How to find the best credit card for groceries, gas, restaurants, and more”). Still, with this card it is possible to earn up to 27,000 points per year at 4.5X and then an unlimited number of points at 3X if you can find gift card friendly gas stations.

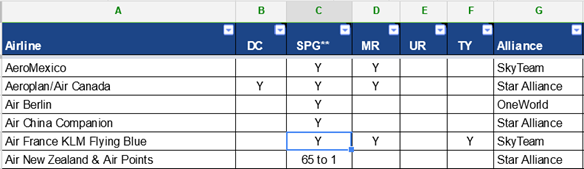

EveryDay cards earn Amex Membership Rewards points which can be transferred to airline miles as follows (transfers are 1 to 1 unless noted otherwise): AeroMexico, Aeroplan/Air Canada, Air France KLM Flying Blue, Alitalia MilleMiglia, All Nippon Airways (ANA) Mileage Club, Asia Miles, British Airways Executive Club, Delta Air Lines SkyMiles*, EL AL Israel Airlines (1 to .02), Emirates Skywards, Frontier Airlines*, Hawaiian Airlines*, Iberia, JetBlue (1 to .8)*, Singapore Airlines KrisFlyer, Virgin America (1 to .5)*, Virgin Atlantic Flying Club.

* American Express charges an Airline Excise Tax Offset Fee when transferring points to US airlines

Diner’s Club and the SPG pass through: 2.25 to 3X

Among the transferable points programs, SPG (Starwood Preferred Guest) has the most transfer partners. And, they offer a 25% bonus when points are transferred to airlines in 20,000 point increments (e.g. 20,000 SPG points becomes 25,000 miles with most transfers). The problem is that there is no direct way to earn more than one SPG point per dollar in spend (except at SPG properties).

A creative alternative approach is to start with the new Diner’s Club Elite card. This card earns 3 points per dollar at gas stations (at the pump), drug stores, and grocery stores, with no cap. And, its points can be transferred one to one to many airline programs. Transfers to SPG are worse than 1 to 1, but by earning Diners Club points at gas stations, drug stores, and grocery stores you can effectively earn 1.8 SPG points per dollar (see “How to earn 1.8 SPG points per dollar, or 5.76 Choice points per dollar”). Then, when you transfer 20,000 points at a time from SPG to airline miles, your effective earn rate becomes 2.25 miles per dollar.

Think about that… for spend at grocery stores and drug stores and pay at the pump gas, the Diner’s Club card can be used to earn 3 miles per dollar with many airline programs or 2.25 miles per dollar with many others. Here are the details:

Diner’s Club 3X: Aeroplan/Air Canada, Alaska Airlines Mileage Plan, British Airways Executive Club, Delta Air Lines SkyMiles, EVA Air Infinity MileageLands, Frontier Airlines, Hawaiian Airlines, Iceland Air, Korean Air, SAS EuroBonus, South African Airways Voyager, Thai Airways International Royal Orchid Plus, Virgin Atlantic Flying Club.

Diner’s Club 2.25X (via SPG): Air Berlin, Air China Companion, Air France KLM Flying Blue, Alitalia MilleMiglia, All Nippon Airways (ANA) Mileage Club, American Airlines AAdvantage, Asia Miles, Asiana Airlines, China Eastern Airlines, China Southern Airlines’ Sky Pearl Club, Emirates Skywards, Etihad Airways, Gol Smiles, Hainan Airlines, Japan Airlines (JAL) Mileage Bank, Miles and More, Qatar Airways, Saudi Arabian Airlines Alfursan, Singapore Airlines KrisFlyer, US Airways Dividend Miles, Virgin Australia.

Other transfer ratios: Southwest Rapid Rewards 15 to 12 (2.4X); EL AL Israel Airlines, 1 to .02 (.06X); Air New Zealand & Air Points via SPG 65 to 1 (.03X), LAN Airlines LANPASS Kms via SPG 1 to 1.5 (3.4X); United MileagePlus via SPG 2 to 1 (.9X)

Not available through Diner’s Club (but available through other programs): Garuda Indonesia Frequent Flyer, Iberia, JetBlue Airways®, Virgin America.

The downside of the Diner’s Club Elite card? It has a $300 annual fee and no signup bonus. The combination of category bonuses and transfer ratios is outstanding, but it is only worth it if you often get outsized value from your miles.

