| Card Details and Application Link |

|---|

Delta SkyMiles® Platinum Business American Express Card 65k miles ⓘ Affiliate 65k after $6k spend in first 6 months. Terms and limitations apply. (Rates & Fees)$350 Annual Fee Click Here to Apply This is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 1.5X on transit, eligible U.S. shipping, and purchases of $5K or more (up to $100K per year) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers (ticket must be purchases on or after 2/1/24 to receive this benefit) ✦ Terms and Limitations Apply. (Rates & Fees) |

Here’s everything you need to know about the Delta SkyMiles Platinum Business American Express Card…

Overview

Application Tips

Current offer

Here is the current offer for the Delta Platinum business card:

| Card Details and Application Link |

|---|

Delta SkyMiles® Platinum Business American Express Card 65k miles ⓘ Affiliate 65k after $6k spend in first 6 months. Terms and limitations apply. (Rates & Fees)$350 Annual Fee Click Here to Apply This is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 1.5X on transit, eligible U.S. shipping, and purchases of $5K or more (up to $100K per year) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers (ticket must be purchases on or after 2/1/24 to receive this benefit) ✦ Terms and Limitations Apply. (Rates & Fees) |

And here’s the current offer for the similar Delta Platinum consumer card:

| Card Offer |

|---|

50K miles ⓘ Affiliate 50K miles after $3K spend in 6 months. Terms apply. (Rates & Fees)$350 Annual Fee |

Should you apply?

Many cards are worth getting for the welcome bonus alone. In this case though, if that’s your only interest, you may prefer to sign up for the Delta Gold card since it has a lower annual fee:

| Card Offer |

|---|

55k miles ⓘ Affiliate 55k after $4k spend in first 6 months. Terms and limitations apply. (Rates & Fees)$0 introductory annual fee for the first year, then $150 |

If you’re a regular Delta flyer and you value the Delta Platinum card’s annual companion ticket or the card’s $2,500 MQD Headstart (towards elite status) then the Platinum card probably makes sense for you. On the other hand, you might do even better with an ultra-premium Delta Reserve card.

| Card Offer |

|---|

75K miles ⓘ Affiliate 75k after $10K spend in first 6 months. Terms apply. (Rates & Fees)$650 Annual Fee |

Are you eligible?

In most cases with Amex, if you’ve had the same card before, you can’t get a welcome bonus when signing up. Consider, though, that each variation of Delta card is considered a different product. Over time, it’s possible for you to earn the welcome bonus on all of the following cards since each one is a separate product:

| Card Offer Mini |

|---|

Here are additional Amex application tips:

Amex Application Tips

Check application status here. |

How to meet minimum spend requirements

Eligible purchases to meet the Threshold Amount do NOT include fees or interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of other cash equivalents.That said, many techniques for meeting minimum spend are perfectly fine. Here are some techniques that are safe for meeting Amex minimum spend requirements (click each link for more information):

Perks

Travel Perks

- Economy class companion certificate (subject to taxes & fees) each year upon card renewal. This is valid for round-trip flights originating within the United States, Puerto Rico or the U.S. Virgin Islands (USVI) and flying to the following destinations: the United States, Puerto Rico, USVI, Mexico, Antigua, Aruba, Bermuda, Bonaire, Grand Cayman, Cuba, Jamaica, Bahamas, Turks and Caicos, Dominican Republic, Saint Kitts, St. Maarten, St. Lucia, Costa Rica, Belize, Guatemala, Panama, Honduras, and El Salvador.

- First checked bag free: First checked bag free for the primary cardholder plus up to 8 additional passengers traveling on the same reservation

