Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

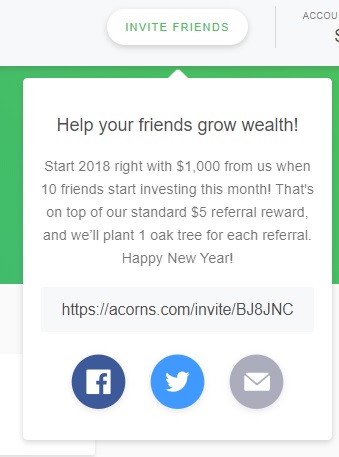

Acorns is a micro-investing platform that’s been around for quite a while now. It first came to my attention last year, when I signed up for an account — though I’ll admit that I never actually funded it and forgot I even had the account. That changed when a reader named Clint reached out a couple of days ago to make me aware of a new referral bonus being offered by Acorns: if you get 10 friends to sign up under your referral link, you will earn $1,000. That’s a monster referral bonus that would be great if you can persuade a few friends to jump on board. Head over to our Frequent Miler Insiders group if you have a referral link to share (see instructions on that below). Read on for details about this promo and the Acorns platform.

The Deal

- Receive a $1,000 referral bonus if you get 10 friends to sign up for an Acorns account using your referral code

- If you sign up, feel free to use one of the following referral codes with our thanks:

- Nick’s link

- Greg’s link

- Clint’s link (the reader who brought this promo to my attention)

Key Terms

- Friends must invest a minimum of $5 for a minimum of 30 days to qualify for the promotion

- Friends must invest by 1/31/18 to qualify for this promotion

- If you have previously referred friends for a referral promotion, you should still qualify for this new promotion

- Link to full referral bonus terms

Quick Overview

In a nutshell, Acorns is a robo-investing platform that allows you to invest in ETFs in four ways:

- Making a one-time deposit into your Acorns account

- Automating weekly/monthly set-amount deposits

- Rounding up the change from your purchases via linked credit/debit cards (e.g. You spend $10.58 and Acorns automatically withdraws $0.42 from your linked checking account to invest)

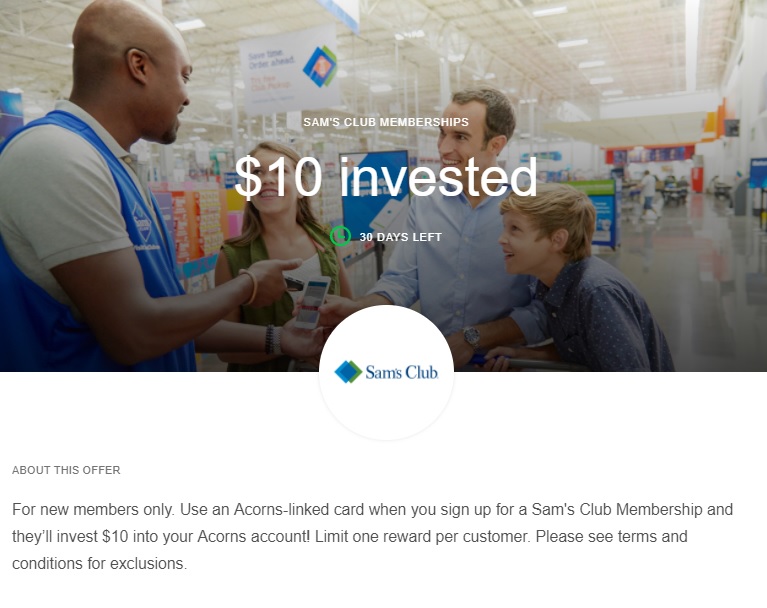

- “Found money”, which has two methods — most partners work like a traditional shopping portal where you click through the Acorns link to earn cashback that is invested, but some partners work similarly to other credit card-linked programs (like in-store cash back, Shell Fuel Rewards, etc) and award cash back when you use your linked card at those retailers

Signup is pretty simple, though keep in mind that they will require your Social Security Number since you are signing up for an investment account. I don’t love the idea of giving out my number more often than necessary, but after the Equifax hack, I am ironically a bit less paranoid about the number itself now that I assume my information is out there (and I’ve followed our tips on How to Survive the Equifax hack).