Conclusion

By using the right credit cards in the right locations, it is possible to manufacture miles at rates ranging from 2.25 to 5 miles per dollar. The question that still needs to be asked is whether 2.25X to 5X is better than earning cash back. It is still possible to earn up to 5% cash back at certain locations (see “Playing 5X everywhere Whack a Mole”), so which is better? The answer almost certainly depends on how you would use the earned miles. With international premium cabin awards it is common to exceed 2 cents per mile in value (same with short hop economy flights using British Airways Avios). In those cases, earning and using miles is the way to go. If you don’t expect to fly such routes often, cash back might be a better bet for you.

[…] Manufactured spending: manufacturing miles – The Frequent Miler […]

While I don’t necessarily agree with all of what MM said, I do hope it encourages FM and others to think about the impact of what they write. There are no real secrets here. All of the above has been covered in other FM posts. But is there really a need to hammer it home over and over? How many times until it only serves as a nail in the coffin? This will be even more important now that we appear to be moving on to a new MS era with OBC on the ropes.

Just a few weeks back MM complained to FM that he and other bloggers had killed the AMEX gift card deals with their blogs……I said the bankers will come back because greed is what drives them……….and yes they are back……..slowly at first to see if we will nibble and then increasing the rebate when they see that sales have not come roaring back (pure conjecture)……But I sense that Diner’s Club is about to steal part of their thunder and the delay will punish them in sales as justly it should……C’mon guys the House (Banks) always has the upper hand and ultimately always wins………FM readers know how to play the odds better than the masses….that’s why we’re here ultimately……..it’s not rocket science……but then it is….

@RM Flyertalk doesn’t allow get any referral money for the links posted there. They strip their links of anything but the credit card companies link.

I do appreciate FM well written posts and sometimes he enlightens me to aspects of MS that I wouldn’t have noticed. My only problem is preaching MS over and over is poking the big companies in the eye. They know it goes on and allow it to an extent, but if everyone gets step by step info on exploiting the system they will shut it down.

I don’t do MS to make money, I use it to generate required spend and get point bonuses. This is the hobby that MM, myself and many others are addicted to. We have the money to travel and invest, we game the system to get nicer, cheaper travel. (not to make a living) It turns my stomach to see bloggers tout the cash value of signup bonuses and that’s the way slickdeals and others advertise most offers. How to make enough points to get giftcards or tickets to sell and cash in on. Worse yet are people who scale up and try to make a living from exploits.

FT was always about the travel aspect, not 5% back, not quick easy cash, not hit the card company hard until they shut you down. The hobby took some effort, patience, restraint and finesse to keep it going for a while and most on FT understood this. The split came as the mint deal came to an end and more bloggers found out CC referrals made pimping offers worthwhile. Now there is no need to be coy, it has become a feeding frenzy at the trough and the greedy hogs keep the bloggers multiplying. End CC referrals and see how many take the time and effort to write about the latest offer.

I like FM’s approach and don’t believe he is intentionally killing anything, just reporting the current state of things. I just wish he would move on to something new and not repeat the same 3 things over and over, like MMS…If MMS pimped the INK offer any harder he would look like huggy bear. I think he did 14 articles on what to do with the points, how to pretend you have a business, how to answer application questions, and if the offer lasted longer he would be telling you how to get a card for your dog through his signup link. FM is getting just as limited with subjects like portal bonuses, debit cards for MS, and lately Redbird…all with explanations in detail of how they relate to MS and a repetitive overly detailed description of how to exploit the credit card companies slack T&C….recently AMEX changed theirs to once per lifetime, chase changed to once in 24 months, so they are noticing….once enough people take advantage of this info, they will have no choice but to kill the deals forever. I don’t think anyone here wants that.

Your problem is that you want to obtain just enough information for yourself, but any more is crossing the line. You say you don’t use MS to make money. I would argue that the points/miles that you’ve cranked out are money equivalents. Just because Ben Franklin’s face isn’t on it, doesn’t mean it’s not worth anything.

I have a feeling the churnable Citi Exec would have died a lot sooner had it affiliate links…

Just got an Ink Plus card am excited to do this thing but am nervous after reading all the Chase shutdown stories on Flyertalk, particularly as Chase is my primary bank. Any news on whether this is happening more often and how we should limit ourselves?

Charge an amount equal to or more than your 5 points on single point categories. Chase is like every other person or company, in that they don’t want to be completely taken advantage of. It doesn’t have to be exact, just a general principal, so you can do mostly the 5 times for the initial bonus spending. I’ve done this myself, and have had no problems. Also, if you use the Ultimate Rewards portal for online shopping, Chase actually earns money from the vendor, making you more valuable as a customer.