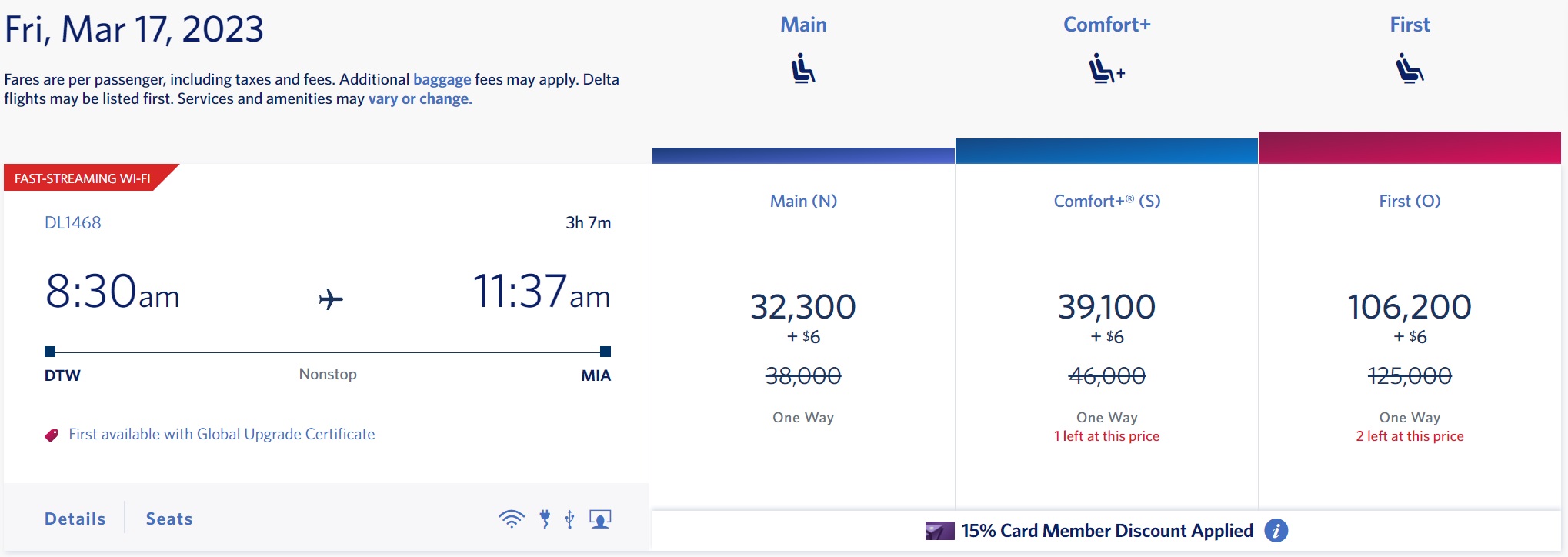

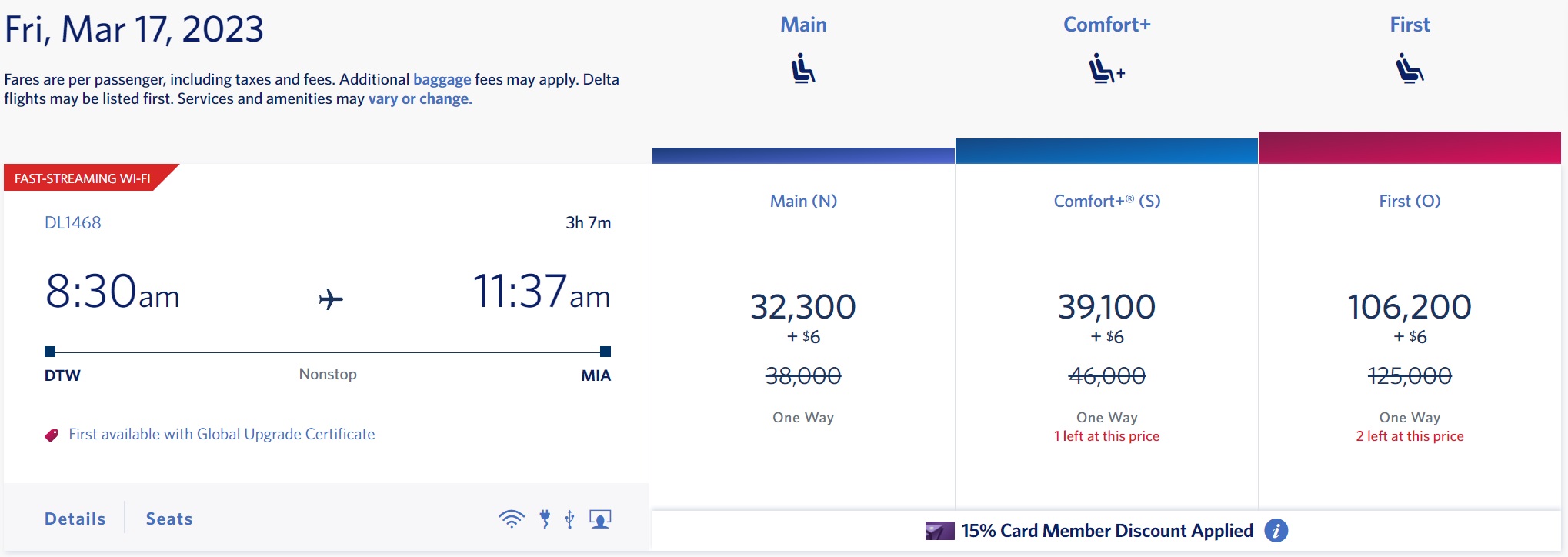

- 15% off award bookings: Cardholders get 15% off the mileage price of an award ticket when the entire itinerary is on Delta or Delta Connection.

- $120 Rideshare Credit: Enroll and earn up to $10 in statement credits each month after using your Card on U.S. rideshare purchases with Uber, Lyft, Curb, Revel, or Alto.

- $200 Hotel Rebate: Get up to $200 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays

- $120 Dining Rebate: Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants

- Global Entry or TSA Application fee credit: One statement credit every 4 years for the $100 Global Entry application fee or one statement credit every 4.5 years for the $85 TSA Precheck application fee

- Hertz Five Star Status: Register at delta.com/mypromos/eligible, and "Enroll in Promotion" at delta.com/hertz

- Priority boarding

- 20% Back on In-Flight Purchases

Elite Status Shortcuts

- Complimentary Upgrade List: Card Members without Delta Medallion elite status will be added to the Complimentary Upgrade list, after Delta SkyMiles Medallion Members and Reserve Card Members.

- $2,500 MQD Headstart: Cardmembers automatically get $2,500 MQDs (Medallion Qualifying Dollars) towards elite status each year.

- Earn MQDs with spend: Earn 1 MQD (Medallion Qualifying Dollar) for every $20 spent on the card. Note that this is very poor compared to the Delta Reserve card which earns 1 MQD per $10.

Travel Protections

- Trip Delay Insurance: Coverage kicks in after a 12 hour delay. Details here.

- Baggage Insurance: Up to $500 per person for checked luggage, and up to $1,250 per person for carry-ons. Must pay transportation in full with your card to be covered. Details here.

