Update 8/23/2016: Chase has eliminated the Special Consideration Form for Personal Card Exceptions. The following post has been updated accordingly.

If you apply a Chase credit card and are denied, you may have luck calling their reconsideration line for help (details here). You may even have luck calling multiple times until you find someone willing to help. And, if that doesn’t work, you may have luck asking to have your case escalated to Chase’s Resolution Department.

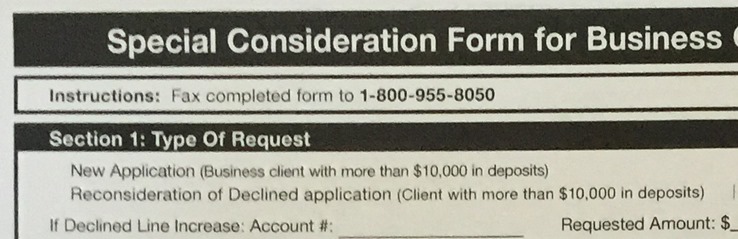

If none of the above works, there is another option for business card applications. If you have $10,000 or more on deposit at Chase, your Chase banker can submit a special reconsideration form on your behalf:

Special Consideration Form for Business Card Exceptions

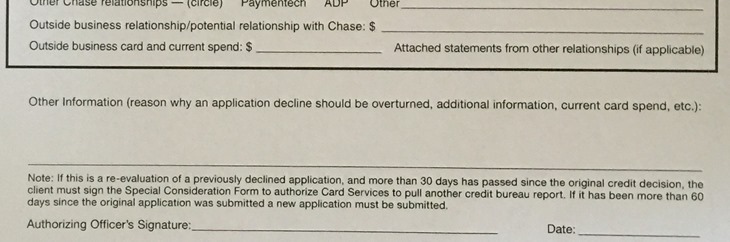

Most of the details that have to be filled out are the same details that were on the application (e.g. your SSN, income, etc.). Some info is new such as your “Other Chase relationships”, “potential relationship with Chase $”, etc. Most importantly, I think, is an open field for your banker to fill in “Other information (reason why an application decline should be overturned, additional information, current card spend, etc.)”.

It’s a good idea to develop a relationship with your Chase banker so that they’ll be willing to go to bat for you with one of these forms. And, hopefully, your banker will be good at filling out those key fields. You do need to sign the form in person, so this option is only useful for those with a Chase branch nearby.

5/24 Rule?

Reports have been mixed as to whether or not this helps with overcoming Chase’s 5/24 rule (where they deny applications from those who have opened 5 or more accounts in the past 24 months). Some have reported success, but not all.

[…] Chase Special Consideration [Now for business cards only] […]

Not sure this is worth it. Banker said they would pull your credit again for this.

I think he/she was wrong. They didn’t pull my credit when I did this. Of course, things could have changed since then.

[…] all of the above fails, ask your Chase banker to submit a Special Consideration Form on your behalf. You do need to have $10K or more on deposit to do so. If you initially applied […]

[…] calls are unsuccessful in reversing the decision, then its time to ask your banker to file a Special Consideration Form. They can do this only if you have at least $10,000 on deposit with Chase. Since you applied […]

[…] despite not being pre-approved, with EIN+SSN -Completed special consideration form documented here: http://frequentmiler.boardingarea.co…consideration/ -Currently awaiting decision, automated line tells me 7-10 days response. -I'm hoping for approval […]

[…] the post “Chase Special Consideration,” I wrote about the special reconsiderations forms that a Chase banker can fill out on your […]

[…] the banker to fill out a special consideration form? The form's existence is documented here: http://frequentmiler.boardingarea.co…consideration/ Unfortunately, all comments on that blog post state that the $10k special consideration form did […]

I have opened CHASE business platinum account with more than $100K deposit. And my banker tried to get My INK PLUS application approved, but after couple of reconsideration request, 5/24 rule wins and my application denied. I have more than 5/24.

It doesn’t help with 5/24 rule. I am a private client, that is, having more than $200k with chase. My private client banker tried his best to help, but no luck.

Hey I really appreciate the blog, you provide abundance of things

Thanks very much for your efforts

[…] Miler discusses another option for getting a Chase Credit Card, in the new 5/24 world. Of course, it breaks one of my cardinal rules in this game, of not mixing […]

Wondering if being a Chase employee helps the cause. Do their employees also fall under the 5/24 limit?

I don’t know, but I assume Chase employees face the same rules when they apply. Are you a Chase employee?

It doesn’t help with 5/24…tried this exact thing with my personal banker for Chase Sapphire Preferred and it failed. Was worth a shot I guess, and outcome may (highly doubt it) be different if you have a substantial relationship, but at that point you’d probably just go Private Client.

Thanks for the data point. It might also have to do with how good of a job your banker does at filling in the “other information” section.

Where do you find the forms? Are they just at the bank or can you download them online and take them into the bank? Thanks for the info!

Chase bankers have access to the forms. They’re not available directly to consumers.

I’m in this process right now, so far no approval, will update if it works.

No success in overturning 5/24 – “too many credit cards opened in the last two years”

I’m surprised. It worked quickly for me. Which card did you try to get approved this way? I’m curious whether business and personal cards are different in how well this technique works (I did business: Chase Ink Plus)

Personal – CSP

This reddit post from today (it was pulled – misplaced/misflared), had a few more failure data points:

https://www.reddit.com/r/churning/comments/4ssbys/do_banks_use_account_balance_to_determine_if_you/

The post text originally talked about the special consideration form and the 10K deposit requirement.

Your immunity to 5/24 is amazing, just wish I could duplicate at reasonable cost.