That’s a great question. Unfortunately we don’t have any good data on what is truly safe and what is not. I know many people who use their Ink cards only for 5X and haven’t been shut down. I wish I had a good answer for you!

@Marathon Man,

Frequent Miler did not present any new tricks or tips in this case. This was better written and organized than most, but that’s it. To say \You have decided for all of us\ smacks of hypocracy if you do the same. Greg did his own research and published his own results. Now you say that he can’t tell anyone the results of his own actions, performed on his own time with his own money?

I’ve been in this hobby for a bit under a year. I’ve read up, and tried to learn while also trying to respect the huge variety of opinions this encompasses. I’ve never scaled up, and generally tried to be sensible. As a gainfully employed, fairly sane person, I have neither the time nor the inclination to go huge on MS. Reasonable benefits and reasonable gain are enough. In all of the times that I’ve gone in person to load up at kate, I’ve only ever seen two other people using it. Two. If this were some horribly out of control situation, wouldn’t I have to wait in line on a regular basis?

As to changing terms and conditions, an informed person is a lot more likely to not screw things up than someone who has only the faintest idea of what they’re doing, and blurting out stupid questions. For the vast majority of us, this is an avocation, not a vocation, and we treat it as such. If it truly is the way you make your living, mentioning that fact might garner a bit more of an understanding ear.

Thankfully the Old Cash Blue didn’t offer an affiliate referral kickback. Otherwise these greedy idiot bloggers would have been pumping that card left and right and would have killed it in half the time that it ultimately worked. RIP OCB. The only thing that allowed it to last as long as it did is that most of the bloggers didn’t even mention it despite it easily being the best CC out there. But most bloggers only think about their own pockets, not their readers……………….luckily.

I love this blog for all the transparency and honesty it displays. I call this argument transparency vs the gnostics and MM you do represent the gnostics well. I would love to hear you talk in Phoenix on the \The way the MS World Should Function and How Information Should be Passed\ It’s obvious you don’t like the present state of the game but you should go back to the drawing room and come out with a plan to have MM and disciples give you an honest trial. We’ll even buy you a Scotch or two in Phoenix prior to the sentencing.

I am certain that the \professional\ MS person is what is making drug stores, banks, etc change policies. When CVS is limiting card sales to $4k a day then you know that the ones making those card transactions are not your average Boarding Area visitor or MM reader. But I do see that they would be quite upset to have others know about the game and it makes them have to move to the next gig move quickly…….

I don’t see anything in this post that is unethical or immoral. I do see it as trying to max out the benefits of the frequent flyer game to the last drop.

Finally, a post like this is not spoon feeding but more like drinking water from a fire hose. It hasn’t been that long since I started MS and frankly many of the strategies and methods make my eyes glaze over and I know from new friends starting that they have the same idea and they all roll their eyes at the boorish behavior from FT. None of us can stand FT because the crowd is omnipotent, arrogant, and just down right mean spirited. This is a nurturing blog from FM and from the readers to each other. Those that want to be all knowing should stick to FT and those that want to drink water from a fire hose should stay right here. It’s a pretty straight forward choice.

Great blog! Great post!

Thank you, JustSaying, for echoing my thoughts about this comments thread and my own experience.

I have the time and read the FT boards as well as other blogs for a \digest\ to keep me up to date in case I miss things. However, Frequentmiler is the first blog to which I have subscribed… ever. Thank you. I appreciate your tables and charts. Your work is how I would put together my own charts. I also appreciate your honesty and your commentary about your feelings on the ethics of various deals.

There is a lot of whining about deals being closed down because of widespread knowledge. However, I do not think that FT should be the only one making income from online CC referrals. I think that the person with the best information should, and currently that is you, Frequentmiler. I know that you don’t always spell things out so deals don’t go sour quickly, and I appreciate that. I don’t think you have done it here either. Please do not let a few bad apples affect the quality of your blog content. I subscribe because I think it’s the best consistent quality on the topic I have found.

Yes, I could remain an FT and insider \purist\ but it’s not just blogs that sour deals…

Hey marathon man and supporters,

Cry me a river. I’m a relative newbie to MS and without these blogs wouldn’t have known about any of it. Fire away.

@wise2u, I read slickdeals, dansdeals, doesn’t make me a plain moron. Maybe one with a doctorate degree. Your intro with \not to be elitist\ is exactly the opposite of what the rest of your post is. It’s the same as when people start with \no offense, but…\ Sorry, you’re just as greedy as I am if you’re doing any MS. I’m sorry I’m more efficient at it than you apparently. You wrote: \ I have a short list of blogs I read and I check the boardingarea page to see what’s being discussed, but I refuse to reward any bloggers\ So essentially, you obtain free information, but then whine that everybody else is getting that same information too. Wow, hypocrite.

