The American Express Gold card has a special place in my heart: the ability to get 4x at US Supermarkets on up to $25K in spend per year (then 1x) and 4x dining worldwide was far and away special when this card debuted. Amex took a unique approach in offering an “extra-premium” card with an annual fee that put it between the traditional ~$95 fee cards and the $500+ ultra premium products. As the time, grocery spend was a category in which there was virtually no competition but themselves and one would have thought it would stay that way with such a large bonus multiplier. However, given the fact that the Citi Premier now offers 3x at grocery stores, the Freedom cards come with a limited-time first year bonus of 5x on up to $12K, and the Sapphire Reserve will now offer 3x on up to $1K per month through April 30, many of us are likely asking the question that is set to be facing me this week when my annual fee posts: does it make sense to keep your Amex Gold card?

First stop: Greg’s Premium credit card worksheet

Greg has previously created and written about a resource that can help one decide which of the premium / ultra-premium credit cards are keepers. It’s not a big stretch to say that the spreadsheet has been wildly popular. See this post: Which Premium Cards are Keepers? Version 3.4.

You definitely want to review the spreadsheet, but these are the benefits it takes into account on the Amex Gold card:

- $100 airline incidental fee credit

- $120 dining credit ($10 per month credit for spend at GrubHub, Seamless, The Cheesecake Factory, Ruth’s Chris Steakhouse, and Participating Shake Shack locations)

- 3x points for flights booked with all airlines or on amextravel.com

- 4x points at US Supermarkets (on up to $25K in purchases per year, then 1x)

- 4x points at restaurants worldwide

- Hotel collection $100 credit for stays of 2 nights or longer

If you can easily assign a value to each of those categories, you can quickly see whether or not the card is worth its annual fee. However, in my case, I felt like the spreadsheet didn’t tell the whole story. Given the oddity that is 2020, I’m sure others will be in a similar boat in some ways, so I wanted to write a post sharing my thought process as I go through valuations (and add one more important category).

Hotel collection $100 credit for stays of 1 nights or longer ($0)

This is simple: I’ve never used this benefit. I have searched a couple of times for opportunities, but haven’t ever found it to be a compelling option (perhaps in part because of access to programs like Amex Fine Hotels & Resorts and Chase Luxury Hotel Collection). This benefit has $0 in value to me.

3x points for flights booked with all airlines or on amextravel.com ($0)

This is another easy goose egg: given that Amex offers no travel protections, I have no desire to book on an Amex card when I can easily book on a Chase card that comes with trip delay / interruption, lost baggage reimbursement, trip cancellation insurance, etc. If I don’t care about those benefits, I can use my Chase Freedom Unlimited to book through the Ultimate Rewards portal for 5x Chase Ultimate Rewards points on my no-annual-fee card. This benefit is a nothingburger to me.

$120 dining credit ($10 per month credit for spend at GrubHub, Seamless, The Cheesecake Factory, Ruth’s Chris Steakhouse, and Participating Shake Shack locations) ($20)

I should note that in addition to the above ways to use the credit that Greg includes in the spreadsheet, it can also be used at Boxed.com.

That said, I don’t use this benefit nearly as much as most folks probably can. I have said since the beginning that I only expect to use this benefit 5 or 6 times per year simply because there is no GrubHub where I live and though my wife likes the Cheesecake Factory, the nearest location is a solid hour away (and the nearest Ruth’s Chris and Shake Shack are farther). I’ve actually never even eaten at a Ruth’s Chris steakhouse. Thus, I only expected to use these credits when traveling and then it depended whether my trips and needs lined up in separate months, etc.

With 2020 being 2020, as you may expect, I have used this benefit even fewer times than expected. I have received the credit exactly 3 times since last anniversary. I can’t value that at full face value since I may not have even ordered from GrubHub in those instances were it not for the credit, but neither do I think I should value the card long-term based on the anomaly that is 2020. Also, now that Lyft Pink membership (which you can get for free with the Chase Sapphire Reserve) gives you GrubHub+ benefits, I am at least likely to score a better deal with GrubHub the next time I order. To be conservative, I’ll value this at $20 this year (with the recognition that I will likely – or at least hopefully – be able to get more value next year).

