| Card Details and Application Link |

|---|

Marriott Bonvoy Brilliant® American Express® Card Limited Time Offer - 185K Points ⓘ Affiliate 185k points after $6K spend within the first 6 months. Terms apply. (Rates & Fees) (Offer Expires 5/1/2024)$650 Annual Fee Click here to learn how to apply This is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Recent better offer: None. this is the best that we've seen. FM Mini Review: Decent ultra-premium option for Marriott fans, especially those aiming for lifetime status tiers Earning rate: 3X airfare -on flights booked directly with airlines; 3X restaurants worldwide, 6X Marriott; 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Annual Choice Award with $60K calendar year spend Noteworthy perks: ✦ 85K Free Night Award each year upon renewal ✦ $300 dining credit per membership year ($25/mo) ✦ Platinum Elite status ✦ 25 elite nights credit ✦ Priority Pass membership (Lounges only) with 2 guests ✦ Global Entry fee credit ✦ Free premium internet at Marriott properties Note: Enrollment required for some benefits. See also: Marriott Bonvoy Complete Guide |

Bonvoy Brilliant Overview

The Bonvoy Brilliant card is pricey, but it is loaded with perks that can easily offset that cost. The combination of the $300 dining credit, automatic Platinum Elite status, and an 85K free night certificate (upon renewal) can make the card worth renewing each year — if you get good value from those perks.

| Bonvoy Brilliant Overview | |

|---|---|

| Annual Fee | $650 |

| Foreign Transaction Fees | None |

| $300 Dining Credits | Earn up to $25 back each month on dining and food delivery charges. |

| Free Night Award | 85K certificate each year upon renewal |

| Big Spend Bonus | Earn an Annual Choice Award after $60K calendar year spend. Choose 1:

|

| Automatic Elite Status | Platinum Elite |

| Automatic Elite Credits | 25 elite qualifying nights each year |

| Earnings from Spend |

|

| Travel benefits |

|

| Purchase protections |

|

Dining Credits

You can easily earn $300 per year back with your Bonvoy Brilliant card by using it regularly for dining spend. Each month, you will earn up to $25 in credits back for any purchases at restaurants or certain food delivery providers like Doordash, Grubhub, Uber Eats, etc.

If you want to use a different card for most dining spend (after all, there are many cards that are more rewarding at restaurants), here are some tricks for earning the dining credit easily each month:

- Reload your credit balance with any of these U.S. restaurants through their apps: Chick-fil-A, Dunkin' Donuts, Panera (buy gift card in-app), Starbucks, Wendy's.

- Buy a gift card in-store from any restaurant you frequent.

- Buy a restaurant gift card through the Toast app (Hat Tip Nun)

- The Fluz app offers a large selection of restaurant gift cards that code as restaurants when you buy them. In other words, buying one of these gift cards for $25 should trigger the $25 rebate. As a bonus, Fluz will give you a small cash rebate too. Gift cards bought through Fluz that qualify as dining purchases include Amazon Meal Kits, DoorDash, Groupon, GrubHub, Starbucks, Walmart Cafeteria, and many more. You can find a full list of qualifying Fluz gift cards at GC Galore. If you’re new to Fluz, below are our referral links. You’ll received 2 "boosts" when joining. Each "boost" is worth up to 25% back on select gift cards. We’ll earn $5 after you make your second purchase of $25 or more.

