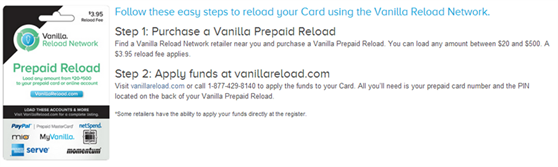

Vanilla Reload cards can be a terrific tool for increasing your credit card rewards: 1) purchase a Vanilla Reload card with a rewards credit card (to earn rewards); then 2) Load the value of the card onto a prepaid card; then 3) Use the prepaid card for expenses where credit cards are not usually allowed: bill payments, ATM cash withdrawals, debit payments, etc.

Vanilla Reload cards are not the only type of reload cards available. There are also MoneyPaks, REloadit cards, PayPal load money cards and probably more (see “The reload game is on“). This post, though, focuses only on prepaid cards that can be loaded with Vanilla Reload cards.

Amex vs. Visa/MasterCard

All of the cards detailed below are branded as American Express, Visa, or MasterCard cards. Unlike the American Express cards, the Visa and MasterCard cards can be used as debit cards. The American Express cards are similar to debit cards in that they can be used at ATMs to withdraw cash, but they cannot be used in any other transaction where a debit card is required.

Two types of Vanilla Reload cards

There are two distinct types of Vanilla Reload cards, but they look virtually identical. With the most common type, you can purchase the card at a store, bring it home, and transfer its value to a prepaid card. With the other type, you must bring the card to the counter in-store and use it in-store to reload your prepaid card. This second type can only be used with true debit card prepaid cards (i.e. MasterCard and Visa cards). For more details see “Pursuing the Other Vanilla Reload card“.

Many types of Vanilla

In addition to the fact that there are two different kinds of Vanilla Reload cards, it is important to understand that there are also multiple kinds of Vanilla cards. Depicted below are a few varieties. None of these can be used to reload other prepaid cards:

Prepaid cards compared

The tables below summarize the fees and limits of each prepaid card that can be loaded with a Vanilla Reload card. Note that most of the numbers below were taken from publicly available member agreements and FAQs. In some cases, these online documents have not been modified in years and so may be inaccurate. Please help me correct these tables if you have recent experience that contradicts these numbers.

Fees:

|

|

Credit transaction |

Debit transaction |

ATM withdrawal |

Cash Advance |

Foreign Xchange |

Other fees of note |

| Amex Bluebird | $0 | N/A | Free at MoneyPass ATMs*. $2 elsewhere | N/A | $0 | $2 for online load from debit card (but free at Walmart) |

| Amex Serve | $0 | N/A | Free at MoneyPass ATMs. $2 elsewhere | N/A | N/A | No other fees |

| Amex Prepaid | $0 | N/A | $2 (first per month free) | N/A | $0 | No other fees |

| H&R Block Emerald MasterCard | $0 | $0 | $2.50 | $5 | ? | $.95 per transaction bill pay. $4.95 inactivity fee after 2 months. |

| JH Preferred Visa | $0 | $0 | $2.50 | $5 | 2% (max $5) | $3 per month if less than $1K was loaded to card previous month |

| Momentum Visa | $1 | $1 | $2 | ? | $1 + 3% | Optional $10 per month plan eliminates per use fees. $10 Activation fee. |

| MyVanilla Visa | $0.50 | $0.50 | $1.95 | $1.95 | 3.5% | $3.95 per month inactivity fee after 90 days; |

| NetSpend MasterCard or Visa | $1 | $2 | $2.50 | ? | 3.5% | Monthly plans available to eliminate per transaction fees. $1 per check bill payment. Check refund: $5.95 |

| PayPal MasterCard | $0 | $0 | $1.95 | $2.50 | 2.5% | $4.95 mandatory monthly fee |

* Free MoneyPass ATM use is supposed to be contingent upon setting up direct deposit to Bluebird, but I haven’t found that to be necessary in practice. See “Bluebird: Are direct deposits necessary for free ATM use?“

