Update 7/29/2017: US Bank no longer codes Kiva as a charity. This post has been updated accordingly.

Kiva is a nonprofit organization that facilitates micro-loans to enterprising individuals around the world so that they may earn their own way out of poverty. Kiva loans do not earn interest, but they can be paid for with a credit card. Credit card payments do earn rewards and do not count as cash advances.

If you’re considering making Kiva loans, here are a few important details:

- Loans range in length from 6 months to many years. Some loans are setup to begin paying back in installments during the loan. Others pay back in one lump sum at the end. Regardless, your money will be tied up long term.

- You will not earn interest on any loans. Borrowers do pay interest to the microlending organizations that they deal with directly (Kiva refers to these organizations as partners), but those interest payments are used to fund those businesses.

- There is risk of losing your money, but the risk is small. Kiva, overall, has a low default rate. The current average per Kiva user is 1.26%. My current average (across 4 years of lending) is 0.74%.

- Withdrawals take time. Loan repayments are credited once a month and first appear in your Kiva account as Kiva credits. You can request to withdraw those funds to your Paypal account. Expect the process to take a week or two. Since my PayPal account was frozen about a year ago, I’ve had to request paper checks each time. Since that requires additional effort on Kiva’s part, I try to limit check requests to once every 3 months or so.

Starting small

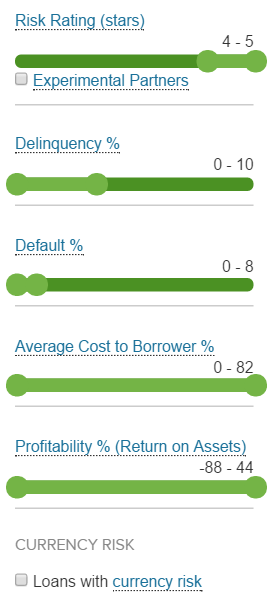

If you’re new to Kiva and want to give it a try, I’d recommend starting small. Go to Kiva.org, find a loan or two of interest, and fund it. Sort by Repayment Term to find the loans that will repay fully the soonest. You can even use Kiva’s Advanced Options filters to filter to “safe loans”. By “safe”, I mean loans that are very likely to be paid back in full. These settings are based on characteristics of the field partner (the microlending organization that interacts directly with the borrower). Safe partners are those with high risk ratings, not experimental, low delinquency rates, very low default rates, and no currency risk. Shown below are sample “safe” settings that can be set within Kiva.org:

Going big

Kivalens.org is a web app designed for those who like to many loans at once. The site used to be built on a browser plug-in technology called Silverlight, but has now been re-written to work directly in any browser without plug-ins. It should now work with almost all browsers including Safari on iPad. And it looks nicer than before too.

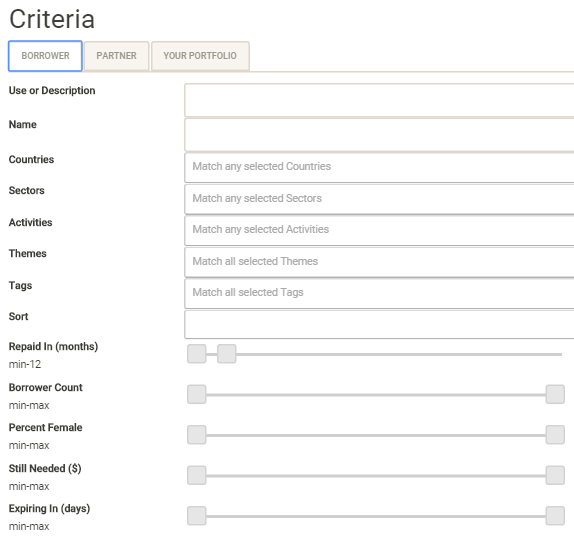

Within Kivalens, you can filter loans by borrower characteristics or by partner characteristics. The Borrower filters help to find loans that interest you. Perhaps, for example, you want your money to go to certain countries or certain types of businesses. Or, maybe you prefer to loan to groups rather than individuals, or to women instead of men.

