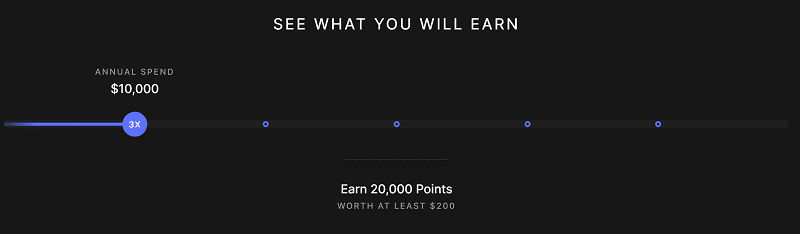

The X1 Card doesn’t yet exist except as a start-up marketing concept. They advertise that you can earn up to 4X rewards on all spend with no annual fee. Earning 4X requires referring others. Earning 3X requires only $15K spend per year. Points are worth “at least” 1 cent each. While it’s not available yet, you can “unbox yours” by “winter 2020”.

If you detect a bit of cynicism in the above paragraph then you’re on the ball. Well done. We’ve been here before with a too-good-to-be-true fee-free 3% everywhere startup credit card. Remember Zerocard which was just a few months from release in late 2016? They finally launched the card two years later (November, 2018). Then, in March 2020, they shut it down.

I thought I’d write about why this card will surely follow the same path as Zerocard. That’s no fun, though, is it? Who wants to read a cynical curmudgeon’s post? Not me. Instead, I decided to get creative. Let’s look at how the X1 team will succeed…

Overview

Here’s what we know about the X1 Card from their website and from Charlie at Running With Miles (who spoke with X1’s CEO):

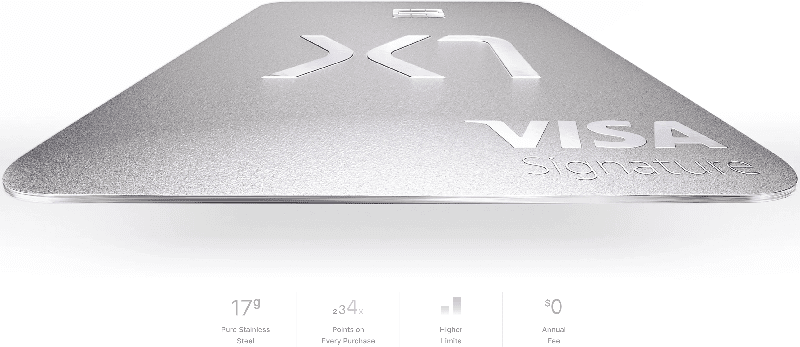

- Heavy metal: 17g “Pure Stainless Steel”

- Annual Fee: $0

- Late Fee: $0

- Foreign Transaction Fees: $0

- Virtual card numbers:

- “End free trials automatically with auto-expiring virtual cards”

- “Cancel subscription payments in one click”

- “Spend anonymously without disclosing your personal information”

- Higher credit limits: Credit limits based on both current and future income (not just current income). “X1 Card offers credit limits up to 5X higher than traditional cards. Higher limits mean you can spend the same amount with lower utilization, which can boost your credit score… Assumes an average credit limit of $4,479 granted to Generation Z, which is calculated by dividing their average total credit limit of $8,062 (source) by their average number of credit cards (1.8) (source). Actual credit limits subject to credit approval and underwriting.”