- Car Rental Loss and Damage Insurance: Secondary car rental insurance. Must pay for rental in-full with card. Details here.

Purchase Protections

- Extended warranty: Up to 1 extra year.

- Purchase protection: Covers damage, loss, or theft up to 90 days after purchase. Details here.

- Cell Phone Protection

- Coverage includes phones that are stolen or damaged.

- Cracked screens are covered.

- Max $800 per claim or $1,600 per 12 month period.

- A $50 deductible applies to each claim.

- “You must charge your monthly Eligible Cellular Wireless Telephone bill to your Eligible Card Account.” (interestingly, the terms do not say that you must pay in full each month, but maybe that’s implied?)

- Policy details can be found here.

Earn Miles

There are few ways to earn Delta SkyMiles with this card:

Welcome Bonus

Obviously, if eligible, you can earn miles by successfully signing up for this card and meeting the minimum spend requirements:

| Card Details and Application Link |

|---|

Delta SkyMiles® Platinum Business American Express Card 65k miles ⓘ Affiliate 65k after $6k spend in first 6 months. Terms and limitations apply. (Rates & Fees)$350 Annual Fee Click Here to Apply This is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 1.5X on transit, eligible U.S. shipping, and purchases of $5K or more (up to $100K per year) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers (ticket must be purchases on or after 2/1/24 to receive this benefit) ✦ Terms and Limitations Apply. (Rates & Fees) |

And here’s the current offer for the similar Delta Platinum consumer card:

| Card Offer |

|---|

50K miles ⓘ Affiliate 50K miles after $3K spend in 6 months. Terms apply. (Rates & Fees)$350 Annual Fee |

