3 Steps Towards Traveling for Free...

Want to use miles to fly First Class around the world? Yes, it can be done! Sure, it sounds like one of those ‘too good to be true’ things, but it really works. We at Frequent Miler have been traveling in First Class for free (less taxes and fees) for years using the tricks explained in this blog. The catch (and yes, there’s always a catch) is that it takes knowledge and organization to pull it off. That’s where this blog can help!

Ironically, traveling is not the best way to earn miles & points (but it doesn’t hurt!). Credit card signup bonuses are the biggest and best opportunity for earning free points and miles. For many, it’s easy to earn hundreds of thousands of points each year through signup bonuses! Here’s how:

1. Sign Up for the Best Offers

Credit card issuers want your business and they’re willing to pay you for it in the form of huge credit card signup bonuses.

As you’ll see on our best credit card offers page, there are dozens of great bonuses out there. A common practice is to regularly sign up for new cards, primarily for the signup bonuses. And, couples can double points earnings by each signing up for the same cards.

There are so many great credit card offers available that it can be tough to know which are best for you. One solution is to check out Greg’s Top Picks where I list my favorite card offers along with info about who I think would benefit from the card.

A year after signing up for a card, consider avoiding the annual fee by downgrading to a no-fee card, or by cancelling altogether.

TIP: If you’re new to this, consider using Travel Freely to guide you through the process step by step. The Travel Freely service is absolutely free.

2. Meet Spend Requirements

Most credit card signup bonuses have minimum spend requirements. For example, a 50,000 mile signup bonus will typically require $3,000 in spend within 3 months of signing up.

Techniques for meeting spend requirements include using the new credit card for all purchases; using the credit card to pay monthly bills wherever credit cards are accepted; using the credit card to pay your rent, mortgage or other loans (often for a fee). Our daily blog posts can help you learn those basics as well as additional ways to increase credit card spend without going broke.

See more here: Increase credit card spend (and get most of it back). What still works?

3. Travel for Free!

Once you’ve earned points and miles, you’ll want to use them for free travel. With some loyalty programs, that’s easy. With hotels for example, it’s usually the case that any time there’s a standard room available for sale it’s also available to book with points, or with a free night certificate. Airline miles are both more complicated and potentially more rewarding. Many airlines drastically limit availability of their cheapest ‘saver’ awards. If you want to plan the ultimate international getaway and you haven’t yet learned the ins and outs of booking award flights, consider using an award search tool or an award booking service. You’ll have to pay for these services, but in many cases it can be well worth the price..

Caution!

There’s a reason that credit card companies are willing to give away points & miles. They make a lot of money from interest and fees. Interest and fee payments can quickly wipe out the benefits gained from signup bonuses. The only way to come out ahead is to pay your credit card bills in full, every month. If you can’t do that, then I highly recommend against signing up for new credit cards.

More Points and Miles

Signing up for new credit cards isn’t the only way to earn points & miles without flying. A few options include:

- Maximizing credit card category bonuses: Many credit cards offer extra points for certain categories of purchases (e.g. restaurants, travel, groceries, etc.). It is often possible to shift spend towards those categories in order to earn far more points than you would otherwise.