Rewards

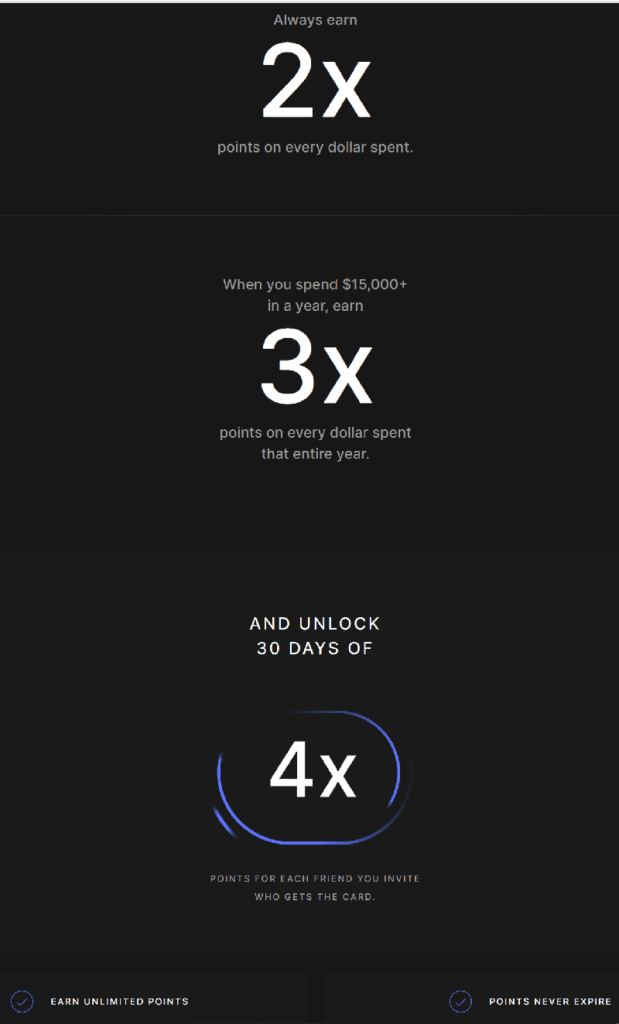

In general, the X1 earns 2 points per dollar if you spend less than $15K per year or 3 points per dollar if you spend $15K or more. It appears that the 3X rewards will apply retroactively once you reach the $15K threshold because the website states “When you spend $15,000+ in a year, earn 3X points on every dollar spent that entire year.” In other words, the first $15K should somehow earn 3X as well. I can’t find any info about whether “year” is defined as calendar year, membership year, or rolling year. My assumption is calendar year, but we’ll see.

There are two ways to earn 4X rewards:

- Upon startup: If you join the waiting list using a friend referral, you’ll earn “4x points on every dollar spent for the first 30 days.”

- Ongoing: For every friend you refer, you get 30 days of 4X earnings. It’s unclear when the clock starts on this. Is it immediately after your friend is approved? Once they activate the card? What if you are already earning 4X and another friend you referred is approved? Does the clock on 4X automatically start at the end of the current 4X period?

What are points worth?

The X1 website makes it clear that points are worth “at least” 1 cent each. Running With Miles, meanwhile, was told that value will go “up to 2 cents per point.”

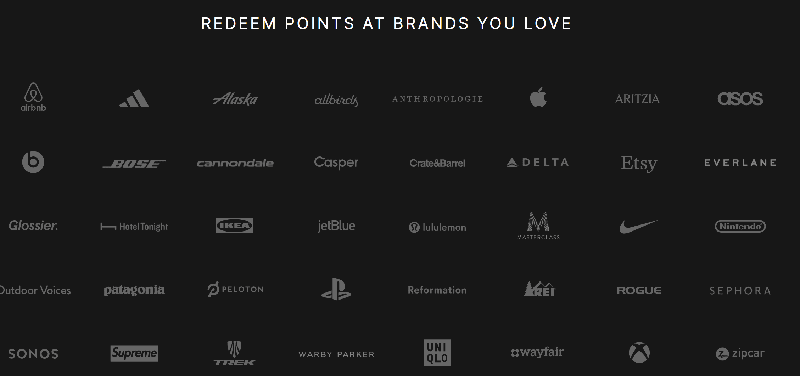

It appears that you can redeem points only for certain brands:

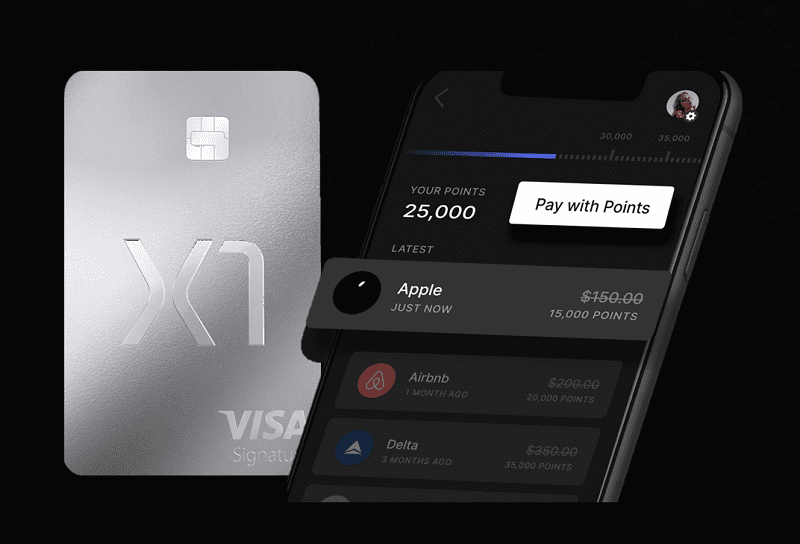

I believe that rewards will be in the form of gift cards. Take a look at the image below from the X1 website. The heading says “use points to pay for purchases in one click.” And each example shows a round number. You can pay 15K points for a $150 Apple purchase. You can pay 20K points for a $200 Airbnb purchase. You can pay 35K points for a $350 Delta purchase.

Based on the above image, I’ve decided (without any proof), that X1 rewards will work like this (sorted with my most confident guesses on top):

- You can redeem points for gift cards from select merchants

- If they offer an awards with more than a penny a point value, it will be for low value gift cards like Restaurants.com, Spa Finder, etc.

- Gift card values will be fixed. You won’t be able to choose a custom value.

- Gift card barcodes, codes, and PINs will be available immediately in-app (that’s how they can get away with saying that you can pay for purchases with one click).

- Gift card fixed values will vary by merchant (e.g. the example suggests that you can get a $350 Delta gift card, or a $200 Airbnb gift card, or a $150 Apple gift card)

- Redemptions start at 10,000 points ($100 gift card value)

How X1 will succeed

The credit card industry in the United States has established 2% cash back as the highest rewards a card issuer can sustain with a fee-free card. There are exceptions, but each involves a “but”. For example, you can earn up to 2.62% back with the fee-free Bank of America Travel Rewards card, but only if you have $100K+ invested with Bank of America, Merrill Edge, and/or Merrill Lynch. And you can earn 2X Membership Rewards points for all spend with the Blue Business Plus card, but that’s limited to $50K per year in spend. Plus, you need to know what you’re doing to get better than 1 cent per point value from Membership Rewards (details here).

So, if 2% is the most an issuer can successfully offer for all spend, how can X1 succeed when offering some cardholders 3X or even 4X? Here’s how…

How X1 will succeed with 4X rewards

Ironically, this is easier to explain than 3X. X1’s strategy here is simple. X1’s entire marketing budget (or at least the vast majority of it) will go into paying 4X rewards. 4X rewards are offered only when signing up new through a referral or when referring others. X1 is counting on its own cardholders to do the marketing for them. Other issuers pay tremendous amounts to acquire customers. They pay for advertising, they pay commissions to publishers, and they pay customers in the form of signup bonuses. X1 won’t do any of that. Instead, they’ll offer 4X for referrals. If/when certain cardholders abuse the system, they can always cut them off, block certain purchases from earning rewards, or lower their credit limits.