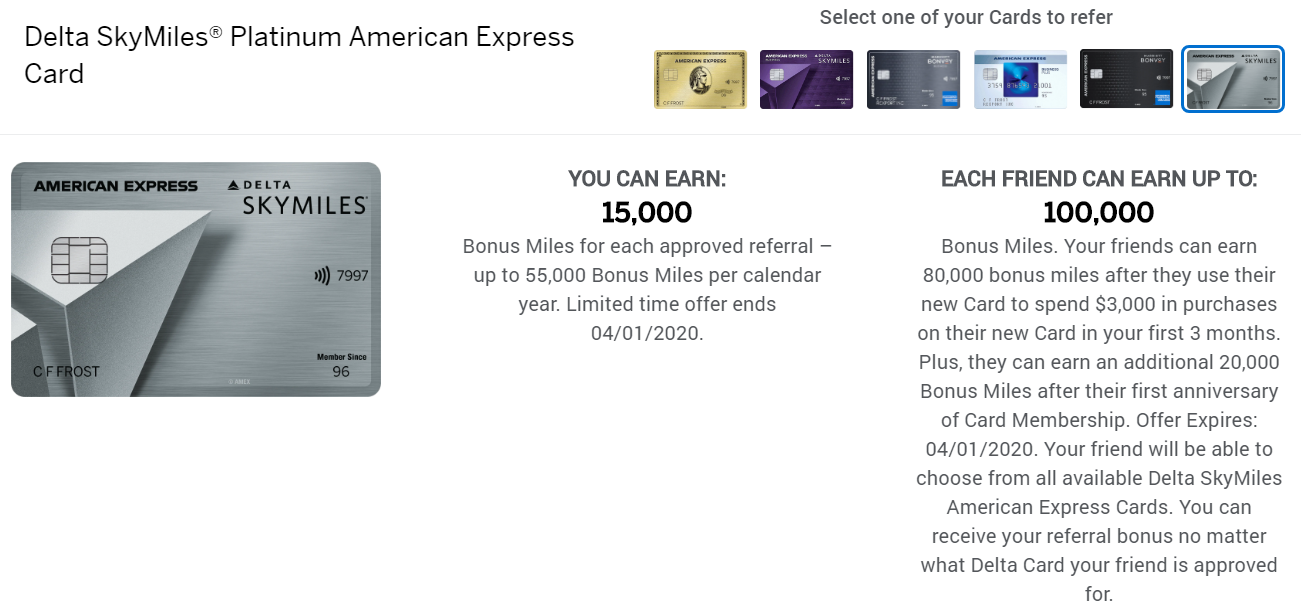

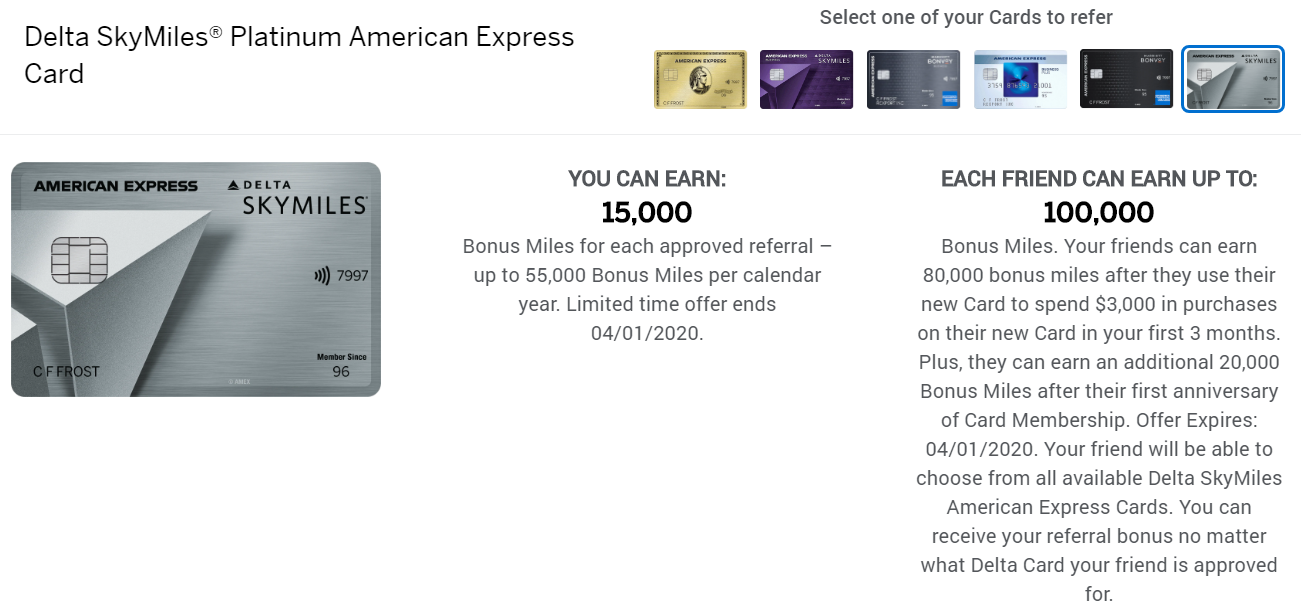

Refer Friends

The refer-a-friend offer shown above for the Delta Platinum card was in effect when this post was first written. Offers can and do change over time. Consider this only an example of the type of offer you may find.

