Over the weekend, my wife and I found ourselves in a situation where we could generate a lot of spend at very low cost. That particular opportunity isn’t the subject of this post. Unfortunately, we didn’t have access to our entire portfolio of cards, so we looked for bandwidth where we could find it. We happened to have a Hilton Aspire card on us. Would it make sense to spend on that card to generate points at a cost near 0 with a high value use in mind? That led me to think a bit more about all of the Hilton cards through the lens of everyday spending versus earning cash back.

Having a high value use

Upon first assessment, the easy answer on the Aspire card in particular would seem to be “no way”. Hilton points are generally only worth about half a cent each, so earning 3 Hilton points is only worth a return of about 1.5 cents total — equivalent to earning about 1.5% back for every dollar spent. That’s a poor return for a rewards credit card. We’d be better off using a card that earns 2% cash back like the Citi Double Cash (which earns 1% when you purchase and 1% when you pay the bill) or Fidelity Rewards Visa, which earns 2% back. The go-to cash back card in my family is even better: the Alliant Cashback Visa earns 3% back the first year and 2.5% back in subsequent years (with a $59 ongoing annual fee). Earning 3 Hilton points looks like a bad deal by comparison.

But what if you have a great redemption value in mind?

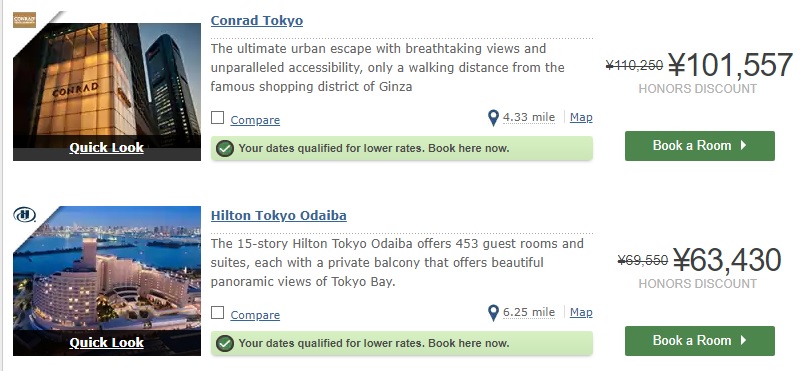

This spring, we have a trip booked to Japan. Tokyo is an expensive city. For example, here are a couple of Hilton properties that are available during our dates:

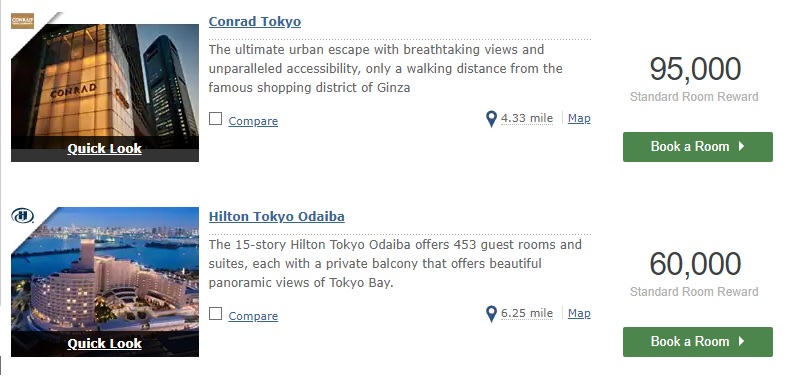

At the time of writing, the Conrad’s rate converts to $934.26 per night. The Hilton Tokyo Odaiba works out to $583.51 per night. Those rates are before tax (the Conrad comes to about $1162 per night with tax and the Hilton Tokyo Odaiba rings it at $717 per night with taxes/fees). Compared to cash rates like that, the award points prices look pretty good:

Let’s for a moment ignore the fact that I’d never consider paying the cash rates at these properties and figure the “value per point” (put in parenthesis because I recognize this is inflated — that’s on purpose as you’ll see):

- Conrad Tokyo: $1,162 / 95,000 points per night = 1.22 cents per point

- Hilton Tokyo Odaiba: $717 / 60,000 points per night = 1.20 cents per point

Those values are well above our Reasonable Redemption Value for Hilton points (0.45 cents per point). Furthermore, they make the return on everyday spend on the Aspire card seem pretty darn good if those redemptions are my goal. After all, the Aspire card earns 3 points per dollar on everyday purchases — that looks like an effective ~3.6% back if I’m using the points for one of the above hotels….right?