How X1 will succeed with 3X rewards

Not all cardholders will earn 3X rewards, but I think it is a safe bet that many will spend $15K per year to qualify. Here’s how X1 can succeed with offering 3X rewards:

- Rewards cost X1 less than face value: By providing rewards in the form of merchant gift cards, these rewards will cost X1 significantly less than face value. Many stores and online merchants sell 3rd party gift cards because they’re profitable. Suppose there’s an average 30% margin on the gift cards that X1 makes available. In that case, 3X rewards will cost X1 2.1 cents per dollar. That’s very close to the aforementioned sustainable 2% rewards rate. If there’s an average 20% margin on gift cards, then 3X rewards will cost X1 2.4 cents per dollar. That’s definitely much harder to sustain, but it’s at least conceivable that they can support it when combined with the following considerations…

- Rewards will go unspent (breakage): By providing gift cards only for set values (and with high minimum values), X1 ensures that customers won’t easily spend down their rewards. Suppose, for example, that you have 69,000 X1 points and you want to use them to buy a Delta ticket that costs around $620. And further suppose that the only Delta option X1 offers is to redeem 35,000 points for a $350 Delta gift card. In that case, you will only be able to use 35,000 of your 69,000 points towards your Delta flight. You’ll have to pay the other $270 out of pocket, and you’ll be left with 34,000 X1 points unspent.

- Some customers will earn 2X rewards: Even though I suspect that many cardholders will earn 3X, I’m sure that a significant percentage will earn 2X because they’ll spend less than $15K per year on the card. For these customers, rewards will cost X1 much less than 2 cents per dollar. Therefore, these customers will help X1 average out to 2% or less in rewards costs.

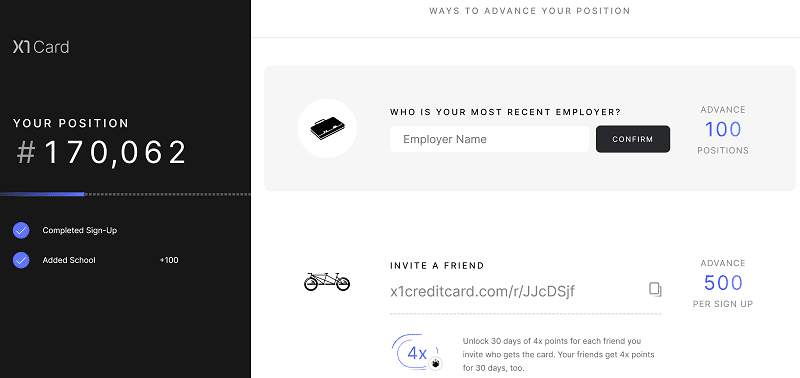

How to get the card

In exactly the same way that Zerocard did this several years ago, X1 is generating buzz by having people sign up for a waiting list to get their card. Once you sign up you’ll see your position on the waiting list. You’ll then be able to move up your position by giving X1 some personal information (What school did you attend? Who is your most recent employer?). And you can move up further by inviting friends. Friends benefit by getting 4X rewards on their first 30 days with the card.

If you’re interested in joining the waiting list and securing a month of 4X rewards, you can use my referal:

- Click here for my “invite a friend” link (Note: I don’t earn anything from this other than moving up the waitlist a bit)

- Click “Request an Invite” and then enter your name, email, and annual income to join the list.

Please don’t post referrals in the comments. I want the comments to be purely a discussion about the X1 card. If you want to post referrals, it appears that Running With Miles (where I first learned about X1) is allowing them in his comment section.

Bottom line

I started out skeptical that the X1 card would succeed, but in this post I convinced myself that it’s at least possible that it can.

Overall, I find the idea of the card compelling. A single fee-free card that earns 3% to 4% everywhere (assuming one spends at least $15K per year) is exciting even if rewards are as limited as I speculated above. And the idea of ending free trials automatically with auto-expiring virtual cards is genius. You’ll never be charged again when you forget to cancel in time. I can’t imagine that subscription services will be happy with X1 about this, but I’m also not sure they’ll have any recourse.