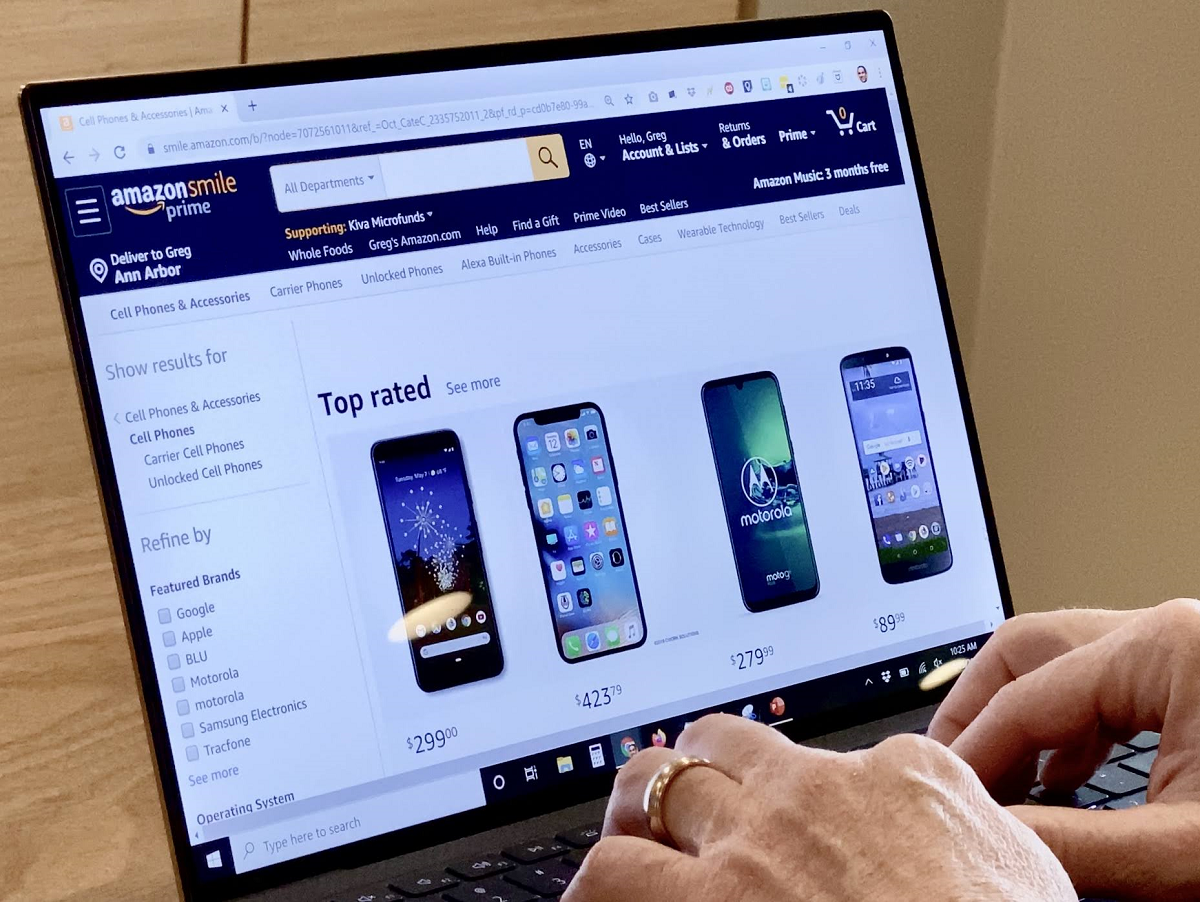

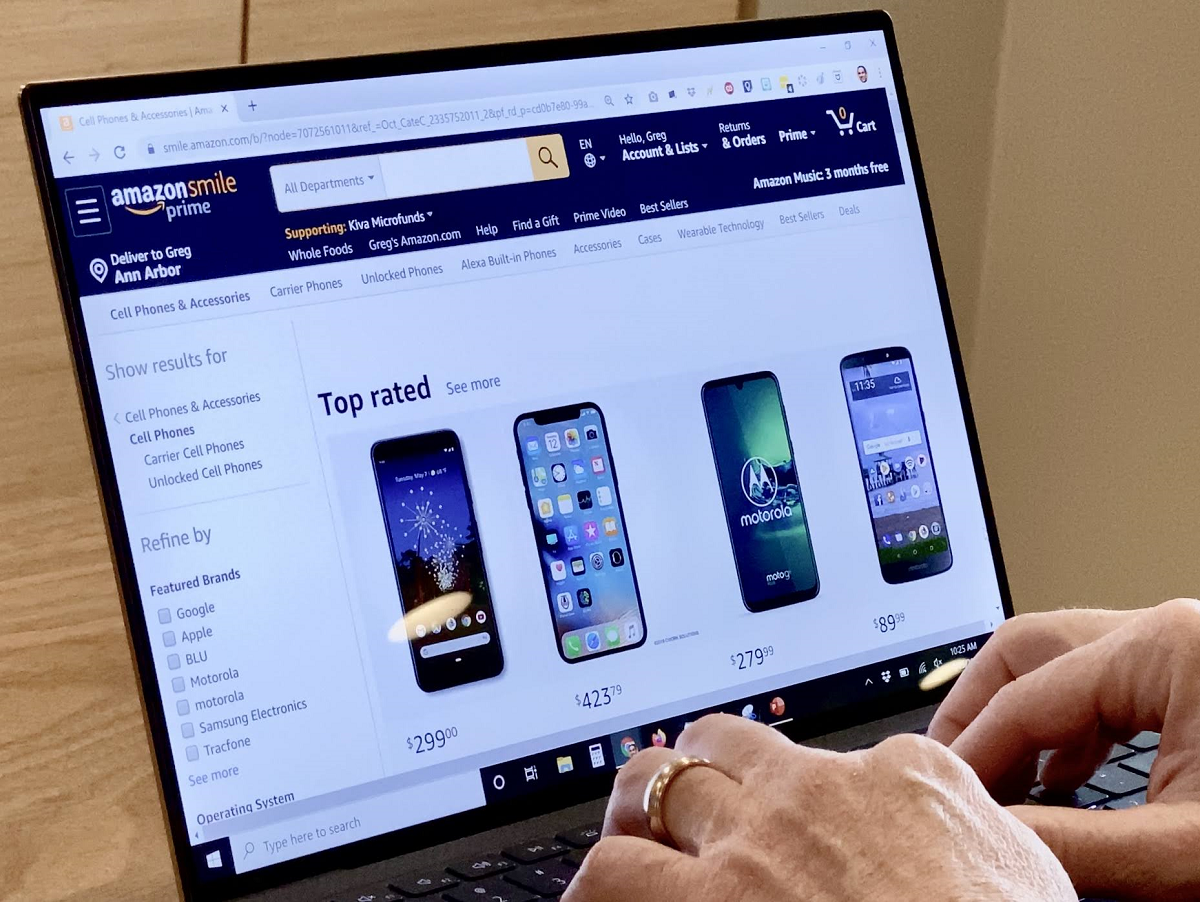

- Online shopping via portals: Online portals offer extra rewards for shopping that you would have done anyway.

- Marketing promotions: Businesses often offer free bonus points or miles in order to attract your business. Occasionally these offers are incredibly lucrative!

There are many other ways to earn points and miles without flying. Please see this post: Top things to do for MORE miles.

Getting Started

- Sign up for Travel Freely (it’s free!) to keep track of your credit cards and to walk you through the process.

- Sign up for Award Wallet (it’s free!) to keep track of your points & miles balances.

- Find the best credit card offers on our Best Credit Card Offers page or go with Greg’s favorites in our Greg’s Top Picks page. If you get an offer in the mail, though, compare it to our Best Offers page. Sometimes targeted offers are better than anything else publicly available.

- Read more:

- The games we play (a big picture overview of the points & miles ‘game’)

- The tools we use (a list of useful tools for earning and using points & miles)

Hi,

I just signed up for weekly emails and i’m waiting for approval for the facebook page bc my buddy is not being offered 90k Amex Gold link, and I really could use one from the group…

Thing is I am not a Facebook person, really not….I just created a profile before trying to join the room and it probably looks like spam. trying to get in touch to let you know it’s not, entire profile is private and tried joining at about 925AM PST… I don’t know if it shows you my name/email or not when I try reaching out for a group invite…

Hi there! My apologies — one of us usually goes through Facebook requests every day or two to review them. I haven’t gotten there yet today, but if what you’re looking for is a link to the 90K offer, you don’t need to join — the reason for the referral thread is to gather reader referrals so that our Best Offers page will always have the best available offer. If you go to the menu on any page on our site and click on “Best Offers”, you’ll find links to all of the best publicly-available offers. You’ll find a link to apply for that 90K Amex Gold card right on our Amex Gold card page:

https://frequentmiler.com/amxgoldcard/

That’s a reader link — we insert a new reader link there every day.

News Feeds – same posts are appearing across Frequent Miler, Frequent Miler Quick Deals, BoardingArea. To cut down on duplication of posts, is there ONE of these that will cover posts w/o missing posts?

This one should be all you need: https://frequentmiler.com/feed/

I ran across your recent episode where you talked someone getting denied boarding, and asked about the worst thing that has happened on a trip. This reminded me of a harrowing experience that threaten to ruin a round the world trip we were on. After requesting United (ticket issuer) change us to a later departure from Vienna, fortunately I caught a bizarre change to the itinerary. Imagine showing up at a foreign airport with THIS reservation: https://drive.google.com/file/d/13Et-Ex2nR8_RkUaqWYJRo2bb1S3ZwRa5/view?usp=drive_link I spent hours trying to convince United representatives there was something terribly wrong with this schedule and their social media channels were totally useless. You would think the possibility of backward time travel would jump out at someone (arriving in 2001?). At one point they said it was fixed. After getting off the phone and checking, I found they had put us on two different flights to different countries! A few more hours on the phone got it “resolved” only to find we were blocked from checking in once we got to the airport. Had to put United on speaker with the Austrian ticket agent to finally get it resolved. The worst experience ever!

Miracle of miracles, I dug up a chat link (https://d3cv1fywnihry0.cloudfront.net/chat/cs.html), got a real live person and he said he’s going to convert my gift card balance into “Shop Your Way” points, dollar for dollar. Allegedly within 24 hours, so fingers crossed.

