If you often apply for credit cards in order to earn welcome bonuses, then you’ve probably realized that managing your credit is important. And it’s not just your credit score that’s important — it’s also good to be alerted when new hard inquiries are made and to know the details of your credit report. Chase’s dreaded 5/24 Rule is a good example of this. Chase will usually decline an applicant if he or she has opened 5 or more credit cards with any bank in the past 24 months. So, it’s a good idea to know how to count your 5/24 status.

The Basics

Three credit bureaus: In the US, there are three credit bureaus that banks can use to request your credit report: Equifax, Experian, and TransUnion. Some banks pull from just one bureau. Some pull from two. Some pull from all three. And they’re not always consistent. Depending upon where you live, banks may vary which credit bureau(s) they pull from.

Scores: Most lenders use your FICO Score to help determine whether or not to extend new credit to you. According to myFICO, scores take into account the following factors:

- 35% Payment History: Always pay your bills on time!

- 30% Amounts Owed: Try not to use anywhere near all of your available credit

- 15% Length of Credit History: The longer the better. Don’t get rid of your oldest cards!

- 10% New Credit: When you open many new accounts, it can affect your score negatively

- 10% Credit Mix: It’s good to have a mix of loans: credit cards, car loan, mortgage, etc.

Inquiries: When you request a new card, the credit issuer almost always issues a “hard” inquiry rather than a soft inquiry. A hard inquiry (a “hard pull”) will usually have a small temporary negative effect on your credit score. Even if your score doesn’t decrease, too many hard inquiries can hurt your chances of getting a new credit card because it looks like you’re desperate for credit. Soft inquiries have no effect.

Tip 1: Hard Inquiries appear only on the credit report of the bureau that handled the inquiry. This means that you will likely have different numbers of inquiries showing on each credit report. By keeping track of which credit bureau each bank uses for your applications, it may be possible to spread out the inquiries across bureaus so that no single bureau shows too many.

Tip 2: Inquiries “hurt” much less as time goes by. After 90 days, the negative effect is minimal. After 6 months, hard inquiries are barely considered. And, after 24 months they fall off your credit report altogether.

Accounts: When you are approved for a new card, it becomes a new account on your credit reports. Most if not all major banks report accounts to all three bureaus. They report the open date, close date (if applicable), current balance each month, current credit limit, whether or not you missed payments, etc.

Tip 1: The status of your revolving credit accounts is much more important to your credit score than number of inquiries. Make sure to pay your all of your accounts on time.

Tip 2: Having more accounts can help your credit score. 30% of your score is your credit utilization ratio. The larger your total credit limit, the better your utilization ratio should be. In most cases, more cards means having a higher limit and therefore a better utilization ratio.

Tip 3: Unlike inquiries, accounts usually show up on all three credit bureaus.

FREE Credit Scores, Reports, and Monitoring

Ideally you would have ready access to your scores, accounts (credit report details), and inquiries from all three bureaus. And, ideally, all three bureaus would be monitored: you would be alerted when new inquiries are made or new accounts added to your reports. And, of course, all of this would ideally be free. Here’s how…

In most cases there are a number of options for free scores, reports, and/or monitoring. Many tools offer free FAKO credit scores (these are estimates of FICO scores), but it’s possible to find free options for real FICO scores. I’ve picked the options that I think will be most accessible to most readers:

Equifax

- FICO Credit Score

- Credit Report and Credit Monitoring

- Credit Report without Monitoring

Experian

- FICO Credit Score:

- Credit Report and credit monitoring

- FreeCreditScore.com (also offers free credit scores to some customers, but not all. You may have to sign up via a private/incognito window to get free scores — yes, weird)

- Experian Smart Phone App

- ProtectMyID via AAA membership (Available to most, but not all AAA areas)

- Credit Report without Monitoring

TransUnion

- FICO Credit Score:

- Free for Barclaycard cardholders (log into your account to view)

- Discover offers free FICO credit scores for customers and non-customers

- Also available free for Discover cardholders (log into your account to view)

- Credit Report and credit monitoring

- WalletHub provides full details and monitoring for free. Unlike other services which update weekly or monthly, this one provides daily updates.

