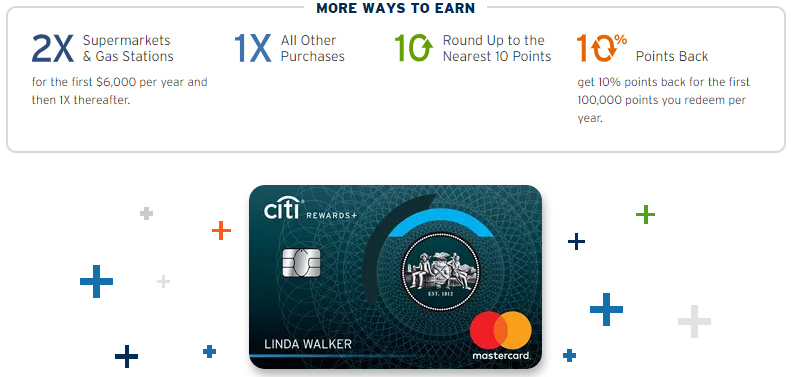

In the post “Citi Rewards+ is a great companion to Premier or Prestige,” I explained why I think that the Rewards+ is a great companion card. It’s not a great card on its own, but if you have another card that earns ThankYou points, the Rewards+ offers an easy way to recoup up to 10,000 ThankYou points per year. The killer feature of this card is that it gives you a 10% rebate on any points redeemed, up to a maximum of 10K points back per year.

The reason the 10% back feature is great is that it works even if points were accumulated from another credit card. The key is that the accounts must be combined into one “pool” of ThankYou points. For example, if you have a bunch of points earned from your Citi Prestige card, you can combine the Prestige ThankYou account with your Rewards+ ThankYou account. Then, when you redeem your Prestige points, you’ll get 10% back. See: Should you combine ThankYou accounts?

How it works

First, redeem ThankYou points from an account that has been combined with your Rewards+ card. You can redeem for anything at all: travel, gift cards, cash back, or transfer points to airline programs. The only exception is that sharing points (e.g. moving points to another member) does not trigger the rebate.

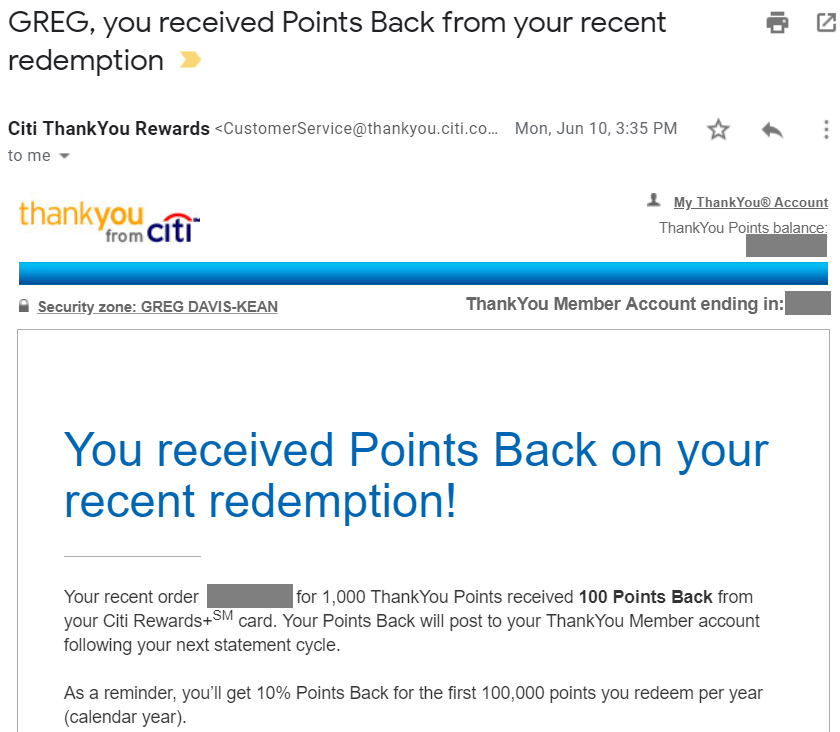

Shortly after redeeming ThankYou points, you should receive an email saying that you received Points Back from your recent redemption:

Note that you don’t get the rebated points in your account until after the current statement cycle ends.

What if you have two (or more) Rewards+ cards?

Until recently, I had two no-fee Citi ThankYou Preferred cards. One was automatically converted from my old Citi Forward card once they sunset that card. Another was a product change from a Citi Premier card when I didn’t want to pay the annual fee (and no good retention offer was available at that time).

There’s not much reason to keep a Citi ThankYou Preferred card now that the Rewards+ card is available. So, when I received an email offering me that chance to product change one of my Preferred cards to the Rewards+, I made the switch. That one was changeable online because I had received that offer. I wasn’t able to find any way to change the other card online.

