My favorite points programs are transferable points programs. These are programs that let the account holder transfer points to their choice of a number of airline and hotel programs. See: A quick guide to transferable points programs. My favorite transferable points program is Chase Ultimate Rewards…

- Membership Rewards vs. Ultimate Rewards vs. ThankYou Rewards. Which is best?

- SPG vs. Amex, Chase, and Citi transferable points programs. Which is best?

Complex Chase point transfer rules

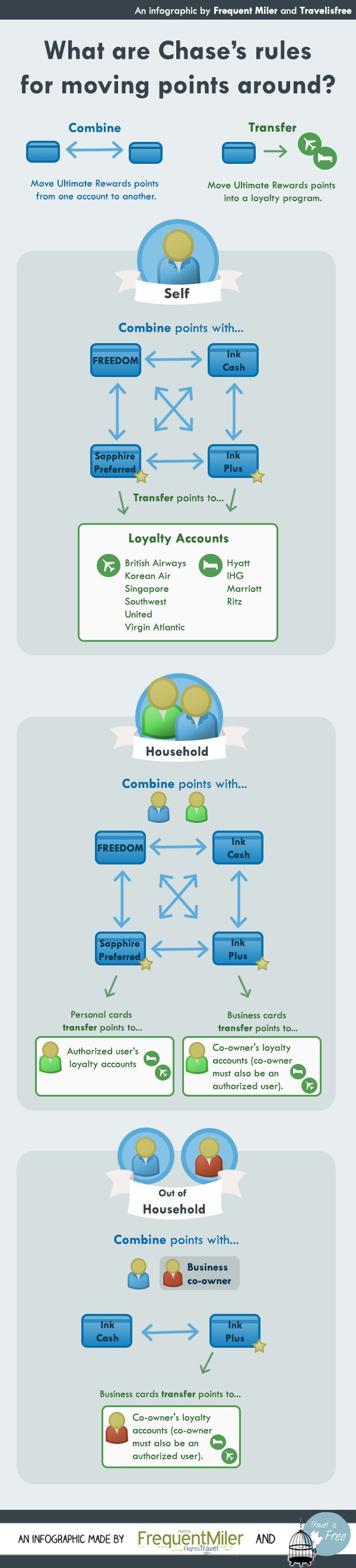

In addition to allowing point transfers to a variety of airline and hotel program, Chase lets you transfer points from one card account to another, or from one person’s account to another, or from one person’s account to another person’s airline or hotel account. Chase has strict rules about these point transfers. In some cases, the point recipient must be a household member and an authorized user on your account. In some cases it’s possible to transfer points to someone outside of your household. When you move points from one Chase account to another, Chase calls this “Combine points”. When you move points from a Chase account to an airline or hotel loyalty program, Chase calls this “Transfer points”. Chase has different rules for combining points than for transferring points.

Chase point transfer rules made simple

To help explain Chase’s point combine and transfer rules, I teamed up with Travel Is Free to develop an infographic, shown below.

Additional details

Chase has more Ultimate Rewards cards than those shown above. Chase Sapphire, Ink Classic, and Ink Bold are no longer available to new applicants, but many people still carry these cards. Additionally, there’s the JP Morgan Palladium card, available only to Chase Private Client customers. Soon, Chase will also offer the Chase Freedom Unlimited card. Here’s how to read the above infographic for these cards:

- Sapphire (not Sapphire Preferred) and Freedom Unlimited follow the same rules as the Freedom card.

- Ink Classic follows the same rules as Ink Cash.

- JP Morgan Palladium follows the same rules as Sapphire Preferred.

- Ink Bold follows the same rules as Ink Plus.

Rules in text form, straight from Chase

Here are the rules as written on Chase’s website as of 3/7/2016:

Combine points personal cards:

You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, or one member of your household. If we suspect that you’ve engaged in fraudulent activity related to your credit card account or Ultimate Rewards, or that you’ve misused Ultimate Rewards in any way (for example by buying or selling points, moving or transferring points with or to an ineligible third party or account, or repeatedly opening or otherwise maintaining credit card accounts for the sole purpose of generating rewards) we may temporarily prohibit you from earning points or using points you’ve already earned. If we believe you’ve engaged in any of these acts, we’ll close your credit card account and you’ll lose all your points.

Combine points business cards:

You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, one member of your household, or your joint business owner, as applicable. If we suspect that you’ve engaged in fraudulent activity related to your credit card account or Ultimate Rewards, or that you’ve misused Ultimate Rewards in any way (for example by buying or selling points, moving or transferring points with or to an ineligible third party or account, or repeatedly opening or otherwise maintaining credit card accounts for the sole purpose of generating rewards) we may temporarily prohibit you from earning points or using points you’ve already earned. If we believe you’ve engaged in any of these acts, we’ll close your credit card account and you’ll lose all your points.

Transfer points to loyalty programs:

For Consumer Card accounts, you may only transfer points to yourself or one additional household member who is listed as an authorized user on your card account. For Business Card accounts, you may only transfer points to yourself or an owner of the company who is listed as an authorized user on your card account.

