The recently refreshed Citi AAdvantage Executive World Elite MasterCard includes travel protections. This was a surprise since Citi had dumped travel protections from their cards several years ago. Apparently someone on the Citi/AA team was smart enough to realize that travel protections are a good idea for a card that is intended to be used to purchase travel. Thanks to Frequent Miler Insiders member, Prash, I obtained the new benefit guide (you can download a copy by clicking here) and added details about the Executive card to this post. Read below to see how this card’s travel protections compares to other ultra-premium cards. Does the AA Executive Card offer the same peace of mind offered by Chase’s Sapphire Reserve or Amex’s Platinum cards?

Below you’ll find a summary of credit card travel protections provided automatically by various ultra-premium travel cards such as Chase Sapphire Reserve, Capital One Venture X, Amex Platinum, Citi AA Executive, and US Bank Altitude Reserve.

Caution: I’m far from an expert on credit card travel insurance. I did my best to read through the benefit guides to figure out what was covered and when, but I can’t promise that I got all of the details correct. For complete information, please consult your card’s benefits guide: Chase Sapphire Reserve, Chase Ritz-Carlton, Capital One Venture X, Amex Platinum Benefit Directory, US Bank Altitude Reserve, CNB Crystal Visa Infinite, Citi / AAdvantage Executive World Elite Mastercard, Citi Prestige

Credit card travel insurance overview

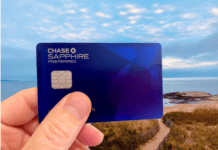

As you’ll see below, Chase continues to lead the field with the best automatic travel protections. Chase’s Sapphire Reserve card and their Ritz-Carlton card offer the same excellent travel protections benefits. They’re the only cards in the roundup to provide baggage delay reimbursements, and the only to provide emergency medical and dental coverage. Meanwhile, Amex Platinum cards offer a killer feature: Uncapped Emergency Evacuation and Transportation, even if you don’t pay for your travel with your Platinum card. If cost were no object, the ideal combination would be to pay for travel with your Chase Sapphire Reserve or Ritz card, but to also have a Platinum card in case you need more than $100,000 worth of emergency evacuation and transportation ($100K is Chase’s cap to that benefit).

How does the Venture X compare? It’s good, but not best-in-class. Its travel protections (provided by Visa Infinite) are nearly identical to USB’s Altitude Reserve, but Capital One’s card does not include $10K worth of emergency evacuation and transportation like USB’s card does.

How about the USB Altitude Reserve? Same answer as Venture X, above: it’s good, but not best-in-class. USB throws in $10K of emergency evacuation and transportation, but I’m not sure $10K will get you very far.

How does the new Citi AA Executive card compare? Not great, but it’s far better than nothing (“nothing” is a summary of protections that this card offered prior to mid July 2023). I do like that most of the coverage they offer is still available if you pay at least in part with your AA card or with your AA miles, but they fall short in other areas: 1) Rental car coverage is secondary within the U.S.; 2) Trip cancelation coverage payout is limited to the amount you pay with your card and/or with AA miles (if you pay for everything with your AA card and AA miles, that won’t be an issue, though); and 3) The card is missing other travel protections such as travel accident insurance, and emergency evacuation coverage.

The following chart summarizes travel protections provided automatically by each ultra-premium card. Cells in green indicate best in class coverage. “Pay partial” means that you can get full coverage even if you pay only part of your transportation costs with this card. For example, you could pay just the taxes and fees for an award flight. Or, you could pay part of a cruise with gift cards and the rest with your credit card.

| Chase Sapphire Reserve | Capital One Venture X | Amex Platinum1 | USB Altitude Reserve | Citi AA Executive2 | |

|---|---|---|---|---|---|

| Ritz-Carlton | Delta Reserve1 | ||||

| Bonvoy Brilliant | |||||

| Hilton Aspire | |||||

| Rental Car | Primary | Primary | Secondary3 | Primary | Secondary |

| Roadside Assistance | 4X / Year | $69.95 per Use | N/A | N/A | N/A |

| Trip Cancellation | Pay Partial | Pay Partial4 | Pay in Full5 | Pay Partial | Pay Partial6 |

