UPDATE (10/31/19): It finally happened! It is now possible to convert cash back account to Membership Rewards accounts! Click here for details.

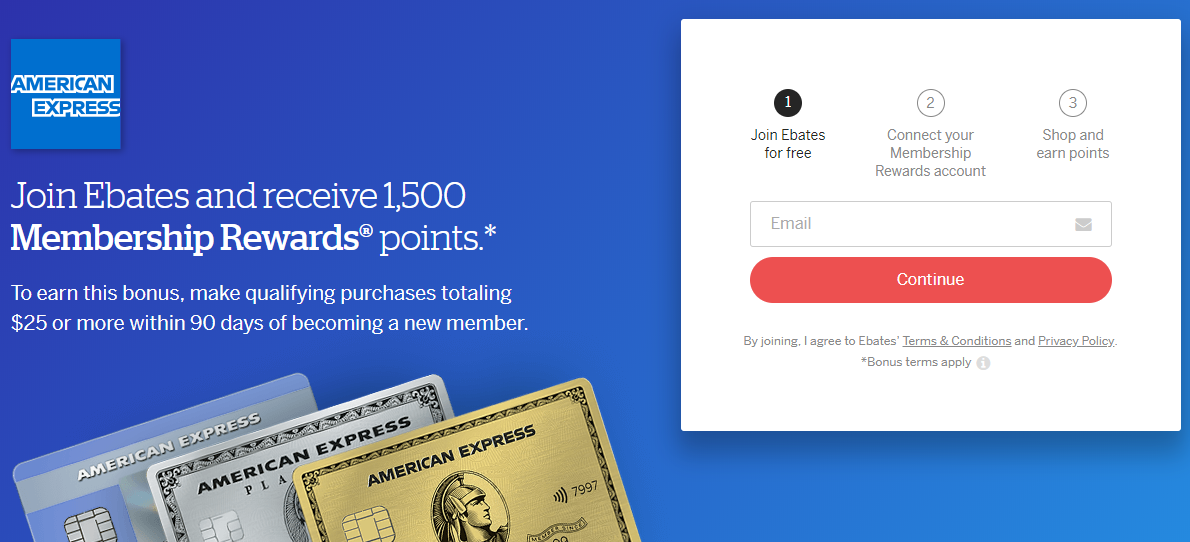

One of the most significant recent developments in miles & points is the new ability to earn Membership Rewards points from Ebates rather than cash back. For many of us, Amex Membership Rewards points are worth considerably more than 1 cent per point, especially when those points are transferred to airline miles for a high value award ticket. For details about Ebates with Membership Rewards please see: In one fell swoop, Ebates shakes up portal and credit card rewards.

The biggest downside of this new feature is that there is currently no way to convert a cash back Ebates account to a Membership Rewards Ebates account. Instead, members have to cancel their cash back account and sign up for the Membership Rewards version. Again, details can be found here. For some members, cancelling and setting up new is not an option. For example, if you have an Ebates Visa card (which earns 3% on purchases that track through the Ebates portal), cancelling your current Ebates account would be a disaster. There’s no way to change which account it is linked to. See: Ebates Visa with Membership Rewards. Everything you need to know.

A few weeks ago, I had the opportunity to speak with Shawn Roberts, the Director of Corporate Communications at Rakuten Rewards (Rakuten owns Ebates and is in the process of rebranding Ebates as Rakuten). Shawn is new at Rakuten and so he wasn’t able to directly answer too many of my questions. Instead, he talked mostly about the ways that Rakuten is planning to offer rewards for all transactions. They already offer in-store rewards when you link your credit card, and some rewards when using Lyft, but they’re looking to do far more of that sort of thing going forward. What I really wanted to know, though, more than anything else, was whether they would make Membership Rewards earnings an option for existing cash back members.

“We are working with American Express…”

Shawn got back to me via email with this:

We are really happy to see how excited Rakuten members are to earn Maximum [sic] Rewards points. We are working with American Express to make this program available to our current members.

I’m sure he meant “Membership Rewards” not “Maximum Rewards”. Anyway, it seems that they need Amex’s help to make it possible to convert existing members.

Will this really happen?

I think it’s likely that Ebates does need Amex’s help to make this happen. After all, signing up for Ebates with Membership Rewards requires logging into your Amex account to link Ebates to Amex. So, something similar would be required to convert existing customers.

Unfortunately, I have no way of knowing whether Amex wants this to happen. What’s in it for Amex? Why did they get into this arrangement in the first place? There are a few answers that come to my mind:

- Amex recognizes that, unlike Chase, they no longer have a points-earning shopping portal and so this was an easy way for Amex to get a good one

- Amex sees this as a way to get their customers more fully tied into the Amex Membership Rewards ecosystem. If their customers earn points rather than cash back with their shopping, they’ll have to stay within the Amex environment to use those points. As a result, maybe their customers will also be more motivated to use and renew their Amex credit cards

- Maybe Amex is counting on its members primarily redeeming points for low value rewards. For example, members can redeem Membership Rewards points at Amazon, but they get less than 1 cent per point value. If this is a common use of Membership Rewards then Amex can earn a profit by indirectly selling their points to Ebates for 1 cent per point.

Assuming Amex wants existing Ebates customers to have the option to earn Membership Rewards, it’s reasonable to expect that it’s only a matter of time before they introduce the ability to convert existing Ebates accounts to Membership Rewards accounts. If/when this happens, it will be great news for anyone stuck with an old cash-only account.

So, will this really happen? My best guess is yes.