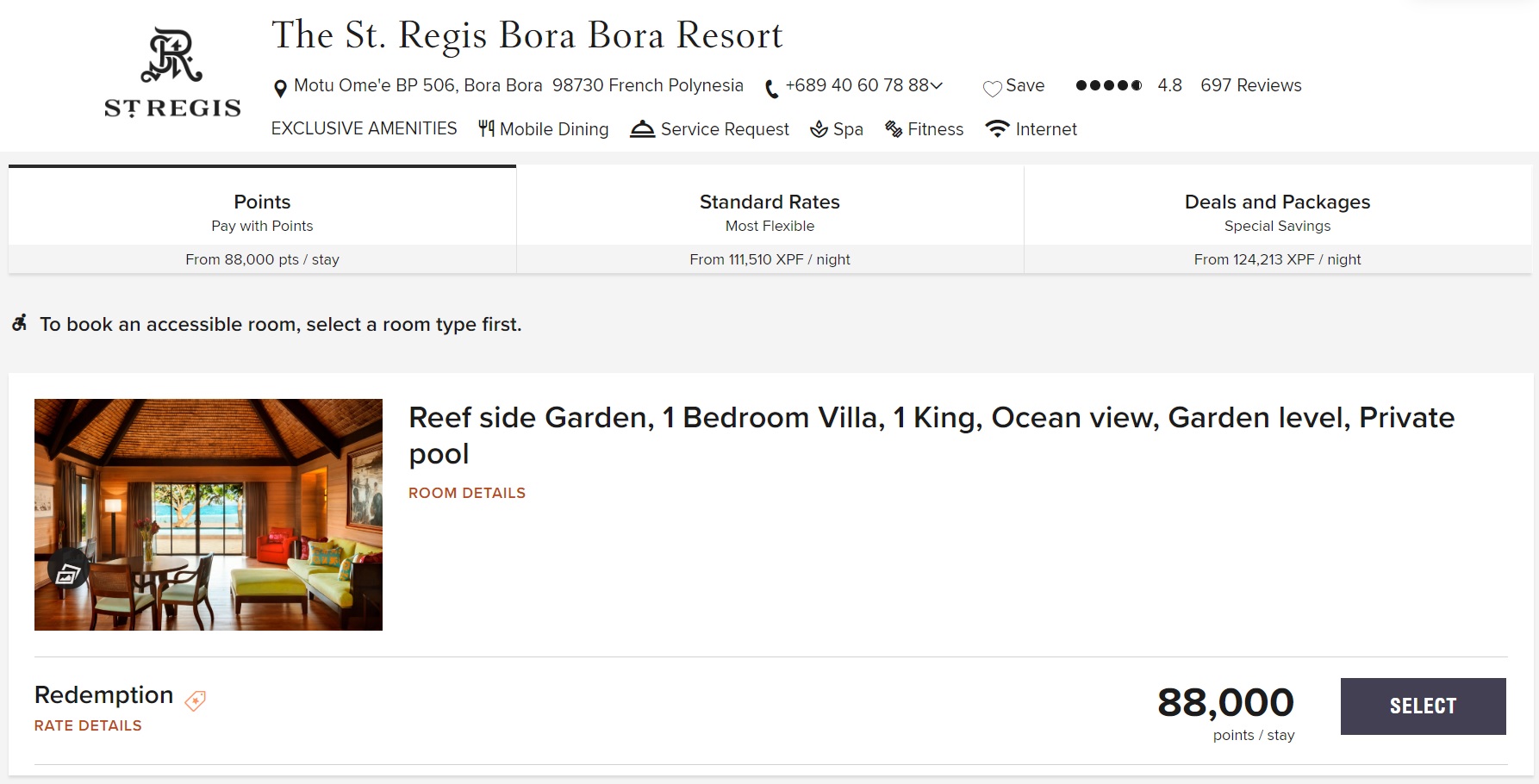

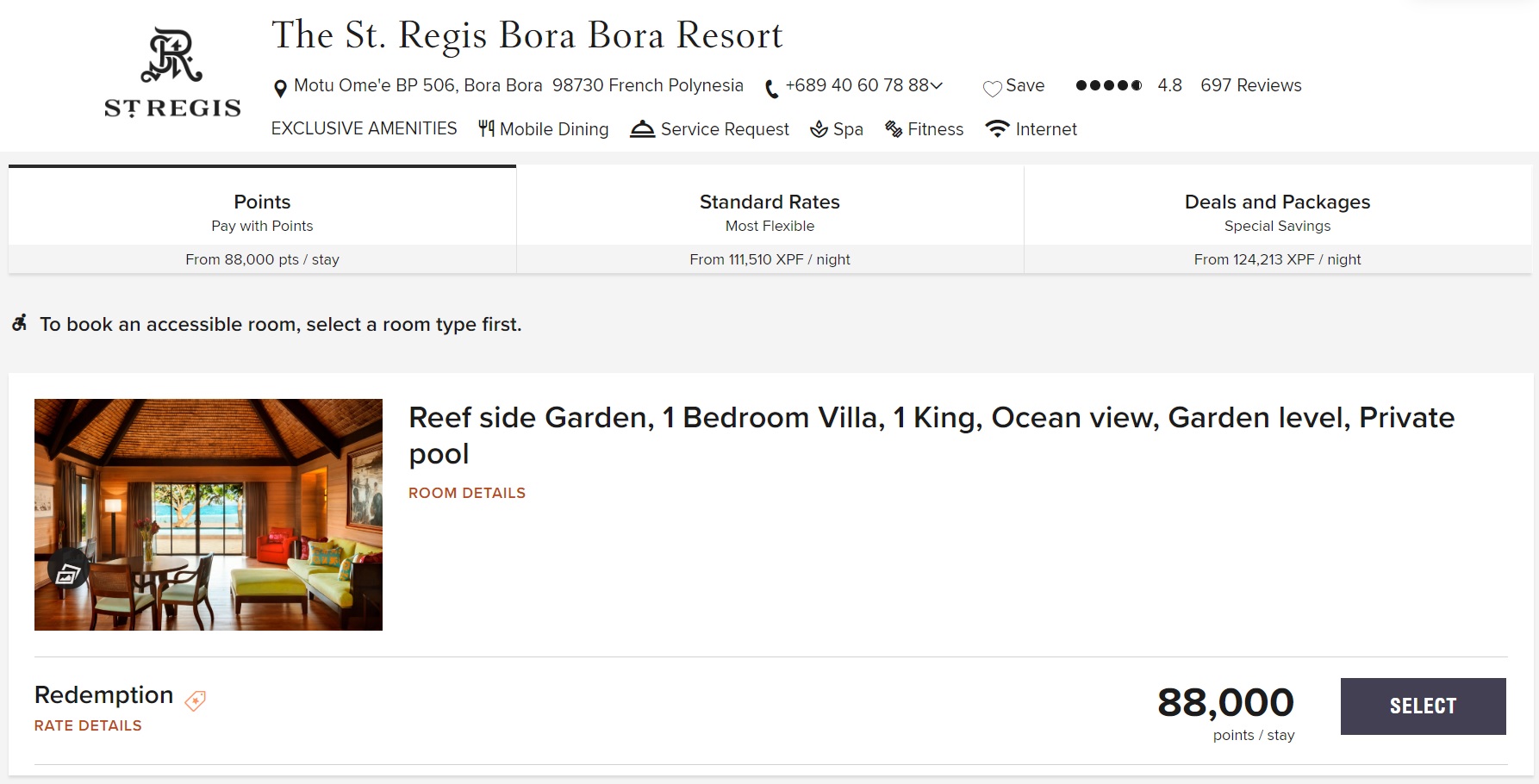

85K Free Night Award

Each year upon renewing your Bonvoy Brilliant card, an 85K Free Night Award will be deposited to your Marriott account. This can be used to pay for one night at any Marriott property that costs up to 85,000 points for the night. You can also add up to 15,000 Marriott points to the booking in order to book a night that costs up to 100,000 points.

If you use the certificate at a hotel that costs less than 85,000 points, there is no residual value to the certificate. Marriott would let you use it at a hotel that costs only 5,000 points, but then the certificate would be all used up, so please don’t do that. You also cannot use the certificate to cover multiple nights. For example, if a hotel costs 40,000 points per night, you might think that you should be able to use the 85K certificate to pay for two nights, but you cannot.

I recently found that the median value of Marriott points was 0.8 cents each. This means that half of the time you can get less value and half the time you can get more value. If you use the 85K certificate for a property that costs 85,000 points or more, this means that you have a 50/50 chance of getting at least $680 value from the free night certificate. In practice, though, you may want to use the certificate at a property that costs less. For example, if you use the certificate at a hotel that costs 75,000 points, then you have a 50/50 chance of getting at least $600 value.