Another key capability of the Borrower criteria tab is the ability to pick your sort criteria. I like to sort by “Date half is paid back, then 75%, then full.” This is the default sort setting, so you don’t really need to do anything. However, some may prefer to sort by final repayment date. You can do that too.

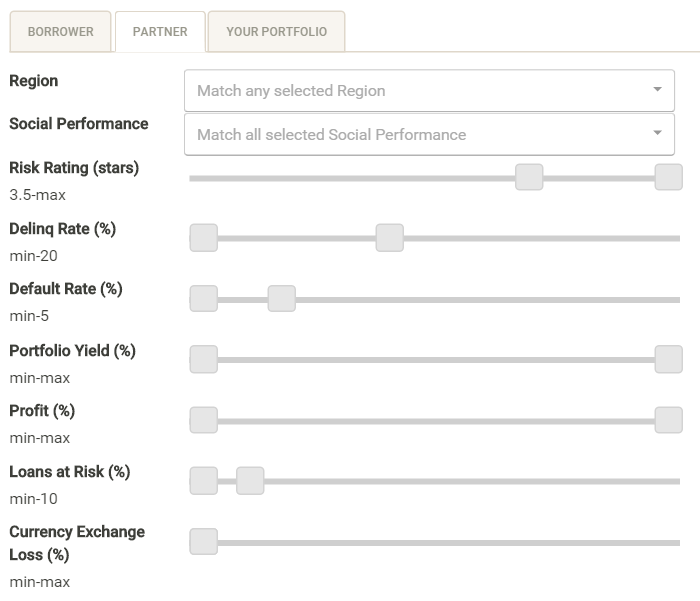

The Partner filters can be used to filter to “safe” loans. “Partners” are the microlending organizations that interact directly with the borrowers. Safe partners are those with high risk ratings, low delinquency rates, very low default rates, few loans at risk, and low currency exchange loss. Shown below are sample “safe” partner settings that can be set within Kivalens.org:

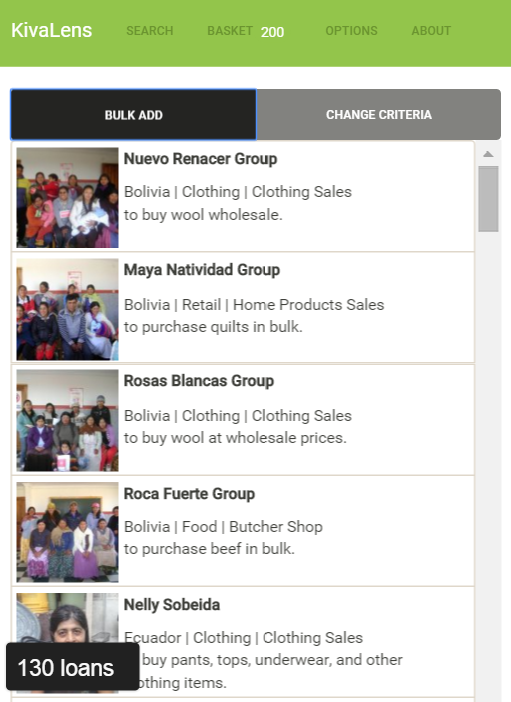

Once you’ve setup your filter criteria, the left side of the screen will display the results. These are the loans that met your criteria, and they’re sorted according to the sort criteria you specified.

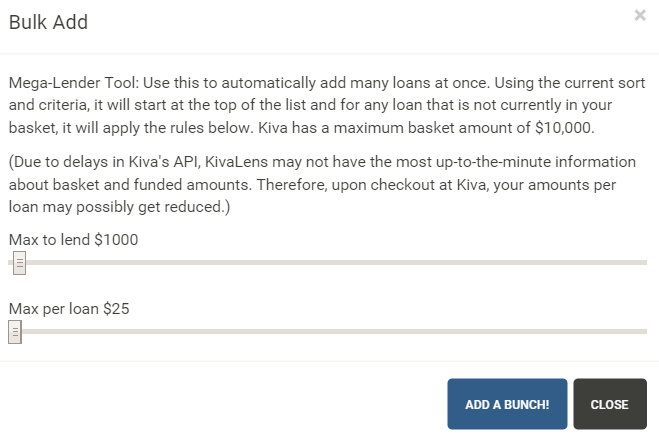

To make a bunch of loans at once, click the “Bulk Add” button. You’ll then see a dialog like this:

Select the total amount you want to loan overall, and the maximum amount you want to loan to each borrower. Then, click “Add a Bunch!” This will move the loans to your Basket. Next, click on Basket (at the top of the screen) to move the loans from Kivalens to Kiva. Once the loans are moved to Kiva.org, you can checkout and pay.

