Thanks to its generous signup bonus, excellent perks, and $300 in annual travel credits, the $550 Chase Sapphire Reserve Card is a great card for almost anyone who can get it. Whether or not its worth keeping after the first 12 months depends upon how much you value its perks (3X points for travel & dining, airport lounge access, primary rental car coverage, $300 in annual travel credits, etc.).

Thanks to its generous signup bonus, excellent perks, and $300 in annual travel credits, the $550 Chase Sapphire Reserve Card is a great card for almost anyone who can get it. Whether or not its worth keeping after the first 12 months depends upon how much you value its perks (3X points for travel & dining, airport lounge access, primary rental car coverage, $300 in annual travel credits, etc.).

Whether you decide to keep the card for just one year or for many, the only way to get value from the card is to take advantage of its perks. Here’s how…

#1 Meet minimum spend requirements

In order to earn the card’s 100,000 point signup bonus, you have to complete $4K of spend in 3 months. And, keep in mind that the card’s $550 annual fee does not count towards that spend threshold. $300 in travel reimbursements do count.

See also:

- 3 easy ways to meet the Sapphire Reserve minimum spend requirement

- Increase credit card spend (and get most of it back). What still works?

#2 Spend at least $300 this year on travel

In order to get the full $300 in travel credits for this year, you have to spent at least $300 on travel before your December statement closes. If your travel begins after that date, you still have options:

- Purchase travel (hotels, flights, etc.) in advance. If booking a hotel, most online travel agencies charge the full amount in advance even if the booking is fully refundable. In this case, that’s a good thing.

- Buy gift cards directly from travel providers such as hotels or airlines. If buying online, make sure that you are not directed to a non-travel URL (like Cashstar) when checking out. If buying in person at a hotel, make sure to buy at the front desk.

- Buy miles or points directly from travel providers when those points are on sale. Be careful: many points purchases are handled by points.com. If so, the purchase won’t count as travel.

#3 Use card for all travel & dining purchases

One of the best benefits of the card, in my opinion, is the ability to earn 3 valuable Ultimate Rewards points per dollar for all travel & dining purchases. Make this card the card you use for these purchases.

#4 Enroll card in dining rewards programs

5.1) Enroll in Restaurants Plus and link your Sapphire Reserve card in order to earn automatic cash back, in addition to the Sapphire Reserve’s 3X rewards, at many restaurants across the country. Even though the Restaurants Plus website only lists a few eligible cities, I’ve found that it works in all restaurants covered by a similar program called Mogl (click here to search your location). Note that if you use my Restaurants Plus link to sign up, you’ll earn 100% cashback on your first meal (up to $20) and I’ll get $20 too.

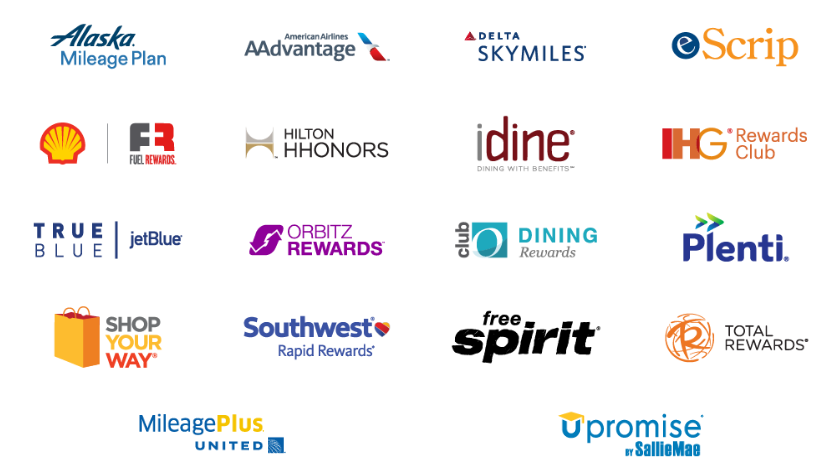

5.2) Enroll in a Rewards Network dining program and link your Sapphire Reserve card in order to earn extra points or miles at many restaurants across the country. I recommend picking the program in which you value the points or miles the most. I’m currently signed up for the Alaska Mileage Plan program. Free Frequent Flyer Miles (under the “Other Programs I Like” tabe) lists most of the Rewards Network programs along with any signup bonuses they may have.

