Credit Cards

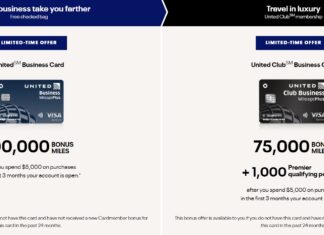

Update 4/4/24: These excellent United business card offers are still showing up on referrals, even though the public and affiliate offers have expired. This allows folks in 2-player (or more) mode to do a...

Recently Nick wrote about a new credit card from Robinhood that will apparently offer a flat 3% back on most purchases. On this coffee break episode, we speculate as to whether or not this...

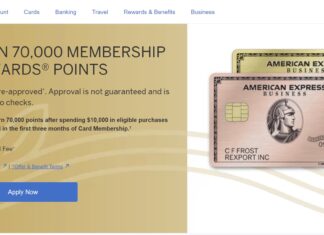

There's a new American Express Business Gold offer out that's got no lifetime language for those targeted. While the offer isn't nearly as many of the targeted offers we've seen over the past year,...

The Chase Ink Business Preferred card is somewhat of a doppelgänger to the uber-popular Chase Sapphire Preferred. Like that ubiquitous consumer card, the Business Preferred unlocks the ability to transfer your Ultimate Rewards to...

Online brokerage Robinhood has announced a waitlist for a soon-to-launch credit card that they claim will offer a flat 3% back on most purchases (and 5% back on purchases made through the Robinhood travel...

A number of high end credit cards give you Priority Pass membership. Full Priority Pass offers access to airport lounges, restaurants, and experiences (e.g. Be Relax Spa, Minute suites, Game Space etc), which can...

In light of yesterday's changes to the Hilton Honors Business Credit Card, we wanted to publish a quick reminder to use any quarterly credits such as those on a couple of the Hilton credit...

Over the past couple of months, a number of readers have commented on the fact that Google Pay has not been coding properly as mobile payments to trigger the 3x bonus category on the...

Overnight, American Express has made massive changes to the Hilton Honors Business Card. The short story is that the annual fee has increased, the free night award benefit is ending on June 30, 2024,...

Breeze Airways started service almost three years ago and has now partnered with Barclays to launch a new credit card.

For people living near airports served by Breeze, this card could be worth picking up...

Last week Wells Fargo launched online applications for their new Autograph Journey credit card that comes with the ability to transfer points to travel partners.

A reader on that post shared something interesting - they...

If you're new to credit card rewards, Chase can be a great place to start, as it offers a terrific variety of valuable cards, often with excellent initial welcome offers. That said, the main...

The Citi Double Cash card is yet another appealing no-annual-fee Citi card, earning two ThankYou Points per dollar on all purchases. Points can be cashed out to make this a 2% cash back card,...

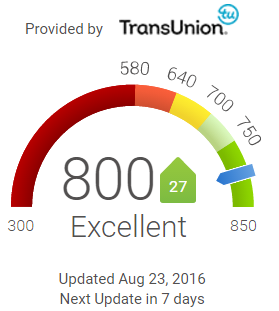

If you often apply for credit cards in order to earn welcome bonuses, then you've probably realized that managing your credit is important. And it's not just your credit score that's important -- it's...