If you often apply for credit cards in order to earn welcome bonuses, then you've probably realized that managing your credit is important. And...

With most Chase credit cards, Chase will not approve a new card application if you have opened 5 or more cards, with any bank,...

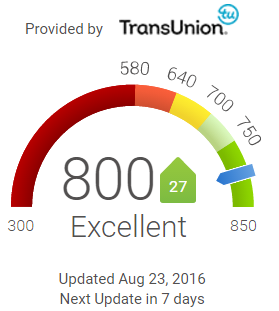

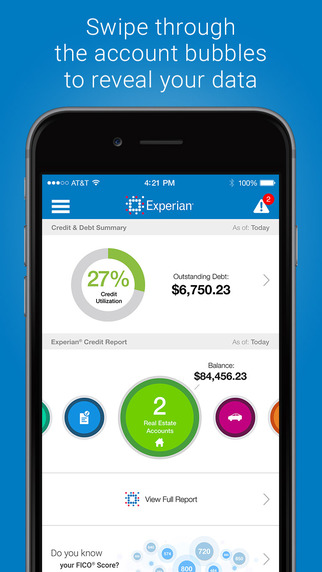

I recently wrote about an opportunity for most AAA customers to get free Experian credit monitoring. Now, it turns out that you don’t even...

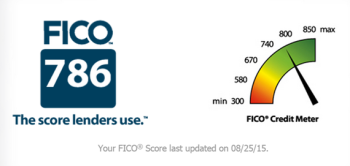

You’re probably aware that many credit card companies provide credit scores to their members for free. And, recently, Discover has begun offering free FICO credit...

In mid August, my wife applied for 8 credit cards across three banks. After a few phone calls, all 8 cards were approved. You...