| Trip Delay | 6 Hour Pay Partial |

6 Hour Pay Partial |

6 Hour Pay in Full5 |

6 Hour Pay Partial |

6 Hour Pay Partial |

| Lost Luggage | Pay Partial | Pay Partial | Pay in Full | Pay Partial | Pay Partial |

| Luggage Delay | 6 Hour Pay Partial |

N/A | N/A | N/A | N/A |

| Travel Accident Insurance | Pay Partial | Pay in Full | N/A | Pay in Full | N/A |

| Emergency Evac | $100K Limit Pay Partial |

N/A | No Limit No Pay Rqmt |

$10K Limit Pay Partial |

N/A |

| Emergency Medical & Dental | $2500 Limit Pay Partial |

N/A | N/A | N/A | N/A |

-

- Amex offers the same coverage for all versions of the Platinum card, including the Business Platinum card and Platinum cards branded with Schwab and Morgan Stanley. Similarly, the Delta Reserve consumer card and Delta Reserve business card share the same coverage.

- Travel protections are the same regardless of whether cardholders use AA miles or the AA Executive Card to pay for travel.

- Amex does offer primary coverage, but you have to pay extra for it. Details here.

- The Common Carrier ticket must be purchased using the covered Capital One Account and/or rewards programs associated with Your covered Account.

- Amex covers round-trip travel paid “in full” with their card, but “in full” includes situations where you pay full award taxes and fees or when you pay with Amex points for travel.

- You are covered when you pay partial, but coverage is limited to the lesser of the actual amount paid for with Your Citi Card (including AAdvantage miles) or the maximum coverage per Trip

Summary by insurance coverage type

Each of the tables shown below summarize the benefits available with each card. With each type of coverage, I’ve listed whether you must pay for travel with the card in order to get coverage. In most cases, it is OK to pay with points rather than the credit card directly (e.g. you can pay with Ultimate Rewards points for Sapphire Reserve coverage, or Membership Rewards points for Amex Platinum coverage, or AA miles for Citi AA Executive coverage).

Auto Rental Collision Damage Waiver

| Sapphire Reserve / Ritz | Capital One Venture X | Amex Plat, Delta Reserve, Bonvoy Brilliant, Hilton Aspire | Altitude Reserve | Citi AA Executive | CNB | Citi Prestige | |

|---|---|---|---|---|---|---|---|

| Primary? | Yes | Yes | No | Yes | Outside USA | Yes |

N/A |

| Limit per claim | $75K | $75K | $75K | $75K | $75K | $75K | N/A |

| Amount required to pay w/ card to be eligible for benefit | 100% | 100% | 100% | 100% | 100% | 100% | N/A |

| Where coverage is not available |

Israel, Jamaica, Republic of Ireland, Northern Ireland | Australia, Italy, New Zealand | Israel, Jamaica, Republic of Ireland, Northern Ireland | Israel, Jamaica, Republic of Ireland, Northern Ireland |

Roadside Assistance

Towing, jump-start, tire change, lock out service, fuel delivery

| Sapphire Reserve / Ritz | Capital One Venture X | Amex Plat, Delta Reserve, Bonvoy Brilliant, Hilton Aspire | Altitude Reserve | Citi AA Executive | CNB | Citi Prestige | |

|---|---|---|---|---|---|---|---|

| Limits | $50 per service; max 2 gallon fill-up, 4X per year; | N/A | N/A | N/A | N/A | None | N/A |

| Amount required to pay w/ card to be eligible for benefit |

None | N/A | N/A | N/A | N/A | None | N/A |

| Amount charged per use to cardholder if within limits |

$0 | $69.95 | N/A | N/A | N/A | $59.95 | N/A |

Trip Cancellation and Interruption

| Sapphire Reserve / Ritz | Capital One Venture X | Amex Plat, Delta Reserve, Bonvoy Brilliant, Hilton Aspire | Altitude Reserve | Citi AA Executive | CNB | Citi Prestige | |

|---|---|---|---|---|---|---|---|

| Limit per person, per trip | $10K | $2K | $10K | $2K | $5K | $5K | N/A |

| Max per trip |

$20K | $2K per Person | $10K | $2K | $5K | $5K | N/A |

| Amount required to pay w/ card to be eligible for benefit | Any part of travel arrangements |

Entire fare less less redeemable certificates, vouchers, or coupons |

Entire round-trip fare* | Entire fare less less redeemable certificates, vouchers, or coupons |

Any part, but… ** | Entire passenger fare | N/A |

* Amex covers round-trip travel paid “in full” with their card, but “in full” includes situations where you pay full award taxes and fees or when you pay with Amex points for travel.