Annual Choice Award

In order to earn an Annual Choice Award, you have to spend at least $60,000 on the card within a calendar year. Once you’ve done that, you’ll get your choice of the following:

- 85k Free Night Award

- Five Suite Night Awards

- $750 off a bed on Marriott Bonvoy Boutiques

85K Free Night Award: The 85K Free Night Award is probably the best choice in most situations. It’s easy to get over $600 value from one of these certificates and so this is like getting an extra 1% back (or more) on your $60,000 spend, but only if you use the certificate towards good value before it expires!

Five Suite Night Awards: Suite Night Awards can be valuable in certain circumstances, but they can also be frustratingly difficult to use. Each Suite Night Award is a one-night confirmable upgrade to a standard suite or select premium room, depending on the hotel’s availability of those rooms. The number of Suite Night Awards used must match the entire length of stay; it cannot be used for part of a stay (e.g., it cannot be used for the first two nights of a five-night stay). Once Suite Night Awards are requested to be applied to a stay, Marriott will begin checking upgrade availability 5 days in advance of your stay, up until 2pm on the day of your arrival. If your Suite Night Award request doesn’t clear, you’ll get the awards back to be used later. Caution: suite night awards can be difficult to use:

- Many Marriott brands do not allow the use of Suite Night Awards: The Ritz-Carlton®, Protea Hotels®, Aloft®, Element®, Design Hotels™, all-suite hotels, Marriott Executive Apartments®, Marriott Vacation Club®, EDITION®, The Ritz-Carlton Reserve®, The Ritz-Carlton Destination Club®, and Grand Residences by Marriott® properties.

- A frustratingly large number of individual hotels within participating brands do not allow the use of Suite Night Awards. The only way to find out for sure is to call and ask Marriott Member Services or to book a stay and try to apply your upgrades (but even that approach isn’t foolproof).

- You must use a Suite Night Award for every night of your reservation. If you have 5 awards, for example, you cannot apply them to a 6 night reservation.

- Once you’ve applied your Suite Night Awards to a reservation, Marriott begins checking for suite upgrade availability 5 days before your stay. If you are not upgraded 5 days beforehand, Marriott will check again each day up until the day before your stay. If the upgrade isn’t successful, the Suite Night Awards will be credited back to your account.

$750 off a bed on Marriott Bonvoy Boutiques: I’m not sure why anyone would want to spend $60,000 on this card in order to get a coupon for a bed discount. I bet you can find similar discounts by Googling or waiting for sales.

Elite Benefits

Marriott Elite Overview

| Elite Status Level | Requirements Per Year | Key Benefits |

|---|---|---|

| Silver Elite | 10 Nights | Late checkout, 10% point bonus |

| Gold Elite | 25 Nights | 2PM late checkout; 25% point bonus; welcome gift (points only); room upgrade; enhanced internet |

| Platinum Elite | 50 Nights | 4PM late checkout; 50% point bonus; welcome gift w/ breakfast option; room upgrade includes suites; lounge access; Choice benefit (such as 5 nightly upgrade awards) when you achieve 50 nights. |

| Titanium Elite | 75 Nights | All of the above, plus: 75% point bonus; United Silver Premier status via RewardsPlus; Ritz-Carlton suite upgrades; Additional Choice Benefit (such as 40K free night certificate) when you achieve 75 nights. |

| Ambassador Elite | 100 Nights + $23K Spend | All of the above, plus: Ambassador Service (dedicated Marriott agent); Your24 (Choose the 24 hours of your stay. For example, choose to check in at 9am after an overnight flight). |

Automatic Platinum Elite

The Bonvoy Brilliant card offers automatic Bonvoy Platinum Elite status. Platinum status gives you guaranteed 4PM late checkout (subject to availability at resorts); a 50% point bonus; complementary room upgrades, including to suites; lounge access at some hotels; and a welcome gift with a breakfast option at many hotels.