Will I sign up? Maybe, but primarily because I write this blog for a living and I like to get first-hand experience with cool new rewards toys. In general, I prefer to continue to earn 2.62% cash back for my “everywhere else” spend (with my Premium Rewards card) than 3% back in gift cards. As a blogger, though, it should be easy to get 4X through referrals. If so, I probably would go with the X1 for my otherwise unbonused spend. A lot of my spend, though, will continue to go on cards that earn 3X to 5X in transferable points currencies for certain categories of spend. The idea of earning gift cards is not nearly as exciting to me as earning travel rewards that can be used for first class flights and luxury accommodations.

See also:

- Best cards for everyday spend (X1 may end up on this list someday)

- Best Category Bonuses: Which card to use where?

![What’s in Greg’s wallet? [2022 Edition] a man holding a wallet with credit cards](https://frequentmiler.com/wp-content/uploads/2022/02/Gregs-Wallet-218x150.jpg)

Post-Covid (if that is a thing) 4x on stuff like income and property taxes even after paying 2% in fees seems worthwhile if you have a $100K combined tax bill.

I would worry more about their ability to sustain 2x rewards on a long -term basis. Outside of bloggers, specific people with businesses, and extreme gamers, most of us would run out of 4x referral bonuses pretty quickly. and as you said, it is just the marketing money anyways as they are not offering SUBs. If they want to crack down on 3x, all they have to do is to shut down accounts doing MS, and that will take care of most people running up huge volumes—obviously someone doing 24K a year is not an issue but those running million dollar spends. US bank has done that with mobile payments on Altitude and the message goes out pretty soon. and people learn.

All those cards with 2X rewards whether Amex blue business or citi double cash–arguably the rewards are higher than 2x here but let’s just assume 2x for argument’s sake— exist in an eco system. To wit, they serve as loss leaders to draw you into the citi or amex eco system where some cards make money and subsidize the ones which don’t. for instance, chase freedom with its 5 percent rotating categories is obviously loss making if someone does nothing except spend on those categories. Chase knows it but promotes it because the 5% cash back marketing is worth it. And then you start looking at other chase cards. Can someone with a single card sustain a no fee 2x card without a large number of people carrying balances? Even Barclays with its Arrival which incidentally has an annual fee seems to have given up. And Barcalys is an established player in the credit card market.

2X rewards should be easy for them to sustain if I’m right about the cost of providing gift cards. If there’s a 30% margin, 2X will cost X1 only 1.4 cents per dollar.

Here’s the question. How much is the cash return if you redeem for cash? One of my problems with many point based credit cards is the theory that is 3x or 3% return because ultimately when you convert it to a gift card or cash, this is usually not the case. Take the discover card for example. 5% on rotating categories but the money is in a monetary form. While they do give $5/gift card bonus they are not diluting the return when redeeming the points. So, I wonder if it is a straight 3% for cash. 3x points is meaningless when you compare other cards on the market that get close to that but would give you the cash if you requested.

My guess is that cash is not an option or if it is you maybe would get a half cent per point.

You see, then it’s not really 2%, 3% or 4% return because when you actually redeem it’s much less than that.

I’ve spoken with others (who don’t really care about the points/miles thing); for them, the main attraction of this card is the Virtual Account Numbers. Need more information on how X1 will implement this feature. Specifically:

*What will the VAN interface be like?

*Will it be smooth and easy to use?

*Can you easily set $ thresholds and expiry dates for the VAN’s?

*Will the X1 card watermark those VAN #s to your account for easy retrieval for your records?

*How will the X1 card handle product returns (where the credit goes back to the original form of payment)?

By way of comparison, the CitiCard VAN interface is laborious and horrible (as is the whole of the CitiCard account website, quite frankly).

If X1 can streamline the VAN interface experience for it’s customers, I might even get one of these cards.