![Amazon: Save when redeeming at least 1 Membership Rewards point [Targeted] a laptop on a table](https://frequentmiler.com/wp-content/uploads/2022/07/Amazon-Laptop-Featured-Image-218x150.png)

Hi There, Sorry if this is way too obvious but I just wanted to make sure – If you get the Rakuten credit card and get 4 MR points per dollar spent on say giftcardm@ll cards. if you use Amex Plat as your primary card then you’ll essentially be getting 35% back on those MRs earned?

The Business Platinum card offers a 35% rebate on certain flights booked with points. Is that what you mean? If so, yes, you can use points earned with the Ebates card to pay for flights and if you have the Business Platinum card, you should get that rebate as long as you book economy with your selected preferred airline or premium cabin with any airline.

I have been confirmed by Rakuten Compliance Office that I can have one Cashback account and one Amex earning account. It is actually what I had so far.

He’s the “Director of Corporate Communications” but doesn’t know what the points are called for their latest, massive, partnership? I’m sure his thoughts matter…

[…] Ebates working w/ Amex to bring Membership Rewards to current customers by Frequent Miler […]

[…] Ebates working w/ Amex to bring Membership Rewards to current customers […]

I’m confused why Greg claims existing Ebates members can’t earn MRs – just need to sign up for an Ebates account using the Amex link – I used different email and simply deleted my linked Ebates Visa from my old account and added it to my new MR-earning account. Fairly simple workaround. Now I have 2 accounts – one earns cash back and the other earns MRs.

Is having two accounts against their TOS?

Wait, you were able to change the link of your Ebates Visa to a different account? A number of readers have told me that they weren’t able to do that. Is there a trick to it?

Yup. Simply deleted my Ebates Visa credit card that was linked to the casback account and then added to my new Amex-earning account.

Agree you can add the ebates visa to your ebates MR earning account by simply adding it to your ebates wallet (same as any credit card). It might even be possible (likely?) that you could have the ebates visa on both your MR and cash earning ebate wallets. The real question is what do you receive when you make an ebates purchase using the visa now moved to your MR earning account. It seems there are 4 possibilities – 3 MR in the MR account, 3% cash in the cash account, zero (because card is linked to the cash account but you made purchase in the MR account), or both 3 MR and 3% cash (wow, that would be nice, but also likely to be short-lived and possibly lead to shutdown).

As Mike says, it’s not clear to us that linking the card the way you did would really have the effect you want. If you go to your MR Ebates account, and where it shows your point earnings, you should be able to see both “Cash back for purchases” and “cash back on credit card purchases”. And there it should show that you earned 3X. Is that how it shows up for you?

You won’t. I’ve tried it and had headaches with support going back and forth with emails explaining I went through my MR account and used my Ebates CB which was attached (wallet) to both accounts. I did receive the 1X MR points for the portal but did not receive the 3X reward from the Ebates CC; only 1X everyday purchase since it was not originally attached to my MR account when I applied for it.

@MS – have you made a purchase yet with the ebates visa on the MR-earning account? The 3 MR from the ebates visa should show pending in your account within a couple days after the normal MR for making the purchase shows pending (at least it did for me). If the 3 MR from the ebates card isn’t pending after a couple days, then your workaround probably does not work (as others have reported).

Hi Greg, can you please elaborate (or post a link to where you have done so) on how you get more than 1c per 1 MR point value? I’m getting amex MR points with Ebates but I kinda wish it were just straight $. Maybe it’s the airlines I fly that are not suited for this gig, but I’d like to see how you assess the value. Thanks.

If you have 10,000 points, equivalent to 10,000 cents ($100.00) if you earned cash back instead of MR, but redeem those points through Amex for an award worth $150 (e.g. a hotel stay or flight), you’ve effectively made each point worth 1.5c each. This is a major principle of this and similar sites, so make sure you understand it.

hi Kent, yes, I understand that part of course. My point is that I’m unable to find awards through Amex worth $150 (following your example). The best I’ve been able to do is 1 for 1. I understand that it might be the airlines and hotels *I* choose for *my* needs are just not suited for this gig. That’s why I asked for good examples of airlines or hotels which make you value MR points greater than 1c per point.

Transfer to Aeroplan to book united flights.

A couple sweet spots I know of:

– Transfer to BA to book short-haul BA or IB flights within Europe. Business class is an especially good value, but many are unwilling to spend one penny for an upgrade (though the lounge could save you a lot in airport food purchases alone; and remember, BA no longer serves meals/snacks onboard intra-Europe Economy). Anyway, I can easily find you 20 routes in 20 minutes with >1.3 cpp value in Economy. I just booked a $477 flight (2 people) for 16,500 Avios + $44. That’s a Saturday flight in summer that probably bottoms out at $300/2 people, which places the value at 1.55 cpp.

– Transfer to Singapore to book United flights from the East Coast to Hawaii for 35,000 miles + $11.20 round-trip. I challenge you to find even a low-season RT for less than $375.

Both of these come with seat selection and checked bags; are you even accounting for those?

thanks for the suggestions, folks

you can get 1.5c per point on bus class airline purchase with Plat card or economy on your chosen airline.

Am I wrong or can’t you just create a second email?

You can, but when I asked Shawn Roberts about it he said that he didn’t want to encourage that. I pointed out that it was the only way for current customers to get an MR account if they didn’t want to close their existing one, but he wouldn’t commit to saying that it was OK. So, yes you can do it, but some people have claimed to have been shut down by Ebates when they created multiple accounts. In those cases, though, I bet they were doing so to game the system not to simply get a MR account.

I created a second one to get an MR account. It didn’t even occur to me to cancel the original one. FWIW, I no longer use my original account, so I feel ok about doing it. I guess I should cancel the original now to avoid any potential conflict- I would hate to lose my MR points I’ve racked up so far.

RIP! once these articles comes out, I would move on. As alway FM killing it One deal at a Time and this time even before it takes off.