Spending $10K on my Aspire card (just as an example) would get me 30K Hilton points — that’s half the points I’d need for a free night at the Hilton Tokyo Odaiba. Half of the $717 nightly total rate is $358.50. Again, that’s a return of nearly 3.6% on $10K spend.

But this is where you can fool yourself with “the game”. I need some Hilton points and I do have this strong redemption in mind. So for a split second, I considered spending on the Hilton card, figuring that I’m going to use the points at better than a cent each in value. But….

You’re better off using a cash back card and buying the points

Hilton frequently puts points on sale. The most recent sale ended 12/31/18, but they offered the same deal repeatedly last year: buy points “with a 100% bonus” — i.e. buy points for 0.5 cents per point.

We’re beyond Year 1 on our Alliant Cashback Visa, so we’re now only earning 2.5% cash back on the card (we’ve decided to keep it and spend enough on it to make it worth the fee). If we can often buy Hilton points at a rare of 0.5 cents each, that means our 2.5% cash back on the Alliant card is worth 5 Hilton points per dollar spent.

Put another way, if we spent $10,000 on the Alliant Cashback Visa at a return of 2.5% cash back, we’d get $250 back. If we then used that $250 to buy Hilton points when they are on sale for half a cent each, we could buy 50,000 Hilton points. Again, if we spent that much on everyday purchases with the Aspire card, we’d only earn 30,000 Hilton points. Suddenly, we’d have earned 83.3% of the points required for a free night — or “$597.50” in Hilton value if we want to fool ourselves by continuing to compare to the Hilton cash rates.

To clarify the math on that, I’m saying that I could:

- Spend $10K on the Alliant Cashback Visa, get $250 back (2.5%)

- Use my $250 to buy 50K Hilton points when they go on sale for half a cent each.

I can then use those 50K Hilton points toward a free night at the Hilton Tokyo Odaiba. Together with another 10K Hilton points, they’ll buy me “$717 in value” (the cash cost of the hotel room). The 50K points from my cash back therefore represents about $597.50 in value towards that room rate.

To be clear, I’m not saying that I’d be getting that much value. Again, I wouldn’t consider paying that cash rate. But my point is that in comparison to spending on the Hilton Aspire card, I’d get a lot more value out of spending on a cash back card and then using the cash to purchase the points. And that’s not the only alternative — Membership Rewards sometimes offers a transfer bonus to Hilton, which also offers opportunities to earn more Hilton points per dollar spent. It really wouldn’t make sense to use one of the Hilton credit cards for everyday spending.

Are there exceptions?

As is the case with any good rule, there have to be exceptions. When does it actually make sense to use the Hilton cards? Here are a few times that immediately come to mind when it makes sense to use your Hilton card:

- You are spending your resort or airline incidentals credits on the Aspire card. This should be clear. You obviously want to spend on those things which are reimbursed by the card.

- You are spending at a Hilton property. The Hilton credit cards earn a return that rivals most other cards within brand. Some will prefer to use the CSR or Prestige cards for 3x / 5x respectively, but I’d like the 12-14x on the Hilton Ascend or Aspire card within-brand. The no-fee Hilton Honors card only earns 7x at Hilton properties, which is much less compelling.

- You have received a targeted spending offer. Amex ran some great targeted spending offers last year. One that we received was to spend $200 at US supermarkets and receive 10,000 bonus Hilton points (since expired). A bonus like that makes sense.

- You are spending towards the annual free weekend night on the Ascend card. Read on for more on this.

In that final situation, you need to spend $15,000 to earn the free night (the Ascend card offers a free weekend night when you spend $15K in your cardmember year). To compare to the alternative, the Alliant Cashback card, you’d earn $375 cash back on $15K spend if you went the cash back route. That’s enough to buy 75,000 Hilton points when they go on sale.

Putting that $15K spend instead on the Hilton Ascend card will yield you a free night at almost any Hilton property in the world. You can get up to 95K value out of that. Additionally, you’ll have the points earned from spend — at least 45,000 points. The combination of a free night certificate + at least 45K points beats the cash back option if you have a halfway decent redemption in mind for the certificate. If you were able to do all $15K spend at US supermarkets with the Hilton Ascend, you’d) have your free weekend night certificate + 90K points (since the Ascend earns 6 points per dollar at US supermarkets. That just widens the gap over cash back.