** Will reimburse the lesser of the actual amount paid for with Your Citi Card (including AAdvantage® miles) or the maximum coverage per Trip.

Trip Delay Reimbursement

| Sapphire Reserve / Ritz | Capital One Venture X | Amex Plat, Delta Reserve, Bonvoy Brilliant, Hilton Aspire | Altitude Reserve | Citi AA Executive | CNB | Citi Prestige | |

|---|---|---|---|---|---|---|---|

| # hours delay required | 6 | 6 | 6 | 6 | 6 | 6 | N/A |

| Max coverage per person per trip | $500 | $500 | $500 | $500 | $500 | $500 | N/A |

| Amount required to pay w/ card to be eligible for benefit | Any part of common carrier transportation | A portion of the Common Carrier fare | Entire round-trip fare* | A portion of the Common Carrier fare | A portion of the Common Carrier fare | Pay entire common carrier fare | N/A |

* Amex covers round-trip travel paid “in full” with their card, but “in full” includes situations where you pay full award taxes and fees or when you pay with Amex points for travel.

Lost Luggage Reimbursement

| Sapphire Reserve / Ritz | Capital One Venture X | Amex Plat, Delta Reserve, Bonvoy Brilliant, Hilton Aspire | Altitude Reserve | Citi AA Executive | CNB | Citi Prestige | |

|---|---|---|---|---|---|---|---|

| Max coverage per person per trip | $3K | $3K | $3K ($2K for checked bags) | $3K* | $3K** | $5K | N/A |

| Amount required to pay w/ card to be eligible for benefit | Any part of common carrier transportation | Purchase a portion of the Covered Trip | Full cost of transportation | Purchase a portion of the Covered Trip | A portion of the Common Carrier fare | Full cost of Common Carrier tickets | N/A |

* Lesser of the following three amounts: the original purchase price of the item(s), the actual cash value of the item(s) at the time of theft or misdirection (with appropriate deduction for depreciation), and the cost to replace the item(s).

** $2K per bag for NY residents; Up to $10K total per trip.

Baggage Delay Reimbursement

| Sapphire Reserve / Ritz | Capital One Venture X | Amex Plat, Delta Reserve, Bonvoy Brilliant, Hilton Aspire | Altitude Reserve | Citi AA Executive | CNB | Citi Prestige | |

|---|---|---|---|---|---|---|---|

| # hours delay required | 6 | N/A | N/A | N/A | N/A | N/A | N/A |

| Max coverage per person per trip | $500 ($100 per day) | N/A | N/A | N/A | N/A | N/A | N/A |

| Amount required to pay w/ card to be eligible for benefit | Any part of common carrier transportation | N/A | N/A | N/A | N/A | N/A | N/A |

Travel Accident Insurance

| Sapphire Reserve / Ritz | Capital One Venture X | Amex Plat, Delta Reserve, Bonvoy Brilliant, Hilton Aspire | Altitude Reserve | Citi AA Executive | CNB | Citi Prestige | |

|---|---|---|---|---|---|---|---|

| Max coverage per person per trip | $1M | $1M | N/A | $500K | N/A | $1M | N/A |

| Amount required to pay w/ card to be eligible for benefit | Any part of common carrier transportation | Entire common carrier fare | N/A | Entire common carrier fare | N/A | Entire common carrier fare | N/A |

Emergency Evacuation and Transportation

| Sapphire Reserve / Ritz | Capital One Venture X | Amex Plat, Delta Reserve, Bonvoy Brilliant, Hilton Aspire | Altitude Reserve | Citi AA Executive | CNB | Citi Prestige | |

|---|---|---|---|---|---|---|---|

| Max coverage per person per trip | $100K | N/A | No set limit | $10K | N/A | $10K | N/A |

| Amount required to pay w/ card to be eligible for benefit | Any part of trip | N/A | None | Purchase either a portion or the entire cost of the Covered Trip |

