Amex gives taxpayers a nasty tax day surprise, Bilt plays a late April Fool's Day joke and…is it time to say goodbye to one...

United Airlines is facing a formal complaint after not returning someone's Chase points, a spiffy Asian carrier starting new route from the US and...

The worst US cities for bedbugs, American Express opens up the world's largest Centurion Lounge in Atlanta and are credit card rewards taxable? All...

You might not like paying taxes, but when you pay taxes via credit card can be quite rewarding. The key is to earn credit...

American Airlines plays demolition derby with passengers' wheelchairs, CLEAR is "upgrading" to facial recognition and a Southwest flight attendant rescues mother from screaming baby....

There's a tax ruling which will be of interest for anyone who manufactures spend (and even those who don't) as the IRS was trying...

It's tax season - yay!

For several years, Greg has maintained a resource advising how to earn rewards when paying your taxes by credit card...

Update 3/23/20: In case you missed it, the IRS has also extended the deadline to file. You now have until July 15, 2020 to...

This is just a quick reminder that second quarter estimated taxes are due in a couple of days. And for those who haven't yet...

Up to date information about paying taxes by credit card can be found here: .

Third quarter estimated taxes are due this Friday, September 15th. ...

Today is the last day to pay your 2016 taxes and first quarter 2017 estimated taxes. Did you know that you can pay those...

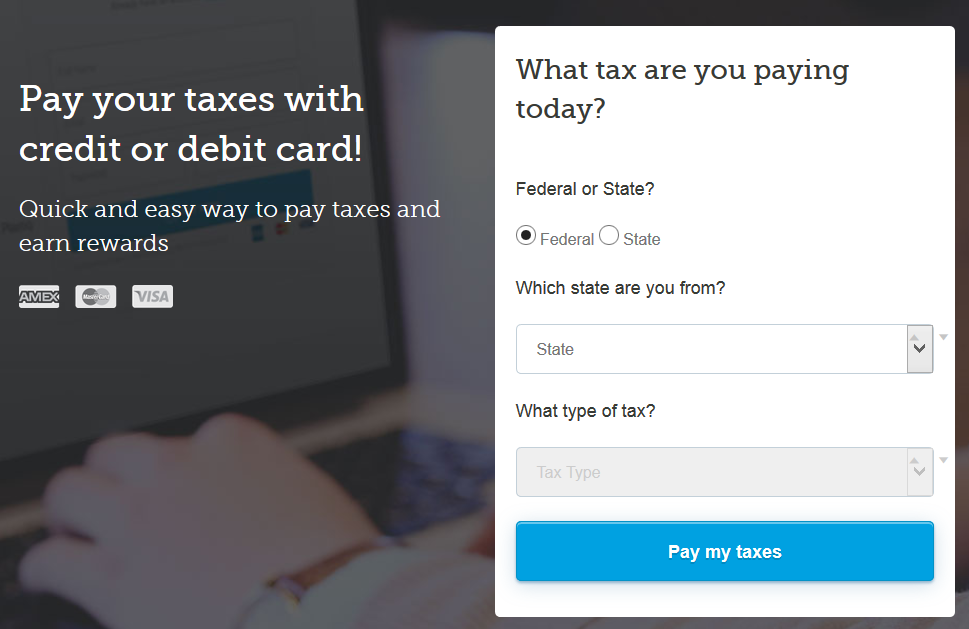

For those readers interested in paying federal income taxes via Plastiq, this is a quick reminder that there are less than two hours left to...

Preparing taxes is no fun. No fun at all. But paying taxes doesn't have to be painful. In fact, paying federal taxes can be...

The bill payment service, Plastiq, has just announced a promotion in which you can pay your federal or state taxes with a MasterCard credit...