Definintions

The following filter definitions were copied from Kiva.org:

Social Performance

At Kiva, we want to create good in the world. A lot of good.

One way that we try to maximize the good created through Kiva is by partnering with organizations that go above and beyond to generate positive outcomes for the communities they serve. This is called social performance.

Different organizations have different social performance strengths. The Kiva Social Performance Badges below were created to recognize organizations with a demonstrated commitment to one or more of these areas.

The badges were developed through careful research into best practices across the microfinance industry, and what Kiva has learned about facilitating positive outcomes for borrowers. These badges are assigned to Kiva Field Partners during an initial due diligence process and are updated annually.

We know that every member of the Kiva community wants to maximize the impact they have when making a loan. When choosing a borrower to lend to on Kiva, we invite you to consider the Field Partner’s social performance strengths.

What is the Field Partner Risk Rating?

The risk rating (0.5 – 5 stars) reflects the risk of institutional default associated with each of Kiva’s Field Partners.

Microfinance loans are inherently risky, and Kiva does not guarantee repayment. There are many levels of risk associated with Kiva loans, one of which is Field Partner risk (to learn more, go to kiva.org/about/risk). A 0.5-star rating means the organization has a relatively higher risk of institutional default, while a 5-star rating indicates the organization is at a relatively lower risk of default, based on Kiva’s analysis and the available information. To calculate the risk rating, a Kiva analyst conducts due diligence on the organization and then completes Kiva’s risk model, which assesses the organization based upon the following areas of focus: governance, management, transparency, business model, loan product(s), financials and external factors.Note that Field Partners in Kiva’s lowest credit tier undergo a lighter level of due diligence and hence do not receive a risk rating; instead, in places where a risk rating would normally appear on Kiva’s website, these partners are labeled as “Experimental.” For more information, see “What is an Experimental Field Partner?”

Delinquency (Arrears) Rate

Kiva defines the Delinquency (Arrears) Rate as the amount of late payments divided by the total outstanding principal balance Kiva has with the Field Partner. Arrears can result from late repayments from Kiva borrowers as well as delayed payments from the Field Partner.

How this is calculated: Delinquency (Arrears) Rate = Amount of Paying Back Loans Delinquent / Amount OutstandingDefault rate

The default rate is the percentage of ended loans (no longer paying back) which have failed to repay (measured in dollar volume, not units).

How this is calculated: Default Rate = Amount of Ended Loans Defaulted / Amount of Ended Loans

Notes:

– Many Field Partners do not yet have many ended loans due to their short history on Kiva (see “Time on Kiva”). If this is the case, a more meaningful indicator of principal risk is “delinquency rate.”

– At Kiva, we define default (non-repayment) as: the time when Kiva determines that collection of funds from a borrower or partner is doubtful, or the cumulative amount repaid as of a quarterly reconciliation is less than the amount expected as of 180 days prior. Kiva typically processes defaults on a quarterly basis, and case by case exceptions may be made if the partner or Kiva anticipates future repayments to be made on the loan. Field Partners also have the option to default loans at any time, should they determine that further collection of loan repayments from the borrower is unlikely.Average Cost to Borrower

Although Kiva and its lenders don’t charge interest or fees to borrowers, many of Kiva’s Field Partners do charge borrowers in some form in order to make possible the long-term sustainability of their operations, reach and impact. There are 4 different types of information about the cost paid by Kiva borrowers to our Field Partners that may appear in this Average Cost to Borrower field: Portfolio Yield (PY), Annual Percentage Rate (APR), Monthly Percentage Rate (MPR) and Not Applicable (N/A). Please check the loan for more information.

What does “Profitability (Return on Assets)” mean?