N/A | Trip purchased entirely with CNB card | N/A |

Emergency Medical and Dental

| Sapphire Reserve / Ritz | Capital One Venture X | Amex Plat, Delta Reserve, Bonvoy Brilliant, Hilton Aspire | Altitude Reserve | Citi AA Executive | CNB | Citi Prestige | |

|---|---|---|---|---|---|---|---|

| Max coverage per person per trip | $2,500 | N/A | N/A | N/A | N/A | N/A | N/A |

| Amount required to pay w/ card to be eligible for benefit | Any part of common carrier transportation | N/A | N/A | N/A | N/A | N/A | N/A |

American Express Platinum Emergency Evacuation and Transportation Coverage

It’s important to note that this coverage is part of the Amex “PREMIUM GLOBAL ASSIST HOTLINE” which is available to Platinum and Centurion cardholders, but not to cardholders of other ultra-premium Amex cards. In other words, cardholders of the following cards do not get this benefit: Hilton Aspire, Delta Reserve, Delta Reserve for Business, and Marriott Bonvoy Brilliant.

Detailed benefits of the hotline can be found by clicking here.

There is no requirement to pay for any part of your trip with your Amex Platinum card to use this benefit.

Here are the relevant terms from the above linked document:

Premium Global Assist Hotline can help you prepare for your trip with customs information and more. While you’re traveling more than 100 miles from home, coordination and assistance services such as lost passport replacement assistance, translation services, missing luggage assistance, and emergency legal and medical referrals are only a phone call away. Plus, we may provide services related to emergency medical transportation assistance. Card Members may be responsible for the costs charged by third-party service providers. Additional restrictions apply, see below.

Please note that any assistance provided by this benefit cannot be in violation of U.S. economic or trade sanctions.

Premium Global Assist Hotline Toll Free: 1-800-345-AMEX (2639) Direct Dial Collect: 1-715-343-7979

MEDICAL ASSISTANCE

Emergency Medical Transportation Assistance In the event that the Card Member or another covered family member (your spouse or domestic partner, dependent up to age 23, or age 26 if full-time student) traveling on the same trip itinerary as the Card Member becomes injured or ill while traveling and is seeking or has sought medical treatment, the Premium Global Assist Hotline medical department can assess the medical need for transportation and provide the service.

A medical evacuation may be provided at no cost to the Card Member or covered family member from point of illness or injury (when the Card Member or covered family member is under the care of a local medical service provider or facility) to a more appropriate medical facility or to a hospital near the person’s home as determined by the Premium Global Assist Hotline designated physician. The Premium Global Assist Hotline designated physician, in consultation with the local medical service provider or facility, will determine whether such transport is medically necessary and advisable. The event must be within the first 90 days of the trip and cannot be a pre-existing condition. A pre-existing condition is any sickness, illness, or injury that has manifested itself, become acute, or was being treated in the 60 day period immediately prior to the start of a trip. The person needing evacuation may need to complete a medical information release as required by the Health Insurance Portability and Accountability Act (a “HIPAA Release”), or provide authorization for next of kin to complete the release. Emergency transportation services in connection with the medical emergency may also be provided to a covered family member pursuant to the full Emergency Medical Transportation Assistance Terms and Conditions at the end of this document. Subject to additional important terms, conditions and exclusions. Please see full Terms and Conditions at the end of this document.

Very Important: Any costs for medical transport not authorized and arranged through the Premium Global Assist Hotline Program are solely the responsibility of the Card Member and such costs will not be reimbursed. Premium Global Assist Hotline does not cover medical expenses (with the exception of cost incurred during the transport) nor transportation of personal possessions including luggage.

Repatriation of Mortal Remains In case of death of a covered Card Member or covered family member (your spouse, dependent up to age 23, or age 26 if full-time student) while traveling with the Card Member, the Premium Global Assist Hotline medical department can provide the necessary administrative services to effect the transportation of the mortal remains back to the person’s principal place of residence or place of burial, whichever is closer. As an additional benefit, Premium Global Assist Hotline can pay for the cost of the transport and, subject to approval, the cost of a coffin or other encasement of the remains suitable for travel.

Regarding insurance coverage on the CRS or ritz …Will paying baggage fees with the card count as paying any part of common carrier transportation ?