Bottom line

I suspect many readers would assume that everyday purchases on the Hilton cards are a bad deal because of the low value of Hilton points. On the other hand, with a high-value redemption in mind, it might seem like spending at 3x for everyday purchases isn’t a bad deal. However, Hilton’s perpetual point sales make the value proposition of spending on their credit cards weak: Since Hilton often sells points for half a cent each, you’ll earn more Hilton points by focusing on a cash back card and then buying the points when you need them. You’ll further gain the flexibility of cash that you could use on anything else that is more important/valuable to you rather than being locked in to Hilton points. That’s a better deal.

[…] Hilton points is a bad deal. It isn’t necessarily — I’ve previously argued that a cash back card is ideal for hotels precisely because you can so frequently buy these points so […]

[…] Hilton Honors points. That works out to a price of .5 cents each. In yesterday’s post (See: Does it ever make sense to spend on a Hilton card?), I noted that it doesn’t make much sense to use Hilton credit cards on unbonused spend since […]

[…] Hilton points with your cash than you are using a Hilton credit card on everyday purchases (See: Does it ever make sense to spend on a Hilton card?). In that post, I used the Conrad Tokyo as an example of a valuable Hilton redemption. The Conrad […]

Right on cue.

Buy 10,000+ Hilton Honors Points, Get a 100% Bonus-DoC. It runs until 2/26/19.

As someone who has an Aspire card and has traveled a few times to Japan, I’m gonna offer a radical / heretical option: Don’t pay a ton (in money or points) to stay in a Hilton in Japan.

If you’re in a big city like Tokyo, there are actually MANY really nice options for <$200/night. For instance, I recently I stayed at the Remm Roppongi hotel (very nice hotel, awesome area) for about $180/night total (in peak season).

If you're staying outside of a big city, for goodness sake, consider staying in a ryokan or doing a home stay or whatnot to enjoy the local culture. In Takayama, for instance, I stayed in a beautiful ryokan that included a jaw-dropping kaiseki dinner and amazing breakfast… in the $85/night rate (!).

I know, I know… with Hilton Diamond access, it's tempting to stay in a Hilton as much as possible. But sometimes it just doesn't make sense… and considering Hilton-alternatives for a particular trip can be a lot better / more enjoyable use of your money.

Good post I didn’t know it was that affordable .I missed out on a Cruise Deal that hit 3 cities on the coast as a cheap way to see something.. I met bus. people from there in Kona ,HI they always claim 3x higher then there I guess I need to do my homework. . CHEERs

Adam, do you have any ryokan recommendations in Tokyo and Kyoto? Maybe I am looking at all the wrong places, but everything I saw was sharing rooms with others, not a lot of private room options

I haven’t yet stayed in a ryokan in Tokyo (I assume they’re less common in big cities).

However, my stay at “Kikokuso” in Kyoto 6-8 years ago was really great 🙂

I had my own private room and private toilet + sink (though in my stay the bath is communal, which was fine with me; maybe they offer private baths, too)

Nick, I highly recommend the Hilton Tokyo (Shinjuku). When I went it was 50,000 points/night; we stayed 5 nights, and so the 5th night was free. It came to 200K points/5 nights. Breakfast there is incredible, and the service is some of the best I’ve seen. In addition, Shinjuku is a very central location.

There is another option no one seems to have thought about. Someone who has purchased all the points Hilton will sell may want to generate more. Last year I burned off 500,000 HH points and I could’ve burned a million if I had been able to buy them.

However, for most people, using a card like CSR for bonus categories and a card like Doublecash for unbonused categories is a better option.

What are good redemptions for 500K HH points? I have a stash of them but they rarely seem to make sense for me (e.g. an upcoming stay at Hampton in Park City, they want $150+tax or 45K points, which even at half a cent per point is nuts).

I find if I’m traveling I hard spend any time in the hotel room so it could be the Conrad or the Courtyard. But then I don’t drive a Porsche 🙂

That thought did come to mind. Since Hilton now allows you to pool points with up to 10 people, nine other people could buy the max and transfer them all to you. I imagine some people’s dogs might have an account, though that’s probably against program terms.

@rj The first rule of hotel redemptions is: a lot of people save up points to splurge, so tourist destinations, whether Park City, Miami or Hollywood, are going to give poor redemptions. I stay in the burbs and drive into the city.