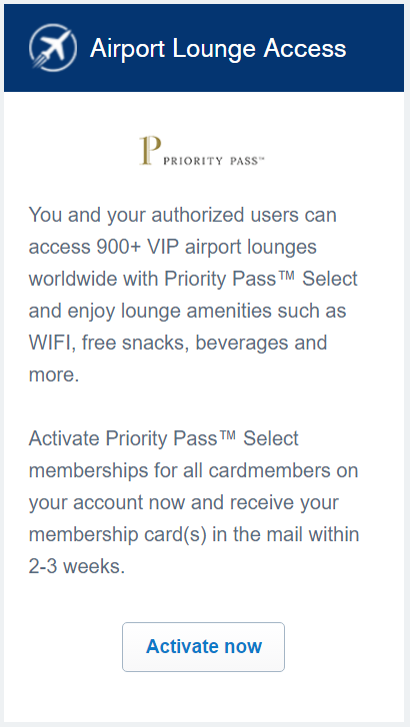

#5 Activate your Priority Pass Select membership

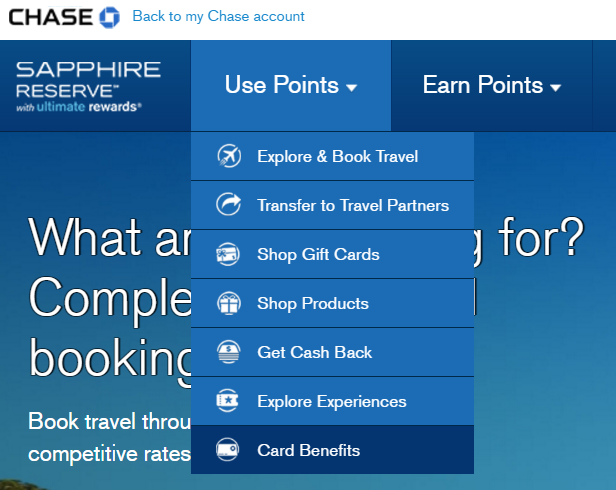

Log into your Chase account, go to Ultimate Rewards, then select Use Points… Card Benefits:

Next, click the button to activate your Priority Pass membership. A Priority Pass card will be sent to you in the mail.

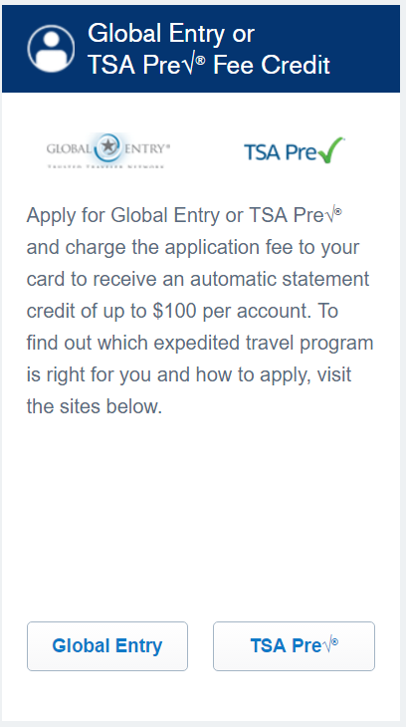

#6 Sign up for Global Entry

Go to Card Benefits (see the Activate Priority Pass section, above) to find the link to sign up for Global Entry (Global Entry includes TSA Precheck so there’s no reason to sign up for TSA Precheck on its own). Fill out the required information and pay with your Sapphire Reserve card. Your payment should be automatically reimbursed by Chase.