“Return on Assets” is an indication of a Field Partner’s profitability. It can also be an indicator of the long-term sustainability of an organization, as organizations consistently operating at a loss (those that have a negative return on assets) may not be able to sustain their operations over time.

Currency Exchange Loss

When lending funds across national boundaries, the local currency in the Field Partner’s country of operation may lose some of its value relative to the USD, thus requiring the Field Partner to use more of its local currency to reimburse Kiva in USD. Kiva offers Field Partners the option to protect themselves against severe currency fluctuations (a US dollar appreciation of over 10% relative to the local currency) by sharing any losses greater than 10% with Kiva lenders.* By bearing these losses, lenders are able to protect the Field Partner and its borrowers from catastrophic currency devaluations.

The Field Partner-specified Currency Exchange Loss to lenders can be one of three values: Covered, Possible, or N/A.

- Covered

- The Field Partner has opted to cover any losses on the loan that are due to currency fluctuation. Lenders will not bear losses due to currency fluctuation.

- Possible

- The Field Partner has opted not to cover losses on the loan that are due to currency fluctuation. In this situation, lenders face additional risk because they will bear losses greater than 10%.

- N/A

- The Field Partner disburses loans to borrowers in USD so their loans are not subject to any foreign currency conversion.

*Note that loans posted before April 16, 2012 with currency exchange risk possible only share losses greater than 20% with lenders.

Currency Exchange Loss Rate

Kiva calculates the Currency Exchange Loss Rate for its Field Partners as: Amount of Currency Exchange Loss / Total Loans.

Loans at risk rate

The loans at risk rate refers to the percentage of Kiva loans being paid back by this Field Partner that are past due in repayment by at least 1 day. This delinquency can be due to either non-payment by Kiva borrowers or non-payment by the Field Partner itself.

Loans at Risk Rate = Amount of paying back loans that are past due / Total amount of Kiva loans outstanding

I just had a Kiva loan that didn’t get funded and the money was put back into my account. I was just wondering if there are people that intentionally search for loans that won’t get funded. There’s a button to sort by loans that are expiring soon. This seems too easy, but it just looks like you could buy into loans with less than an hour remaining and still needing several thousand dollars to fund the loan. When the loan doesn’t get funded, you get your money back and you are able to immediately withdraw the credit to your PayPal account.

Kiva doesn’t let you withdraw cash that hasn’t been successfully loaned.

I just checked my July rewards statement and found that US Bank was not giving me the bonus 2 points per dollar for Kiva. They did give me some arbitrary bonus number, though. I called in take ask what happened, and the CSR said that Kiva is not a recognized charity anymore. Is anyone else that does MS through Flex Perks seeing this?

Thanks.

Yep, same here with my business Flexperks card. Was yours a business and personal card?

Personal card. If this holds true, this is a bummer. I was trying to take advantage of the 3x flex perk points through the rest of 2017 before the point earning structure changes. I have had this card since last year’s Olympics promo. Actually, outside of using 3,500 points for the annual fee, I haven’t used any of these points. I enjoy doing Kiva loans, but I will probably slow down considerably my Kiva activity following this development with US Bank. I may still have to MS other cards with high spend amounts through Kiva, but this will be rare as I have other ways to meet minimums (college loan payments via Gift of College and federal taxes, to name a couple). I wonder how much effect this will have on Kiva.

[…] per dollar, to a fixed 3 cents per dollar. Ouch. For those of us who like to contribute to Kiva loans, this will […]

[…] Kiva loans code as charity, this has been a great way to get rewarded while doing some good (See: Manufacture Spend (and do good) with Kiva and Kivalens). At 2X, the FlexPerks Visa will still be the best standard option for charitable donations, but no […]

[…] I knew about miles and points, so it was a natural fit. Here are two blog posts, one over at Frequent Miler and one over at Rene’s site, that will help you even more should you decide to fund some Kiva […]

I am testing this out for the following reasons:

– I was already loaning to Kiva, and donating to their general fund, so this was just a change in method

– Since I leave the auto 15% donation to Kiva in each loan, they end up with a nice annual donation

– I travel and love points like every other traveling fool

– I have the cash to pay off cc each month

– I like the monthly dopamine hit of empowering underdogs

– It lets me earn points while helping others, and incentivizes me to do more of it

[…] See: Manufacture Spend (and do good) with Kiva and Kivalens. […]

[…] See: Manufacture Spend (and do good) with Kiva and Kivalens. […]

Kickfurther/Kiva are not MS. It is gambling, pure and simple. I imagine you always win every time you gamble Greg. And you pay for it with your credit cards. The fact that you don’t put caveats on these methods makes me wonder if you get Kickbacks ala the Points Guy.

