Update: This no longer works as per this comment from reader Aloha808.

In a presentation I’ve done at conferences about tools to be used to find great deals, one of the things I always suggest is to read the comments on blog posts. People often share their findings and experience with various deals and angles. Sometimes, through the collective experience of the Internet, you’ll stumble on great ideas you hadn’t considered. Just last week I stumbled on such a gem regarding the rebates on the JetBlue Plus and JetBlue Business credit cards. Each card comes with the benefit of 10% of your points back on award redemptions, and you might have known that….but did you know they stack? According to a couple of reports, they do — and that could be awesome for those who collect TrueBlue points or even a good deal for transfers from Ultimate Rewards in the right circumstances.

JetBlue has a family of three credit cards. The no-fee JetBlue card does not offer a rebate on award flights. However, the JetBlue Plus card and JetBlue Business card each offer a 10% rebate on award flights. Here are key details on both cards (click either card name to go to a page with more information on the current welcome bonus offers):

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Frequent JetBlue travelers should seriously consider this card for its terrific perks. The combination of the 10% rebate on awards and the annual 5,000 point bonus make this card a keeper. $99 Annual Fee Earning rate: 2X restaurants and grocery ✦ 6X JetBlue ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 tile for every $1,000 in purchases. Noteworthy perks: ✦ Free checked bag ✦ 5000 bonus points every anniversary ✦ 10% point rebate on awards ✦ $100 statement credit w/ purchase of travel package ✦ 50% savings on in-flight purchases |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card is almost identical to the JetBlue Plus card except that this one offers Group A boarding and earns 2X at office supply stores rather than grocery stores. Both cards are great choices for JetBlue flyers. $99 Annual Fee Earning rate: ✦ 2X restaurants and office supply stores ✦ 6X JetBlue ✦ 1X everywhere else Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 tile for every $1,000 in purchases. Noteworthy perks: ✦ Free checked bag ✦ Group A boarding ✦ 5000 bonus points every anniversary ✦ 10% point rebate on awards ✦ $100 statement credit w/ purchase of travel package ✦ 50% savings on in-flight purchases |

As you can see, both are pretty good cards for JetBlue flyers. Each carries an annual fee of $99, but you get a free checked back, 5K points every anniversary, and a 10% point rebate on awards. Between the anniversary points and the 10% rebate, you don’t need to redeem many points to break even or come out ahead over the annual fee.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

Last week, JetBlue offered a discount of 20% off award flights (See: (EXPIRED) Save 20% On JetBlue Award Flights From Sep 17-Nov 6 – Book By Aug 29) that could be stacked with this 10% rebate for around 27-28% off of a normal award (JetBlue’s revenue-based system doesn’t always yield a precise value).

However, that same deal could have gotten even better. In the comments of a separate Doctor of Credit post about JetBlue last week, I found this gem:

My first thought was, “Hold up…you can get a 20% rebate on JetBlue points all the time? That can’t be right.” That led into looking for additional data points. I came across this data point posted on reddit from 1 year ago claiming the same:

Posted byu/IvanXQZ NYC1 year ago

20% redemption rebate on JetBlue if you have both Plus and Biz cards

One of the advertised features of the JetBlue Plus and Biz cards is that you get a 10% points rebate on redemptions. I just traveled on award tickets (two round trips, one me and one for companion), and I got a 20% rebate on both, and I think it’s because I have both cards.If that’s right, considering that each card gives 5,000 points annually, and costs $99 per year, it’s more like you’re getting 12,000 points annually when you use those 10,000 points. If you go by the common wisdom of each point being worth 1.4 cents, that’s worth $168, meaning the total bottom line to keep both cards is $30 ($198 – $168).

You can see that link to reddit for further comments and discussion. It certainly sounds like he did in fact receive 20% back from having both cards. I don’t totally agree with his math on the anniversary points — receiving 20% of points back after redemption isn’t exactly the same as getting 12K points each year. Still, the point stands that all of your JetBlue points become more valuable if you are able to successfully stack the rebates.

