Separately, I tackled the question of which program offers the best transfer partners; and on our podcast, Nick and I discussed more broadly which program was best overall (there are other important factors besides transfer partners). With that info published separately, it was time for me to update this previously published scorecard…

In my opinion, transferable points programs are the most valuable points to accumulate. In many cases, points can be used at better than 1 cent per point value to book travel. Even better, points can be strategically transferred to airline and hotel programs when valuable awards are available. If you’re at all interested in free travel or luxury travel with points & miles, then you need to understand the basics of each of these transferable points programs.

In this post, we’ll compare the following transferable points programs (click each link for a guide to that particular program):

- Amex Membership Rewards

- Capital One “Miles”

- Chase Ultimate Rewards

- Citi ThankYou Rewards

- Bilt Rewards: We haven’t yet written a Bilt Rewards guide, but you can click here to see a list of our posts about Bilt.

- Brex Cash

What are transferable points programs?

Each of the card issuers covered here offer their own rewards programs. With each program, you can earn rewards points (which Capital One confusingly refers to as “miles”) through credit card sign up offers, credit card spend, and more. All of the rewards programs share common traits:

- Points can be redeemed directly for travel, merchandise, or (sometimes) cash back. Points are often worth most when redeemed for travel.

- Points can be transferred to airline and (sometimes) hotel loyalty programs. For example, Chase Ultimate Rewards points can be transferred to United miles or to Hyatt points, among other options.

- Points never expire unless you close your associated credit card accounts

Even though the programs are similar at a very high level, they are very different when you drill down.

Transferable Points Programs, Graded by Greg

| Amex | Capital One | Chase | Citi | Bilt | Brex | |

|---|---|---|---|---|---|---|

| Earn Points | ||||||

| Redeem for Cash | ||||||

| Redeem for Travel | ||||||

| Hotel Awards via Transfer Partners |

||||||

| Domestic Flight Awards via Transfer Partners | ||||||

| Luxury Flight Awards via Transfer Partners | ||||||

| Share Points | ||||||

| Keep Points Alive | ||||||

| Amex | Capital One | Chase | Citi | Bilt | Brex | |

| Summary Grade |

Transferable Points Programs Summary Grade Details

In order to determine a summary grade for each program, I assigned values to each grade as follows: A=4, B=3, C=2, F=0. Next, because I value some things more than others, I gave greater weights to the following program aspects: Earn Points (4x weight), Hotel Awards (2x weight), Domestic Flight Awards (2x weight), and Luxury Flight Awards (3x weight). These calculations resulted in the following scores:

- Amex: 3.4

- Capital One: 3.1

- Chase: 3.4

- Citi: 3.3

- Bilt: 2.8

- Brex: 2.1

I then “graded on a curve” and gave an A to the programs at the top, a B to the next, and a C to the last.

Details about all of the individual grades follow…

Amex Membership Rewards

| Amex | Grade Details |

|

|---|---|---|

| Earn Points | Amex offers a slew of options for earning points:

I particularly love that the no-fee Blue Business Plus card offers 2X everywhere on up to $50K spend per year (then 1X), and points earned with the card are fully functional (i.e. they can be transferred to airline and hotel partners). Amex also has great food-related earnings with the Amex Gold Card, which earns 4X points at US Supermarkets (up to $25K in purchases, then 1X) and 4X at restaurants worldwide. |

|

| Redeem for Cash | The only good way to redeem points for cash is with a Charles Schwab branded Amex card where you’ll get 1.1 cents per point. That said, this is the only program in the roundup where it’s possible to get more than 1 cent per point in cash. Details here. |

|

| Redeem for Travel | The only options to redeem for travel and get better than 1 cent per point value is to hold specific high-end cards. Even then, you only get high value for your selected airline or for premium cabin fares. | |

| Hotel Awards via Transfer Partners |

Amex supports point transfers to Choice Privileges (1 to 1), Marriott (1 to 1), and Hilton (1 to 2). Unfortunately, none of the supported hotel programs reliably offer better than 1 cent per point value (or half a cent per point value with Hilton), so it’s rare for these transfers to make sense. That said, Amex frequently offers transfer bonuses to Hilton and Marriott which can make these transfers worthwhile under the right circumstances. |

