Whether you need to increase credit card spend to earn a new credit card signup bonus, or to earn elite status, or simply to earn credit card rewards, it’s important to keep up with the latest news of what works and what does not.

This month, I’m trying out a new format. I’ve moved details about each “increase spend” technique to a separate page: Manufactured Spending Complete Guide. To be honest, most of the techniques aren’t technically “manufactured spending”, but I thought that the title worked better than “Increase credit card spend (and get most of it back)”.

The goal is to keep the Complete Guide up to date at all times. That is the resource to check when you have questions (and please let us know if more details are needed to answer your questions!). This post, meanwhile, is focused on just the changes. What significant changes have occurred since we last reported in? What have we changed about the guide? Read on…

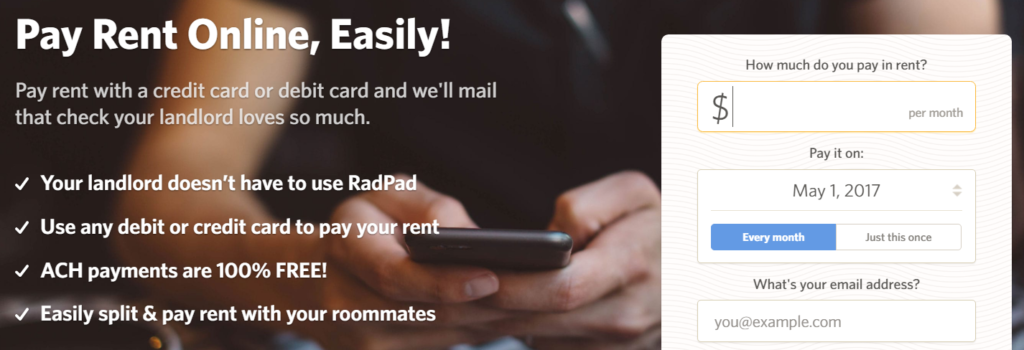

RadPad is back

RadPad is a rent payment service that had previously shuttered their service, but is now available again. This service is interesting because it may code as travel or online purchases for the purpose of earning credit card category bonuses.

More about RadPad and category bonuses can be found here.

Gift card churning suffers a blow at Target

The primary news regarding gift card churning came in late January. Doctor of Credit reported that the Target.com 5% REDcard Double-Dip is Dead. It used to be possible to use a Target REDcard to get 5% off even when paying with Target gift cards. Apparently, no more.

Additionally, despite this being old news, I recently added to the guide the fact that Amazon allows buying 3rd party gift cards with Amazon gift cards. If you can get a great deal on Amazon gift cards, this significantly increases opportunities for using those gift cards.

More about Gift Card Churning can be found here.

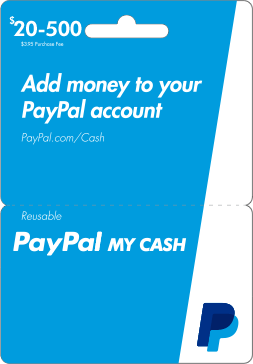

PayPal My Cash still kicking

There’s nothing new (that I know of) about PayPal My Cash cards, but I didn’t previously list them in the spending guide. My Cash cards continue to be an incredibly easy way to increase credit card spend at very low cost ($3.95 per $500). But, as I’ve previously reported, they are also a great way to get your PayPal account frozen. That said, PointChaser suggests using My Cash cards with the PayPal Business Debit card as a backup manufactured spending technique. That sounded reasonable to me, so I added PayPal My Cash cards to our guide.

More about PayPal My Cash Cards can be found here.

Gift of College still going strong

Again, there’s really nothing new to report here other than the fact that this option for increasing spend is still going strong. Gift of College Gift Cards are widely available at Toys R Us and Babies R Us stores across the country. The cards can be used to fund 529 College Savings accounts or to pay student loans. When purchased in-store, the cards each have a $5.95 fee. There is no fee to load the funds from the card to your 529 or student loan account. So, when you purchase $500 cards, fees come to just 1.19% ($5.95 / $500). Before buying these cards, I highly recommend creating a Gift of College account and adding a plan (your 529 account or student loan account) to ensure that it works with the account you want to fund. Also note that when you redeem a Gift of College gift card, it usually takes about 10 days for funds to get applied to your account.