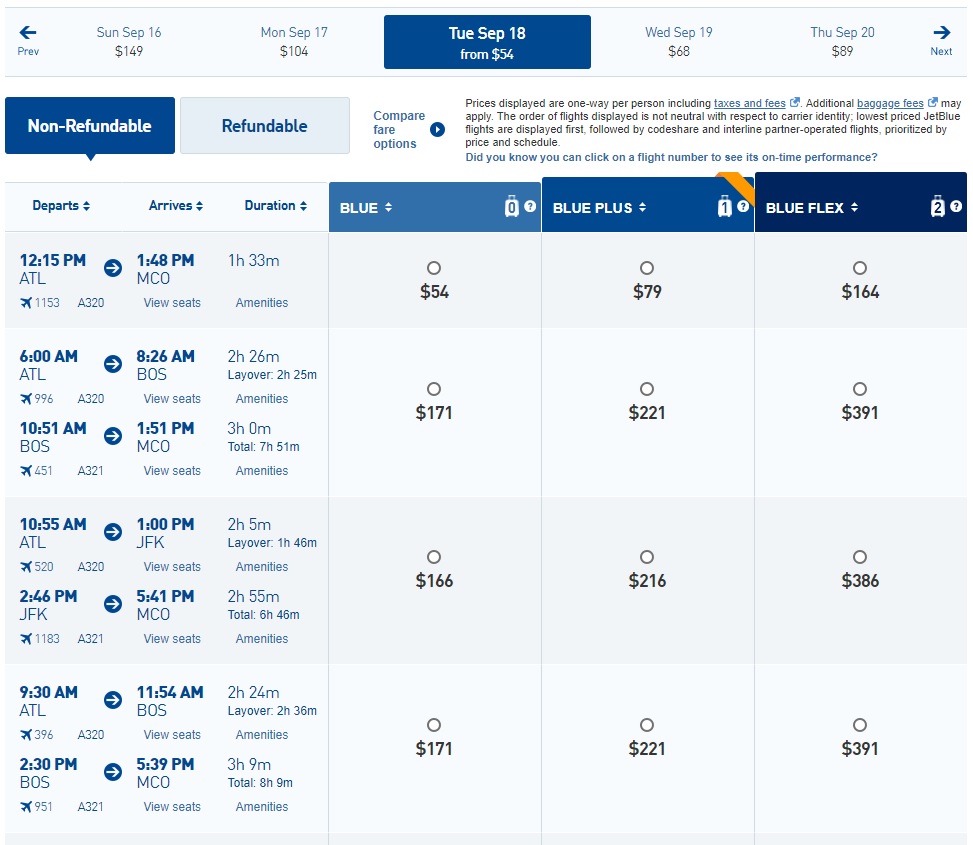

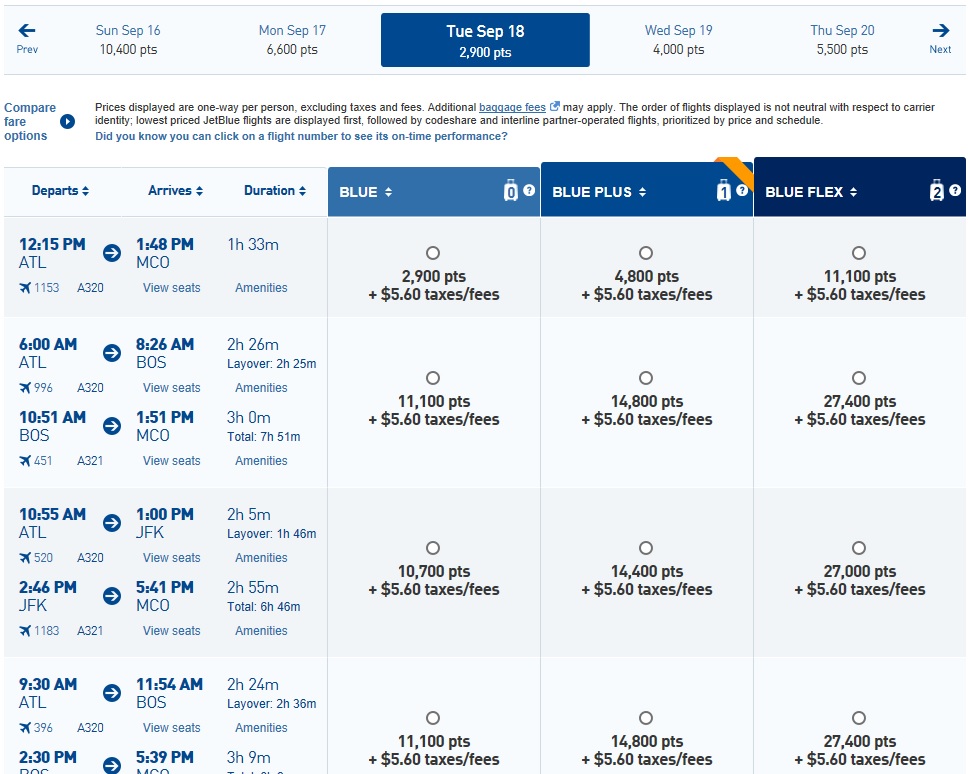

How valuable do they become? Since JetBlue’s pricing is variable, it depends — but getting 2 cents per point in value wouldn’t be impossible if this stack is indeed possible. For example, under the current fare sale, flights from Atlanta to Orlando are available for as little as $54 one way.

If you’re booking with JetBlue’s TrueBlue points, those $54 flights come to a total of 2,900 TrueBlue points plus $5.60.

That comes out to a value of 1.67 cents per point ($54 – $5.60 = $48.40 / 2,900 = 1.668). If you also got back 20% of your points, the end value for TrueBlue points climbs to over 2 cents per point: $54 – $5.60 = $48.40 / 2320 = 2.08 cents per point. Compared to our Reasonable Redemption Value of 1.46 cents each for JetBlue points, that’s terrific.

Had this redemption happened last week during the JetBlue award sale, it would have gotten even better. In Lucky’s post at One Mile at a Time, he showed how a $98 one-way flight from New York to Tampa with a regular cost of 6,200 points one-way came down to 5,000 points and $5.60 with the award sale. If you were also able to get 1,000 points back via the two credit card trick, your net value would be $98 – 5.60 = $92.40 / 4,000 = 2.31 cents per point! That would be an amazing value for JetBlue points. Heck, that’s a solid value for any airline’s points on a domestic flight.

