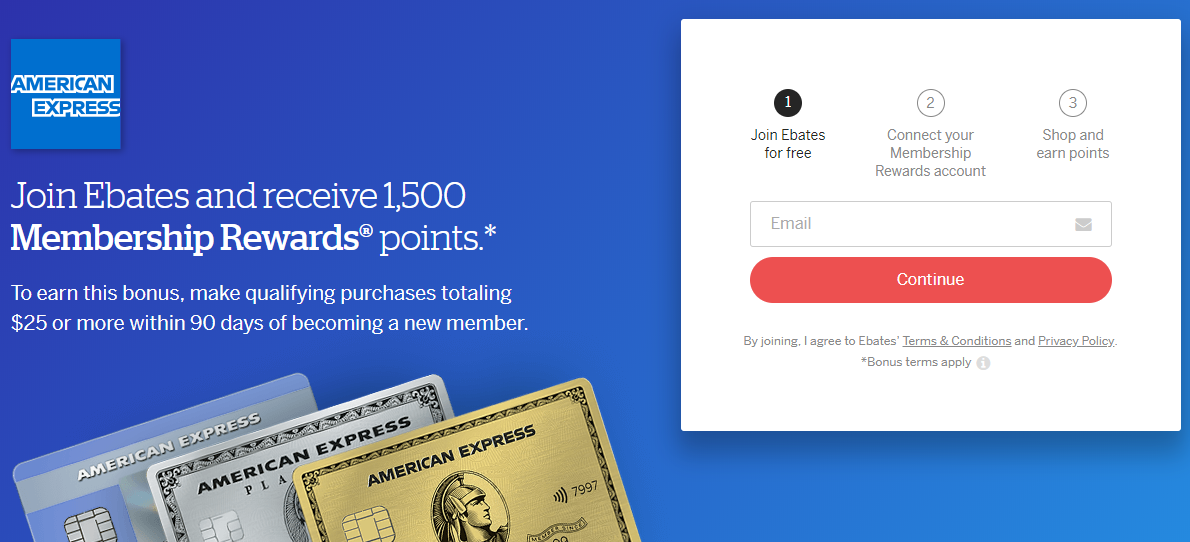

Last week Ebates quietly introduced a new feature to their portal. New members can now sign up to earn Membership Rewards points rather than cash back. That alone is huge news. However, Doctor of Credit points out that this change also means that the Ebates credit card now becomes the card for online purchases. First the basics, then analysis on why I think this is a really big deal.

The Ebates Shopping Portal

The Ebates shopping portal now allows people to choose to earn Amex Membership Rewards rather than cash back. This is a one-time choice. Once you choose one or the other, you can’t switch. Current Ebates customers get cash back by default and cannot switch to Membership Rewards. You must sign up new with a special link to get Membership Rewards. Update: You can now switch your earning preference at any time. Click here for details.

Offer link (this is not an affiliate or referral link): www.ebates.com/american-express

To take advantage of this opportunity, you must have a consumer American Express card that earns Membership Rewards points. Here are some cards that should work (press “next” to see additional cards):