BOOM! https://myvisainfinite.com/content/dam/vppPremium/premiumrewardselite/gtb/PremiumRewardsElite_GTB.pdf

Note: The AA Executive has “Secondary” rental coverage in the United States, but is “Primary” elsewhere. I will be using this card for a Europe rental to use up the $120 credit.

BOA premium card? Trip delay, baggage delay, cancellation/interruption, lost luggage, etc; but would welcome a more educated evaluation.

One thing I think it’s important to point out is that the Trip Delay and Trip Cancellation/Interruption policies are “named peril” policies and not “open peril” policies. That means that the situations they identify in the guide to benefits aren’t just examples of things that are covered, they are quite literally the only situations that are covered.

For example, Chase only covers 4 hazards for trip delay: weather, common carrier mechanical failure, terrorism, and strike.

If you’re delayed for 6 or 12 hours and it’s not due to one of those 4 hazards, you’re not covered. So the common problems lately like United cancelling flights because of aircraft/crew positioning problems, or delays due to ATC ground stoppages, or delays due to crew timeout / crew shortage are all not covered events. Even weather as a covered event needs to be a direct impact and not knock-on effects. So this last winter the first couple days of Southwest flight issues were covered, but the weeks that followed were not.

Kudos to you for this fantastic guide. Never realized that you don’t have to pay for trip with Amex Plat to get medical evacuation coverage, making that card and the Sapphire Reserve quite the dynamic duo. This info will help me with coverage for our free Carnival Cruise, which, of course, i wouldn’t be getting had it not been for Nick’s tips on parlaying player’s cards into free cruises. Frequent Miler is the best!

In order to avail yourself of Amex’s coverage you need to be admitted to a hospital for treatment and the Global Assist medical team has to reach a consensus with the local medical team treating you that it would be medically advisable to transfer you to a facility with improved capabilities.

It won’t pay for any aspect of your care other than the logistics specifically related to moving you from one facility to another.

Not to diminish the value of this coverage which can cover a very expensive piece of a very unfortunate event, but it’s important to understand the coverage is very narrow. If you search on CruiseCritic you can find several examples of people needing to use the ship’s on-board medical services, and none of that would be covered by Amex and those services are not cheap.

Are the benefits the same for Amex Business Platinum or any other Platinum?

+1

Yes, all Platinum cards have the same coverage.

Do these insurance benefits only for roundtrip airline tickets? Or I can just pay one way ticket, or can two one-way tickets work?

Two one-ways work for Amex. I’m too lazy to go find the verbiage but Amex explicitly states that as long as you are taking a round trip itinerary i.e. you are going to a place or several places and then returning home, one ways, multi stops, etc. all count as long as you pay for them with the Amex.

Could you consider adding the Bank of America Premium Rewards Elite card to the matrix?

Yep, I’ll add it in a future version

So valuable, thank you Greg! I have been looking for a summary like that.

If you ever consider expanding it I would love to see the CSP covered as there a slight difference but I am still wondering how it stacks up against the Venture X.

Good suggestion. I’ll see if I can squeeze it into a future version

Awesome, thank you!

Would love to see the same charts for the non premium cards, and please add a row to include the annual fee for each card.

Good ideas. I’ll consider for the future

Can you also add the Bank of America Premium Rewards Elite card to the list? Had no idea until I read Mango’s post below from 2 months ago that it offered Primary Rental Coverage.

Yep, I’ll add it to a future version

I think you made an error in the Roadside assistance for AX Platinum. It should be n/a across the board as per the summary table, the card does not provide Roadside coverage.

I don’t understand. Doesn’t it already show that it’s not covered?

It should n/a for the AX Platinum column in Roadside Assistance. While the first row says n/a other rows say, for example, that the amount charged is $0. IT should say n/a

Thanks for being the only site that includes Altitude Reserve in discussions. However, your information on the Hilton Aspire is incorrect. The Aspire does have Premium Global Assist Hotline as well as uncapped emergency medical transportation (evacuation) coverage, identical to the Platinum. (click on the Aspire benefit guide pdf here: Global Assist® Hotline¹ and Premium Global Assist® Hotline² | AMEX US (americanexpress.com). It also comes with

You are right! Delta Reserve and Bonvoy Brilliant cards also have this! I’ll update the post now.

Secondary car on the AA Executive makes the $120 Avis credit card less valuable for those who have a card with primary.

True