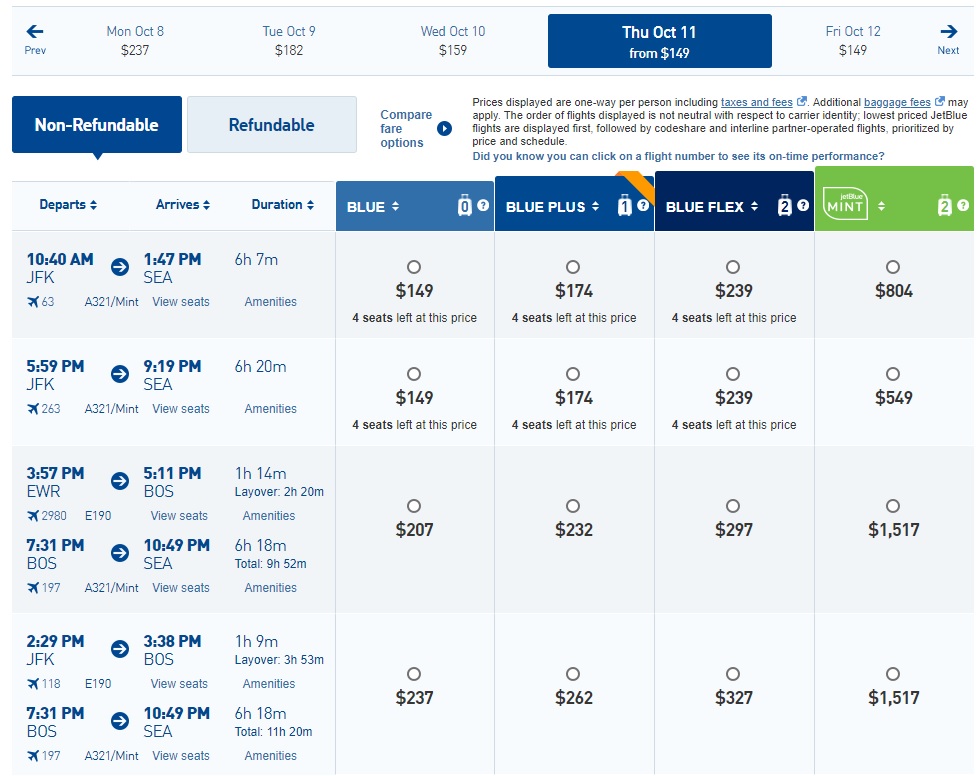

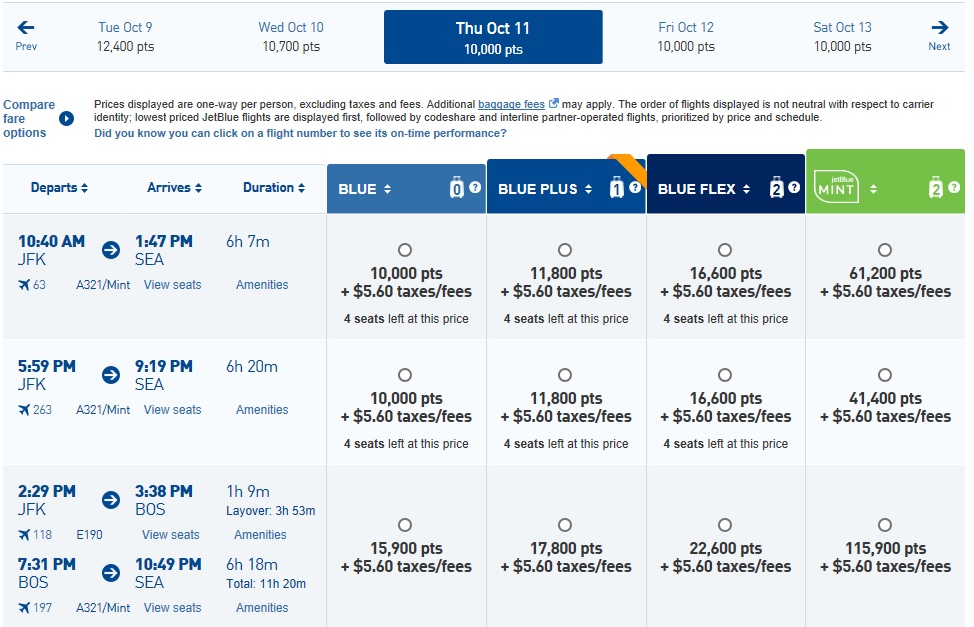

Not all routes yield quite as much value. For example, New York to Seattle prices on October 11th start at $149.

In terms of points, the $149 fare rings in at 10K points even. That’s a value of 1.43 cents per point before a 20% rebate from the credit cards or 1.79 cents each after rebate.

Perhaps more interesting there is the Mint fare on flight 263. While it won’t yield quite as much value per point as other options, it would come down to a net 33,120 points one-way to fly Mint from New York to Seattle. That’s only yielding about 1.64 cents per point in the above example, but it’s not a bad deal for what might be the best transcontinental flight experience. At times, we see Mint fares as low as $399 one-way, which could work out even better than traditional saver-level business awards on the legacy carriers.

Reader experiences?

When I first saw the comment at Doctor of Credit, I was a little skeptical. Neither Greg nor I had heard about this stacking opportunity before. However, the reddit thread’s age and lack of contrary data points leads me to believe that this might be an opportunity people have missed simply because the market for people looking to hold two JetBlue credit cards is fairly niche. Still, with one card earning 2x at grocery stores and the other earning 2x at office supply stores (and the new addition of TrueBlue as a Chase transfer partner), this could be valuable for those who frequent JetBlue if it does indeed work. If any readers hold both cards, we’d love to hear about your experiences with the rebates in the comments.

Data Point: I have both cards (Plus & Business), only receive 10% back. This does not work, I do not think that Frequent Miller Killed it, I do not think it ever worked. I can not find any confirmed cases of it working, not on Flyer Talk, Dr. of Credit, Reddit, Frequent Miller extra. there are some people who are guessing that it worked, but no confirmed cases. If you have both cards, the computer will some times credit 10% back to the business card, and others to the personal card. you can pay with a non-JetBlue card and you will still get 10% back. And yes I know if you read through the terms and service and F&Q nowhere does it say that you can not stack it, but the computer is programmed to only do one rebate and to pick the largest of whatever you have linked to the account. Thank you for publishing this article, even if this trick does not work. I learn a lot from you guys.