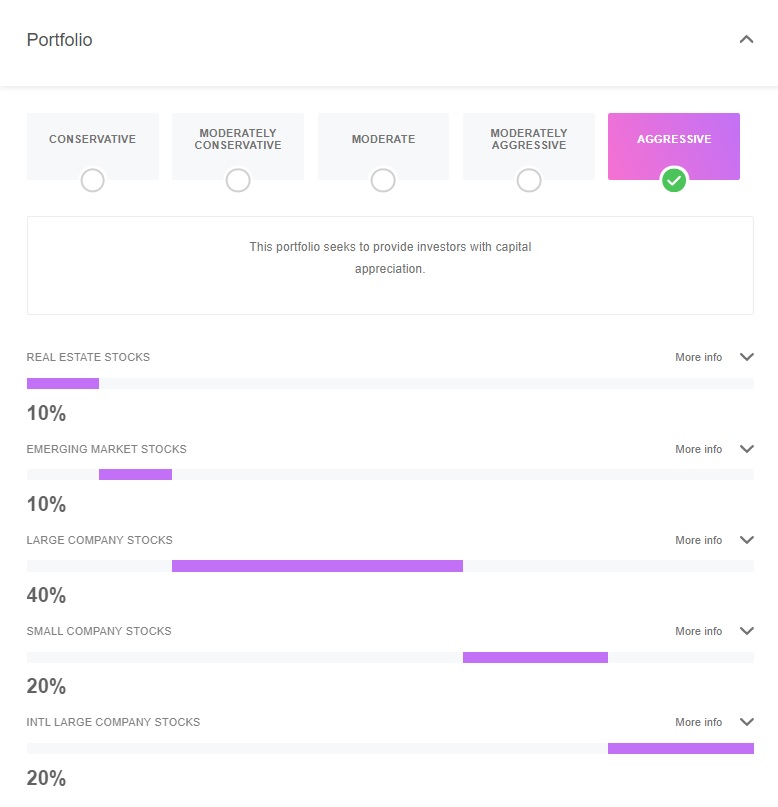

During the signup process, you’ll have the ability to fill out some profile information and determine what kind of investment portfolio you would like.

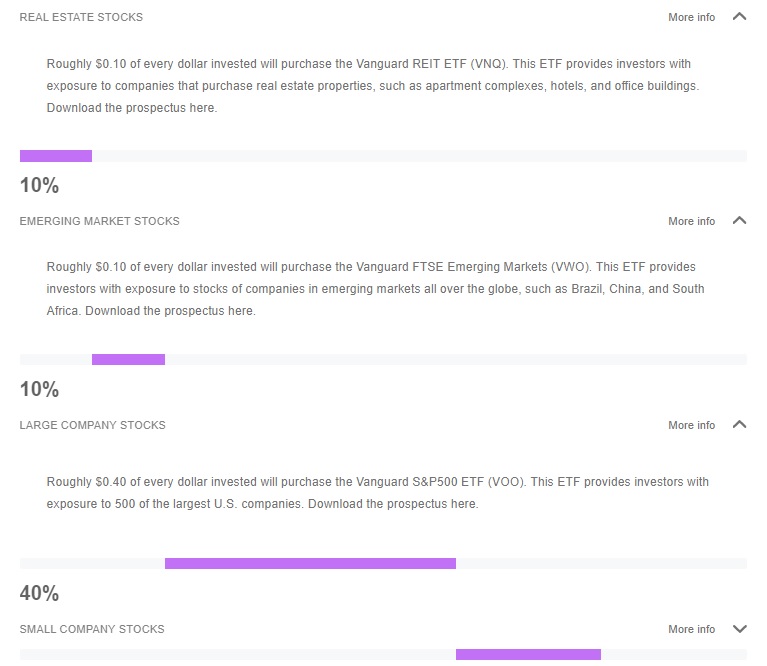

You can further expand those categories for “more info” on what each one means:

Unfortunately, you can not adjust the sliders as you see fit — you can only choose your preferred level of aggression and then accept the layout.