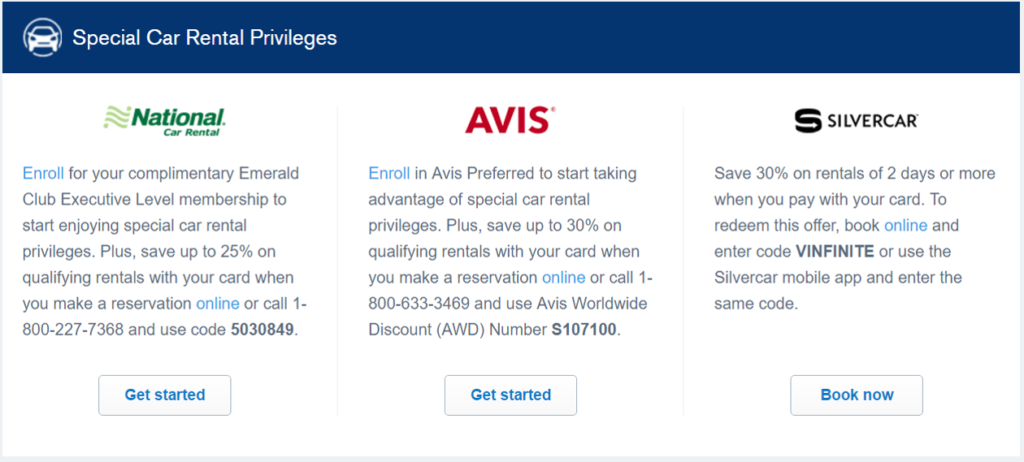

#7 Upgrade to National Car Rental Executive Status

This is seriously worth a minute or two of your time. Go to Card Benefits (see the Activate Priority Pass section, above) to find your “Special Car Rental Privileges”:

Under National Car Rental, click “Get started”. With Executive status, you can reserve a mid-size car and then pick from any car in the Executive Aisle. This typically includes your choice of nice sedans, large SUVs, etc.

#8 Setup as primary card with rental car programs, ride-shares, etc.

To take advantage of the Sapphire Reserve Card’s primary rental coverage and 3X rewards for travel, I recommend adding it as your primary credit card in your rental car accounts (National, Hertz, Avis, etc.). You can also earn 3X rewards with ride share services, so you may want to make it your primary card in your Uber and Lyft accounts too.

| Name / Link | Offer | Frequent Miler Notes: |

|---|---|---|

| Uber | You will receive $5 towards your first ride if you use my link. | Use to call up cars “on demand” from your smart phone via the Uber app. Trip is automatically charged to your credit card. If you go with UberX (default option) prices tend to be much cheaper than taxis. |

| Lyft | You will receive $5 towards your first ride if you use my link. | Very similar to Uber. |

I’m on CSR account right now on Chase.com and there is no link if you go to Ultimate Rewards by CSR for Benefits. Its the same screen as your screenshot, but those Benefits link doesn’t exist.

If you go back to the actual account, and use the dropdown, you can select card benefits, but its not there either. Anyone know if they moved it?

I still see the Card Benefits option as shown in this post. Log into Ultimate Rewards, click Use Points… Card Benefits.

Maybe try again, or try with a different browser.

Hi Greg,

I had a CSP and now took a CSR. I am gonna downgrade the CSP to a free card, which one would be the best option?

Also, I took my new CSR on Jan 8th, 2017, my billing cycle is set to 6th of each month. Will I be eligible to use 300$ annual travel credit 2 times in 2017? If so, how?

Freedom Unlimited is a good choice for a downgrade. It is a great compliment to the CSR since it earns 1.5X everywhere and points can be moved to the CSR.

Yes, you can earn $300 in travel credits now, and then again after your December statement closes.

Thanks Greg. If I plan to close CSR later, how many days will that take? What is the usual process for closing such top end credit cards? Do I walk in to the branch or it has to be via their customer support?