$100 airline incidental benefit

We value this at $90 in the spreadsheet and I’m inclined to leave it there. I messed this one up by waiting until December 31st last year to make a charge (a United Club lounge pass) that didn’t post on the Amex side until January 1st and thus I missed the credit for last year and tied myself into an airline I didn’t want this year, but nonetheless I intend to get full use out of the credit this year and I know without a doubt that I will in 2021 as I won’t repeat that procrastination mistake.

That leaves me with the two hardest benefits for me to value: the dining and grocery bonus categories.

Grocery bonus category

This category should be the bread and butter of the Amex Gold card (see what I did there?). When this card debuted, I was super excited about the chance to earn 4x at US Supermarkets on up to $25K in purchases per year (then 1x). This would easily become our grocery card and between groceries and the occasional gift card purchase, we would be able to max this out pretty easily.

But my oh my has 2020 complicated that plan.

On the surface, we have spent more time at home in 2020 than I have in any year in as long as I can remember. Our organic grocery spend (the puns are just too irresistible) is the highest it has ever been. Yet I looked back at previous statements and I am way under the $25K cap on 4x spend this year.

How did that happen? Ultimately, it was a combination of pandemic-related factors.

First, I’ve erred on the cautious side with regard to potential COVID exposure. Whereas I used to take a couple of hours on a weekend once or twice a month to run around for manufactured spending activities, I have completely stopped making special trips for that (and in fact I can’t do that in my hometown at all, so I was completely cut off for months this year and stuck with a large pile of gift cards for longer than I’d like). I have only recently purchased some gift cards at a grocery store again.

The second major reason I have been far below the 4x cap on the card is for the same reason that some reading this likely have been: temporary COVID enhancements. Between 12x Hilton points over the summer, 5x Chase Ultimate Rewards points over the summer and 5x ongoing with my first-year Freedom card, and 10x Marriott for a while, I just haven’t reached for the Gold card as much as I ordinarily would have.

A third reason it hasn’t gotten a ton of use has been Amex’s general attitude toward spend that they don’t like. They offered a grocery bonus on Hilton cards over the summer and then clawed back or never awarded points in many cases where they didn’t like the amount of spend. They have been particularly aggressive in clawing back old airline incidental credits, etc. I think that if all of my normal grocery spend went on this card, I could probably max out the bonus category without enough irregular activity to get on the radar, but the fact is that for me my member year is nearing end and I will still be far under the cap this time around. I’m not sure how much different my situation will be a year from now given the opportunities I have to earn 5x Chase points on groceries for the time being. I’d like to think that I’ll use up those Chase bonuses and also this one, but 2020 has shown that I might not.

I am therefore having difficulty putting a concrete value on this benefit. I decided to reverse-engineer things by coming back to this after evaluating everything else to see how much value I would need to get here at minimum in order for the card to be a keeper.

4x restaurants

This is another pandemic-affected benefit. I have spent very little money at restaurants this year compared to years past. I haven’t dined in at a restaurant since the first week of March and only really began feeling comfortable with takeout in July and August. When I did want to eat at restaurants again, I had more temporary COVID enhancements, like using the Aspire’s resort credit at restaurants (which was available over the summer), 10x at restaurants on Marriott cards, and more recently the ability to redeem the Chase Ritz travel credits on restaurants and at grocery stores.

Truthfully, there was also another barrier in that pre-COVID, I still had a Citi Prestige card. Given the Prestige offering 5x at restaurants, that was my go-to dining card for the half of my membership year when I was spending as normal on dining. The Gold card only became the “primary” dining card at a time when we weren’t eating any restaurant food and while every other card began offering a bonus.