By logging into your American Express account, you should be able to find an offer to earn miles when referring friends. It's often the case, but not always, that your friends can get bigger bonuses through your referral link than through a public offer.

Note that your friends can use your referral link to apply for any Delta card. They are not limited to the one that you have. For example, a friend can use your Delta Gold or Delta Platinum friend-link to apply for the Delta Reserve card. Similarly, a Delta Reserve referral link can be used to apply for the Delta Gold or Delta Platinum card. Regardless of which Delta card they apply for, you will earn a referral bonus if they are approved.

Bonus Spend

Delta Platinum cards have different bonus categories depending upon whether you have the consumer or business version. Here are the details:

Consumer Delta Platinum

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 2X restaurants ✦ 2X US Supermarkets |

Business Delta Platinum

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 1.5X on transit, eligible U.S. shipping, and purchases of $5K or more (up to $100K per year) |

Redeem Miles

You don’t need a Delta credit card to redeem Delta miles for award flights, but there are a couple of features that require having a Delta credit card: 15% discount and Pay with miles…

TakeOff 15 (15% Discount on Award Flights)

We did some research to see whether Delta simply increased award prices for those without credit cards, but found instead that this is a true discount. Award prices relative to cash prices were pretty consistent before and after this feature was introduced and so we concluded that the 15% discount is real. See: No catch -- Delta’s 15% discount is real.

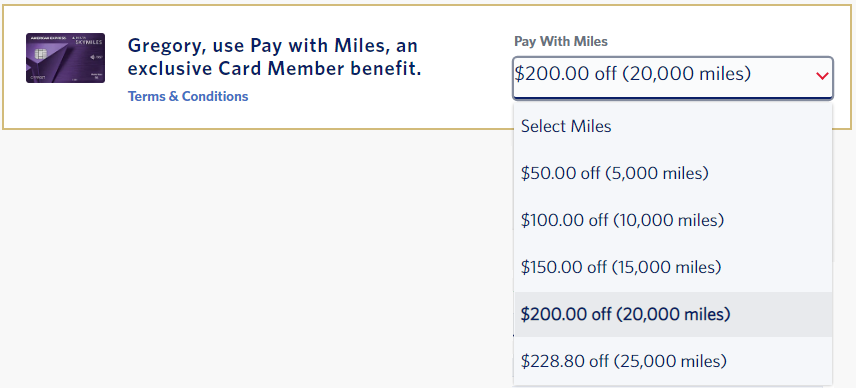

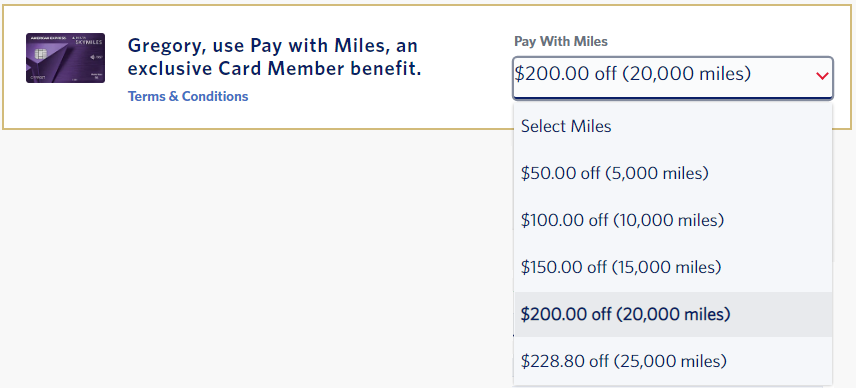

Pay with Miles

Delta's "Pay with Miles" feature is limited to primary cardholders of any Delta card (Blue, Gold, Platinum, or Reserve). This feature lets you pay for cash tickets in part or in full with Delta SkyMiles at a value of 1 cent per mile. You must pay in increments of 5,000 miles. Every 5,000 miles you apply decreases the ticket cost by $50. In other words, each mile is worth exactly 1 penny with this feature.