|

| Domestic Flight Awards via Transfer Partners |

Amex is the only program that supports transfers to Delta SkyMiles and Hawaiian Airlines. Often Delta runs award flash sales that offer very good value, usually for economy flights. Hawaiian Airlines rarely has good award prices, but it’s good to at least have that option. Unfortunately, Amex charges a small fee to transfer points to any US based airline. Via airline partnerships, Membership Rewards points can be transferred to a number of foreign airlines in order to get excellent award prices for flying domestic. Examples include Avianca LifeMiles or Singapore KrisFlyer miles for flying United; British Airways or Iberia Avios for flying American; Virgin Atlantic or Air France for flying Delta; and Singapore KrisFlyer miles or British Airways Avios for flying Alaska. |

|

| Luxury Flight Awards via Transfer Partners |

Amex offers quite a few partners that make it possible to redeem miles for very high value international awards. These include Air Canada Aeroplan, ANA, Avianca, and more. Best of all, Amex frequently offers transfer bonuses that can greatly increase the value of your points. For details on using miles for luxury flight awards, see our “Best ways to get to…” series. |

|

| Share Points |

Amex doesn’t allow point sharing with other people. You can indirectly share points, though: you can transfer your points to another person’s loyalty program as long as that person is an authorized user on one of your Amex Membership Rewards cards. |

|

| Keep Points Alive |

All you need is one Membership Rewards card open in order to keep all of your points intact. Even better, Amex has a couple of no-fee cards that give you full power to transfer points as needed. |

Capital One “Miles”

| Capital One |

Grade Details |

|

|---|---|---|

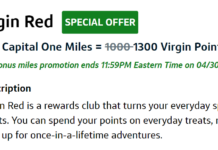

| Earn Points | Capital One points can be earned through credit card welcome bonuses and through spend. You can also earn through Capital One cash back cards like Savor or SavorOne and then move those cash rewards to a Miles earning card (like Venture) in order to convert the cash back to transferable points. Capital One shines with the ability to earn 2X everywhere, uncapped, with the Venture X, Venture Rewards or Spark Miles card. | |

| Redeem for Cash | Whereas points are worth 1 cent each when redeemed for travel, they’re worth only half a cent each for cash back. |

|

| Redeem for Travel | Even though Capital One only offers 1 cent per point value for travel, the way they do so is great. With competing transferable points programs, you must book travel through the bank’s portal in order to use your points for travel. With Capital One you can purchase any travel with your credit card and then redeem points to reimburse those purchases. This is great because you actually earn points on these purchases as well. Even better, you can take advantage of sales, promo codes, portal rewards, members-only deals, etc. | |

| Hotel Awards via Transfer Partners | Capital One supports point transfers to Accor Live Limitless (1000 to 500 transfer ratio), Wyndham Rewards (1 to 1 transfer ratio), and Choice (1 to 1 transfer ratio). While it’s not a slam dunk, Wyndham can offer exception value at times, especially via Vacasa Vacation Rentals. | |

| Domestic Flight Awards via Transfer Partners |

Capital One doesn’t currently have any U.S. domestic airline transfer partners. Capital One “miles” can be transferred to a number of foreign airlines in order to get sometimes excellent award prices for flying domestic. Examples include Turkish, Air Canada, or Avianca LifeMiles for flying United; British Airways, Cathay Pacific, Etihad Guest, or Qantas for flying American; and Air France for flying Delta. Details about Capital One transfer partners can be found here. |

|

| Luxury Flight Awards via Transfer Partners |

Capital One offers a number of partners that make it possible to redeem miles for very high value international awards. These include Air Canada Aeroplan, Avianca, Cathay Pacific, EVA Air, Turkish, Virgin Atlantic, and more. For details on using miles for luxury flight awards, see our “Best ways to get to…” series. |

|

| Share Points |

Capital One lets you share points with anyone, anywhere. Awesome. |

|

| Keep Points Alive | Points don’t expire as long as you keep your account open. Capital One gets an A here because they make it easy to transfer points to another card (such as the no-fee Capital One® VentureOne® Rewards Credit Card which supports transfers to airline programs) or to another person. So, if you want to cancel a premium card, you can keep your points alive by moving points to a family member or to a no fee card. |

Chase Ultimate Rewards

| Chase | Grade Details |

|

|---|---|---|

| Earn Points |

With Chase, you can earn Ultimate Rewards points through credit card signup bonuses, spend-category bonuses, friend referrals, and even through bank account and/or mortgage promotions. Chase consistently has very high signup bonus offers for their cards, especially their business cards. Plus, they have great category bonuses. The best may be from the Chase Ink Business Cash card which earns 5X for cell phone, cable, and internet service and 5X at office supply stores, and 2X at gas stations and restaurants. Office supply stores such as Staples, Office Depot, and OfficeMax sell gift cards for other merchants, as well as bank gift cards. By purchasing gift cards from these stores, you can earn 5X rewards in far more categories of spend. One downside to Chase’s program is the fact that they won’t approve new credit card applications if you’ve signed up for 5 or more cards (with any bank) in the past 24 months. Another downside is that, unlike Amex, Capital one, and Citi, they don’t have a 2X everywhere option. |