See more cool stuff

If you enjoyed this infographic and want to see more, see Travel is Free’s InfoGraphics page.

[…] Getting Hyatt points: Points can be transferred from premium Chase Ultimate Rewards cards including Sapphire Reserve, Sapphire Preferred, and Ink Business Preferred. If you have points in a no-fee card, you can move those points first to a premium card account and then to Hyatt. See: Chase point transfer rules made simple [Infographic]. […]

This may be a stupid question. Does it matter which account I log on to do the combine points/add account between my wife freedom acct and my chase reserve sapphire acct? I will want to transfer from her acct to my acct. She just got her freedom card. She doesn’t have points til the end of the statement, so I can’t do the combine points/add user option on her acct. If I add her acct from my chase reserve login will it automatically allow me to transfer points from her freedom acct to my chase reserve when she has points? Or will I have to wait until she has points and do it from her acct?

You will have to wait until she has points and do it from her account.

I guess this is a *hypothetical*. Say I want to transfer points to my girlfriend–different address. I open the Ink Plus Business Preferred and list her as a co-owner of the business (not much of one), and she is an AU. Can I transfer the 80,000 points to her UR account (which she could then transfer to her Sapphire Reserve account)? She booked a trip for me using her own UR points so this is to reimburse her. Would that work?

Theoretically that should work. You wouldn’t transfer points to her Ink card though: as an AU she can’t hold any points in that account. But, you should be able to transfer points to her Sapphire Reserve based on my understanding of the rules. A more certain way to make this happen would be if she also opened her own Ink card under the same business name and EIN as you. That way you can transfer points to her business card.

Are there any datapoints to verify this? That it’s possible to transfer points between different Ink cards, from different owners, that share same EIN. I’d like to list my P2 as a co-owner in my business (they are), but I haven’t figured out a way to do so besides what you’ve suggested above.

I haven’t actually tried it. But if you’re both registered with the same home address, you can move points between P1 and P2 cards

So to be clear, does the Chase Ink Cash card give you the ability to transfer points to travel partners? Your infographics seem to imply no

That is correct — the Ink Cash alone can not transfer to partners. You need a Sapphire Reserve, Sapphire Preferred, Ink Plus, or Ink Business Preferred to transfer to partners (or perhaps one of the old varieties of Bold that is no longer available — Ink Plus is no longer available either).

[…] other accounts you own, or from a selected household member, or from a joint business owner. See Chase point transfer rules made simple [Infographic] for […]

[…] Chase point transfer rules made simple [Infographic] […]

My wife has a Chase Sapphire card and I’m an Authorized User on her card. If I got a Chase Freedom card or an Ink Cash card (not the tier 2 cards, but the cash back cards) can I transfer those rewards to her so we can earn the 5X points, or do I need to open up a tier 2 card (Sapphire, Ink Plus, etc) to be able to transfer the points to her account?

I understand that she could just open the Ink Cash or Freedom card, but I wanted to give it a shot first, especially since our side business is in my name.

Yes, you can transfer points to her account as long as you are in the same household. Plus, since you are an AU on her card, she can transfer points from her Sapphire account to your loyalty accounts.

More details here: https://frequentmiler.com/2016/03/08/chase-point-transfer-rules-made-simple-infographic/

I have a CSP card with my wife being the authorized user. Can my wife apply CSR and get the sign up bonus? Or do I need to remove her from the CSP authorized user list before she can apply? Secondly, after she gets the sign up bonus, it is possible for us to merge points rignt?

Yes, she can apply for the CSR and get the signup bonus. Yes, you will be able to merge points as long as you live in the same house

[…] For details, see: Chase point transfer rules made simple [Infographic]. […]

[…] Chase point transfer rules made simple [Infographic] […]

[…] Chase point transfer rules made simple [Infographic] […]

[…] or domestic partner, you can transfer points back and forth to each other. See this infographic Chase point transfer rules made simple on Frequent Miler for […]

[…] Chase point transfer rules made simple [Infographic] […]

So, my recently ex-wife and I both have two freedom cards and an Ink plus. We shared the same address for years, still share some finances (along with a child), but as of a few months now, have different addresses. Wonder if I should call Chase and ask about combining points from Freedom to Freedom, or just do it and hope for the best?

I guess it depends on your comfort level with either option. I don’t have any useful advice for you here, sorry!

I have 400k UR points in a Freedom account. I can’t get the SP or ink because of 5/24 rule. My wife should be able to. Can I become an AU on her account despite my own 5/24 predicament? Does it matter if she adds me at time of application or later? Thank you

Yes, you can become an AU on her account, no problem. She can add you at any time. The advantage of doing so at the time of application is to earn the additional 5,000 points.

You do not have to add the AU at application to get the 5k points. I’ve done it a few days after activating the card for both CSP and Hyatt cards and both times received the 5k AU points.

Good point. The AU has to be added within the first 3 months.