| Card Info Name and Earning Rate (no offer) |

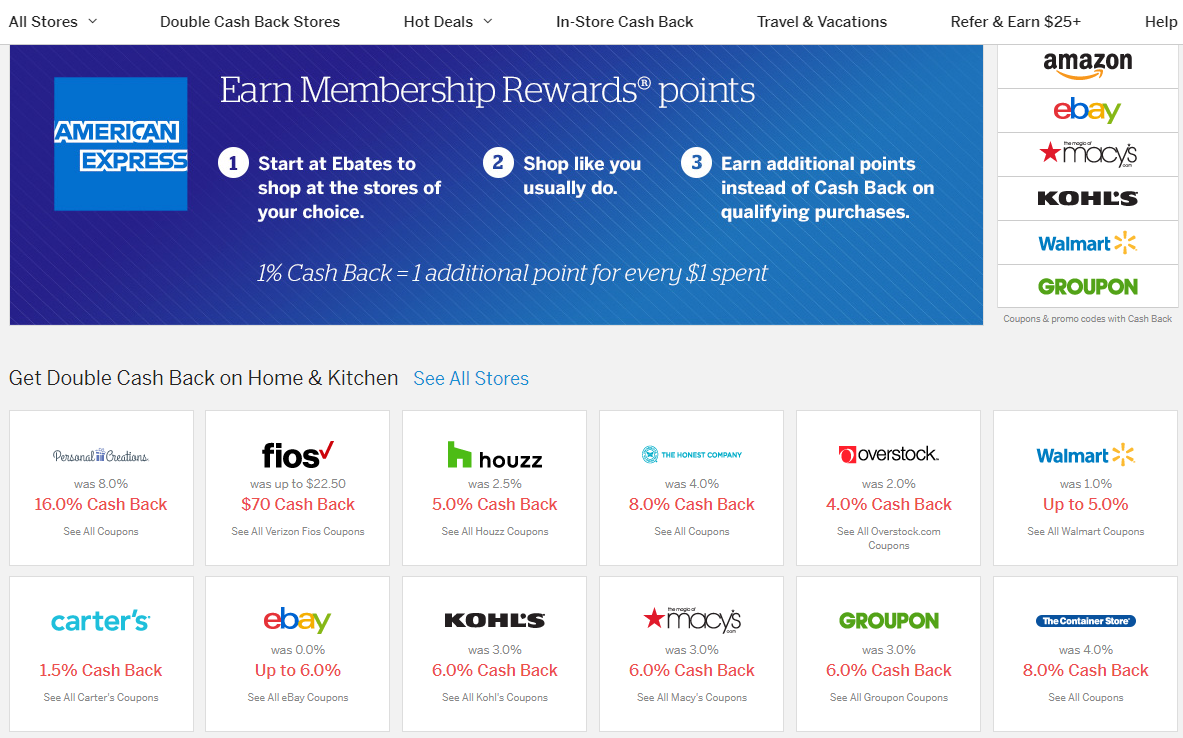

Once you are signed up to earn Membership Rewards points, the portal works just like a cash back portal. It even displays cash back rates rather than points for each offer (and yes, the cash back rates are the same regardless of how you sign up for Ebates). When a store is advertised as earning 5% cash back, you’ll really earn 5 Membership Rewards points per dollar. Even though rates are displayed as cash back, you’ll know that you are signed up for the Membership Rewards option because the Ebates home page says so:

In my opinion, Ebates is a very good portal, even for cash back. While TopCashBack almost always has the best portal rates, Ebates often matches them and occasionally exceeds their rates when offering a special deal.

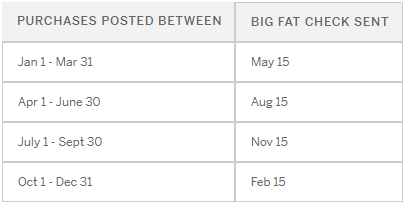

For those new to portals, the basic idea is this: If you’re going to shop online anyway, you can usually earn extra rewards by starting with a portal and clicking through to the merchant you want to shop with. For example, in the image above you can see that Ebates was offering 6% cash back at Macy’s at the time I wrote this. If you click through from Ebates to Macy’s and then make a purchase at Macy’s, you would get 6% cash back on your total purchase before taxes and shipping. Often you’ll receive an email within a few hours stating that the purchase was tracked, but it usually takes much longer for the cash back to become payable. Once the cash back is payable, Ebates will pay you, at a date determined by their quarterly payout schedule, either in cash back or Membership Rewards points (depending upon how you signed up).