@Nick Reyes We know there are people on Boardingarea, including some of the bloggers, who play the multiple accounts game, but I have only one Hilton account. At the speed HH devalues, I wouldn’t squirrel away points.

Hilton killed themselves when they went to fluid redemption cost….the rooms now have a range (set by the individual hotel) of slightly higher than reasonable to laughably outrageous…the only good redemption is to have a particular property in mind and book it at it’s minimum redemption cost. Our play, before the last devaluation and new card offerings, was to earn sign up bonuses and 6x at grocery to manufacture points at roughly 60k points for $125….at that time Hiltons all inclusive resorts were 60k or less per night…with the added value of free food and booze for 2 it was a great redemption. We enjoyed Jamaica and Puerto Vallarta quite a few times and with diamond status we scored some great rooms. The one in PVR had multi level rooms with hot tubs on the private rooftop terraces, top shelf bar, but crappy food …since the devaluation, peak pricing is in effect most all year and can be over 120k per night, not much of a redemption for a low level AI….after staying at Hyatt AI properties, which I consider mid to upper level AI’s we don’t miss Hilton or the hassle of generating points at all..

I still have the Ascend card and it constantly offers $40 off $175, $60 off $200, etc. at various Hilton properties.

I keep it (for now) for that pretty much. A couple trips where there is no Hyatt (my new preference) would pay the annual fee.

I get many of those Hilton offers on my other Amex cards that aren’t Hilton, so I don’t really think your annual fee analysis is the right way to look at it.

Actually, his annual fee analysis is the correct way to look at it for using a Hilton designated card at a Hilton family hotel returns the most points per dollar spent as it has the highest points per $ ratio = 12 points per Dollar for the Ascend and 14 points per Dollar for the Aspire.

I agree with others that using the Ascend for dining/gas/supermarket spend is appropriate when seeking to spend $15,000 in order to obtain the weekend free night certificate, as well as for non-bonus spend when seeking that same goal. 1.2 cents plus the Free Certificate at the endpoint is worthwhile to me to sacrifice an additional .8 cents if I were to use my Fidelity Visa or Citi DoubleCash card.

In no way, however,am I going to put spend on those cards outside of those situations.

In those examples, I would probably fall back to putting non-bonus and dining spend on my Chase Hyatt Visa to earn the second free night from that card that I could earn during a card member year — the first being the annual free night for holding the card being delivered to your inbox on your anniversary date.

Just because you wouldn’t spend $1100 per night on a particular hotel room doesn’t change the fact that a particular room actually costs that much and therefore a certain amount of points will get you that level of value for that room. So if 95000 Hilton points gets you an $1100 room, you really are getting over 1cpp because the only alternative to paying for that room is shelling out $1100.

Take another example from the “real” world. A certain Porsche costs $100k, but the most you’d be willing to pay for any car is $30k, so you say you value the Porsche at $30k. No one actually does this, but bloggers say this sort of thing about hotel rooms and plane tickets all the time.

This is a dangerous approach to take. It encourages cost-per-point generation that is way out of line.

You also have a mistaken notion of substitutions. Maybe the Hilton is $1,100–but hotels are generally pretty fungible. You need to take into account the other lodging options.

Now, maybe it is the case that you HAVE to be somewhere and you WOULD pay the price–this is pretty common for example for airline redemptions to get to funerals/sick relatives. But inflating cpp when there are cheaper alternatives/you would never spend the money is not a good idea.

Hotel rooms and plane tickets do go on sale, and you can generally negotiate the price of a car. You can always buy a cheaper hotel room or a cheaper car also, but the amount of points or cash required generally goes down in kind. If you want a Porsche, or the Porsche of hotel rooms (Conrad Tokyo) you have to pay what they say. And if they take a favorable amount of points instead of cash then you’re getting that value from those points. Walk up to the front desk and tell them you only value hotel rooms at $200 and see if you get a night at the Conrad Tokyo…

You are artificially inflating your returns with that attitude and that will lead to bad economic choices.

I understand your point, but I think the difference here is between what our points can buy and what our points save us. I prefer to value my points closer to what they save me in real cash than what they get me in cash I would never have spent.

You’re absolutely right that the Conrad Tokyo is charging $1,100 a night and somebody will pay that. The free market has decided that that’s the value of the room.

However, if my only two options were to either spend $1,100 per night or not go to Tokyo, I would not go to Tokyo.

