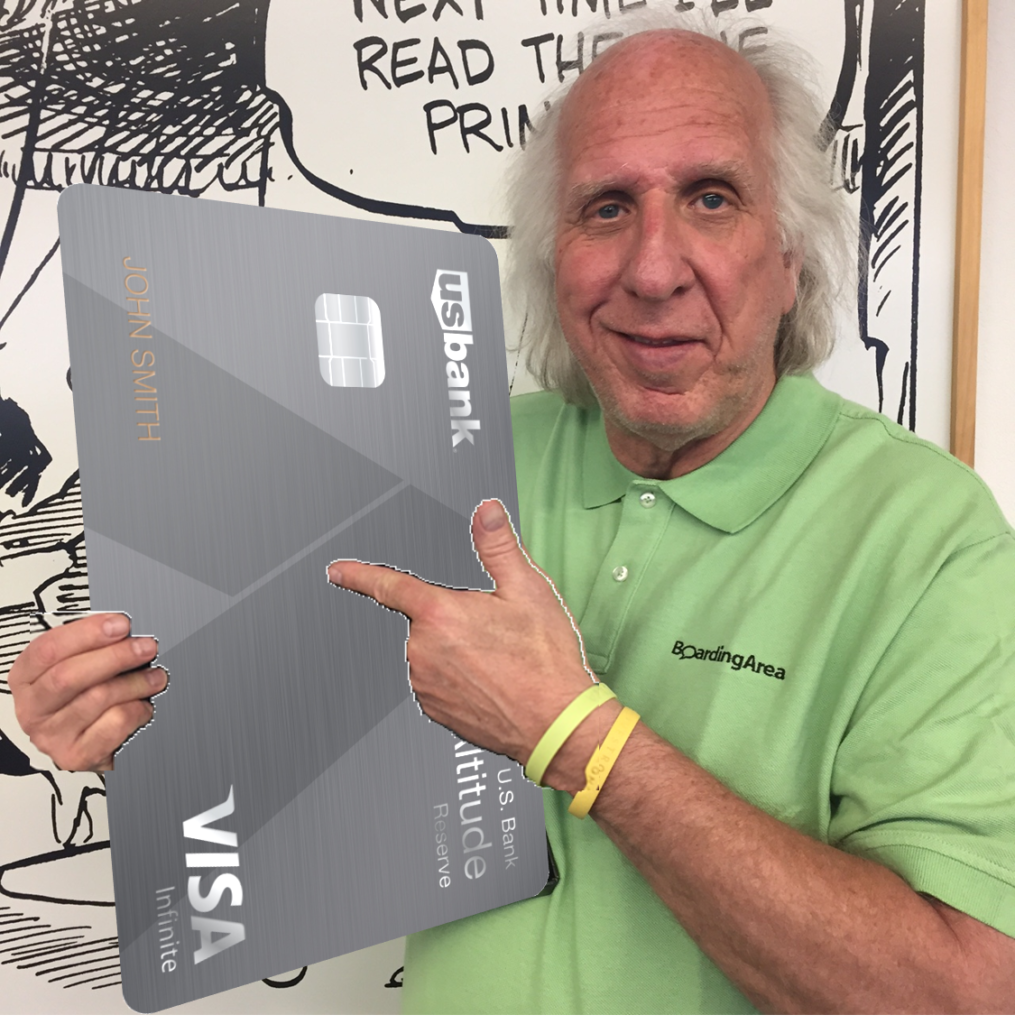

On Wednesday, Randy Petersen (founder of Boarding Area, Inside Flyer, Flyertalk, and more) had an opportunity to interview John Steward, president of Retail Payment Solutions at US Bank, about the new US Bank Altitude Reserve card. The interview was published at Inside Flyer, here: [60 Seconds] US Bank Altitude Reserve Card.

In preparation for the interview, Randy asked me if I had any questions about the new card. You bet I did! I sent Randy a list of questions (and, later, follow-up questions) and he returned the favor by sharing the interview with me, and he sent along card art and scanned documents. The latter included a marketing brochure and the US Bank Altitude Reserve Visa Infinite Card Agreement.

Checkout the Inside Flyer post for the full interview, or read on for the bits that I found most interesting…

Randy: Frequent Miler called your card the “Sapphire Reserve Killer”. Is that the intent of this card, to go head to head against the Sapphire Reserve?

John: I wouldn’t go as far to say that it’s the Sapphire Reserve Killer, but I will say that we are unapologetically entering the luxury card space… [response truncated]

Randy: Is there something that the disparate new benefits have in common, a theme around which you’re building the card’s offerings?

John: The product is centered on motion and mobility… [edited for brevity] … This is the first card to feature 3x on mobile wallet spend using Apple Pay, Samsung Pay, Android Pay or Microsoft Wallet. This benefit enables the Cardmember to de facto choose the spend categories where they earn triple points on the things they like to buy – not just the categories a card presets for them….

Randy: 3X for mobile wallet purchases is a completely new and unique credit card perk. As more and more merchants accept mobile payments, how do you think you will be able to sustain such a generous perk?

John: You are right. This is a very valuable feature and the real beauty of it is that it puts the cardmember in control of their accelerated point earning. We believe that 3x points on mobile wallet purchases will be a powerful driver of loyalty and engagement and therefore worth the investment. We’re eager to see how engaged they become in the innovative benefit.