You will also need to link a bank account if you plan to auto-invest, either via rounding up or recurring investments. One thing that surprised me here: I had not linked any credit cards for round-up when I created my account. However, when Clint reached out with this deal a couple of days ago, I linked a bank account to transfer funds for a one-time investment. Today, I saw that I now had 3 cards linked for round-ups. The bank account I linked to transfer funds was a Capital One bank account, and to link it I had to log into my Capital One account via the Acorns system. I realized today that Acorns automatically enrolled all of my Capital One debit and credit cards for round-ups. I was able to un-link those cards today — but I didn’t like the fact that they were instantly added. If you link a bank account login that also has credit cards linked to it, be aware that this may happen.

Once you have invested money, you can see your performance, invest more, withdraw, etc.

Note that per the terms, in order to qualify for the referral promotion, the friends you refer much invest at least $5 and keep it there for 30 days.

Fees

This is the kicker as their fee schedule isn’t a deal (though that said, the thousand dollar referral bonus will mitigate this if you’re able to refer friends).

- $1 per month if you have under $5,000 invested

- 0.25% if you have over $5,000 invested

That makes this a relatively poor deal in comparison to doing it yourself. That said, if you’re the type of person who will put off doing it yourself for the next five years, it’s probably better to get the ball rolling on investment now.

Furthermore, reported returns certainly aren’t bad. Danny the Deal Guru reports gains after fees of 12.58% over the past year. He furthermore reports that there are no fees for those under 24 years of age or those attending college. How soon can my as-yet unborn son begin investing? 😀

Found Money can be a win

The “found money” feature can add to the deal. Greg recently signed up up for a Sam’s Club membership with the deal we posted (a great deal on its own as you can get $25 back from an Amex Offer and an additional $20 Sam’s Club e-gift card by using the referral link in that post, bringing your net cost down to $0 if you value the Sam’s Club gift cards at face value). That deal got even better for Greg when he later got an email from Acorns saying that he received $10 in “found money” for signing up for a Sam’s Club membership. That membership became a money-maker for him — and a deal like that here or there might help to offset the fees.

Where to get your code

I’m not sure whether or not a brand new account will qualify for the $1,000 referral code, but you can find your referral link under the “Invite Friends” button in the top right when you log in. My link shows the $1,000 bonus when I click “Invite Friends” as shown below:

Where to share your code

Our spam filter automatically blocks comments with a link. If you would like to share your referral link with others, head over to our Frequent Miler Insiders group and post your link in the comments on this deal as a reply to my first comment on the post (referral links not posted following this direction will be deleted). This helps us keep the thread open for discussion below the referral links replies and below this post here at Frequent Miler. Thanks!

I think this one might also be an easy enough one to share with friends and family as it’s a pretty simple investing platform. While the fees aren’t cheap, the ability to auto-invest as little as $5 per week will probably make this one appeal to many people who would normally be daunted by spending $3,000 for a credit card signup bonus (and by the task of setting up their own investment portfolio. While Acorns won’t become my primary means of investing, I think it’s certainly got something for a segment of the investment market.

Bottom line

This is an easy thousand dollars to be made if you can find ten people interested in investing five bucks for a month. Note that your thousand dollars will be paid out in shares according to your investment portfolio — so you’ll have to withdraw it if you’re looking for cash. Personally, I invest toward retirement but had been needing a kick to do some further investing on my own. While this deal will ultimately push me to look a bit further into other types of ETF accounts, in the meantime it will get my investing on a more regular basis. Given the changes coming in my life, that kick is coming at the right time.

[…] out this post about Acorns by Nick over at Frequent Miler which offers a great overview of how it […]

[…] (EXPIRED) Huge $1,000 bonus for referring friends to invest (although that bonus offer has since expired, Nick wrote comprehensively about Acorns in that post and so it’s a great starter post to read.) […]

[…] (EXPIRED) Huge $1,000 bonus for referring friends to invest (although that bonus offer has since expired, Nick wrote comprehensively about Acorns in that post and so it’s a great starter post to read.) […]

[…] up in the same way as last month’s. The reward is potentially lower than earlier promotions where you’d earn $1,000, but the benefit of this type of promotion is that you only have to refer five new users rather […]

[…] (EXPIRED) Huge $1,000 bonus for referring friends to invest […]

got an email…

This is good news…was looking a little sketchy.

