Note: On January 8, 2016 American Express sent out a notice to a large number of Bluebird & Serve cardholders informing them that loading capabilities on their accounts had been terminated. For more information, see: Amex kills Bluebird and Serve for manufactured spend

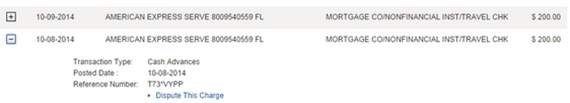

I posted earlier today that US Bank has started charging cash advance fees for Serve online credit loads. In response, several people informed me that the same is true for Citibank. In fact, PointsCentric tweeted a screenshot of his online statement:

This is a new phenomenon that began recently, around October 8th. So far, my loads using Barclaycard Arrival Plus still appear to be purchases.

Note that some banks are known to treat these loads as cash advances while the payments are pending. Once they move from pending to actual, they are treated as purchases. With US Bank and Citi, though, recent loads are being treated as cash advances even once they are no longer pending.

Please report below your experiences with Serve loads since October 8th. Please only include transactions that are no longer pending. Thanks!

Safe List

Here are cards that were reported by readers to be safe, along with the most recent date of purchase:

- Barclaycard

- Arrival Plus, October 9

- Priceline

- US Airways, October 9

- Capital One Venture

- Chase

- Freedom

- Southwest Premier, October 11

- Sapphire Preferred, October 9

- Marriott Business, October 11

- Ink Plus, October 10

- Fidelity Amex, October 12

- Nasa FCU Rewards Visa, October 11

Unsafe List

The following cards were reported to charge a cash advance fee for Serve reloads. Most recent reported date is listed:

- Citibank, October 9

- Bank of America

- Bank of America Travel Rewards

- Alaska Signature

- Travel Rewards

- Emigrant Direct Visa, October 8

- US Bank

- Club Carlson, October 9

- LifeMiles, October 30

Never miss a Quick Deal, Subscribe here.

Based on Doctor of Credit’s recent post, has anyone tried loading serve with the Citi AA AmEx recently?

Someone reported that Fidelity AMEX Serve loads count as cash advance now.

Interesting. Anyone have that happen? Fidelity Amex process as cash advance for a Serve load?

Our Fidelity AmEx card posts Serve as a purchase from a specialty retail store. This is from last week.

Transaction type:

Purchases

Merchant description:

MISCELLANEOUS AND SPECIALTY RETAIL STORES

Forgot to mention that they counted towards the $50 sign up bonus, too!

Sorry, couldn’t find info for Discover IT card. Does that charge cash advance fee with Serve reloads?

I don’t know for sure.

I was just trying to attach my usairways barclays mastercard to my serve account, I notice it won’t take it. The site is acting like it doesn’t understand the account number. testing out other cards numbers for visa/amex/mastercard, all work, but the first few digits of the us airways card seems to confuse it, but arrival mastercard doesn’t. (bank of hawaii business mastercard seems to have same issue)

any thoughts?

I’ve heard that some Barclay cards with a certain set of starting numbers (I forget the details) don’t work with Serve. I don’t know of a workaround.

Hi,

Does the Arrival card currently work to load Redbird, as a purchase, not as a cash advance?

Thank you.

REDbird can only be loaded in-store with a credit card. In-store all credit cards count the transaction as a purchase, so yes, Barclays is fine.

Got it. Thanks a lot!

Hi,

Does Arrival card currently work to load Serve, as a purchase, not as a cash advance?

Thank you.

Does anyone know if it’s safe to use a Chase Ink BOLD card with Serve?

Thanks for all the info everyone! I’m looking to get a Serve card, but I want to make sure I can actually use it first.

If not, perhaps I should just switch to a Chase Sapphire or that allegedly amazing Bardclays card.

Thanks!

I could be wrong, but my understanding is that the Ink Bold won’t work since it is a charge card without cash advance capability. And since Chase preauthorizes Serve loads as cash advances (but later changes them to purchases), loads with the Ink Bold would be denied.

