Bank of America will once again be offering double cashback on select BankAmeriDeals. The promotion starts on April 29 and will last for almost...

Bank of America's shopping portal-like Bank AmeriDeals are going to be offering "double cash back" on select merchants from April 29th to May 10,...

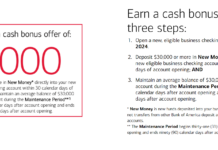

Bank of America is running a promotion for new business checking accounts that offers a $1000 bonus with fairly simple requirements. Deposit $30,000, keep...

Bank of America is back with a welcome offer on the Air France/KLM World Elite Mastercard of 70,000 Flying Blue miles and 100 XP...

Bank of America (BOA) has announced a partnership with Starbucks that could be pretty rewarding for the coffee-addicted (like me). Once you add your...

At the beginning of the year, the Frequent Miler Team gives guided tours through the credit cards that each of us currently has taking...

Bank of America has increased the welcome offer on the Alaska Airlines Business card to 75,000 Mileage Plan miles + a Companion Fare when...

Bank of America's first "More Rewards Day" goes live tomorrow. Get your BOA cards ready for action!

Bank of America has announced its second "More...

Is there anything better than a credit card card welcome offer? You get approved, a shiny, new card arrives in the mail and then,...

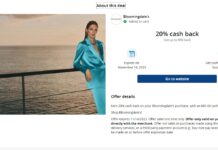

There is a new card-linked offer out for Bloomingdale's that could be good for up to $83 cash back. Depending on the version you've...

Bank of America is running a promotion for new business checking accounts that offers a $1000 bonus with fairly simple requirements. Deposit $30,000, keep...

Bank of America is back with a best-ever welcome offer on the Air France/KLM World Elite Mastercard of 70,000 Flying Blue miles and 100...

The Alaska Airlines Visa Signature card is now featuring a welcome offer of 62,000 miles and along with the usual $99 (plus tax) companion...

Bank of America is returning with a double cashback offer for BankAmeriDeals later this week which has the potential to be nicely rewarding depending...