Thank you for helping your friends grow wealth with us! We’ve started to process the $1,000 referral bonus as of February 15, 2018. This bonus will finish processing and be available in your Acorns account within 3-5 business days.

Let’s keep growing. Earn another $1,000 when 12 new friends start investing with Acorns in February!

[…] month, we wrote about an easy-money promotion from Acorns (See: (EXPIRED) Huge $1,000 bonus for referring friends to invest). The deal is back, though this time it requires you to refer 12 friends (last time it was 10 […]

[…] even managed to turn a new Sam’s Club membership into a profitable deal by using Acorns’ Found Money feature and paying with a linked […]

This was a good post and given how hard it is for folks to consider to invest anything that would ultimately help them, these small automated investments make sense. I use Acorns and since August of 2016, I’ve set aside $1,295. Not bad! Although I have other accounts on platforms like Motif Investing, FolioFirst(formerly Loyal3), and OptionsHouse, these opportunities to make fractional investments compound and build over time. Over one my website, I’ll be advocating this promo as $1,000 is a lot of money to me and every little bit helps towards saving for old age

[…] More Offers. Besides standard contributions to your account, you can also link your credit cards for more opportunities to invest by rounding up and enroll in their found money rewards. See more about the “found money” at Frequent Miler. […]

Thanks for the tip, I used your code. Here’s mine, would appreciate if you want to spread the wealth and use mine: [Edited] (Don’t have Facebook, so can’t join the group.)

Hi HMC. As noted in the post, we ask people not to share referral links here. The purpose for this is so that people can discuss the deal itself as they did above without that discussion getting buried by replies containing just referral codes. We set up the Facebook thread in order to give readers access to one platform on which to share codes with others. If you don’t have Facebook, I’d encourage you to share your code within your personal networks, whatever those may be.

There are various signs of a stock market bubble. Now I can add a brand new one: A travel blogger pushing investment in a company-you-never-heard-of that, apparently, invests in the stock market.

Thank you for this info! I just signed up and invested $10 through your link, Nick. 🙂 I don’t have Facebook, but if anyone wants a link, send me a message 🙂

Hey, I’m a climber, too! I’ll use your link. What’s the invite code? (Don’t need the whole link, just the code.) I don’t have Facebook, so have to do it here.

It is a good investment app. Last year, I added $50 to it per week automated. Now, it has total 8% return.

8% in this market environment is pretty low. If you want something to set and forget it’s probably not the worst but with a little effort you could be making a lot more.

0.25% fees is pretty low though considering how much actively managed funds generally charge.

You’re right. 8% is way too low. However, considering my situation, I think it’s pretty good.

1. I started on last May, from $0 to $50, $100, $150… At the end of 2017, I have $1700 in my account, and the return rate is 8%. It should be more than 8% if I put $1700 into my account one time. But, I don’t know how to calculate it.

2. It’s good for a lazy man like me. Don’t need to think anything. LOL.

I did some math to find the real APR.

Assuming APR is X, and it’s fixed, from last May to Dec, I count it to 35 weeks. So the first $50 will get ($50 * X/52) * 35 return by the end of 2017, the second $50 will get ($50 * X/52) * 34, and so on, the last $50 will get ($50 * X/52) * 1. They are the return every time I invested by the end of 2017. The sum above all will be ($50 * X/52) * 35 * (1+35) / 2 = ($50 * X/52) * 35 * 18.

Since now I have 8% return for all, so the real return money is $50 * 35 * 8%. I can get an equation:

($50 * X/52) * 35 * 18 = $50 * 35 * 8%,

Then we can get X = 23%.

I think it’s wonderful if I did the right calculation.

Please feel free to tell me if I’m wrong.

Can you give an example of where I can make more than 8% ?

Thank you

Sounds like a pyramid scheme

Agree. Meets all the requirements of a Ponzi scheme