The Chase Ink Business Preferred card rolled out in the fall of last year with a mighty 80,000 point signup bonus. I’ve been eager to get the card, but Chase’s 5/24 Rule has been a roadblock. For most of their cards, Chase won’t approve your application if you’ve signed up for 5 or more cards from any bank within the past 24 months. And I’m way over 5/24. I’ve asked a couple of times in-branch whether I was pre-approved for the card (which has proven to be a way around 5/24 for the Sapphire Reserve card), but no dice.

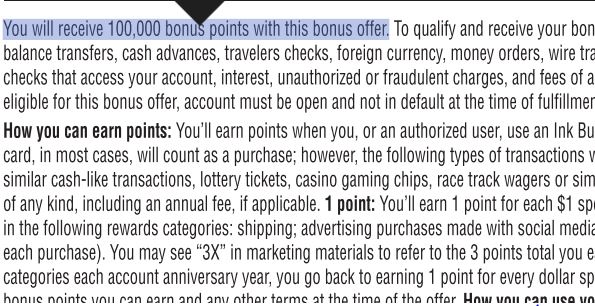

Then, on Wednesday, Doctor of Credit published “New Way To Bypass Chase 5/24.” The idea is to submit a paper application through a Chase Business Relationship Manager (BRM). Apparently these applications go through a completely separate process from regular old applications. And, as a bonus, the business card offers available through BRMs are better than the public offers for these cards. BRM’s currently offer the following:

- Chase Ink Business Preferred Card: 100K signup bonus after $5K spend in 3 months (the public offer is currently 80K after $5K spend). $95 annual fee is not waived in either case.

- Chase Ink Cash Business Credit Card: 50K signup bonus after $3K spend in 3 months (the public offer is currently 30K after $3K spend). This card has no annual fee.

I didn’t know if I had access to a BRM, but I remembered that a couple of years ago I met with someone at my local Chase branch regarding my business banking at Chase (I do all of my business banking with Chase). I dug up old emails and discovered that he was in fact a BRM! I contacted him and learned that he had moved to another area, but he was able to dig up contact info for my new BRM. Great!

Yesterday I filled out the Ink Business Preferred paper application. I considered applying for the Ink Cash card at the same time, but I didn’t want to risk having that 50K offer approved instead of the 100K offer. If this works out well, I may try the Ink Cash application in a month or two.

My understanding is that it will probably take quite a while before I find out if my application was approved. Fingers crossed!

I’ve gotten the 100k card several times but now the BRM won’t answer my calls! Might be because they don’t get brownie points by bypassing the system!

[…] waiting for a decision on my Chase Ink Business Plus application, which I wrote about here (it has been a long time with that one because my first BRM left on emergency medical leave before […]

Some redditor buzz Chase will offer in-branch 100K IBP sign-up and 50K Ink Cash during Small Business Week, which technically starts Sunday.

Any update on your app status? I submitted mine on the 17th with no updates yet. How’s yours doing?

My app seems to have gone into a black hole. I can’t even get the BRM to reply to my emails. No idea what’s going on

FYI on my update, a BRM from Cali took care of my app even though I’m in Texas. Submitted on the 17th and he confirmed today it’s been approved and he’s trying to overnight it. Once received, I’ll confirm the terms of offer. Then I’ll have my wife and friends hop on after that.

I did call the automated line mid week and it didnt even find my app. so I’m sure they are super delayed on apps review with this blog along with reddit.

Any updates on your end?

Confirmed mine is approved for 100K after 5K spend. Getting the card tomorrow. Submitting app for my wife and a friend now.

Glad you got approved! In my case, it turns out that my BRM was out on emergency medical leave and never submitted the app after all. Will work on plan B

Greg,

let me know if you want contact details to my BRM in Cali.

Thanks David, but I’m good. I just need to find time to meet with another banker

Thanks for this article Greg!

If it’s been *under* 90 days since my last credit card run, if I apply through the BRM for the Chase Ink Preferred, will this be overlooked? Or is it better if I wait until the full 90 days are up?