|

| Redeem for Cash | Chase makes this simple. Points can be redeemed for a penny each. You can also indirectly redeem for cash back at better than 1 cent per point through Chase’s Pay Yourself Back feature. |

|

| Redeem for Travel | With a premium Ultimate Rewards card (Sapphire Preferred, Ink Business Preferred), points are worth 1.25 cents each for travel booked through the Chase Ultimate Rewards portal. With the ultra-premium Sapphire Reserve card, though, points are worth 1.5 cents each for travel booked through Chase. | |

| Hotel Awards via Transfer Partners |

Chase Ultimate Rewards points can be transferred 1 to 1 to Hyatt, IHG, and Marriott. Hyatt, in particular, can offer fantastic value. | |

| Domestic Flight Awards via Transfer Partners |

Chase has very good coverage of domestic airlines. They support 1 to 1 transfers to United, Southwest, and JetBlue. Additionally, via airline partnerships, Ultimate Rewards points can be transferred to a number of foreign airlines in order to get excellent award prices for flying domestic. Examples include Singapore KrisFlyer miles for flying United; British Airways or Iberia Avios for flying American; Virgin Atlantic or Air France for flying Delta; and Singapore KrisFlyer miles or British Airways Avios for flying Alaska. |

|

| Luxury Flight Awards via Transfer Partners |

Chase has fewer foreign airline partners than the other programs, and they’re missing some of the best options for booking international business or first class awards. That said, the addition of Air Canada Aeroplan was a big step in the right direction and so I moved this score up from C to B. For details on using miles for luxury flight awards, see our “Best ways to get to…” series. |

|

| Share Points |

Chase allows you to share points, but only with a person in your household. |

|

| Keep Points Alive | Points don’t expire as long as you keep your account open. If you want to cancel a premium card, you can keep your points alive by downgrading to a no fee card or by moving points to a no fee card. Or, you can move points to a household member. Chase didn’t get an A here because their no-fee cards don’t allow point transfers to airline and hotel programs. |

Citi ThankYou Rewards

| Citi | Grade Details |

|

|---|---|---|

| Earn Points |

Citi’s biggest downfall in this category is that they don’t offer many signup bonuses. Plus, if you sign up for one Citi ThankYou card, you have to wait 24 months after receiving the welcome bonus before you can qualify for another one. On the other hand, their cards offer fantastic earnings on spend. The fee-free Citi Double Cash Card offers 2 ThankYou points per dollar on all spend, and the fee-free Custom Cash card offers 5x on the category you spend most within a billing cycle (on up to $500 spend). Plus, the Citi Premier Card offers 3X at grocery stores, restaurants, gas stations, air travel, hotels, and travel agencies. Additionally, Citi makes it possible to earn points when redeeming points! With the Rewards+ card, you will automatically get 10% of your reward points back (up to 10K points per year) when redeeming ThankYou points from the Rewards+ card or from any card who’s ThankYou account has been combined with your Rewards+ card. For more, see: Citi’s awesome trio: Double Cash, Premier, Rewards+. Citi frequently offers targeted spend bonuses and, even better, will often offer great retention bonuses if you simply call and ask. |

|

| Redeem for Cash | Citi Premier and Prestige cardholders can redeem points directly for cash at a value of 1 cent per point. |

|

| Redeem for Travel | While you can redeem points for travel, you won’t get better than 1 cent per point value this way. | |

| Hotel Awards via Transfer Partners |

Citi doesn’t offer any hotel transfer partners. | |

| Domestic Flight Awards via Transfer Partners |

JetBlue is Citi’s only US-based airline transfer partner. Additionally, via airline partnerships, ThankYou Rewards points can be transferred to a number of foreign airlines in order to get excellent award prices for flying domestic. Examples include Turkish or Avianca miles for flying United; Cathay Pacific for flying American; Virgin Atlantic or Air France for flying Delta; and Singapore KrisFlyer miles for flying Alaska. |

|

| Luxury Flight Awards via Transfer Partners |

Citi offers quite a few partners that make it possible to redeem miles for very high value international awards. These include Avianca, Etihad, EVA Air, Turkish, Virgin Atlantic and more. For details on using miles for luxury flight awards, see our “Best ways to get to…” series. |

|

| Share Points |

Like Capital One, Citi lets you share points with anyone, anywhere. That’s great. Unfortunately, shared points expire after 90 days, so don’t transfer until you have a plan for how to use the points. Also, Citi has a 100K per year sharing limit. |

|

| Keep Points Alive |

With Citi, if you cancel a card you’ll lose all associated points even if you had pooled together your points with a card you still have open. This is extremely confusing and counter-intuitive. Instead, the only good way to keep points alive when you want to avoid an annual fee is to downgrade to a no-fee ThankYou card such as the Rewards+ Card. Note: Downgrading to the Citi Double Cash will not keep your points alive. |