Still, long-term, the big question for me is how much incremental value I’ll get from keeping the Gold for restaurants. Given that I will keep the Citi Premier, which offers 3x at restaurants, and that my Chase Freedom Unlimited also earns 3x at restaurants, I am looking at an incremental 1x with the Gold card. If I spend $5,000 per year on restaurants/takeout, this card would only offer me 5,000 more points. At a penny and a half per point, that’s about $75 worth of extra points over the course of a year. I think that’s a max win here as I wouldn’t be surprised to see the continuation of temporary grocery bonuses and the ability to use certain travel credits on dining spend, so even if my dining spend went back to a normal level I don’t think it would all go on the Gold card.

Therefore, to be conservative, I’ll only value this benefit at $50.

The final benefit that’s unique to me: referrals

One benefit that Greg doesn’t include in his sheet is Amex referral bonuses. It makes sense that he doesn’t include this for several reasons. First, most readers likely don’t have the capacity to generate more than a couple of referrals per year. Secondly, even those readers who can pick up a few referrals per year could likely do it with a no-fee Amex card rather than paying an annual fee.

In my unique position as a blogger, I’ve been able to take advantage of more Amex referral bonuses than most people. I have therefore earned the maximum 55,000 points this year from referrals on the Amex Gold card. Amex will send me a 1099 valuing those points at $600, so the points will cost me something – but far less than they’re worth. Sticking with Amex’s $600 value and discounting by ~$150 in taxes, this alone has been worth $450. That’s huge. And when combined with the ~$160 at which I’d valued other benefits (not including any value for grocery bonus), it makes the card well worth keeping in my case whether or not it gets much grocery spend.

Retention?

It’s worth noting that many members have reported generous retention offers on Amex cards this year. We’ve even heard of instances where members were given 20K or 30K Membership Rewards points with no spend required. We haven’t been getting any retention offers at all in my household, so I’m not holding my breath on this. Still, we’ll try chatting with Amex after the fee posts and then maybe follow up with a phone call to see if they offer any incentive to keep the card.

Bottom line

The Gold card is in a tough spot right now: most people are spending more than ever before on groceries and many are spending quite a bit on dining still. However, so many other cards have offered a bump on that type of spend as to push the Amex card out of the wallet for many of us. While that change has been “temporary”, the way it keeps continuing feels less and less temporary.

I still think that the Amex Gold can be a great value in some instances. For example, i you don’t have any Chase Ultimate Rewards cards (perhaps a shut down situation or you were over 5/24 before you knew to create a Chase plan), your main competition for the Gold would be the Citi Premier (which earns 3x dining and 3x grocery with a $95 annual fee). . Further, if you regularly order from GrubHub, you may value the monthly dining credit more than I do. If you value the dining credit at closer to $90 or $100 and the airline fee credit at around the same ~$90, you may find it easy to justify the Gold in comparison.

In my case, while I expect to get more value from the dining credit in the year to come, it probably wouldn’t be enough to justify the card if not for my relatively unique ability to maximize referrals. Given that I do get a ton of value out of the Amex referral system, I’ll likely be keeping the Gold card (if given a retention offer I’m sure I will keep it) — but if you had told me a couple of years ago when this card was refreshed that the referrals would be the key to me keeping the card rather than the big spending bonus multipliers, I’d have not believed you. That’s far from the most surprising thing about 2020, but surprising nonetheless.

Is anyone seeing the Uber $10 credit? I only see the $15 from Platinum card but not from Gold card.

Its coming in “early 2021”. Not sure exactly when

My annual fee is posting soon too and I do want to get rid of it, I think. I have increasingly soured against Amex with their behavior, even if I haven’t been caught up in much at all besides a less than $2 clawback on an airline fee credit months after a card closure. Yes, they’re that stingy.

Amex offers have been kinda good this year, but adding the annual fee on negates that a bit. The Grubhub offer is more of a pain than anything. I don’t naturally want to use it, and making food at home is my preferred option. It has been nice having a treat every month, I guess, but I normally do pickup. Even with Plus coming with Pink, there’s still tip etc.

A retention offer might push me over the edge, but I would honestly rather have a bigger Platinum offer instead. I considered downgrading to Green to see if an upgrade offer to vanilla Platinum comes along, but guessing that’s not very likely.

Not including credits, I’ve paid out almost $2k in annual fees in the last 12 months just to Amex. I need to cut back.