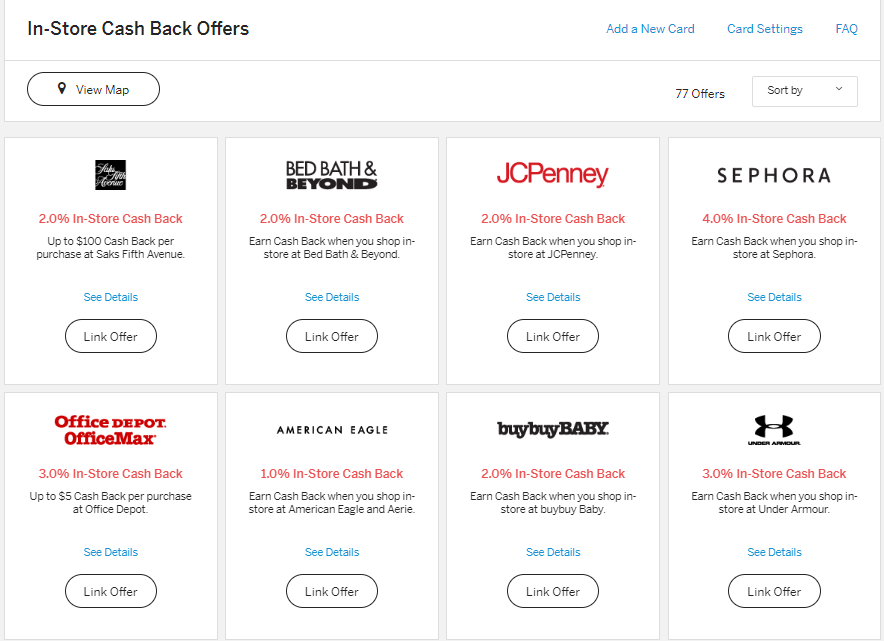

Ebates In-Store Cash Back

In addition to online rewards, Ebates offers bonuses for in-store shopping. You must first link the credit cards you’ll use for purchases and then click “link offer” for each offer of interest. Once you’ve used an offer it’s often necessary to link the offer again (if still available) to earn rewards a second time. This is from the Ebates FAQ regarding store-linked offers:

When I link an offer to my card, do I get In-Store Cash Back for all future purchases at the merchant?

No. For some offers, you may make additional qualifying purchases within a 24-hour window following your initial redemption, but, for others, the link is good only for a single redemption. Check “See Details” on the In-Store Cash Back site to determine the rules for a specific offer. After that time, you must re-link the offer to your card to earn Cash Back.

In-store offers result in additional cash back getting added to your Ebates account. Therefore, if you are signed up with the Membership Rewards option that cash back will pay out as Membership Rewards.

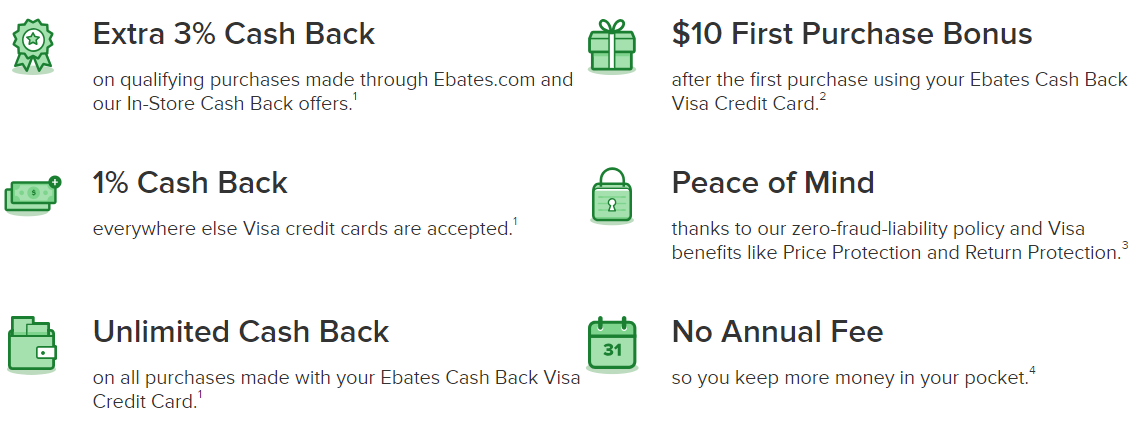

Ebates Credit Card

This is where things get really interesting. The Ebates Cash Back Visa, issued by Synchrony Bank, offers 3% cash back on qualified purchases made through the Ebates portal and in-store offers, and 1% cash back everywhere else. When you earn rewards with this card, those rewards are added to your Ebates account and paid out along with your other Ebates rewards. Therefore, cash back earned with this card turns into Membership Rewards points upon payout.