Jake

Confirming Jake’s point; just got 10% back on a trip I took four days ago (first jet blue flight in a few years), but not 20%, and I hold both personal and business cards on the same account.

Yes, this has been dead for a long time now. I’ll add a note.

Clap.clap.clap.

Well done, killing a great trick

OMG. Way to go FM. Kill it for everyone so you could make 35 cents from the clicks on this post.

[…] for award flights, making the return closer to ~4.78cpp. If you also own the JetBlue Plus card, you’ll get an additional 10% rebate which makes the return more like ~5.18%. That means that even when accounting for the 2.5% Plastiq […]

[…] in the first 90 days. That’s a valuable offer for JetBlue flyers that is augmented by the 10% rebate on award […]

Just today I got an email titled “Important changes to your JetBlue Plus Card Reward Rules.” It says it is “to clarify two benefits in particular: ” Mosaic for $50k calendar year spend, and the 10% back. I had never heard of this doubling up with two cards, but that’s what led me to this post. Still, nothing I see in the FAQ or Terms and Conditions that specifically states that it can’t be combined with other cards, etc.

cmon FM. u need to bust out some secret password protected posts. certain unintended glitches, aside from mistake fares, cant be posted like this for everyone on reddit to see and replicate. how u define “niche” and how the airlines look at a cost center are totally different. this entire game is “niche” under a certain lens, but we know how the banks feel about that.

[…] A JetBlue stacking opportunity hiding in plain sight? by Frequent Miler. This was one of those hidden in plain sight type of deals, I think it was in the comments on a lot of our JetBlue posts. […]

This seems to not be working anymore. Jetblue and Barclays both tell me that (although admittedly both were a little fuzzy).

[…] A JetBlue stacking opportunity hiding in plain sight? by Frequent Miler. This was one of those hidden in plain sight type of deals, I think it was in the comments on a lot of our JetBlue posts. […]

Thanks for the detailed write-up, and yes, it is posts like these that make me visit the site daily. I’d really like to see more details about the “citi grAAvy” train that some commenters have referenced (but not divulged) on several blogs. Like the jetBlue cards, it is easy to simply grab both the personal & business aviator for a quick 100k AA. While there is good info about churning barclay, the citi family brand limits + 24mo language make me puzzled when people keep talking about a current citi grAAvy train. Your usual maximize strategy post would be fine, I don’t want circles and arrows.

Check the churning reddit, its laid out pretty squarely there. 1 app every 8 days and 2 every 60 days. follow those rules and keep applying as long as you can meet spend. you need the invite codes to by pass 24mo language

Thanks for the info, that’s exactly what I was looking for on this subject.

So you just want it all laid out in circles and arrows to you. LOL

The day FM posted about opening 9 BOA cards for his Nesttler trip on single day , BOA executives noticed it…and brought the rule 2/3/4

While I do understand that bloggers jobs are to post on things like this, I’d really hate for this to die. Now that a few people have read it, can we delete it now?

So it’s ok for Dan and others to have written of this but it’s not ok here? I’m betting that if those of you that knew of this already did not, you would be saying thank you.

What difference does “headline” make? It is written the same way as all of FM articles.

BTW, all bloggers that I read share info from other blogs and give a H/T or link or credit where it is due, as did Nick. Why suggest that he is not being honest about his sources and “ripped off” Dan? Go write your own blog. Good grief.

Thank you FM for all that I have learned from you going on two years now, it has changed my travel life!

Same reason I wrote about Alaska 12BMs buried in articles which lived on for many years until blogs started making headlines about it. Headlines attract attention, BOFA execs said this themselves that the headlines were the reason it was killed.

It’s sticking it in their eye.

20% is dead now according to some DPs on DoC. Tried to make a post earlier but it disappeared due to moderation.

Been dead for at least 5 months according to DPs on DDF.

This is great, since I’d only fly MINT whenever it’s available on a route.

I’ve been posting this in JetBlue posts for years without feeling the need to make it headline news, surprised you never noticed it until now.

You’re on the clock now, let’s see how long this thing lasts now.