I would wait, unless the card bonus is disappearing. I am waiting until day 31 or 32 …. not this card actually, but the other 100K card.

Thanks Frank!

Yeah, I agree with Frank. I don’t think there’s any harm in waiting and it will help reduce the impact of your previous hard inquiries.

I appreciate it, Greg.

Thank you!

Is an EIN tied to my SSN, name, address, etc.? I’ve always just used my SSN for business apps – if I used an EIN would they still see me as the same person that is way over 5/24?

@jcb, Yes.

I called Chase about 6 months ago to cancel my Chase Sapphire Preferred card because I had just got the Reserve, At the time I mentioned that I wanted to get the Freedom Unlimited card and the rep said no problem I can do that for you right now. It turned out that when the FU arrived it had the same credit card number as the Preferred and of course I never got the sign up bonus. So my question is – does this FU card count as a new signup towards 5/24 or not?

It’s the account timing, not the card so whenever you originally got the CSP will count towards your 5/24 count

Whether EINs are required or not Chase determines on a per-state basis, per whatever they think the law says. So if you’re still where you were when you got your last Chase business card, you already know.

I’ve long been interested in getting a buz card. I handle the administrative duties for a group of guys that rent out a basketball court once per week. The annual spend is around $8k/year. I treat the money collection part as a non-profit since I only accept payments for the exact cost of the court each week and the guys all pay me with paypal, bank transfer, venmo, etc. I know that this could be considered a business but I do not want to cause any tax complications for myself. I like dealing with an easy, clean tax return. Is it possible for me to get a buz card and not acknowledge the business income?

@MRS, Possible: Yes. Advisable: No.

For clarification, is a BRM the same thing or different than a “Relationship Banker”?

A BRM (business relationship manager) is specifically focused on businesses. If you deal with a “relationship banker” I imagine that’s someone who helps you with all of your accounts? If so, that’s not a BRM

[…] Going for the latest 100K Ultimate Rewards business card offer despite 5/24 […]

Why not just post when you get the result? Clickbait?

@Mark, clickbait? I don’t agree with you.

I like to read these musings as I do the same myself, chalisching over every nuanced word in an offer.

The big story here is that there seems to be a way around 5/24, and I wanted to let readers know about it. I kept that out of the title because I thought that would be deceiving the the many who do not have access to a BRM. In other words, I was avoiding clickbait in the way I wrote the post

Every blog post could, in some way, be considered “clickbait”. Greg is running a business and his business will be more successful when more people visit his site and use his application links.

If you don’t like the posts on Frequent Miler, you might think about reading another blog that doesn’t post “clickbait”. You might find such a blog is non-existent, though.

I have the Ink Cash as a sole proprietor (originally Ink Plus), but I don’t have an EIN. Do I still have access to the BRM?

+1, I’d like to know too. I’m self-employed and got my Ink+ with my SSN.

@Dave, A business is a business, and it isn’t necessary for having a business relationship manager. But I think you should get an EIN anyway. It looks better on an application and you can get one in 2 minutes. I can see no downside.

I don’t know if an EIN is required but it takes all of a minute to get one for free from the IRS. As Nike would say, just do it.

Hmm, I wonder if getting a EIN and then reporting no business expenses or revenue will increase risk of audit.

I have 3 Personal Cards with Chase and 3 Business Cards. My third Business Card was HARD to get, and the reconsideration line process was grueling. I did finally get approved, but they seemed awfully skeptical about why I would need 3 Business Cards. Bottom line – am I pushing the limits of Business Cards with Chase, or did I just happen to talk to a really skeptical guy?

Additionally, can I improve my odds of being automatically approved by calling and having my credit limit lowered by, say, $5,000 on two different cards? The reason I was turned down by the automated system last time was total overall credit and we had to move credit around – so would I have perhaps better odds by pro-actively having them lower my limits?