I use the monthly $10 credit with Grubhub/Seamless every month by putting an order in for pickup at Subway or some other option where I can avoid the delivery charge and stay close to the $10 credit amount. I’ve used the airfare incidental credit for 2 X $49 Southwest tickets which I canceled for future credit. I hope the player to be named later replacement will be a usefull credit.

I might get rid of my gold card because – since the pandemic started my grocery spend has shifted from the supermarket to farmers markets and meat delivery from a small butcher shop. The butcher shop and most places at the farmers market don’t code as groceries on AmEx but do with visa. I think I will continue to shop this way so if I don’t get a retention offer it might be time to say goodbye to the gold card.

Hotel Collection $100 credit requires at least two consecutive nights, no? That’s what the website says.

I’m sticking with this card this year. I got a 20k retention offer with no spend. I use the food delivery credit and the airline credit really isn’t much of a problem earning with most airlines having free cancellations (just put your cancelled tix funds into your travel bank and the Amex RAT team never finds out about it) . Their offers are really useful for me. I easily get another $500 in value from offers that don’t show up on my other Amex cards .

I thought Amex added travel protections recently?

Which chase cards still have 5x at groceries?

Newly approved freedom unlimited and freedom flex are 5x on groceries up to 12k

Was a hard pass for me even pre pandemic. $10/mo credits are ridiculous, $100 airline credit has become nearly impossible to burn, and 4x is easily replicated or exceeded by other lower AF options, or ideally while working on a new SUB. Not even close to being worth $250.

Great analysis! I definitely feel like the Gold is not useful until Chase’s grocery bonuses are no longer available.

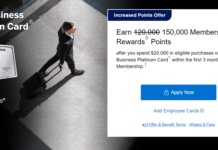

Even with the record 60K-75K SUB currently available, you will still have to pay $250 (although I personally would value Seamless/GrubHub credit in full, reducing it to $130 net) to park MR points until you can either justify another $550 for a Schwab Platinum (before considering what value you can put on the Platinum’s credits/perks) or are ready to transfer for a flight award ticket.

Since I don’t do MS and don’t come anywhere close to $25K on groceries this card just makes no sense to me. The airline incidentals and the other “bonuses” are things I won’t use.

I can get 6% back on the Blue Preferred for groceries. That works for me, especially nowadays.

I don’t have the consistent referral opportunities nick has, but there are a few days left to get the current lucrative 25k and extra 3x for 3 months offer. When Chase freedom came out with 3x dining, I was going to cancel my Gold. But it is too tempting to get 60k for spouse, 25k for me, plus extra 3x on all spending through the holidays and including my January 15th estimated tax payment. (Plus the spouse will get 6 months for initial bonus spend on the new card, so after my 3x). In fact, I worry about hitting it too hard for amex rat even with just organic spend. My renewal will come up before bonus points post, so spouse and I will likely each have a Gold in 2021 and 2022 will depend entirely on the credit replacing airline incidentals (good riddance).

I’ve not maxed the specific benefits, but definitely covered the annual fee through Amex Offers (over $300 this year so far) and when I’m not going to use the GrubHub benefit, I order for the college kid to pick-up lunch or dinner on me.

@Susan: The issue with considering the annual fee “covered” through Amex Offers is that you can get the vast majority of those offers on an Amex card that has no annual fee. I’ve used a number of Amex Offers on my Gold card this year, but I don’t think there has been a single one I’ve used that I haven’t also seen on other Amex cards. In most cases, you don’t need the Gold card to get that $300.

Excellent point. I actually occasionally see things on my Everyday that are not anywhere else, but don’t know that I have for the Gold. Will recalc my value, but still I think a keeper for me.

I’ve updated the $100 airline fee credit section to note that this benefit is going away in 2022 to be replaced with… we don’t know what. That doesn’t change anything about Nick’s immediate decisions, but hopefully we’ll know more a year from now when Nick struggles again to decide whether to keep or cancel the card.

I agree about referral bonuses not being taken into consideration. Just got 25k last night for p2. Only 10k available on platinum and BBP. Also, seem to get all the best offers on gold.