This card then, sort-of earns 3X for online purchases just like the old Citi AT&T Access More card (no longer available to new applicants). The difference is that with the AT&T card it was a mystery as to what online purchases would count for 3X. With this card it’s much more clear: if you can earn portal or in-store rewards, you can earn 3X with the Ebates card.

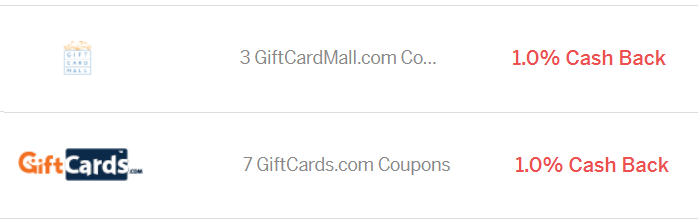

Why is this awesome? Some of us avoided the Ebates credit card in the past because we prefer earning airline miles or, better yet, transferable points like Membership Rewards. Now we can. I personally wouldn’t use this card anywhere except online when shopping through Ebates or in conjunction with an in-store offer. There, the card earns 3X rewards on top of whatever you earn from Ebates itself. For example, if you buy gift cards from GiftCardMall or GiftCards.com and earn 1% cash back from the portal, you’ll also earn 3% from the credit card for a total of 4%. With the Membership Rewards option, that’s 4X rewards when buying gift cards.

The funny thing about all of this is that, if this works, the Ebates Visa card will become the single best Membership Rewards card for most online purchases. It’s crazy to think that a non-Amex card may offer better Amex Membership Rewards earnings than their own cards.

Wait, don’t you have to pay with your Amex card for this to work?

Some people have pointed out that the Amex terms on the Ebates site make it seem like you have to pay with your linked Amex card for this to work (highlighting in mine):

Additional Membership Rewards® points at Ebates available to U.S. American Express Card Members with a Card enrolled in the Membership Rewards® program (“Eligible Card Account”) only. Card Members must become a new Ebates member and link their Membership Rewards® program account at Ebates.com/american-express. Card Members must use an Eligible Card Account at checkout to earn Membership Rewards points in their Ebates account. Corporate Cards or accounts are not eligible to participate.

Update 10/31/19: Fortunately, in practice, you can use any credit card to make your purchases and you’ll still earn portal rewards just as before. I’ve personally used my Ebates Visa through the portal many times and have successfully earned Membership Rewards.

Why the Membership Rewards option is exciting

Amex Membership Rewards points can be used towards greater than 1 cent per point value in several different ways. Those who fly often can get fantastic value by transferring points to any of a large number of airline transfer partners. That’s why our current Reasonable Redemption Value for Amex Membership Rewards points is pegged at 1.82 cents per point. Here are a few examples of transfer partners with which it’s possible to get outsized value:

| Rewards Program | Best Uses |

|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus (Avios.com) rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| ANA Mileage Club | Redeem for Star Alliance flights. Multiple stopovers allowed. ANA offers many great sweet-spot awards, including flying around the world in business class for as few as 115K miles! See also: ANA - a terrific Membership Rewards gem. |

| Avianca LifeMiles | Avianca LifeMiles can be great for Star Alliance awards. They offer reasonable award prices and no fuel surcharges on awards. They also offer shorthaul awards within the US (for flying United, for example) for as few as 7,500 miles one-way. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Cathay Pacific Asia Miles | Cathay Pacific has a decent distance based award chart, but they no longer allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

Other options for getting more value out of Membership Rewards points include using points to purchase flights for up to 1.5 cents per point value, or converting points to investment cash at 1.25 cents per point value. Full details of these options and more can be found in our Complete Guide to Amex Membership Rewards.

Q & A

Q: Are the rewards rates different depending upon whether you sign up for Rakuten/Ebates with the cash back or Membership Rewards option?

A: No, the rewards rates are identical. The only difference is whether you ultimately get paid in cash or in points

Q: Do I have to use my linked Amex credit card when making purchases through Ebates?