No miles earned: Only the portion paid in cash earns redeemable SkyMiles and MQDs (Medallion Qualifying Dollars). This reduces the value of the Pay with Miles feature.

Tip: Unless the full ticket amount is an exact multiple of $50, I recommend stopping short of paying the whole fare with miles since you'll get lower value from the last 5,000 miles. For example, if you want to use this feature and your ticket costs $228, I recommend paying 20,000 miles to decrease the cash cost to $28. Otherwise you would have to pay another 5,000 miles for that last $28 (which is a poor value).

Keep, cancel, or product change?

If you regularly make good use of the card’s annual companion certificate, then the card basically pays for itself with that feature alone. And for those who seek Delta elite status, the card’s $2,500 MQD Headstart is great. If neither of these apply to you, then you’re probably better off cancelling or downgrading to the lower fee Gold card.

One way to decide is to use our spreadsheet to compare similar cards. See: Which Ultra Premium Cards are Keepers?

Related Cards

Here’s a full list of Delta branded cards available in the United States:

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate $350 Annual Fee Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 1.5X on transit, eligible U.S. shipping, and purchases of $5K or more (up to $100K per year) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers (ticket must be purchases on or after 2/1/24 to receive this benefit) ✦ Terms and Limitations Apply. (Rates & Fees) |

FM Mini Review: Good choice for frequent Delta flyers who can make use of annual companion certificate $350 Annual Fee Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 2X restaurants ✦ 2X US Supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $20 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy companion certificate (subject to taxes & fees) each year upon card renewal ✦ Earn up to $150 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Up to $10 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Priority boarding ✦ First checked bag free on Delta flights ✦ Complimentary Upgrade list: get added to the complimentary upgrade list after Delta elite members and Reserve cardmembers (ticket must be purchases on or after 2/1/24 to receive this benefit) ✦ Cell phone protection ✦ Terms and Limitations Apply. (Rates & Fees) |

FM Mini Review: Excellent choice for frequent Delta flyers who can make use of SkyClub access and companion certificate. Also a good choice for big spenders seeking Delta elite status. $650 Annual Fee Earning rate: 3X Delta ✦ 1.5X on eligible transit, U.S. shipping & office supply store purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $10 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Domestic, Caribbean, or Central American economy or first class companion certificate (subject to taxes & fees) after card renewal ✦ SkyClub access (starting 2/1/25, 15 visits per year (after 15 visits have been used, additional visits can be purchased for $50 each) or earn unlimited visits after spending $75K/calendar year on the card ✦ 4 Delta SkyClub one-time guest passes ✦ Centurion Lounge access when you book your Delta flight with your Reserve card ✦ Earn up to $250 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Complimentary upgrades ✦ $100 Global Entry fee credit every 4 years (or 4.5 years for TSA Precheck) ✦ Priority boarding ✦ First checked bag free on Delta flights. ✦ Hertz President's Circle Status ✦ Terms and limitations apply. (Rates & Fees) See also: Delta Reserve complete guide |

FM Mini Review: Excellent choice for frequent Delta flyers who can make use of SkyClub access and companion certificate. Also a good choice for big spenders seeking Delta elite status. $650 Annual Fee Earning rate: 3X Delta Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 Medallion Qualifying Dollar (MQD) per $10 spent Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Annual $2,500 MQD Headstart ✦ Domestic, Caribbean, or Central American economy or first class companion certificate (subject to taxes & fees) after card renewal ✦ SkyClub access (starting 2/1/25, 15 visits per year (after 15 visits have been used, additional visits can be purchased for $50 each) or to earn an unlimited number of visits each year starting on 2/1/25, spend $75K or more on eligible purchases between 1/1/24 and 12/31/24, and each calendar year thereafter. ✦ 4 Delta SkyClub one-time guest passes ✦ Centurion Lounge access when flying Delta ✦ Earn up to $200 as a statement credit each year after booking prepaid hotels or vacation rentals with your Card through Delta Stays on delta.com/stays ✦ Up to $20 per month in statement credits on eligible purchases with U.S. Resy restaurants [enrollment required] ✦ Up to $10 per month in statement credits for purchases with select rideshare service providers [enrollment required] ✦ Complimentary upgrades ✦ One statement credit every 4 years for the $100 Global Entry application fee or one statement credit every 4.5 years for the $85 TSA Precheck application fee ✦ Priority boarding ✦ First checked bag free on Delta flights. ✦ Hertz President's Circle Status ✦ Terms and limitations apply. (Rates & Fees) See also: Delta Reserve complete guide |

