The Chase Sapphire Reserve card offers a standard signup bonus of 50,000 Ultimate Rewards points (worth $750 in travel!). To get that bonus you have to pay the $550 annual fee and you have to spend $4,000 in 3 months. The $550 annual fee does not count towards the $4K spend requirement.

I’ve written before about why I think the card is worth keeping long term, but thanks to its signup bonus, it’s equally compelling for those who intend to cancel or downgrade in 12 months. Those who travel frequently (including by bus, train, taxi, Uber, etc.), can make use of the card’s $300 in annual travel credits twice in their first membership year. Since the travel credits are available each calendar year, it’s possible to get $600 in travel credits in your first 12 months of card ownership. Combine that with using the 50,000 bonus points for travel at a value of 1.5 cents each and you can get $1,350 worth of travel in exchange for that $550 annual fee.

The first challenge is to get approved for the card: How to get approved for the Sapphire Reserve.

The second challenge is to meet the $4,000 spend requirement within 3 months.

For the latter, here are 3 easy options…

1) Open a bank account (or two)

Doctor of Credit maintains a list of banks that accept credit card funding of new accounts. Importantly, Doctor of Credit also keeps track of whether or not this funding is treated as a cash advance. The key is to find banks that allow large initial deposits by credit card and where Chase credit cards do not treat that funding as a cash advance.

At the time of this writing, for example, it looks like you may be able to safely fund a new OceanFirst Bank account up to $2,500 and an Agriculture Federal Credit Union account up to $1500. Options that work change regularly, though, so please find up to date information on Doctor of Credit’s page: here.

Make money too! Doctor of Credit also keeps a list of current bank bonuses where you can earn cash for opening a bank account. Note that some banks have more stringent requirements than others for earning the bonus (such as direct deposits). Details here.

2) Pay federal Taxes

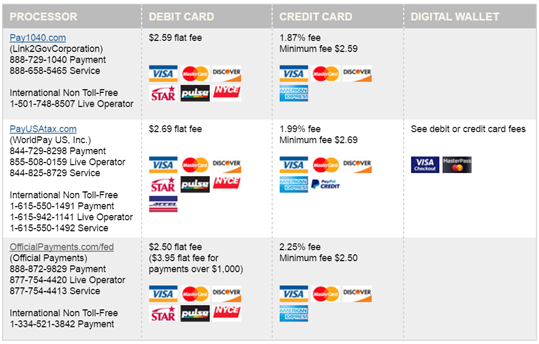

The IRS maintains a list of payment processors that accept credit and debit cards for tax payments. Currently, the best option for credit card payments is Pay1040.com which charges a 1.87% fee. Tax payments are always counted as purchases not as cash advances.

If you can float the money, you can knock out the Sapphire Reserve’s $4K spend requirement in a single blow by paying $3927 in estimated or end of year taxes. With fees, the total will come to just over $4K. And, if you can float the money, you don’t need to worry about whether you overpaid taxes: if your end of year tax preparations show that you overpaid, the IRS will send you a refund.

3) Pay bills with Plastiq

UPDATE: This option may not work with Chase Visa cards (like the Sapphire Reserve). Plastiq has been having issues with some Chase Visa cards coding their service as a cash advance. If this is still an issue when you try it, Plastiq will pop up a warning.

The Plastiq bill payment service accepts credit cards for almost any type of payment. Plastiq can be used to pay your mortgage, rent, tuition, contractors, baby sitters, and much more. You cannot use Plastiq, however, to pay your credit card bill or to pay yourself. A more complete list of accepted and not-accepted types of bill payments can be found here: Complete guide to Plastiq credit card payments.

At the time of this writing, Plastiq charges 2% to pay by MasterCard or 2.5% to pay by Amex or Visa. And, periodically they offer better rates for repeated payments (such as this current offer for MasterCard mortgage and rent payments).

Since the Sapphire Reserve card is a Visa card, Plastiq will charge a 2.5% fee. If you use Plastiq to pay $3903 worth of bills, you’ll pay a total of $97.58 in fees, and you’ll quickly knock out the Sapphire Reserve $4K spend requirement.

Other easy options

Please see: 9 ways to increase credit card spend without leaving home.