More about Gift of College Gift Cards can be found here.

Venmo and PayPal pay friends feature previously neglected, but no more…

Both Venmo and Paypal make it possible to pay friends via credit card for a 3% fee (actually, with PayPal it is 2.9% + 30 cents). Normally I wouldn’t recommend doing this since the fee is higher than the value most credit cards offer, but if you’re trying to meet minimum spend requirements it could be worth it. I’ve added these to the guide.

More about paying friends with Venmo or Paypal can be found here.

What did I miss?

Are there new techniques, or changes to existing techniques that aren’t captured in our Manufactured Spending Complete Guide? If so, please comment below.

There is this well known crypto exchange that allows you to deposit money and withdraw with out a fee. Credit card does not treat it as a cash advance, and when you with draw it goes to your chequing account. Only draw back is it take 4-5 business days for the funds to reach your chequing account, but there is no limit.

What is it called?

Just got off the phone with AMEX after my prepaid AMEX card was declined. They are telling me that Venmo is no longer accepting prepaid AMEX cards as of Monday, if I understood the CSR correctly.

I will email VENMO and find out if this is the case.

Thanks Tom. People are reporting similar issues on Reddit: https://www.reddit.com/r/churning/comments/6icck7/agc_venmo_may_be_dead/

Well, as usual, customer service for so many companies is nothing more than a standard reply that doesn’t address the issue:

Tommy, we allow all card types to send payments, but cards may be declined for funds availability or fraud prevention reasons. Also, some payment cards may require a zip code to be linked to your account. Because we require a zip code to add a card, we may be unable to add some prepaid cards to Venmo. If you were required to verify your address when purchasing/applying for your card, we may be able to support it, but this varies by provider. If you have troubles, you can add your bank account attached to your debit card to make payments.

Okay, that was short and not so sweet. Venmo cancelled my account with never having made a single transaction citing violation of terms of use. All I did was try to add a prepaid debit card.

[…] This post, meanwhile, is focused on just the changes. What significant changes have occurred since we last reported in? Read […]

[…] is a disappointing development as it was one of the easy ways to increase credit card spend and get most of it back. It seems that this is a firm decision by CVS to stop selling these particular cards. As Stefan […]

Hello! I have been reading your posts for a couple of weeks now and am relatively new to this. Alot to consider! I have a specific manufactured spend question – What do you consider to be the most reliable and cost effective ways to make mortgage and rent payments with an indirect credit card payment? I am applying for the Chase Sapphire Reserve and Chase Ink Preferred Cards for both of us (as well as Freedom cards) and want a means to ensure we meet the spend goals to get the bonus miles, as well as maximize category spend bonuses.

Sorry, by “both of us,” I mean for my wife and me.

I think that Plastiq is your best (and easiest) bet. I recently added the following to the guide:

Plastiq

New: Payments for Rent/Mortgage are coding as lodging. This means that some credit cards will earn a travel bonus. For example, the Chase Sapphire Reserve earns 3X (and the Chase Ink Business Preferred should too). Keep in mind that this is only for payments coded within Plastiq as Rent or Mortgage. Note too that this should also be a way to get the Sapphire Reserve annual $300 travel credit.

Bump…is this still true?

No. This post is from March 2017. That died in August 2018:

https://frequentmiler.com/ink-business-preferred-no-longer-earning-3x-via-plastiq/

Then at some point, it started earning 3x again. That died again in May 2019:

https://frequentmiler.com/plastiq-3x-is-dead-again/

You can always find the latest Manufactured Spending news in our Complete Guide to Manufactured Spending:

https://frequentmiler.com/manufactured-spending-complete-guide/#Pay_bills

And the latest information about Plastiq will always be found in our Complete Guide to Plastiq credit card payments:

https://frequentmiler.com/complete-guide-to-plastiq-credit-card-payments/

Thanks for the reply and links. Thanks to you I did get in on the $4K offer, and wondered if rent/mortgage might still be an exception. I did try a small test purchase with my Ink Biz Plus…only 1pt/$.