A: No

Q: Should I sign up for the Ebates Visa?

A: The value The Ebates card offers depends on how much money you are likely to spend on purchases made through Ebates (or linked to Ebates with in-store offers). 3% is a strong return on online purchases. 3X Membership Rewards is great. Keep in mind that these are on top of the rewards that Ebates itself offers. Signing up for this card will count against your 5/24 status though so keep that it mind if you are hoping to sign up for Chase credit cards.

Q: Will you (Greg) sign up for the Ebates Visa?

A: Update 10/31/19: Yes. I signed my son up for the card but with an Ebates account linked to my own Amex account. It works.

Q: Where can I find the terms and conditions for this Ebates / Amex stuff?

Q: Where can I get answers to questions you didn’t already answer?

Ebates has a decent FAQ for their partnership with Amex here.

Is there an app for the ebates credit card?

Like a phone app? I don’t know.

is the GCM 3x still alive? purchases from 7/20 haven’t posted as 3x on portal

Yes, my recent purchases have posted as 3X on the portal

[…] Your calculations will also need to take into account whether you’re earning 10% cashback or 10x Membership Rewards if you set up a new account with them recently. […]

Regarding the “challenge with existing accounts” and the three options you list to getting a Membership Rewards earning account, Rakuten customer service said this to me in an email: “We can’t convert your existing account to points, but you are welcome to create an account to use for earning Membership Rewards Points using the following link…” It seems highly unlikely people will be shut down for creating another account when that is the option provided by customer service.

I agree that it’s highly unlikely that people would be shut down for that. I asked Shawn Roberts about the option of using a second email and he said that he didn’t want to encourage that. I pointed out that it was the only good way for current customers to get an MR account, but he wouldn’t commit to saying that it was OK.

[…] One of the most significant recent developments in miles & points is the new ability to earn Membership Rewards points from Ebates rather than cash back. For many of us, Amex Membership Rewards points are worth considerably more than 1 cent per point, especially when those points are transferred to airline miles for a high value award ticket. For details about Ebates with Membership Rewards please see: In one fell swoop, Ebates shakes up portal and credit card rewards. […]

Thanks Greg

[…] The Ebates portal suddenly became exciting when they introduced the ability to earn Amex Membership Rewards points instead of cash back. The combination of the Ebates portal with the Ebates Visa credit card is arguably the most exciting event in the points & miles world since… um… Redbird maybe? Regardless, it’s been a while since we’ve seen anything this interesting. You can read all about it here: In one fell swoop, Ebates shakes up portal and credit card rewards. […]

I only have business Amex CCs, and Ebates just let me do your option 2 (as you stated above).

I realize that this post is a month old but connected via the link on 4/1 related to Top 3 Ways to Earned Uncapped….I took the tip to disassociate my Schwab Amex from my current Ebates account and created a new one. I did not use the link above at first (comment below). Timing was perfect for 4/1 as there was 12% back at Saks…used by first half $50 Saks benefit (spent $51) and received 1500 points as a new user and 615 for the purchase. $21.15 from Ebates equates to $31.73 using the conversion of 1.5 cents for the Schwab investment program and some free product from Amex (not worth the effort to resell). Win Win Win!

BTW…I had several email exchanges with Ebates CS regarding my purchase as it was very late last night when it was made and I had some account set up issues…dummy me did not use the correct link to set the account. They walked me through this morning and credited to me the above mentioned cash back/points immediately! They are wonderful to work with.

I really appreciate the blog and the emails! Thanks Greg and Team

I just got around to opening an MR Ebates account for a family member. Any DP on whether or not we really need to use an AMEX card to make the purchase (per the T+C) for it to count?

Nobody will know for sure for sure until the first set of points post on May 15th. That said, I highly doubt you need to. I remember when the airline shopping portals had language insinuating that you needed to use the airline credit card or when the Chase Portal had language insinuating that you needed to use a Chase ultimate Rewards card, but that’s never been the case. The shopping portal is just earning a commission and passing part of that on to you. In this case, they’re obviously buying the points at less than $0.01 each. As long as they’re getting paid, I’m sure you’re going to get paid. At least, pretty sure.