Once I received my new Rewards+ card, I made a couple of test ThankYou redemptions. First, I cashed out 1,000 points for a $10 statement credit (the Prestige card gives me that ability). I quickly received an email like the one above saying that I received 100 Points Back and that the points would post following my next statement cycle. Next, I transferred 1,000 points to Avianca LifeMiles. This was primarily done to reset the clock so that my LifeMiles wouldn’t expire. But also it was to make sure that the rebate really works on transfers to airline partners. I can now personally confirm that it does indeed work.

The second card

I hate it when I have to call to get things done, but I couldn’t find a way online to change my second Preferred card to a Rewards+ card. Online chat was a complete waste of time. So, I finally called and switched over the card quite easily.

The two card test

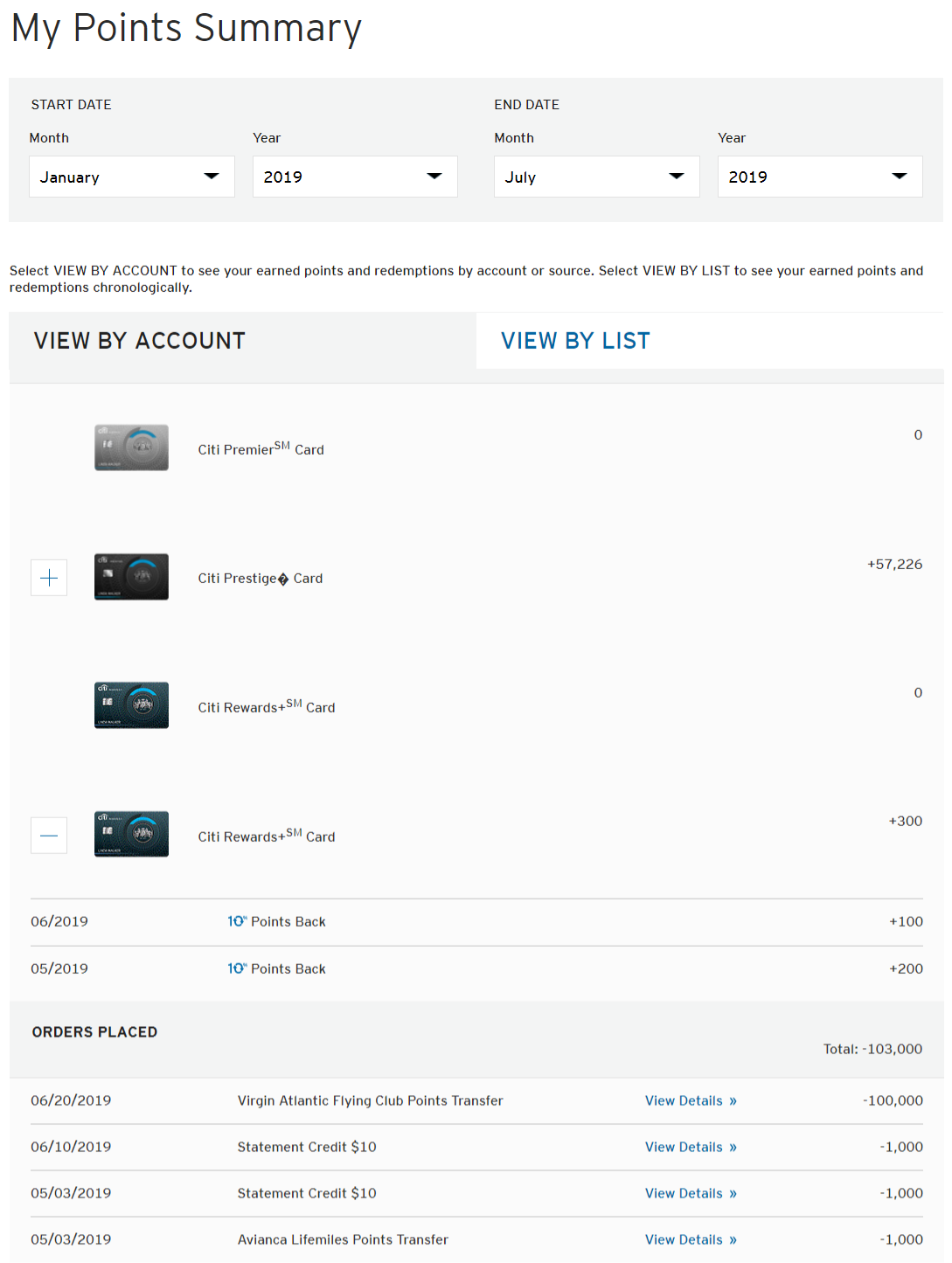

My ThankYou Preferred accounts were already combined into one ThankYou account along with my Prestige and Premier accounts. So, shortly after the call to product change, I conducted a small test. I once again cashed out 1,000 points for $10. My hope was that I’d receive two emails instead of one saying that I had received 100 points back. That didn’t happen. I only received one email.