[…] 3 easy ways to meet the Sapphire Reserve minimum spend requirement […]

Just got my CSR. Do you think it would be a good use of the $300 travel credit to buy Choice Hotels pts, which is offering 30% off points promotion? So buy 50k choice pts cost $385-$300 travel credit final cost $85. Then transferring those points 50k= 15k RR pts to my Southwest account in January to finish off the points I need for CP? In Jan I’ll get 50,000 pts sw card, plus emiles and other spend totaling 95k add the 15k and for $85 I would get the CP for 2 years and 15k RR pts worth above $200. Please let me know your thoughts Thx

I think it is a reasonable approach if:

1) you need an easy way to use this year’s $300 in travel credits; and

2) you will make good use of the companion pass

[…] 3 easy ways to meet the Sapphire Reserve minimum spend requirement by Frequent Miler. I agree that bank account funding is one of the easiest ways, but I’d focus on accounts that give a bonus on opening and allow funding. […]

Newbie Question – regarding funding new bank accounts with credit card.

Called Chase to remove cash advances (lowering limit to zero.) They agreed to lower, but not to zero (amounts vary per card, all over $100.00).

How do you know that funding a new bank account with a credit card codes as purchase rather than a cash advance?

Doctor of Credit’s page lists whether others have been charged cash advances or not. Also, make sure that the amount you fund is well over your cash advance limit so that the transaction will be denied if it is a cash advance.

Hello Creg, I apply for the new chase saphire reserve and my application got denied , so I call chase and they told me that I have 6 credit cards open in the past 2 years . Do you if I apply again in a month or two they mi reconsidered ? Thank you

Yes, once your number of credit cards opened in the past 2 years drops to 4, you can apply again and will likely get approved.

RadPad’s 2.99% fee is also an option, as they are coded as travel-lodging, so probably triggers 3x UR. (The Android pay promotion is dead.)

For every $100 rent, you pay $2.99 fee, and get 308.97 UR points. Redeeming even for cash you end up paying just $99.9003 (~0.1% cashback), redeeming for travel, $98.35545 (~1.65%), if you value transfers as 2.1c, $96.50163 (~3.5%)

Is radpad still coded as hotel? If it is true, isnt paying bills with radpad better than using plastiq? Opinions, please. Thanks.

what site can i use to send money to my wife? I don’t mind the fee. NO time for gift cards cos MS is 90% dead these days.

I’d recommend Venmo for sending money to a friend or spouse. They charge 3%.

Paypal is free. Why not use that?

PayPal also charges 3% if you pay a friend with a credit card

Tony, you got to remember on this site some people may apply for two or four different cards very quickly, maybe even the same day. $4K spend is easy but when you multiply that by two or four you need to get creative to meet the spend.

@Hin App-O-Rama for the average person is over, people need to change the mind set that they want 300K of miles in 3 weeks. I like Greg’s website, and I think he presents things very clearly, however, I also think that the average person wont be able to do 12-15k of MS in 3 months, since the game changes so quickly these days. I’m very luckly that my two business I have allow me to do spend like that.

Why are people worrying about meeting the min spend of 4K? That is 1,300/m a month. fairly easy to do.

I do my monthly tithe on CC (increase it to cover the cc cost), my house payment and car payment through Plastiq, and that does a good job of covering the needed spend. I make out a plan in excel of the cards, and the spend needed, and then lay it out again for the next 3 months showing my spend plan to fund those 3K to 5K required spending. Plastiq has been a big saver in doing this, albeit at a cost. I did a bunch of cards like this in March and used my state and federal tax payments.

How much are you paying as a % fee using Plastiq? Is that worth enough to offset the benefits you gain from the CC bonus?

Per SD, Radpad rental pay is coded as “hotel” so it would earn 3x… but I haven’t tried it myself yet.

Radpad through android pay

drat i don’t have android

;(

Nobody will know how Chase coded until it get supported in Android Pay.

the link to DoC article is going to IRS…

Thanks. Fixed.

Greg, is there a place to contact you at? (the contact page seems to by cyclically looping to your articles, and not a contact option).

Thanks in advance,

Luke

FYI: Luke found me. Anyone can email me at: greg@Greg The Frequent Miler.net

quick off topic question. The $300 travel credit….i paid my timeshare assn dues and was reimbursed for $300 of them. Does the $300 that was credited back for the travel credit count towards the $4,000? or do i need to actually spend $4,300?

Thanks!

I think it will count, but I’d recommend sending a secure message to Chase to ask. That way if you have any trouble getting your bonus, you’ll have hard proof that they told you the $300 will count (assuming that’s their answer!)

Won’t opening a new bank account cause another hard pull on your credit report?

Some do, some don’t. Doctor of Credit keeps track of hard/soft pulls here: http://www.doctorofcredit.com/current-bank-sign-bonuses/

Great! Thank you.

My power company charges a flat $1.65 to pay by cc. As a percentage of our bill, this is a very small price to pay. Certainly not $4K, but it will knock out a nice chunk of that.

why not pre-pay your power company $4000 so you do not have to pay the bills for a year or more.