FM Mini Review: Priority boarding and first checked bag free make this a reasonably good option for Delta flyers who do not have elite status. However, those who can make use of an annual companion certificate would do better with the Delta Platinum card. $0 introductory annual fee for the first year, then $150 Earning rate: 2X Delta ✦ 2X U.S. purchases for advertising in select media and U.S. shipping purchases (capped at $50k per year starting 1/1/24) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $200 Delta flight credit after $10K in purchases in a calendar year Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Get up to $150 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays ✦ Priority boarding, and first checked bag free on Delta flights. Terms and limitations apply. (Rates & Fees) |

FM Mini Review: Priority boarding, and free checked bag make this a reasonably good option for Delta flyers who do not have elite status. However, those who can make use of an annual companion certificate would do better with the Delta Platinum card. $0 introductory annual fee for the first year, then $150 Earning rate: 2X Delta ✦ 2x restaurants worldwide ✦ 2x US supermarkets Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $200 Delta flight credit after $10K in purchases in a calendar year Noteworthy perks: 15% off when using miles to book an award flight (Delta metal only) ✦ Get up to $100 back per year as a statement credit for prepaid hotels or vacation rentals booked through Delta Stays on delta.com/stays ✦ Priority boarding and first checked bag free on Delta flights. Terms and limitations apply. (Rates & Fees) |

FM Mini Review: This card offers an OK welcome offer for a no-fee card, but many/most other cards offer better return for spend. No Annual Fee Earning rate: 2X restaurants worldwide ✦ 2X Delta ✦ 1X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: 20% statement credit on in-flight purchases of food, beverages, and headsets Terms and limitations apply. (Rates & Fees) |

Given the recent changes if you have the GOLD business can you still apply for the PLATINUM business and get the bonus?

Yes. At least at this time, the “family” rules for signing up for Delta cards are limited to consumer cards. https://frequentmiler.com/amex-adding-once-in-a-lifetime-family-language-to-delta-consumer-cards/

Thanks Greg!

Is the 100 statement credit no longer after a delta purchase?

Correct. No Delta purchase needed.

[…] Platinum and Delta Platinum Business. For each $25K of calendar year spend (up to $50K), earn 12,500 MQMs in 2021 (usual: 10K […]

[…] have the Delta Platinum Business card which offers 1.5 miles per dollar for purchases of $5,000 or more (up to 50K extra miles per […]

Greg, Nick is there a way you guys can mention there are better offers using referral links?

Until the end of October, there’re some better offers using referral links from others. This one offers 80K miles I believe.

I know you guys always mention better offers than publicly available, but I just noticed that you can improve this part of your awesome and useful website.

Thanks for all that you do guys!

When the referral offers are better than other public offers we simply display the referral offer instead. Right now the referral offer for the Delta Business Platinum is the same as the offer shown here. If you can tell us where to find a better referral offer, we’d be thrilled to list it.

If you just go to https://www.deltaamexcard.com/ you can check with your SkyMiles # and Lastname better offers for you without helping any other user. I see 60k for Gold +50 Credit, for instance, I also see 75k for Plat, etc..

There’s a Reddit sub for referrals, where you can see better offers and it says you are helping some other user. I think they also have a website now, rankt.com. But I’m not so sure it works as it’s intended. But at least you can see if there are better offers using referrals.

I love what you guys are doing, helping decide what CC application makes more sense next. And after reading you and some other blogs for almost 2 years (I know, I’m late to the party 🙁 ) I figured it out this website is the best one for unbiased information.

My other place to check SUB is uscreditcardguide, they are not as sophisticated analyzing the 1st year value of each CC, but at least you can see if there are better SUB using referrals.

I hope it helps.

Hi – this card has 10k MQMs for a total of 20k and not 30k MQM as listed above? Correct?

Yikes! Yes, you are correct. We’ll fix this ASAP

Fixed