Brex

| Brex |

Grade Details |

|

|---|---|---|

| Earn Points | Brex points can be earned through a welcome bonus, through spend, and sometimes through other specific promotions. Brex offers some compelling category bonuses such as 8x on Rideshare, 5x on Brex travel, and 4x on Restaurants. That said, many options for earning points with other issuers aren’t available: you can’t earn with multiple different signup bonuses, there is no “2X everywhere” card; you can’t earn points referring friends; etc. | |

| Redeem for Cash | Points can be simply redeemed for a penny each. |

|

| Redeem for Travel | While you can redeem points directly for travel, you won’t get better than 1 cent per point value this way. | |

| Hotel Awards via Transfer Partners | Brex doesn’t support any hotel program transfers | |

| Domestic Flight Awards via Transfer Partners |

Brex’s only US transfer partner is JetBlue. Via airline partnerships, Brex points can be transferred to a number of foreign airlines in order to get sometimes excellent award prices for flying domestic. Examples include Avianca LifeMiles for flying United; Cathay Pacific for flying American; Air France for flying Delta; and Singapore KrisFlyer miles for flying Alaska. |

|

| Luxury Flight Awards via Transfer Partners | Brex has a few transfer partners that make it possible to redeem miles for very high value international awards. These include Avianca Lifemiles, Cathay Pacific, Emirates, and more. Brex would get an A if they would expand to include ANA and/or Air Canada, Etihad and Virgin Atlantic. | |

| Share Points | ? | I suspect that Brex doesn’t allow sharing points, but I don’t know for sure. |

| Keep Points Alive | Points don’t expire as long as you keep your account open. And since Brex Cash is free, there’s no reason to close your account. |

For more details about each of the above transferable points programs, please visit our online guides:

Citi DC/Rewards+/Premier combo gives you a 1.1cpp on TYP up to 100k/yr.

Need to add an ease of approval rating. I know you’re very pumped about getting a Venture but some of us are still on the outside looking in. The idea of getting multiple SUB with Cap1 seems like a fantasy.

That would be useful, but truthfully I don’t have any idea of the current ease of approval. I’m confident that C1 is easier than before, but how it compares to the others is unknown.

Greg, are you aware that Citi TY points earned from the sign up promotion is NOT eligible for transfer anymore? Citi said those are “taxable points” & thus not transferable. bad news ……..

Are you talking about points earned from a checking account bonus? This is definitely not true for credit card signup bonuses.

I am talking about my Citi Premier card sign up bonus, was going to do a transfer, but do not see the 60k bonus points showing on transfer screen, so IMed with Citi CS, was told those are taxable points ….

I don’t know why you don’t see the option to transfer, but I guarantee you that the Citi CS was wrong. They just made something up because they didn’t know the answer.

Indeed, Citi TY Points earned from Checking Account bonuses *cannot* be transferred.

Additionally, Customer Service points (or, as I like to call them, “Apology Points”) for billing dispute corrections/inconveniences, etc are treated the same as Checking Account bonuses and also *cannot* be transferred. FYI

[…] Rewards is a transferable points program available through a number of Chase cards. In my comparison of transferable points programs, Chase Ultimate Rewards came out ahead of Amex Membership Rewards, Citi ThankYou Rewards, and […]

Yup you finally got it right, Greg (but maybe A+ for Chase, at least by comparison). Excellent analysis.

Giving Amex a B for hotel awards is quite generous. I’d say C at best, and that’s only due to occasional Hilton transfer bonuses.

Under 5/24, Chase = “A”. Stuck in 5/24 purgatory, Chase = “F”.

Isn’t there a way to cash out ThankYou points by the paying your mortgage option?

Yes, but I didn’t want to give Citi an A when they require a hack to cash out at full value

Yep. It requires a phone call to do. Call the Citi ThankYou phone line, say that you are redeeming the check for a mortgage, tell them the value you want to redeem in $25 intervals, tell them the bank you are cashing this with, and wait several days for the check to be mailed to you.