It’s easy. Just call the number on the back of the card, or send a secure message online. Make sure to move all of your points out of the account first though!

Hi, Greg thanks for the awesome post. I am yet to use the $100 credit for TSA pre-check/Global entry.

Que:

1. Can I use this credit to apply for my wife’s Global Entry fee (She is not AU on this card)?

2. Sept-17 is the first closing year for my CSR. Will I be able to use another $100 credit if I apply Global Entry for me for the next year after Sept-17?

Appreciate your response here.

Thanks

1. Yes. Simply pay for her fee with your card

2. No. You can get the credit once every 4 years.

See: https://frequentmiler.com/chase-sapphire-reserve-complete-guide/

Thanks Greg for the clarification…!!!

If you get Global Entry first & approved, will you be required to do another interview when you go for pre-check?

Also in the pic posted for GE/PC, it says receive an automatic statement credit of up to $100 per account. Will this count for an authorized user’s account too?

You get pre check automatically when you interview for global entry. No need for a second interview

Yes I think that authorized users get global entry credits too but you should double check before doing so

Thanks. I did call Chase Sapphire # on GE for AU and the CSR told me the credit was for primary only. Has anyone done this yet and knows for sure? I held off getting the AU for now.

I was just advised from a Chase rep that they cannot change the statement closing date sooner.

It means that your travel spending will count towards 2017, not 2016…

Yep. Thanks for the update. You can still get two travel credits first year but now it will be for 2017 and 2018

Hey Greg,

Quick question/clarification about moving the statement date. My parents told me today they had a large spending coming up so i had them apply for the reserve, but the first statement closing date will probably be in January. Will it still count toward 2016 if I get chase to move that date up back into December?

I’d appreciate your opinion on this, thanks.

John

If you can get Chase to move the close date to December, then it will count towards 2016 as long as the purchase clears from pending before the close date

Cool, thanks Greg.

Hello Greg,

I activated my card today November 29,2016 and my account shows a due date of January 23,2017. It’s not allowing me to change the due date with reason that the account is new. Do you think I’m still going to get the $300 annual credit this year? Thanks.

Maria

I think whether or not the credit counts towards 2016 depends on when the December statement closes and not your first payment due date. So the question is: when does your December statement with them close? If it closes *in* December and your travel transaction posts *before* that date then it should qualify for a 2016 credit. I have been told that it counts as 2016 as long as it’s through December 31, but, as Greg mentions above, I might have been misinformed.

PS: A Chase representative just confirmed to me that your purchase must be made before the close of your statement *in* December in order to qualify for the travel credit. So if your first statement closes in December (the due date is a different thing entirely) and your purchase posts before that date, then you should be good to go for the credit to qualify for 2016.

Thanks for your help!

You’re welcome. I’d recommend calling the number on the back of your card and simply asking Chase when your first i.e December statement closes. It would probably take less than a minute and save you weeks of concern.

Followed your advice! spoke to chase and they told me closing date is December 26! any travel purchases posted by that date should be counted towards the 2016 credits 🙂

Great!

Maria,

What is the closing date for your first statement? If it is in December, then (as J.B. wrote) you should be fine as long as you can spend $300 or more in travel before that date.

I’m not sure where to look for the closing date on this account since it is new but I have checked my 2 other chase credit cards previous statements and it looks like the closing date is 25 days before the due date. My CSR due date is Jan 23 so I’m crossing my fingers my statement will close on December 30 and have my credits for 2016 counted! Thanks

I signed up AFTER talking to a CSR and they confidently confirmed that it was calendar year in which the $300 travel credit renews, but I called again to expedite my card and increase the credit limit only to find out that what everyone is saying is true — renewal of the travel credit is based on the Dec close statement, in which case I won’t get a 2016 + 2017 travel credit since I just signed up (12/6/2016). Any money spent on travel in Dec 2016 will be a part of my 2017 credit.

Ravi: Call again and ask to have your close date moved to December. Several people have reported success with this, but you may have to ask to speak to a supervisor to get it done.