@Jeff, I do not believe in reducing credit in advance – ever, not even with B of A. I always try to trade when I want a new card. Why give up something before trying to get something else in exchange? I have many Chase cards (4 business, 6 personal right now and my wife has similar). I had 3 Ink cards at one point (and even then I maxed out the bonuses) but gave one up to get a SW card for companion pass.

I am now thinking of trading 2 other business cards and one personal card for this new Ink Preferred 100K offer if I can get one. What I mean is I apply for the new card, knowing they will likely refuse, then I offer to give up one, two or even three cards in this case. I actually don’t even want these 3 cards anymore anyway – but I won’t drop them without first trying for a new card. Timing is everything and I have an exact day I plan do pull the trigger, frantically looking for a good private client banker right now. I am way over 5/24 – actually I’m 21/24 right now, and 7 were Chase cards! I do push my luck, as you can see. But I am a really good Chase client and have been for many years.

Last time in a branch I was told that the paper route was no longer working (we did that for the Sapphire Reserve last year), but I don’t really believe there is a hard and fast rule at Chase on everything. I think the right banker can get it done. Like most things, a good advocate (salesperson) can get it done for you. Unfortunately right now I don’t have a good banker nearby (mine left).

The worst outcome would be a hard pull and no approval – not terrible, but I could take the alternative approach and go for a different Chase card that is not on the 5/24 list, and so take less of a risk of failure.

Decisions, decisions …. but I always keep in mind that this is just a game and I am really having fun with it.

I mostly agree with Frank — that you can bargain after the fact with your existing cards. But if you’re looking for automatic approval, reducing credit lines or cancelling cards in advance can help. Another point: With Chase, usually business reconsideration cannot move credit from personal cards to business cards (but BRM applications may be an exception). So, if not applying through BRM for a Chase business card it may actually help to reduce your personal card exposure first.

I just reread the question and saw the words “automatic approval’ and I see the point. Who doesn’t love automatic approval? I got one from Chase in January (on a card exempt from the 5/24 rule) and it sure beats the grueling one can get from the bank.

I also just read the Doctor of Credit post referred to above and see talk of $500,000 business income. While that was true for me 10 years ago, it is no longer so.

So, I have decided to get the only other cards that offers 100K miles at Chase that is not on the 5/24 list, and still drop 3 cards with AF due. So, all this back-and-forth chitchat (clickbait to some) has helped me make up my mind. Thanks.

Greg and Frank,

Thanks to both of you for your perspective, I really appreciate it and helps me understand the process much better. Sounds like getting a 4th Business Card is not considered too outrageous by Chase.

On the “trading” suggestion, if I were on a reconsideration call and offered to let go of say my Southwest Business Card – wouldn’t that open the door for the rep to suggest just converting the SW card over (forcing me to choose between giving up the signup bonus or struggling to find an explanation for why I only want my new card if I get the signing bonus?)

Hope that’s not too convoluted, I’m still learning how to navigate those calls.

@Jeff, As long as you have applied for a card and that is what you are calling about then you will get the bonus if you are approved for it.

A different issue is the question below by BigMac which is where you downgrade (or upgrade when you are not discussing a new application. I had a similar issue where I wanted to cancel my Sapphire Preferred (so I could apply again later) and they allowed me to swap it (I used “trade” earlier to mean something different) for the Freedom Unlimited – and I did not get a bonus and they left me with the same card number, just the name changed. But I was happy because I get 1 1/2 points per $ on general spending.

Chase has the whole range covered and if you have a spouse or equivalent you can cover all possible spending:

Sapphire Reserve for the 3x for travel (broader range than any other card in that category);

Sapphire Preferred for a low annual fee and great for car rental insurance;

Freedom for the 5x rotating bonuses;

Freedom Unlimited for everything else.

Ink (if you have a business) for Telecom and Staples.

Some redditors are claiming approvals overnight. Was this the Ann Arbor Main St. branch?

That would be nice! No news yet. Briarwood branch.