Thankfully, Tokyo has many Hotel options, so in reality my choice isn’t A or B.

If I had to pay for my room, I would probably be willing to pay $200 per night. Using points at the Conrad keeps that $200 per night in my pocket. It would be disingenuous to say that it keeps $1,100 per night in my pocket because that money would have been in my pocket and I would have been staying at home if that were my only option. It would never leave my pocket. However, the $200 per night would leave my pocket. Therefore, using points saved me that money.

And that’s why many of us value our points based on the alternative that we might be willing to pay for. That’s the real savings. Sure, you can make the argument that I got an $1,100 per night room. And I guess I did if I used my points in this situation. But it didn’t save me $1,100 per night. It saved me $200 per night.

To many of us, it makes more sense to value our points based on what they save us rather what they get us. And don’t get me wrong, the $1,100 per night room is worth something more to me than the $200 per night room. If it weren’t, I’d be just as likely to pick the $200 room. I’m clearly more likely to choose the Conrad because it will likely be comfortable, have better service, give me lounge access, Etc. But realistically, points are not saving me $1,100. They’re saving me $200 per night + giving me an experience I wouldn’t ordinarily pay for. That’s not a tangible thing that’s easy to value in any sort of objective way. I definitely enjoy it. It’s a big part of the reason why I’m involved in this game. But if I start valuing the experiences at face value that I wouldn’t pay, I’m kidding myself. I never would have spent that, so it didn’t really save me that.

Let’s use a simpler example than your car example. Let’s say I’m standing outside of McDonald’s. I’m about to walk in and buy my wife and I an extra value meals for six bucks each. But somebody on the street outside stops me and says I just won a free lunch at the local Ruth’s Chris Steakhouse. Would I say that I just won $150? That doesn’t seem right. I won something that saved me the $12 I was about to spend. Is a Ruth’s Chris lunch worth $12? Of course not. It’ll obviously be better than McDonald’s and many people obviously spend more money on it. It’ll probably be delicious. But it didn’t really save me $150, it saved me $12 and provided a nice experience. So I can accept deciding the value at somewhere in between, but not at or close to the face value when I wasn’t going to spend that much on lunch anyway.

I could get on board with your perspective of how much you are saving relative to what you would normally spend. For me, nearly all the travel I do with points is travel I wouldn’t do otherwise, so I think comparing point cost to actual cost is valid. As for the restaurant analogy, I think I would say I won about $200 and spend the $12 on big macs another day 🙂

Points are only worth what they Save You . You can compare A to A not to B . I look @ Hotel.com and Prestige and others to see what I can get the Same Room Date ect for..Remember to add in the Fees for the card the fees to get those points and Your time to get those points (MS) .Also add the Free perks ur card gives for Free .But that said I could get a $40 BK for free but in Hawaii I got a better one for $15 across the street .That’s the True Cost of the points No Stay is Free Ever..

A Deal is a Deal only if that’s what you want not what they want to give you a Deal on ..

CHEERs

Your use of psychology in your response here is very interesting.

“the Conrad Tokyo is charging $1,100 a night and somebody will pay that.”

– I assume not just somebody but a lot of people are paying that and even more than the 1,100 as that I believe is a standard room rate.

Why did you need to win and get the Ruth Chris lunch for free? What if you bought that for someone as a special gift. As the gift giver do you value your gift at a McDonald’s lunch? As the receiver of that gift would you write on the thank you note thank you for the free McDonalds lunch? Do you tip the waiter based on the value of the Ruth Chris lunch or based on the value of the McDonalds lunch?

Personal point valuations are useless in a conversation with other people because they are just that personal. If you would only save 200 dollars per night in Tokyo has no relevance to anyone else’s situation. If you inherit a large sum of money and are willing to spend 500 dollars in Tokyo the value of Hilton Points did not change just your perspective changed. I get doing the calculation of how much did I save in real life but you can’t compare the same exact trip with anyone else if you are setting a personal valuation.

I share your mentality, Nick, but not everyone does. It’s why I don’t value biz class award tickets as highly as others do because I would almost never pay the published prices to fly biz class (and neither would most people — the tickets are mostly paid for by their employers). But others think they’re getting 5x value for their miles. To each his own, I guess.

Of course, the latter scenario is probably the best if you can use the Free Weekend night certificate at a high value Hilton family hotel.