Information will get out. If frequentmiler doesn’t post it, someone else will. And you know what? Frequentmiler has been the only consistent source of the new Target Redcard info that I’ve appreciated.

For those of you complaining about how these blogs ruin deals, you’re absolutely lying if you haven’t obtained a single useful piece of information from one. If you haven’t, why do you even read the blogs? So, quit the whining.

Proud to read slickdeals, dansdeals, boardingarea, etc. Umad? Sorry I don’t live in my mom’s basement and spend hours upon hours desperately looking to be part of some elitist group.

Rock on frequentmiler.

if a blogger makes $$ by views, making a PPV site is idiocy honestly. Why? B/c unless ALL bloggers go to a PPV, then there is increased incentive for existing, or new, bloggers to post the deals that are being discussed in the PPV blog, thus ravaging their subscribers b/c they figure they can get the same info for free.

If ALL bloggers somehow went to a PPV-type model, then why wouldn’t ppl just read FT instead…for free? In short, PPV is doomed to failure.

As for ppl that have time, not everyone is retired and/or working a gov’t job with plenty of time to surf the web at work. I.e. there will always be a set of ppl that have the money, have the desire, but not the time…perhaps that small subset would be willing to PAY for such knowledge. That said, wading thru FT takes a good deal more time than various blogs and there will be a market for that, but not the biggest I’d imagine.

Going to the various FTU and \beginner FTU, if you will\, quite a few ppl are already on FT and reading, but b/c the people there are deliberately secretive w/ codes, acronyms, etc…so I can see why people would rather go to a blog to help decipher some of the mystery. Not to mention many of the FT threads have hundreds, if not thousands, of mindless posts…\I got my Sac coins today\….\they overcharged me for my coins and they arrived late waa waaa waaa\. Nobody REALLY cares, as typically they are doing something wrong.

The short of it…as long as FT remains thick in jargon, there will be room for bloggers to act as translators. As long as there are ppl who are new to the game that want ‘free’ once-in-a-lifetime trips, or ppl that have the resources, but not the time to learn, the game, there will be room for bloggers

As MilesDividendMD says, some doors will close and others will open. Whether one person blogs about a recently found open window or gets paid (whether in $$ or adulation / respect) to speak in PHX about these clever tactics, I see no difference. For one to criticize the other for their mode and scope of communications is just silly.

I for one appreciate the wide sharing of this information, as I wouldn’t have the time or interest in reinventing the wheel. Does this mean I don’t deserve to utilize this information and these loopholes, just because I didn’t discover them independently? Sheesh, this isn’t patent law, and it’s not rocket science.

Marathon Man, forgive me for making assumptions, but you seem to have put many of your eggs into the basket of MS ‘expertise’ for your livelihood. I would not have made such a choice.

I agree with MM. Not to be elitist but bloggers like MMS and FM are ruining the game. I have plenty of time to research and put work into finding the best angles. In the past it took a couple of hours of reading through the piles of info on FlyerTalk and that alone kept the group of players to a minimum. Now FT categorizes every post into easily searchable topics and bloggers read the info there and regurgitate it for the masses. Think lazy, greedy, slickdeals, dansdeals morons would take more than 5 minutes to research a deal? Not without help from blogs like these. I have a short list of blogs I read and I check the boardingarea page to see what’s being discussed, but I refuse to reward any bloggers for dumbing down a deal for public ravaging. Maybe if some of these blogs were subscription based and closed to the public that likes spoonfed, circles and arrows, step by step info to exploit a deal it would keep a deal alive longer. It is an old question on free info sharing VS overexposure that ruins a deal…I guess it all comes down to are you so lazy you would have never figured out a deal on your own and need spoonfeeding from blogs, or could you figure it out on your own with a few vague clues and a few posts buried on a back page of FT, that is the real difference on where most people stand on the issue.

Hey Marathon Man, perhaps you could talk in Phoenix about all these great ways to MS that you have found for yourself and not shared with others (you have apparently developed many based on your comments), since you are obviously much smarter and have found things that other bloggers have not found and therefore have not said anything about. Or perhaps you have not found anything yourself and are using the same methods other bloggers already use and share with people who do not make a living off of MS but want to take a vacation every once in a while. So maybe you don’t have anything to say because you don’t have any original material that everybody else doesn’t already know.

FYI – Korean Air is no longer a partner for Diners US.

Thanks for that clarification. Do you know where I can find an official list from Diners?