Limits:

|

Max load via Vanilla Reload (day / month) |

Maximum balance (from Vanilla loads) |

Max ATM withdrawal (day / month) |

Maximum debit transaction |

Other limits of note |

|

| Amex Bluebird | $1K / $5K | $10K | $500 / $2K | N/A | $10K per month spend limit except for checks |

| Amex Serve | $1K / $5K | $10K* | $500 / $2K | N/A | $10K per month spend limit except for checks |

| Amex Prepaid | $1000 | $2500 | $400 | N/A | |

| H&R Block Emerald | $1K / $5K | ? | $3000 | $3,500 | |

| JH Preferred | $1K / $5K | $9,999 | $2,550 / $5,500 | $5,000 | |

| Mio | $2,500 | $9,999 | $400 | $9,999.99 | |

| Momentum | $2,500 | $10,000 | $1000 | ? | |

| MyVanilla | $2,500 | $9,999 | $400 | $5,000 | |

| NetSpend | $7,500 | $15,000 | $940 | $4,999.99 | $4999.99 max cash advance |

| PayPal | $2,500 | $15,000 | $940 | ? |

A deeper look at each card

American Express Bluebird

American Express advertises Bluebird not as a prepaid card, but as a checking account alternative. It is the only card in the roundup that not only includes free bill pay, but also provides an option for paper checks that cardholders can write out themselves (Unlike a regular checking account, though, each check must be preauthorized and results in an immediate reduction of available funds). Another great feature of this card (and the Amex Serve card) is that funds can be transferred directly to your bank account for free. This card is also the only one in the roundup that can be loaded for free at Walmart using debit cards or gift cards (see “Gift card PINs“). Overall, Bluebird has an almost perfect combination of multiple load options, easy access to funds, and almost no fees. Grade: A+.

American Express Serve

Serve is so similar to Bluebird that American Express only allows you to have one or the other. One big difference between the two (that I’m aware of) is that Serve allows loads via credit or debit card for free (limited to $200 per day and $1000 per month). Also, while Serve has the same bill pay feature as Bluebird, it does not have a paper check option for writing out checks yourself. Overall, the two products are so similar that they’re hard to differentiate. They’re both terrific products for loading up from Vanilla Reload cards. Grade: A+.

American Express Prepaid

Amex prepaid cards are great in that they have virtually no fees, but unlike Bluebird and Serve, they are very limited in options for accessing your money. The only options for accessing your money are to withdraw cash at ATMs or to use the card like a regular credit card (and therefore forego additional credit card rewards for those same transactions). Grade: B-.

H&R Block Emerald

UPDATE 4/13/15: This card is now available online.

The only way to get this card is by visiting an H&R Block location in-person. Even then, you may not be able to get the card without using their service and getting a tax refund. If you can get the card, though, it seems very attractive since it has no monthly fees and no debit or credit transaction fees, and it offers bill pay services. Note that some readers have warned that their cards were shut down quickly after they loaded and withdrew $5K or so. Grade: B.

JH Preferred

The JH Preferred card is similar to the H&R Block card, but this one can be ordered for free online. Both are issued by tax preparation organizations and have few fees. Like the H&R Block card, this one has no debit or credit transaction fees. And, monthly fees are waived if you deposit at least $1K per month. They advertise a bill pay feature, but the list of available payees is quite limited. Note that some readers have warned that their cards were shut down quickly after they loaded and withdrew $5K or so. Grade: B.

Momentum

The Momentum card is only available in certain regions of the country and must be bought in-store. You can use this web page to search for availability in your area. Momentum charges fees for virtually all transactions unless you sign up for the $10 per month plan, which seems steep to me. The best use for this card is to go without the monthly plan and use only for high value debit transactions. Grade: B-.

MyVanilla

Unlike the Mio and Momentum cards, MyVanilla is available everywhere within the U.S. You can buy the card at a store, or simply order one for free online. Fees and limitations are very similar to the Mio card described above. A number of people who have run very large amounts of money through these cards have had their accounts shut down. When that happens, it can take a while to get your remaining funds back so beware of that. Grade: B-.