Maybe I hadn’t waited long enough? The second card conversion resulted in a new card number. Maybe I had to wait until that card arrived and was activated? So, I waited…

Once the new card arrived, I immediately activated it. Then, I checked my ThankYou account to make sure the card was listed as a Rewards+ card rather than a Preferred card. It was. So then I transferred 100,000 ThankYou points into 130,000 Virgin Atlantic miles (while that transfer bonus was still active). The result? I still only received a single email about the rebate. And this time the rebate was capped at 9,700 points (because I had already earned back 300 from the earlier transactions).

Results of the two card test

Failure.

I was hoping that I would earn double rebates with two cards. Or, almost as desirable, I was hoping that the rebate cap would be lifted to 20K points per year. Based on the emails I received, it looks like neither is the case.

It is a bit too soon to put the final nail in the coffin because points haven’t yet posted for my final rebate, but it certainly doesn’t look good.

A stack that might work

If you have multiple Citi ThankYou accounts that have not been combined, then it might be possible to increase your rebate limit. The trick would be to get multiple Rewards+ cards and combine them separately with each of your previous cards. For example, if you have both a Prestige and a Premier card and haven’t combined accounts, then combine one Rewards+ card with the Prestige account and combine another Rewards+ card with the Premier account. I haven’t tested this, but my best bet is that it would work.

I also wonder if I could product change my first Rewards+ card back to the Preferred card and whether that would free up the 10K limit for the other Rewards+ card. It seems like a long shot, but it might work. By viewing my ThankYou account, I can see that the points rebated so far are all associated with just the one Rewards+ account:

If I cancel or product change the Rewards+ card that has those rebates associated with it, would my newer Rewards+ card suddenly have a new 10K rebate limit? Again, I think it is unlikely to work, but theoretically possible.

Conclusion

It appears that stacking two Rewards+ cards does not lead to double points rebates. That said, it very well may be possible to increase the total cap on the rebate but only if you avoid combining ThankYou accounts. See the section above titled “A stack that might work,” for details.

I’ve talked to Citi reps and they’re now saying it’s possible to increase the Citi Rewards+ rebate by having multiples of them. Could you try again to see if it works? It has been three years since you’ve last tried. Maybe it works now.

I’d notice if it suddenly started working since I redeem TY points fairly regularly. I think that the only way to increase the rebate is by keeping the Rewards+ cards separate. ie. don’t pool them together. Then you should be able to get 10K back with one card and 10K back with the other. The problem is that you’ll want to pair each card then with a premium card so that you can transfer points to partners. If you’re OK just getting cash back, then it should work fine.

[…] Miler: Can you double the Citi Rewards+ 10K rebate by getting two? (July 3, […]

Hi, it’s clear based on t&c’s that the person who shares his points will not get 10% rebate for sharing them. However, it wasn’t clear if the person who receives those said points could get the 10% rebate when he redeems them sometime in the future (assuming he has the rewards+)? Would you know answer to this?

I’m confident that the person redeeming the points will qualify for the 10% rebate regardless of how he/she got the points (including via point transfer).

You get the rebate and the rebated points do not have an expiration date.

[…] on this point was proven true, as illustrated in Greg the Frequent Miler’s excellent article, Can you double the Citi Rewards+ 10K rebate by getting two? (July 3, 2019). In the comments to that article, I even talked about this very experiment of having […]

The 20k bonus offer for Rewards+ seems to no longer work… public offer is 15k I think.

Thanks. I’ve updated our Best Offers page.

[…] Can you double the Citi Rewards+ 10K rebate by getting two? by Frequent Miler. Short answer is no […]

[…] Can you double the Citi Rewards+ 10K rebate by getting two? […]

Honestly, this card is offered by the same bank (Citi) as the AA card. You could never get a 10% rebate on those if you had two, so not sure if you seriously thought you could on these cards. Sorry, don’t mean to come off snarky (I’ve already had my nightly alcoholic beverage), but the result of this test was probably easy to predict.

The limit on the AA card rebate was probably enforced by AA not Citi. I’m actually pretty surprised that it didn’t work

Are both credits from the same card or from different cards? I noted that the one which closes first after redemption gives you 10% back. You can try redeeming before second card closes and then see if you get another 10% from it.

Good idea. Thanks.

Thanks for the experiment! Did this idea here ever pan out?

I forgot all about it and never tried it.

Thanks for running the test Greg, now my dream of 100% of 100k is set aside.

Hi Greg – Thanks for running this experiment and sharing the results. This is a good DP to have for planning purposes. I contemplated running this exact experiment, but I thought it was very unlikely to be successful. So I tried a different experiment, which is still in progress. I’ll write an article once I have something definitive or at least useful to report. I think having 2 separate TY accounts with a Rewards+ associated with each seems likely to work. The product change idea is brilliant & might work – you never know! Have a great 4th of July! ~Craig

Thanks Craig. I’m looking forward to hearing your results