I should clarify–when I call the automated phone number on the back of the gift card, it tells me I have a valid balance, so I know (allegedly) that the card is still worth something, but it’s not being accepted on Sears.com.

I came across this site when searching for someone at Sears to talk to about their website not accepting my Sears gift card. Has anyone had any success reaching an actual human (whether by phone or email) to ask about issues with ordering online? I’ve come up empty after several days of trying. Thanks.

Can you explain or post an article on understanding the relationship of KLM & Transavia airlines? I know KLM is the parent company, but when my connection in Amsterdam is with them, when booking through KLM, no points, no lounge privileges & now I’m confused on a new policy on carry on. If I start my flight on KLM or Delta as a partner carrier & my final leg is on them, do I have to pay for my carry on?

Question on reactivating miles with American Airlines: I have 56000+ miles with AA that I can activate for $550. Is that considered a good deal?

Does anyone know when American Airlines might begin opening up award availability to book business class seats on the new Japan Airlines A350 NY-Tokyo non-stop route? As of this posting, it looks like AA is only allowing miles to be redeemed for premium economy and below, even for months in advance. Wondering if anyone has any insight on when this could change. Thanks!

That’s not a matter of American Airlines “opening up” award availability – Japan Airlines has to open availability to partners. Unless you’re seeing those seats available via other oneworld partners like Alaska or British Airways, it sounds like Japan Airlines just isn’t offering partner availability on those flights at this time. That wouldn’t be terribly surprising — Japan Airlines doesn’t tend to release a ton of award availability and on a route that likely has a lot of business class demand from business travelers, I would expect award availability to be quite tight. You have to keep searching, be flexible with dates, and/or use an award alert tool.

I am trying to buy economy RT ticket sgn-lax. I have the option to either purchase directly from KE, or on DL (with a DL number, but operated by KE). Anyone knows which route would generate the most MQD for the purpose of qualifying for DL elite status?

I’m not sure but I think you’ll earn the same MQDs either way. This page shows the MQDs earned with each of Deta’s partners: https://www.delta.com/us/en/skymiles/how-to-earn-miles/airline-partners

I’ve applied for and been rejected for the Amex Bonvoy Brilliant. They will give me the card, but not the bonus. Is it worth it to just get the card w/o the points? I want it primarily for Bonvoy Platinum, but hate giving up 90K points.. I’ve tried the reconsideration line, and they just say I’m ineligible for the bonus. Help???

It can be worth it to get the card for the Platinum status and annual free night certificate (and assuming you’ll use the monthly dining benefit).

You mention being rejected, not getting the pop-up. Did you check the Marriott card eligibility matrix to know if you’re eligible for it based on any other Marriott cards you may have?

https://frequentmiler.com/marriott-bonvoy-complete-guide/#Credit_Card_Eligibility

Do you know if you can earn Delta mileage when buying AX or Visa gift cards and charging them to your DL Reserve AX card? Thx

Hi Nick. Have you ever analyzed loyalty point transfer ratios across other industry sectors (telco, grocery, gas, retail etc.) apart from airlines, hotels, and banks? If so, do you have link(s) to some research insights?

Hi @AAkhter, sorry for the slow response.

No. I’m not even sure what you mean about that — I’m not aware of any ability to transfer grocery rewards to airlines for instance. Can you give me an example of the kind of point transfers you’re talking about?

Bilt card, does anyone know if you can use bilt for 2 properties? I rent my house in Ca. that’s one. the other is a home i own in mexico with an american bank with hoa fees. can i use it for both for rewards?

No. You can only make one rent payment per month.

thanks

VENTURE X Business:

Be careful with this card. I mistakenly loved it and wanted to implement to my company. I have a $40M+ business and this is my new Amex replacement. But I found out today from customer service that “Unlimited spend” has to be earned by their Algorithm.

So I distributed 8 cards today, and they began to be rejected.

When I called to inquire was told my limit is “around” $4000 and algorithm must be taught to give me more credit.

To get a 150,000 point bonus in 90 days, means I have to pay off my balance every 3-4 days so my team can spend more. Otherwise I would never hit my Bonus spend.

I am really disappointed, and will push through this for the bonus, but if after my spend limit isn’t where I need it to be, it’s back to Amex Plat.

Did I get bad information? Is there any help with this?

My monthly spend on my Business Spark card is $80k?

So confused and disappointed.

Can anyone help, or know how I get help?

ask them to move from the spark to venture x

*move the 80k