In pretty sure I read some people didn’t get UR points when they used the UR portal without paying with a Chase card. Same with Discover.

Odd. I’ve done a lot of shopping through the Chase Portal, rarely using a Chase card, and never had an issue getting points. I do remember some folks having clawbacks on Discover at some point. Though I guess the difference there is that it’s the bank giving you the points. Ebates adds a later of middle man.

With Ebates, what I assume is happening is that Ebates is buying Membership Rewards points from Amex for less than $0.01 each. Let’s say 10 Membership Rewards points costs them 8 cents. Then they can offer you 10x and it costs Ebates less to do that than to give you 10%. I’d assume as part of the agreement, Amex wants Ebates encouraging you to use their cards. It’s a win-win. Amex gets paid more for the points than they cost to print, Ebates pays you less than they would have, you get excited about Membership Rewards and are therefore more excited about using your Amex cards (most people aren’t going to earn enough from Ebates so as to have enough points to be useful without also spending on Amex cards). It also encourages you to keep your Amex card(s) open since it is now linked in to your everyday shopping lifestyle.

I feel like there’s not enough upside for either side in making this more difficult by being too restrictive.

That’s all pure conjecture and may be totally wrong, but that’s my take on it. We’ll see next month. I haven’t made any of my purchases with an Amex.

Greg: Potential work around I have an existing Ebates account. My son has a AU Gold amex card that’s linked to my Platinum MR account, so I earn all the points. if I open up a new MR earning ebates account with his email and his amex card (Amex made him set up his own online log in – it should work that the points get sent to my Amex account, right?!?!?!

Good idea, but my guess is that Ebates won’t let you setup a MR version of their account with an Amex log-in that doesn’t have a MR card as a primary account holder. This would be a great work-around if I’m wrong about that.

[…] must concur with Doctor of Credit and Frequent Miler – this card has just become the card for online […]

I emailed the portal customer service to see if there’s a way to change the account my credit card is linked to. Will see how they reply.

Any reply from customer service yet?

Bad news.

“The Ebates Visa can only be associated to one account and once associated to an account it cannot be changed. You can update the email address of the account that has the card associated.

Unfortunately we would be unable to move this card from one account to the other.”

Bummer

Got my ebates CC. Can’t wait to find out if it’ll earn 3% cashback (subsequently) in AMEX MR points on giftcard purchases. Anybody had any luck yet?

And no, it doesn’t, 1% only, wasted opening a CC on the credit report. I can’t imagine I’m the first one to find out that it doesn’t earn 3x back on GC purchases. Seems like the policy has been in place for a while on Ebates. The hype the article created should either be removed, in my opinion, or updated with the specific source where it works. I tried it at giftcardmall.

Give it some time. GCM is always slow to pay out portal bonuses, pretty quick to track the purchase. I usually am notified of 1% portal cashback w/in an hour through ebates. The T&C of state: “Please note that due to time lags in third party purchase tracking and reporting systems, a purchase may initially be credited 1% Cash Back and later (usually within a few days) be increased to 3% Cash Back.”

I would wait a week or two before reaching out to ebates because it might update to 3% automatically.

I have also seen previous datapoints of people having to have Ebates manually add in the additional 2%. If that’s the case, that makes this a more challenging.

Thanks for that DP, Chris. My Groupon purchases showed at 3% right away. So when I saw GCM show up at 1% under the “standard purchases” section (as opposed to “qualifying purchases” section), the conclusion was obvious to me. I’ll wait another week, per your suggestion. In the meantime, I’m trying giftcards dot com

You were right, Chris. A few days later, the points got updated to 3x. Interestingly, the subsequent order went to 3x quick. Maybe there’s some kind of “quarantine period” on the initial GCM order : ). Nevertheless, I have to apologize for a knee jerk reaction type message and compliment the site instead ! I wouldn’t have known about this deal. This is a great for sure. In all honesty, I don’t understand how it’s survived so far. The AM$X deal is new, but seems like folks have been getting 3x cash back all along, which would be just as awesome !

[…] In one fell swoop, Ebates shakes up portal and credit card rewards […]