Guys, I’m concern about depositing money orders at my bank after I read that if you deposit a couple thousand a month, that could consider money laundering/suspicious activities. Does anyone have any thoughts on this? I have about 5k left to deposit.

I try to keep money order deposits under 3K a month to hopefully fly under the radar but that’s just me. I have been doing this over a year at one local bank and they greet me by name when I walk in the door.

It’s generally a good idea to open an account with a bank that you don’t care about: where you wouldn’t mind the account getting shut down if it comes to that. I don’t think that $5K in a month is likely to lead to a shutdown, but you never know.

I live in a rural area (nearest Sams/Costco is an hour away for example). For me, Amazon Prime is a gift from the heavens. I’ve ordered things like laundry detergent that would never make sense if I had to pay shipping.

As a result, $500-$700/month on Amzn is pretty normal. I buy Amzn gift cards at Staples using my chase Ink card (no fee) and then apply them to my account. Turns normal spend into 5x.

I’ve read on Doc’s site that Amazon will start charging sales tax nationwide starting April 1. Currently, they charge sales tax on select states but will start charging it nationwide soon. It wish it was an April Fool’s joke but I think this isn’t one of those. Hopefully jet and boxed doesn’t follow soon enough.

You could move to Oregon, no sales tax.

2 questions. #1- Now wait a sec- how is Amazon going to start charging Nationwide sales tax on a sale made outside the state you live in? That’s illegal unless you’re buying the item from the state you live in? Are they planning on just keeping that money? and,

#2- Why do people even shop at Amazon when you can get almost anything cheaper at Ebay and the sale is guaranteed?

Granted, this is less useful for those who still apply for a lot of cards, but I’ve slowed down to just a couple per year.

For me, it isn’t worth the time/effort/risk for many of the spend methods, so I’ll generally just make a big estimated tax payment for the < 2% to grab a credit card bonus, especially if it starts getting near the end of the calendar year and there's a decent offer on a card. The earlier in the year you do it, the worse it is because you won't get the refund until you file your taxes, but for < 2% near the end of the calendar year, it's worth it for me to get a quick 50,000 points, miles, whatever.

Manufactured spend buying gift cards and doing other piecemeal things just isn't for me…

Anyone? Bueller?…………Can I pay off my credit card statement directly at local branch (Chase, USBANK, BOA) with Money Orders? Risky?

Yes you can. I’m not aware of any risks with this

You can but I personally know a person shut down at Chase for this and one other at BOA.

@Brian – That’s conjecture they were shut down solely for paying at the bank. Says the guy who has done a fair share at one of those banks….

I have been using Paypal My Cash with Bluebird checks and Paypal Business Debit card for almost three years and have no issue to MS.

Every month, I will buy and load 2x$500 paypal my cash to my paypal account and then loaded them onto my bluebird. From bluebird, I use their free checks to pay for daycare tuition (~$1,000/month) for my child.

Starting early last year, I used plastiq with Paypal Business Debit card to pay my mortgage. It’s especially good when combining recent plastiq mastercard 2-month-free promotion. Since it’s a paypal debit, the fee is only 1% (=1% paypal debit cash back). I basically can buy paypal my cash using any credit card to MS and earn at least 0.2% net gain.

The rule I am following is, I never transfer My Cash balance out or send to others. I only did bluebird loads and other legit debit purchases(like plastiq).

Thanks for those details! Curious if you’re loading bluebird online or in store?

I did the loading online on Bluebird’s website using Paypal debit. $200/day x 5 to max out.

I did the same but got shut down by PayPal. But I did it with a much larger scale than your $1000 per month.

It was good when it worked….

Subscribe

Subscribe again

Subscribe