It should be noted that you do not have to actually be using it for a mortgage payment. There isn’t anything denoting that the check is specifically for a mortgage (if I remember correctly). A bank teller is likely to cash the check like any other standard check into your bank account.

Also, it is important to have the check correctly listed as the payee. When Citi sent my redemption check the first time it had a typo. I had to call them up and get it resent with the correct spelling of the bank to cash it.

I did this having a Citi Premier card, but I don’t believe it matters what type of Citi credit cards you hold. Simply that you are using the ThankYou points program.

Thanks for that info!

Since we don’t expect to travel anytime soon. Regarding Chase UR downgrade option. P1 downgrade CSR to CF or CFU and he will keep the points alive for how long?

Some time later this year P2 apply for CSP or CSR. Can P1 “points” from his CF/CFU be moved to P2 Saphire?

Thanks as always Greg, Nick and Stephen for all you do!!

Answers:

1) Points will stay alive as long as CF or CFU account is open

2) Yes, points can be freely moved from one UR card to another within household

[…] For more about transferable points programs, please see: Transferable Points Programs Compared. […]

[…] Transferable Points Programs: Amex vs Chase vs Citi vs Capital One […]

[…] think this was pretty good too, grades are very fair: Transferable Points Programs: Amex vs Chase vs Citi vs Capital One. And another one by Frequent Miler: Transfer partners: Chase vs. […]

My sense says AMEX rated too high and Citi too low

Another great synthesis article, and I think the letter grades work well.

To me, it looks like you based “potential value” on advanced redemptions. I understand why, since you have the separate “Transfer Partners Ease of Use” category. However, there’s really no way from that to tell what value to expect if you are more in the intermediate category and/or not willing to spend a lot of time on the phone, etc. The “dropoff” in value, from advanced to intermediate strategy, is not the same between the various currencies.

So, for me, I think a more useful organization would have been “Potential Value, advanced” and “Potential Value, intermediate”. Based on the recent Citi vs Chase transfer partners discussion (which I found to be really useful), it does seem there is a segment of your blog readers, myself included obviously, who just aren’t going to do the complicated redemptions that would make Citi transfers useful. Citi would get a C at best for intermediate transfer redemptions from me.

Anyway, maybe that’s overly complicated or just not realistic for you to estimate since everyone is going to have their own definition of how many hoops is too many hoops to jump through. But for me, intermediate is really what I should be basing my earn decisions on.

+1

Based on my experience, to obtain economy tickets, good cash back cards or Chase ultimate rewards are better choices. However, people heavily investing in the miles world often target business or first class tickets, so AMEx or Citi often works better, especially with their frequent transfer bonus to high value programs like virgin, avianca, flying blue.

Those are good ideas. You’re right about the meaning of potential value here. I thought I had captured the intermediate stuff with the ease of ease of use grade, but I guess not?

Agree with the conclusion. No matter you are a routine everyday shopper or a MS player, Chase UR and Amex MR are the top 2 program you should consider. I really don’t feel Capital one’s “mile” deserve a column in the table at all. Future maybe, but a far distance I guess.

U can use the one by their CO link for Hotels.com I’ll be applying in Mar . I’ll take that 10%. and hopefully it will b a 75K sign up too .CHEERs.

I think the grade given on earning points with Chase and amex are overly generous. While they have point earning cards, they are hard to get approved for.

Chase has 5/24 and Amex simply tells you, you won’t get a bonus. I only have 3 Amex credit cards and one charge, and already get this message.

Also, you didn’t mention the awesome 60k point Sapphire banking option. If you own investments, JP Morgan YOU INVEST makes it very easy to do a complete a count transfer online. Woot woot for chase. (My wife and I doing this is the equivalent of two large chase credit card sign up bonuses.

(a brokerage account transfer is called an ACAT transfer)

I understand what you mean about Chase and Amex signup bonuses, but can you think of any transferable points programs where points are easier to earn? Chase has 5X at office supply stores so it’s easy to manufacture chase points. Amex has about a bazillion different cards, so it takes most of us a very long time to hit the once per lifetime limit.

FYI, I did mention Chase banking: “and even through bank account and/or mortgage promotions”

My fault, most won’t qualify for Sapphire banking, but I think you will Greg, and if you need the points, you could double dip on this with your wife. We have individual brokerage accounts specifically for this kind of offer.

I’d also like to do a Citi offer someday, if they ever offer me TY points or AA miles to open up a checking account.

Go look @ their Margin interest rate if u do that first ..The one broker gave me 10 trades for free Tinking that was a big deal !! If ur moving somewhere and u like them points are a Plus that’s all .. Money is Money points are NUTTHING really.

CHEERs