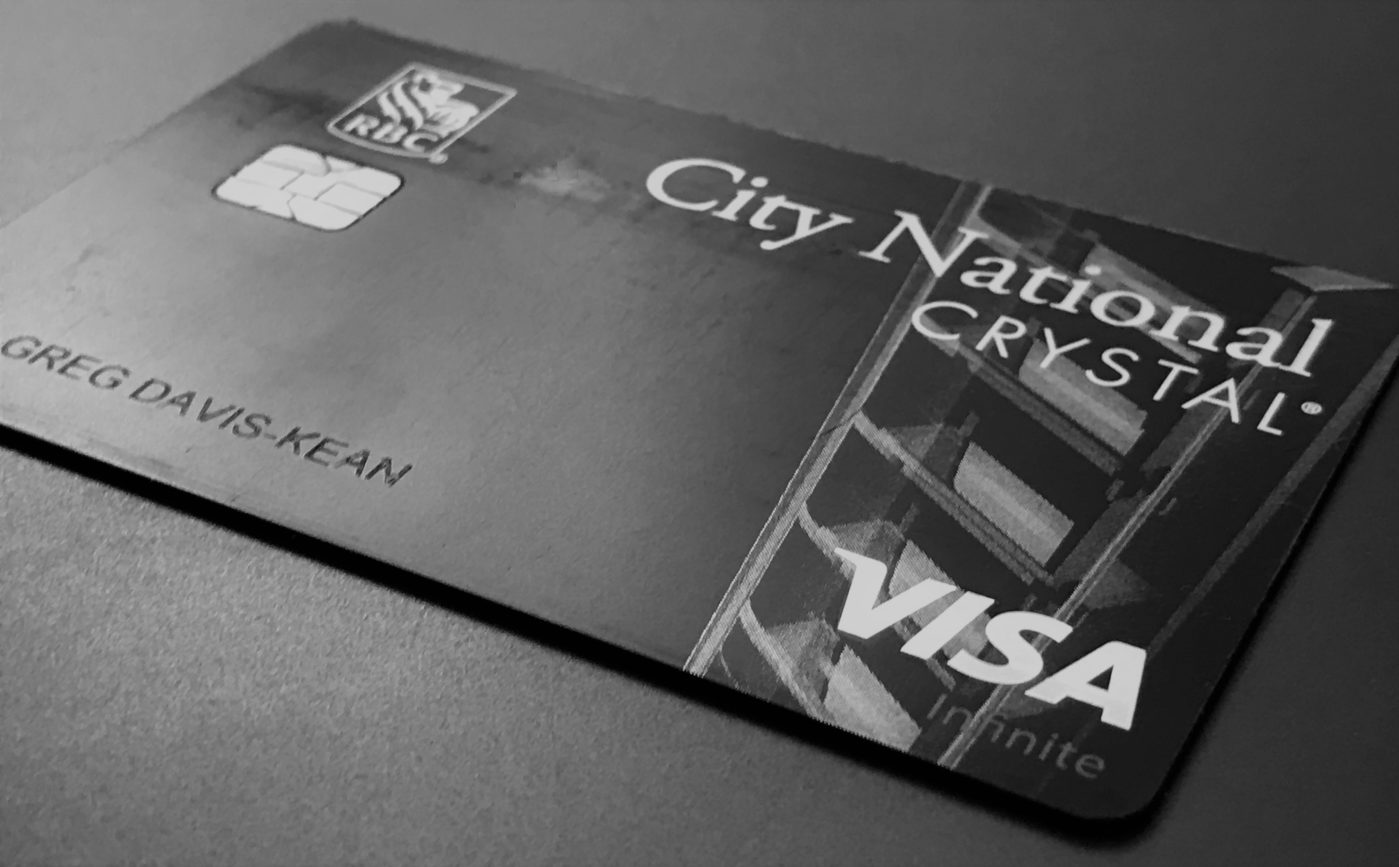

City National Bank has brought back a sign-up bonus offer on their Crystal Visa Infinite card.

The Offer

Earn 50,000 bonus points after spending $5,000 or more during the first 90 days after the opening of your account. Expires September 30, 2016.

Card Benefits

This card comes with a number of benefits including:

- Priority Pass select lounge access for primary and one authorized user. Membership includes unlimited guests.

- $250 airline incidental credit for each card (including authorized users) each calendar year.

- 12 GoGo passes every year.

- $100 companion fair discount.

- Visa Infinite benefits.

- $100 Global Entry fee credit.

- $400 annual fee (waived the first year).

You can find a flyer for the offer along with the terms here.

Need to Know

- This offer most likely needs to be opened in-branch.

- Branches are located in NY, DE, GA, TN, NV & CA. (Search for locations here.)

- You may be asked to provide financial information such as W2s, 1099s and/or bank statements.

- This offer may only be available to RBC Wealth Management clients.

For more info on this card, the points and applying see:

- Crystal Visa Infinite: The best card you can’t get

- How much are those 100,000 Crystal Visa Infinite points worth?

Never miss a Quick Deal, Subscribe here.

HT: Doctor of Credit

[…] CNB Crystal Visa Infinite 50K Offer + Great Lounge Access, No 1st Year Fee & $250 Air Credit […]

[…] CNB Crystal Visa Infinite 50K Offer + Great Lounge Access, No 1st Year Fee & $250 Air Credit […]

[…] recommend going for the City National Bank Crystal Visa Infinite instead of the Ritz-Carlton. The CNB Crystal Visa Infinite just saw the return of a 50,000 signup bonus, and unlike the Ritz-Carlton card, its $400 annual fee is completely waived for the first year. […]

[…] Visa Infinite card available in the US (to my knowledge) was the CNB Crystal Visa Infinite card (which currently has a 50K signup offer). Unfortunately, that excellent card is extremely hard to […]

Shawn, please remove this blog post. You have copied content from a private source and not a public source.

What private content has been shared exactly? Everything looks pretty much like public marketing info to me.

On a related note, if some kind reader were able to get their hands on…say…more than one of those applications from the NYC or CA branches, perhaps there would be some very grateful readers who would be thrilled to have the opportunity to fill them out and mail them in?

Not sure if that’s “how it works” but it looks like the most realistic route for me at this point unless I happen to be in California (unlikely any time soon) or NYC (highly unlikely).

Hi – I live right next to one of their branches in CA. I used to live near DE and passed this bank but never thought any good of it based on their website or their offers then. They primarily cater to the Hollywood types .. so any entertainment or TV creds is the way in. I can get those applications and put them in a link. Let me ask them about the process.

Thank you so much!

I’m looking forward to hearing what you find.

For what it’s worth, I’ve (unsuccessfully) tried to get this card…more accurately to get an app – for over a year. Most recently in Nashville on business I stopped in and the branch Manager was familiar with the card but firmly stated the only places you can apply are the “full-service” locations in New York or California.

All other locations (including Nashville) are basically branches for Business Loans. I can confirm that his branch looks nothing like a traditional bank (No tellers, counters, etc just desks and clearly no efforts have been made to welcome the public).

Unless someone else can share a different experience with non-NY/CA branches I would recommend saving yourself the time, hassle, and expense of trying to reach the other branches in Nashville, Atlanta, etc.

What kind of points are these and what do they transfer to? Doesn’t say anywhere. Also, where are branches in Georgia?

You can find out more about the points by clicking through the article above which discusses how much they are worth.

I have also added a link to their branch locator to the post.