Randy: Do you have any plans to offer point transfers to loyalty programs in the future the way Chase, Amex, and Citi do?

John: We’re confident that cardmembers will find Altitude points to be more valuable than other loyalty program currencies, but we haven’t ruled out point transfers in the future.

Editor’s note: In a follow-up phone conversation, Randy asked whether adding point transfers is an active topic for them or whether they’ll wait to see how the card does on its own first. John responded with something like this (not verbatim):

John: We’re confident in the value we have. We see point transfers as a nice to have topper – it is something we’ll look at as we go, but as you know most of those are built off of co-brand relationships. We have limited options in that regards. We have valuable partners, but niche.

Follow-up phone questions

The following questions and answers are paraphrased and should not be taken to be exact quotes…

Randy: How long did this percolate? [i.e. when did they first consider creating this card?]

John: We started discussing this in July or August of 2016

Randy: What was the worst card name you considered before choosing Altitude Reserve?

John: Probably “Specter”

Editor’s note: That name would have given a whole different connotation to “Sapphire Reserve Killer”!

Randy: Is car rental coverage primary or secondary?

John: Primary

Related Readings

If you’re interested in reading more about the Altitude Reserve, please see:

- US Bank Altitude Reserve Complete Guide

- Surprising details about the US Bank Altitude Reserve

- US Bank’s Sapphire Reserve Killer

Are the writers of this blog planning on applying for this card, if I may ask? If not, what are your reasons? I have to get other cards first and then may consider this one if there are good reports on the cash back opportunities presented by the travel credit (round about way).

I will apply for it, but I’m not a good example since I can justify having the card for blog research.

I think this is a good card (but not amazing, given the high annual fee) for those who just want a signup bonus.

I think this is a great card for those who are mobile savvy and want a single card with outstanding earning power for everyday spend. And even better for those in that group that want to use the rewards for travel.

For those who want to ms heavily, my guess is that this won’t be a very good card because they’ll likely get shutdown quickly.

So what is your guess as to how much MS is too much? Personally I don’t find this card very attractive, outside of the one-time signup bonus and 3X for mobile pay. But given that I’d need to buy a new Samsung phone, and given US Bank’s history of nurfing their cards (Cash Plus and Club Carlson), this card is a waste of time unless one can MS a “moderate” amount (say $50K/year). I’d actually like it better if there was a cap on the 3X mobile pay, along the lines of the $50K on the current version of the OBC or Ink Plus. Without a cap, 1) the mobile pay bonus will get nurfed sooner due to abuse, and 2) there is a higher risk of individual account shutdown due to not knowing the limit that USB is willing to pay 3X on.

Yep, good points. I don’t have any idea how much MS is too much.

Randy Peterson looks like an extra from Poltergeist.

[…] Inside Randy Petersen’s huge Altitude Reserve interview […]

Regardless of what people say competition I’d good ad our will naturally raise the average offer… I welcome all new entries to this space

Are you eligible to apply for this card if you are a Fidelity Visa card holder?

I don’t know for certain, but I doubt it

I think this is a very compelling card, basically a $75 net annual fee. If you “only” did cash back, you would still come out $425 in year one.

If you travel with a family like I do, I can definitely see the travel benefits, $750 goes a long way towards flying 4 people anywhere (I wrote out hacking to Puerto Rico on my blog). This is definitely on the longer list of cards we wish to apply for, but as newbies, we are working our way down the list.

Thanks US Bank, always good to have more competition and more options.

Seems like he is saying it will not be 3x on all mobile spend but only on mobile and a category you choose. Possibly you can change it quarterly or some other frequency – would like to get more info on that.

I don’t interpret it that way at all. The documentation for the card is very clear: 3X on all mobile wallet spend. I think he was just trying to contrast the card to others that have specific category bonuses. In this case, people can get the category bonus wherever they want, as long as mobile wallet payments are accepted.

50,000 bonus ($500 cash back) minus the large annual fee is what makes this card less interesting to those who have plenty of travel related points and only interested in cb opportunities. Although the 3x on mobile purchases for those who don’t have many 5% earning opportunities. Let’s see what the travel credit actually credits and if that could lead to ways to redeem/resell certain travel related items for cash. Again, not downing the card overall, but for those in my shoes we’re waiting to see if it will be worth our ‘spending’ time.

I think that as more and more places accept mobile payments, this card becomes more and more interesting. For cash-back people, the card approaches a 3% everywhere card. And for travelers, it approaches 4.5% everywhere.

Rubbish. Despite the blather and hype about mobile payments, very few places acctually accept mobile. Of the places I shop, almost none accept mobile.

This card is so far from a CSR killer (let alone Amex Plat), it’s laughable.

Samsung Pay works on swipe terminals so…

Right now I have so many 5% opportunities at cash back it’s hard to find time for just 3% spend. However, if more stores (with mobile payment) would sell 500vgc that are not drugstore, office, grocery, gas, then I might be interested in this long term for obvious reasons where I not already have a 5% cb earning card. If I had more time I’d add this to my cc collection. Will wait to see if certain travel items get credited when others use the travel credit. If that can turn into cash back then I’ll get this card. I’ve had a relationship with this bank for years.