Yes the travel credits post right away but that doesn’t necessarily mean that they will count towards 2016. We won’t know for certain until people with January closing dates and remaining 2016 credits make travel purchases in December

@kingofkingsforu is correct. The credit takes ~ a day to show-up. I got $7 credited for parking in downtown chicago, but only live in a suburb. I got credit for adding to my toll pass as well as the fees for an award flight. All within a day of booking/realizing the charge. Some I didn’t even realize until I checked for my award flight fees. $180 down…$120 to go!

[…] Your Chase Sapphire Reserve card has arrived. Here’s what to do next…Counting the days months to get this baby… […]

for travel credit i dont think so we need to worry when the statement closes. Travel credits are immediately getting credited whenever the travel purchases are made. i made a purchase for 30 $ for baggage and it is getting credited back immediately after the transaction posts

Uber charge does not include a tip for the driver and there is no way to leave a tip in the app. You give the driver a cash tip if you desire to tip.

Hi Greg,

Just a data point if it helps. I tweeted Chase a few days ago asking specifically about the travel credit and whether a statement that opened in December and closed in January would count towards the 2016 or 2017 travel credit. Here’s my question:

“If 1st statement with CS Reserve opens Dec & closes in Jan does $300 travel purchase in Dec count as 2016 or 2017 trvl credit?”

And here’s the response I received:

“Great question! Purchases through December 31 will count towards 2016 travel credit. Let us know if you have more questions.”

I’m not sure if that information helps anyone but just through I’d put that out there. I asked Chase for this information because I don’t anticipate getting my Reserve (if I’m approved) before early to mid-December. I do have an immediate travel expenditure that would count towards the travel credit.

J.B

If the travel purchase posts to your account before your December 2016 statement close date then it should count towards your 2016 $300. There is still much confusion if it’s the statement close date or Dec 31, 2016. The website says statement close date, many reps say Dec 31st. Already used my 2016 credit and my statement close date is December 20, 2016. I’ll check my account on December 21, 2016 to see if the $300 resets (becomes available) for 2017

Just reread your question. Did not see the January statement close date. Agree with Greg, the credit will post virtually the date the charge posts but the $300 credit will go against 2017. Sorry for the confusion

Thank you for the confirmation! I might have left this application too late now thanks to the misinformation from the Chase rep. Will have to make a call in the next day or two.

I’m concerned that the Chase Twitter rep may have given you wrong info. The card’s benefit terms state that it is based on your December close date so I’d expect your charges to get credited for 2017 in that example.

Yeesh. Thanks, Greg. I wonder if it’s possible to move *up* one’s statement date so that it closes during the December window. Of course, that means getting hit with the annual fee a little sooner than expected, although the $300 travel credit is supposedly nearly instantaneous according to a report on TPG–which should help offset things.

Hi Greg,

I have what I think will be a useful update for those of us, like me, who have been confused about the requirements to qualify for the travel credit in this year. I was just approved for the Reserve (hooray!) and had a conversation with a friendly representative on this very subject. He told me that Chase recently sent out a memo to its own people clarifying that in order for a travel purchase to count towards this year’s credit it would have to post *before the close of the December statement of that year* and *not* through 31 December (the latter being what I was told by another Chase rep). In short, in order to get the travel credit for 2016 your travel purchase must be made before your statement closes *in* the month of December–it is not based on the calendar year as some, including myself, had been led to believe.

My first statement closes in the 3rd week of December and, fortunately, I have a travel purchase I need to make before then. If I had followed the instructions of the first Chase rep I would have been in trouble.

Hope this helps anyone still looking for this information.

J.B

Thanks for the confirmation J.B.

I have signed up with Uber through your link but I did not receive the promotional code for one free ride.

It should be automatic. You shouldn’t need a code

Does the Restaurants Plus stack with Rewards Network?

And what’s up with Mogl itself? I’ve only used Rewards Network.

Yes, they stack