Neither Nick nor I noticed this before in any of your posts. If we had known about your approach to discussing it, but not headlining it, we would have followed suit.

Nick and I discussed the 20% angle as well as a more advanced, less legit option and decided that the less legit option shouldn’t be published at all (I think that people who try it will get accounts shut down). My take on the 20% angle is that it’s pretty niche: it only applies to those who fly enough on JetBlue to make it worth getting and keeping both cards (most airports around the country have very few Jetblue flights). Plus, I don’t think that either the bank or airline (whoever pays for the points in this case), would look at this and think that they’re losing a bunch of money because of it. People would have to hit it crazy hard to make a significant difference and to do that means getting both credit cards (which the bank would be happy about) and earning and then spending tons of JetBlue points. To me, all this really does is make JetBlue points *almost* as valuable as other airline miles that offer the chance to get outsized value for certain flights.

Could I have made the wrong call? Of course that’s possible, maybe likely. Time will tell.

Got to agree with Dan and others. By the time I finished reading the article, I had the feeling that this angle is gonna be doomed now. Like he says, you’re on the clock. Bloggers , (Including you Greg, with the 8 cards from BofA at the same time) have killed a lot of great deals. Being circumspect is good, even if it cuts back on commissions and referrals. This thing is getting harder to do on its own, it doesn’t need help.

Who is truely doing this on their own, without the help of bloggers? Good grief!

You didn’t follow the “discuss but not headline” because that’s not your style. You’re the guy if he won the lottery that would wear a shirt announcing it.

With B6’s new ex-Spirit CEO board member raising fees and such you can be sure this loophole gets slammed shut fast.

Looks like the 20% angle is dead now. 10% only. See here: https://www.doctorofcredit.com/increased-signup-bonus-on-jetblue-cards-60000-for-business-version-and-50000-for-personal-version/#comment-758171

https://www.dansdeals.com/points-travel/milespoints/chase-adds-jetblue-latest-airline-transfer-partner-transfer-points/#comment-1372836

Thanks for the link. I was wondering what Jessica was talking about above you. Further data points are a good indication this works.

As for those concerned that this post will kill it, we discussed that before posting and thought it likely wouldn’t and that knowing about it likely stands to do more good for readers than harm.

I’m 100% on your side team fm. Posting hacks is part of what bloggers do, if you want to keep it private don’t post it!!

“As for those concerned that this post will kill it, we discussed that before posting and thought it likely wouldn’t”. How did you reach that conclusion? This has been public knowledge for a while, but there was a good reason no other blogger screamed it from the rooftops by headlining it.

Dan’s a pretty experienced blogger, why do you think him along with literally every other competent M&P blogger haven’t headlined this?

Freequent Flyer wrote a decent article about the factors to consider before posting sensitive information.(http://freequentflyerbook.com/blog/2017/4/2/its-hard-to-know-whats-public-and-whats-private-these-days) The gist of it is, if it’s an obvious error / mistake (which this clearly is), don’t bring undue attention to it.

FM’s own post on what to blog (https://frequentmiler.com/2014/01/13/blogging-the-line/) include:

“Advertised deals are OK” – This is not advertised by B6, and has been kept purposefully lowkey.

“Pre-published deals are fair game . . . it is not just one-time exposure that can kill deals, but repeated exposure as well. I can’t argue with that” – If you were going to do this, at the very least don’t headline it;

“Dying deals are usually OK to publish” – This deal was not dying specifically because of the care people had taken to not headline it;

“Obfuscate as needed” – This clearly has not been obfuscated in the least.

The right way to have handled this would be to post it somewhere obscure and then have a post saying “Quick Jetblue Tips” that sent you there — true readers would have found it and been helped while the B6 fun police wouldn’t ever see it. But that would get less clicks so Nick decided to make an extra dollar and put to info on blast. If he really cared about helping readers, he’d think about HOW to spread the information rather than just doing it.

For those who didn’t click through that link I’ll just repost that comment because it’s gold:

“You just found the info, what else are you looking for? Better kept on the down low, though I’m sure some other blogger will rip this off and make a headline about it to ensure it gets killed quickly as has happened so many times in the past.” – Dan

August 26th 2018

I’ll make sure to send you the bill for the lost rebates when they kill this