After recently switching from Bluebird to Serve I have been unable to upload via credit card. Error message stating “We’re sorry, something went wrong! Please try again.”

This is with Arrival and us airways cards. Chase cards show as been declined by the bank. Any suggestions would be much appreciated.

Thank you

I loaded a chase card on Feb 14th and posted as purchase. What are your load dates? You must know that they can only store one credit and one debit card in the system. Once you use a different card you must verify with amex. I would call AMEX SERVE!

Do you have your cash advance limits set very low? It appears that Chase treats these as cash advances only for authorization but not for the final charge. So you might get denied trying to load the money if you don’t have a high enough cash advance limit.

Does Citi cards really count as cash advance when posted? Please advise!

THANKS!

Reports have been conflicting, so Citi may treat it as a cash advance on some types of cards, but not all. The safe approach is to not use a Citi card.

So is chase freedom card still safe to be used? I charged 200 dollars and my cash advance limit was reduced by 200. But once the transaction was posted, it was listed as sales and earned points. I am confused. Would love some clarification.

That has been my recent experience with Chase cards as well. I haven’t tried since December and it wasn’t the Freedom, but my cash advance limit was lowered, but it posted as a purchase.

Yes it appears that Chase treats these as cash advances only for authorization but not for the final charge. So it is safe

FrequentMiler,

I set the cash advance limit to $100 in my Chase card linked to serve.

I’ve been loading serve with $100 at a time every two or three days or so. I pay all other bills except any of my Chase accounts, to avoid the perception of cyclical transactions.

Do such routine $100 charges, raise a flag at Chase?

Does it raise a flag at Amex ?

If so, how best to do this safely under their radars?

I don’t think that would raise a flag

I lowered my cash advance to $100 but load random amounts, i.e. $490.66 or $277.12 but always end the month near $1,500 because I applied my serve account through softcard. I use my cc to pay purchases with little $$$ amount so that it shows I pay retail purchases with it and stay under the radar.

maifriend, Thank you.

But if your cash advance is $100, how can you load amounts greater than $100?

FrequentMiller, do you have any advice about the visa signature Chase mileage plus with Serve? Is it safe to load serve with it?

Yes I believe all Chase cards are safe

FrequentMiler.

I have been using my us airways card to fund my serve but after a month they closed my account because I was doing that. Us airways did not charge me any fees. What should I do now? Can I open a new serve?

What were you doing to unload the card?

@Gabriel Were the names the same on the load card and the SERVE? serve gets a cold headache if not and will close you down immediately as they say you have broken the terms and conditions…….married couples with different last names can find how punitive this can be………

Hi. I have the same question than Peter. Can you please clarify or help? Anyone? thanks in advance

I have the same question that Peter has. I am in the fence about using the visa signature Chase mileage plus with Serve.

How about other Chase cards such as Chase IHG and Chase Milage Plus?

What about Chase SW bus? will it treat as “purchase” and earn miles? Is it really true that Amex will not count to meet min spending?

Yes, Chase SW business cards are fine. Yes its really true that Amex will not count to meet min spending (nor will it earn points).

On AMERICAN EXPRESS CARDS:

I have confirmed with calls to Amex CREDIT CARD customer service that, even if Amex Serve loads are counted as regular purchases (not cash advances), those loads still do not count towards spending thresholds or points/miles/etc. If you look carefully at your Amex bills, you may notice the number of points or miles you have been awarded each month do NOT include your Serve load transaction totals.

On CITIBANK:

I called Citibank and they said that American Express began reporting the Serve load transactions differently — they used to come through as “purchases” and are now being coded as “quasi-cash”, and Citibank had always considered that a cash advance. So it’s not really true that Citibank has changed its policies, the change was at SERVE.

Citibank was nice enough to undo SOME of my transaction fees after some very persistent prodding. YMMV.