- Credit Karma provides full details and monitoring for free

- Chase Credit Journey provides summary information and monitoring

- Free for SoFi members

- Credit Report without monitoring

Recommendation

For most people, monitoring all three credit bureaus is probably overkill. In my opinion, WalletHub is an excellent choice for those who want to subscribe to just one free service which provides credit monitoring (get alerted when there are any changes to your report), full credit details, and a FAKO credit score (which is good enough for most needs). Alternatively, if you want to use a similar service that also makes it possible to count your Chase 5/24 status (via the trick described here), consider Credit Karma.

With either WalletHub or Credit Karma, if you then also want to look up your actual credit score, look to your credit card issuer: Citi for Equifax, Discover for Experian, and Amex, Barclays, or Discover for TransUnion.

In the past I run the free credit report every year. What stops me from that is the inconvenience way the credit companies display the account. Instead of showing flast 4-5 digits they have whatever internal way. It is possible to identify account by bank and open date. It is still hassle that way when you have many accounts.

It becomes too much time consuming and I abandoned monitoring.

Could just be me, but Discover now only gives TransUnion FICO 8 scores. Amex has Experian.

You’re right. Fixed. Thank you.

Is there any resource to which credit bureaus are pulled by which card issuer? And which ones you can freeze with each issuer application to still get the app through by them using another bureau?

You can try this: https://creditboards.com/forums/index.php?/creditpulls/

Interesting personal lesson learned on “Make sure to pay your all of your accounts on time.”

Many cards offer an introductory 0% interest rate for 12 months or so. Last year, I got a Chase Ink *business* card and quickly charged $40K+. Instead of paying the card off, I parked that $ in a Bask account earning 5% for the year and made only minimum payments on the card. I then paid off the balance after the 12 months. This worked splendidly and had no adverse impacts to my credit score.

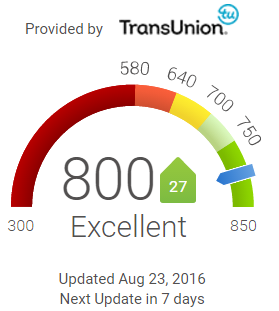

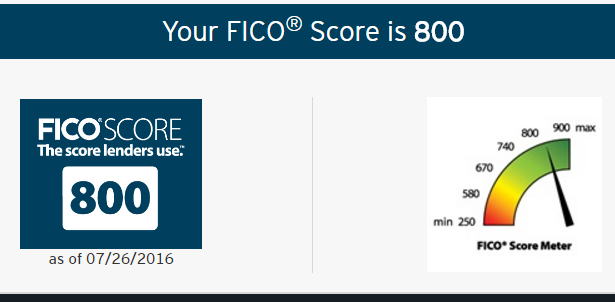

Later in the year, I got a Chase Freedom Unlimited *personal* card (0% interest for 15 months) with the same goal in mind. After the first month, I had charged about $8K and made the minimum payment on the card. A couple of weeks later, I noticed that my credit score had tanked about 60 points from 800 to about 740.

It took a couple of month for me to realize what had happened, but when I paid off the balance in full, my credit score fully recovered.

Be careful out there!

Good point! The difference was that the high utilization wasn’t reported for your business card but it was reported for your personal card.

FYI wanted to share this experience, not sure if it has occurred to others. When being approved for my Chase Hyatt card earlier this year, I wanted a higher credit line to help spend to status easier. I moved credit from other minimally used cards (Southwest, IHG, Ritz), no problem/piece of cake on the Chase side. However my credit score was dinged big time — 25-29 points on all 3 due to ” a decrease in credit limit” noted on those 3 cards (this is all from CreditKarma). So it seems even though my net available credit did not change, these ‘decreases’ had a significant impact.

[…] For more info about credit scores and inquiries, please see: Free Credit Scores, Reports, and Monitoring: Complete guide. […]

Discover will monitor your Experian credit report. Inquiries only effect Fico score for 12 months. The reason code states that “too many inquiries within the last 12 months” there is no reason code “too many inquiries within the last 24 months”.

Experian.com gives me free score and report for my Experian file

They offer free Experian credit monitoring as well. But it basically the same thing as freecreditscore.com or freecreditreport.com they are all owned by Experian

When I click the Amex TransUnion link, it says it’s a free Vantage score

Good catch. I’ve removed that option from the list since it can be confusing.

Greg, wonder if adding info on how to freeze a bureau when needed, or just a little on the two, goofy small bureaus out there? (came into play with the rakuten card…..)

Maybe not the right post, but that could be useful info again.

Great idea. Will add next time!

Amex offers cardholders complimentary access to their Experian 8 scores.

Added. Thanks!