The combination of holding the Aspire which gives you Diamond status (and is an effective no fee proposition if you use all the benefits each year available to you) plus $15,000 spend on an accompanying Ascend is the way to go, since you get the Free weekend night and a minimum of 45,000 HHonors points. In addition, depending on the date on which your Aspire annual Free Weekend Night certificate is issued, you may have the earned Free Weekend Night from the Ascend and the Aspire annual Free Weekend night from the Aspire available to you for quite a nice 2 day weekend — as a Diamond member at that particular hotel.

Rinse and repeat at a minimum your significant other also holding the Aspire and you could have quite a nice 3 day weekend at a high value HHonors hotel while receiving Diamond benefits during your stay.

As between the Hyatt card $15,000 spend and the Hilton Ascend $15,000 spend to earn the weekend free night, it comes down to an it depends situation, unsurprisingly.

You can do almost the same maneuver as above with your Hyatt card, and if you time it correctly, you can have 2 Hyatt Free nights to play with if your annual Free Night from holding the Hyatt card is available to use when your Free Night from spend is issues.Thus, you can string together 2 nights at up to a Category 4 Hyatt hotel. Rinse and repeat and you have a minimum of 3 nights if your Significant Other also has the Hyatt card, and potentially 4 nights if they, too, spend 15K on their card.

Against the above is the uncapped Free Weekend Night(s) from Hilton that are uncapped and can be used at most Hilton properties worldwide — further, if you hold the Aspire card, you are a Diamond member while using those free nights, something that the Hyatt card simply cannot match as their credit card portfolio does not permit this — and that’s probably a good thing.

As others point out, the amount of additional points you earn in each program while meeting the respective spend is variable depending on the bonus category you choose.

I value Hilton points at ,004 cents and I (for now) accept the 1.5 cents formula used by FM for Hyatt points (I usually undervalue points myself) so non-bonus spend is roughly 1.2 cents vs. 1.5 cents = pretty even in my book.

Both card now have their own type of offers, though AMEX’s are a bit more extensive thus far in my opinion.

If one does not have a Chase Sapphire Reserve to earn 3x points on dining, then Hyatt’s 2x dining is quite good, and would be 3 cents per dollar spent vs. Hilton’s 2.4 cents (6x multiplier, I believe), so advantage Hyatt (if you have large spend each year and can choose between the 2 in meeting each of their respective spend requirements annually). Of course, the Hyatt Visa card is accepted at more dining establishments in the US and worldwide than the Hilton AMEX.

However, I will point out that the online delivery service that I use — Delivery.com codes online dining delivery purchases as a dining purchase when using an AMEX card, thus qualifying for the dining bonus, but is not listed as a dining establishment when using a Chase Visa card — thus no bonus if such a card is attached to your profile.

I know other delivery services are coded differently, so be on the lookout for these differences!

Health Club membership and local transportation costs (again if you don’t have a Chase Sapphire Reserve) go to the Hyatt card and grocery and gas spending are advantage Amex Ascend.

Therefore, think wisely on which card will be best for you to maximize your point accumulation and eventual certificate use when contemplating where, when and what card to get and what spend to put respectively on it!

Other than targeted bonuses and Hilton stays, the only time it really makes sense to spend on a Hilton card is with Ascend at supermarkets/gas stations/restaurants at 6x points and then earn the free weekend night with $15k spend. Many of us live in places where grocery stores give us free/cheap gas by buying visa/MC gift cards. If you spend $15K, this makes the card essentially a 5x card — and a fun one at that. Many of us buy enough gift cards that it pays for our spouse to also have an Ascend card. It’s fun to have free nights at very expensive hotels that otherwise make no sense to stay at.

My “problem” with the Honors program is that it’s not so easy to spend the points and obtain good value. It seems like an average Hilton is usually about 40,000 points. If you value the points at a half penny each (generous), that means you’re using $200 in points for that night. How many average Hiltons are worth $200? Few, in my mind, so I usually redeem with other chains at better value. In December, there were a couple of very brief opportunities on Amazon to redeem Hilton points at a half penny (you could buy Visa gift cards and such) and that was a terrific deal. But, otherwise, Honors points are a weak currency that is hard to spend for value.