NetSpend

NetSpend used to have the option to pay bills via mailed checks, but a reader told me that that feature has been discontinued (can anyone confirm?). While the fees and limits of this card appear to be very similar to the others in this roundup, the NetSpend card has a major disadvantage: they eventually shut down the accounts of almost everyone who loads funds via Vanilla Reload cards. You can read about my experience with this here: “We’re sorry, there is a problem with your account.” Grade: C-.

PayPal

This card has a mandatory $4.95 monthly fee, but then free credit and debit transactions. This card belongs to the Allpoint Network so while the card itself charges $1.95 for ATM withdrawals, you won’t get another fee from the ATM operator if you go to an Allpoint Network ATM. Note that the PayPal card is administered by NetSpend so this card may be just as likely to be shut down as the NetSpend card (but I don’t know that for sure). Grade: D (I don’t like mandatory monthly fees!).

Summary

Bluebird continues to be my favorite Vanilla Reloadable. You just can’t beat its perfect combination of almost no fees, easy load options, and easy access to your money. I expect that if I had a Serve account I’d be just as happy with that too. If you want a card that acts as a true debit card, I’d look to H&R Block or JH Preferred.

I bought a 25$ prepaid visa or do I thought buddy passed me a long paper with a activated pin number but no card number. What can I do to use my $25 im not happy and I can’t get my money back ..PLEASE TELL ME WHAT I CAN DO TO USE MY CASH . THE SIMPLEST WAY

where can i turn my onevanilla card into cash

i will like to know how much i can spend on myvanilla mastercard and how much can i spend when i go to store to make purchases with it? lastly how much can i withdraw from atm per month. Thank you

In other words can some set a per-purchase limit on the card and avoid some emptying the card on first use

I don’t think so

As you purchase a vanilla prepaid card can you put a transaction limit on the card or register info to the card so it cannot be abused by anyone in the event the wrong person gets their hands on it

Please which shop or store can I get one vanilla prepaid visa card to buy in United Kingdom,UK?

I have no idea. Sorry.

How about a shop to get a vanilla prepaid Visa card to buy in USA

My vanilla card has 10 digits, is it faulty?

I just like to pay rent or bill pay by using AMEX serve.

I used to use paypal debit card, but it was deactivated..So I am looking for another method.

I would like to confirm this about my Vanilla reloadable card.

I am not sure yet I can buy my vanilla visa card with credit cards, but myVanilla visa card can be used for reloading of AMEX serve card online, right?

Totally $10 fee per month for loading of $1000 = $7.5 ($3.95×2 reload fee) + $2.5 ($0.5 per each transaction for the reload $200 per day up to $1000 per month, 5 times)

This is like 1% fee. Is this worthy?

(By the way, 1% fee will be same as above If I use myVanilla visa card directly on plastiq)

That won’t work. Amex only approves real bank debit cards for loading Serve online

i have onevanilla debit card which i activated for 100$ at the store,so that that’s mean that i cant reload it after the 100$ is finish….or how does it work….i taught will now load money after the activation …???

One Vanilla cards are one-time loads. My Vanilla cards can be registered and then reloaded.

I have the Vanilla Gift card and I want to know if its reloadable

Only the “My Vanilla” version is reloadable.

I have a money network card an account now card both have options to load a check but the limit is $2,500.00 I need 1 that does the same but with a little higher limit like $3,000 ….any help??

Sorry I haven’t looked into check load limits at all so I don’t know.

I bought a prepaid myVanilla Visa and it has 10 digits instead of 16. Is it a bad card or is this something new?

I’m not sure what you mean. All Visa cards have 16 digits

Can i load my vanila visa debit card with a cc

No, not directly. If you have a reloadable vanilla visa you might find a store that allows debit reloads. In that case you may be able to:

1) buy Visa or MC gift debit gift cards with your credit card

2) reload your Vanilla Visa debit card with the gift cards

Unfortunately, after fees it may not be worth the hassle

[…] Vanilla Reloadables – Frequent Miler – … – Vanilla Reloadables. Vanilla Reload cards can be a terrific … They’re both terrific products for loading up from Vanilla Reload cards. Grade: A+. American Express … […]

Is there a card out there that I can buy with a CC that I can load onto my serve account online??

Probably not. Some people have been able to buy reloadit cards at grocery stores with credit cards, but I’ve never had luck with that.