This probably makes interesting reading for someone who knows what it is, but for the rest of us? I read the overview twice and scanned the list of benefits. OK, it’s “different”, it’s stainless steel, it has a bunch of benefits. Who issues it? What can you do with the “rewards”? I’m sure this is generating “buzz” but some of us are interested in knowing what we’re reading about. Without that basic information, all the rest is just … well, buzz.

If you do manage to get it, cash out ASAP

1. Tempting rewards thanks to VC money

2. Everyone signs up

3. “Wow look at this explosive growth!”= More VC money

4. “Oh wait we’re just spending other people’s money to look good to get even more money”

5.suddenly rewards get “delayed”, point redemptions get worse

6. Everyone bails now that gravy train has stopped

7. Company slowly withers and dies

There are other 3% CB cards. This thing looks DoA, just sleek enough to burn some VC money & then completely disappear.

You’ve got two points here that are really the same thing.

“Rewards cost X1 less than face value”

and

“Rewards will go unspent (breakage)”

The reason the GCs cost less in value is, in part, due to breakage.

Either way, X1 isn’t getting the direct benefit of the breakage – the merchant is.

I agree that gift cards cost X1 less partly because of breakage. But I wasn’t writing about gift card breakage. In the post, the breakage I was referring to is that X1 points will go unspent.

Doesn’t seem like there will be much breakage because as far as we know there isn’t a rewards expiration and there isn’t a physical gift card to lose. The points will just stay in the account until there is a merchant purchase to apply them to, which shouldn’t be too hard even with the current partner list (e.g. Apple).

I don’t think I’d value a merchant GC redemption like they are showing at more than about 65 cents on the dollar compared to cash.

The way I see it, especially now with Covid and trave. is an easy 3%. To me I can use the gift cards as if they were cash money. In the business world I know enough people that we can sort of setup a round robin to assure each other of 4% for at least a few months out of the year, maybe more. The airlines redmeptions are good. Apple at 4X is good. Airbnb for many people in the points and miles travelers would be good, I think there are be mroe gift cards available. I would not keep many points month to month. i would cash them in ASAP until the business model is proven, knowing that they may or may not survive.

The card sounds great, but the extremely limited redemption options makes it a hard pass for me.

At first I thought this Could work well , for individual situations. For example, an Alaska Airlines frequent flier — earn 3% toward the gift cards and then earn the miles for the flights on the back end. A bit of a double dip.

But then again that currently can be accomplished by purchasing flights via the Chase UR portal…in an easier fashion without the breakage you described. Although everyday earning is less using the CFU at an effective 2.25% (CSR holders)

Or buy airline gift cards (or airfare) from a place where you already earn 5x.

Right. Although not sure if there are any opportunities to get Alaska gift cards easily, certainly not at Om/Od/Staples for Ink 5x (like for Delta). Would love to know if any out there! Also my comparison was for the ‘everyday spend’ options for the Alaska flier, again as one example of the gift card options available via X1.

Redeeming X1 points for merchant gift cards has the opportunity cost of the UR/MR+Grocery Rewards I would have earned buying those same merchant gift cards optimally.

The limited selection of gift cards is a killer for this deal for me. So, I think I will sit back and just watch how it develops before applying.

Merely having Apple is a way you can buy items and liquidate them for cash. Maybe not 100% perfect?

I spend a couple hundred grand each year on un-bonused spend.

I’ve been looking for a card to fix that (or just put everything on Chase Business Unlimited and take the 1.5x and run)

So, I signed up on their email list, as, this *could* be a place for that.

The merchant list is… pretty sparse… which is my main concern.

I shop at Patagonia once every 3 years, and use Amex MR for Delta…

Anyway, like you, I’m interested to see how this develops.

Even 3x – towards gift cards or whatever… has to be similar to 1.5x on Chase UR (which, I actually can spend easily on all things travel).

God bless Capitalism though, love it!

Perhaps the first 50K on BBP then amounts over that on the options you discuss?