Here’s another scenario. I used the Ascend for groceries and 6x HH points, once I used up my $6k on the Amex EDP. I also put my daughter’s tuition on the card twice (once in August and once in January with no CC fee) which is about $15k each. Using the free nights earned from that for a high end redemption ($800+ per night) gives great value (up to 135k HH points per $15k counting the free night plus the 45k from the spend). I realize I could have met several minimum spends with that, but decided to hold off on using it for new cards for now and this was the best value from my existing cards. Probably will cancel Ascend when next fee hits to open an Amex slot as I just got the CNB Crystal Visa Infinite and will use that when my groceries bonus runs out on EDP this year.

If you’re spending the $15K for the free night certs, it makes sense (free night cert + 45K points).

If you’re just spending the $15K at 3x, it doesn’t. Spending $15K at 3x gives 45K points. Spending $15K instead on a 2% card yields $300, which can (many times per year) buy 60,000 points. If you’re able to use a card that earns 2.5% or 3% back, you can buy even more Hilton points with it.

As noted above, the 6x at the grocery store isn’t as good as it seems. It doesn’t matter what your redemption plan is — a 3% card where you use the cash to buy the points yields the same exact 6x when points are available for half a cent each. Using a card that earns a higher category bonus at the grocery store earns even more than 6 Hilton points. My argument here is that since Hilton sells the points so cheaply, it doesn’t matter how good your redemption is — that redemption is just as good if you earn cash back and instead buy the points.

Sure – I wouldn’t spend the 15k without the free night. Would be better off on a 2% card in that case. Keep up the great work. You guys consistently have more interesting and helpful articles than your fellow bloggers.

Youre forgetting 1- its 6X at supermarkets and at times a person can earn gas pts as well , 2- Spend $40k on the card and youre Diamond for the rest of that year and the next

No sense going to a top hotel only to have a great view of the parking lot or a/c units, at least as a Diamond you most likely wont be stuck in either of those, as well as get lounge access

Now after reaching the $40K in Spend thats another thing altogether, but will still pay at 6X

I’m not forgetting that — I did mention it in the post, though only briefly.

A couple of thoughts on that:

#1) 6x at the grocery store isn’t bad, but if you use a Discover IT Miles card or the Alliant Cashback Visa card, you earn the same (3%, buy points at half a cent each, that’s 6x Hilton points….plus have the flexibility of cash). And that’s not even considering cards with category bonuses at the grocery store. It’s not strong enough to beat the alternatives except when working towards the free night cert.

2) Spending $40K on the card has too high an opportunity cost. Run the numbers — you’re better off getting the Aspire card. Pay the $450 and get 1 free weekend night each year, $250 in airline credits, and $250 in resort credits along with your Diamond status. Then put that $40K spend to more valuable use. Again, the return on unbonused spend in year 1 of a Discover or Alliant card matches the grocery spend and far exceeds your return if you aren’t spending all $40K at the grocery store. Being able to take advantage of some 5% back spots at the grocery store and/or using Apple Pay/Google Pay with the Altitude Reserve would potentially increase your return substantially.

3) Totally agreed on having Diamond status, I just don’t think it’s worth the cost of putting $40K spend on the Ascend.

Alliant is…well, let’s just say Alliant is not unlimited 3 percent cash back!

Lets say a person MSs $40k at a supermkt, they end up with 240k in HH pts If I remember correctly fees per 95k (top hotels) works out to slightly less then $200 So you have 2 1/2 nights 1 free weekend night for hitting 15k and Diamond 3% back on 40k is $1200, Im sure that = < 2 1/2 nights at a top hotel that requires 95k , or 76k if you are staying for 5 nights. Now the 1200 may workout for a person who isnt interested in a top hotel and prefers say a Hampton or HGI even say in Hawaii Then the 1200 may get them bet 3-4 nights but at a non resort

I crunched the Aspires #s and found I preferred the Ascend @ $95, I dont have to ring every penny out of any card or program, as long as Im getting what I consider a good deal it works for me

Lets just say a person MS $40k at a supermarket: 1) How much time is involved and 2) What is your risk of a shutdown?

This just goes to show that there are two real variables at work:

1) The marginal COST per acquisition of a point

2) The volume of spend that one can engage in.

As a practical matter, #2 is the main limitation that many of us face–throughput. If your throughput on a 2 percent card is running capped and you can increase volume at low to no cost then it always makes sense to do so. Or (like me) if your overall throughput is capped by marginal returns greater than 2 percent. Indeed, it very rarely makes sense for me to do anything for a straight 1.5-2 percent return.