Through September 30th 2015, the Plastiq bill payment service is offering a discounted rate for paying new bills with your MasterCard credit card or gift card. Plastiq’s usual fee is 2.5%, but during this promotional period you will be charged only 1.5%.

Key info

- This promo is available to everyone. No special signup link is required.

- The 1.5% rate is only for new payees added to your account. If you’ve paid a particular payee before, you will not qualify for the 1.5% rate.

- The 1.5% rate is only for payments made with MasterCard credit cards or gift cards. Visa or Amex payments will not qualify for the 1.5% rate.

Quick analysis

If you have any qualifying bills to pay and you’re working on meeting minimum spend requirements on a MasterCard credit card, this is an easy and fairly inexpensive solution. See the “Cautions” section below.

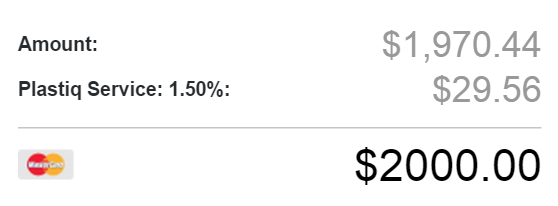

If you have flexibility in the amount you pay (perhaps you want to pay down the principal on your mortgage, for example), then you can pick the target amount you want to spend on your credit card and divide by 1.015 to determine your bill payment amount. For example, suppose you need to spend $2,000 in order to meet a minimum spend requirement. In that case, divide $2,000 by 1.015 to get $1970.44. Plug in that amount as your bill payment amount within Plastiq and the total, after the 1.5% fee, should come to $2,000 exactly.

Cautions

A number of readers have told me about issues they’ve had with payments taking a long time to verify and to ultimately show up as received by their payee. If you use this service, make sure to make payments much earlier than required in order to avoid late payment fees or other issues.

Questions?

Full details about Plastiq can be found here: Complete guide to Plastiq credit card payments. There, you will find answers to questions such as:

- Is Plastiq reliable?

- What types of payments are allowed?

- Can I pay with gift cards?

- Do Plastiq payments count as purchases or cash advances? (answer: purchases)

Never miss a Quick Deal, Subscribe here.

[…] is the last day to pay any new bill for a fee of only 1.5% (see: Limited time: 1.5% credit card bill payment fee; MasterCard only). However, Plastiq has introduced a new promo that’s available tomorrow through October […]

OK, who’s paid their mortgage with this? I remember chatter a while back that payments from services like these generally post as extra payments to principal, rather than your standard/required monthly payment. I’m just a little paranoid…

Does citi cards register these as cash advance ?

thanks

No, they treat these as regular purchases

Hi everyone,

Just wanted to answer questions and offer clarification:

1. You don’t need to register, or have registered, through a referral link. This promotion applies to everyone!

2. We recommend submitting payments 10 business days before they are due to ensure timely arrival.

3. I can’t get Plastiq to show me any payees based outside of Canada. Even searching for big payees like a Wells Fargo mortgages only shows me Wells Fargo Mortgage Services Canada. I emailed support but they were no help. I’ve given up on them.

You can add any Canadian or US-based payees regardless of whether they are already in our system.

4. What is the maximum payment allowed under Plastiq? Let’s say that you had a car or student loan that you were going to payoff anyway, it would be nice if this promo allowed you to get some miles/points/cashback in the process.

Plastiq doesn’t have any limits; the only limits that exist are the ones from your card.

5. Does anyone know if they send out 1099’s to payment recipients?

We are not federally required to issue 1099’s.

If you have any questions or issues, please email support@plastiq.com or chat us in the app (available Monday to Friday, 8 a.m. to 6 p.m. PT).

Best,

Rebecca from Plastiq

Does anyone know if they send out 1099’s to payment recipients?

This is fantastic! I just removed the current payee and add it back. Then I got 1.5% promotional rate! Assume you have a loan of 1 million and pay it off using CITI Double Cash with this promotion. You can even earn $5k LOL

What is the maximum payment allowed under Plastiq? Let’s say that you had a car or student loan that you were going to payoff anyway, it would be nice if this promo allowed you to get some miles/points/cashback in the process.

I can’t get Plastiq to show me any payees based outside of Canada. Even searching for big payees like a Wells Fargo mortgages only shows me Wells Fargo Mortgage Services Canada. I emailed support but they were no help. I’ve given up on them.

FWIW, this promo was offered to current members to pay ‘new payees’ as well.

I’ve used them twice and am still waiting to see if the second payment posts. If it doesn’t soon I’ll have to call and make a payment directly via the phone. I’m not sure it’s worth the hassle of constantly checking to see if a payment gets made by the due date. I’ve allowed plenty of time before the due date, so I’m hesitant to do this regularly.

This is great if you have a Citi Double Cash CC (MC). I just need to figure out who I can pay…

I don’t know why plastiq rejects “refunds” 9 out of 10 payments I try to make. (among multiple accounts) its annoying especially on some when they ask for ID and various identification