VERY YMMV. Personally I’d avoid.

[…] See: Manufacture Spend (and do good) with Kiva and Kivalens. […]

[…] Kivalens resurfaces, better than before. – Kivalens is a great tool for people who use Kiva to make loans. The tool has been improved with a new interface and wider compatibility. […]

A few other points to add to my comment above:

1) Many 6 month loans have been predisbursed the month before, which really makes it a 5 month repayment term.

2) If you make the loan at the beginning of your CC statement cycle, the statement doesn’t close for another 3.5 weeks and then the bill is not due for another 3 weeks after that. So you’ve gut about 1.5 months of the term of your “loan.”

Combine the two points above, and you’re looking at an effective term of 3.5 months, with the money being paid back in installments.

I am sorry, but WTH is the point to this? I get the getting points part, but tying up my money waiting on a NO interest loan while I am paying interest on my card? Seems like crazy to me! Nice for those with unlimited resources, etc, but for a regular person this makes no sense, unless there is something you’re not telling me/us here.

I mean, will the/any credit card NOT charge me interest while I want for someone to pay me back a no interest loan?

Gonna have to explain this better for it to make sense, at least to me, or it seems like I am giving money away to get some points when there are easier ways to buy points.

This is for people who have the excess cash to cover the loans. If that’s not you, then fine, move on to other things. You should NOT pay interest on your credit card. That will more than wipe out the value of credit card rewards. Those that have spare cash that can be tied up long term may be interested in Kiva for both doing good and earning credit card rewards.

Although I have been making Kiva loans, I often wondered how people were able to make a large number of loans without taking an inordinate amount of time reviewing each borrower. Now I know. Thanks!

This is good news – I had planned on swearing off Kiva after the death of Kivalens, but I may have to reverse that decision – new Kivalens looks slick and glad to see them moving to HTML5 instead of Silverlight.

I’ll at least probably continue to run my $2k/quarter through my wife’s Cash+ card. Assuming 7-month loans on average and a 1% loss rate, that’s an average continuous “investment” of $2,666 with a rate of return of 12%/year.

Can you explain how you come to that 12% APY?

Sure – if I invest $666.67/month (i.e. $2k/quarter), and the average loan duration is 7 months and pays out evenly (1/7 each month), on average, I have a sum of $2,666.67 invested at any given time*.

$2k/quarter * 5% = $100/quarter, or $400/year, but I lose 1% of my total invested for the year due to default/currency, so that’s $80 lost. Total gain: $320.

$320/$2,667 = 12%

* Obviously, this can vary substantially, especially based on delinquency rate and what type of repayment structure is in place (some front-load repayments, some – like agriculture loans – are repaid in full at the end, others are evenly distributed). To simplify, I assume that on average, loans are evenly repaid each month. Here’s my calculation:

Let’s say I’m in August with 7-month loans, loaning 1/3 of $2000 each month. I have:

7/7 of July’s loans still unpaid

6/7 of June’s loans still unpaid

…

1/7 of January’s loans still unpaid

(1 + 2 + 3 + 4 + 5 + 6 + 7)/7 * $666.67 = 4 * $666.67 = $2666.67

We can extrapolate a formula for n-month loans by using the formula for an arithmetic series:

Continuous investment = (n+1)/2 * A, where A is the monthly loan amount.

That is a pretty nice return. Is your US Cash+ limited to $2K per quarter or is that the limit Kiva has for loaning?

It’s the limit for Cash+ getting 5% on charity. I have one too, but I almost use the entire limit of mine on actual charitable contributions, so I don’t have much left for Kiva.