Platinum Elite status can be incredibly valuable at some hotels and almost meaningless at others. The lack of consistency in elite benefits between Marriott hotels is one of the most frustrating aspects of the Bonvoy program. For example, you might be treated like a king at a St. Regis hotel and barely acknowledged at a Ritz. And while some of that comes from individual hotel policies, this differentiation is actually baked into the program. Different brands have different requirements for supplying elite benefits. While St. Regis hotels have to offer daily free breakfast as a welcome amenity choice to Platinum elites, Ritz-Carlton hotels don’t have to offer anything but a few points.

25 Elite Qualifying Nights

Each year as a cardholder, Marriott will add 25 elite qualifying nights to your Marriott account. Since you will already have Platinum Elite status (which otherwise would require earning 50 elite nights per year), you might wonder why those elite nights would be useful. There are three reasons I can think of: 1) to earn Choice Benefits; 2) to reach a status level higher than Platinum; and 3) to inch you closer to Lifetime Platinum status.

Before we dive into each of these, it’s worth pointing out that you can automatically get 15 additional elite qualifying nights each year by holding a Bonvoy Business card. With both cards, you’ll start each year with 40 elite qualifying nights.

Choice Benefits

Every year in which Marriott Bonvoy members earn 50 elite qualifying nights and again at 75 elite qualifying nights, they are invited to select a Choice Benefit. Full details about Choice Benefits can be found here. For most people, I recommend the following options:

- 50 Night Choice Benefit: Select either 5 Suite Night Awards or 5 Elite Qualifying Nights (the latter can help get you closer to Titanium status)

- 75 Night Choice Benefit: Select either the 40K free night certificate or 5 Suite Night Awards.

Shortcut to Titanium Elite status

Titanium Elite status requires earning 75 elite qualifying nights each year. With 25 nights under your belt automatically, you’ll only need 50 more elite qualifying nights each year. Additionally, if you get a Bonvoy Business card, you’ll get 15 more qualifying elite nights each year and so you’ll only need 35 nights to reach Titanium. And if you pick 5 Elite Nights as your 50 Night Choice Benefit, you’re down to needing only 30 nights at Marriott hotels to earn Titanium Elite Status.

Titanium Elite status offers the following benefits (in addition to all of the benefits offered to Platinum Elites):

- 75% Point Bonus on paid stays

- United Airlines Silver Premier status

- Complementary suite upgrades (subject to availability) at Ritz-Carlton properties

Shortcut to Ambassador Elite status

The Bonvoy Brilliant’s 25 elite nights can also be a stepping stone towards top-tier Ambassador Elite status, but that requires both 100 elite qualifying nights and $23,000 spend per year at Marriott properties. The main advantages to this status are:

- Ambassador Service (a dedicated Marriott agent)

- Your24 (Choose the 24 hours of your stay. For example, choose to check in at 9am after an overnight flight).

Lifetime Elite Status

The Bonvoy Brilliant card can get you closer to Lifetime Elite status both with its automatic Platinum Elite status (which gives you additional years of status) and with its automatic 25 elite nights each year. Here are the requirements for Lifetime Status:

- Lifetime Silver Elite: Requires 250 lifetime nights + 5 years of elite status

- Lifetime Gold Elite: Requires 400 lifetime nights + 7 years of Gold elite status or higher

- Lifetime Platinum Elite: Requires 600 lifetime nights + 10 years of Platinum elite status or higher

Marriott does not offer Lifetime Titanium or Ambassador Elite status.

Earnings from Spend

The Bonvoy Brilliant card offers 6 points per dollar at Marriott properties, 3 points per dollar for airfare charged by the airline, 3 points per dollar for restaurants worldwide, and 2 points per dollar for all other eligible spend.

With Marriott Bonvoy points worth about 0.8 cents each at the time of writing, this card’s earning power is lackluster. For example, 3x for dining translates to a return of approximately 2.4% back. Considering that many cards offer an effective return on dining of 5% back or more (you’ll find a list here), 2.4% isn’t very good at all.

Overall, I think that the Brilliant card is a good choice for Marriott fans for its perks, but I don’t recommend using it for daily spend. One possible exception is if you know that you’ll get great value from the 85K cert that you can get with $60K spend. In that case, spending to exactly $60,000 each year may make sense.

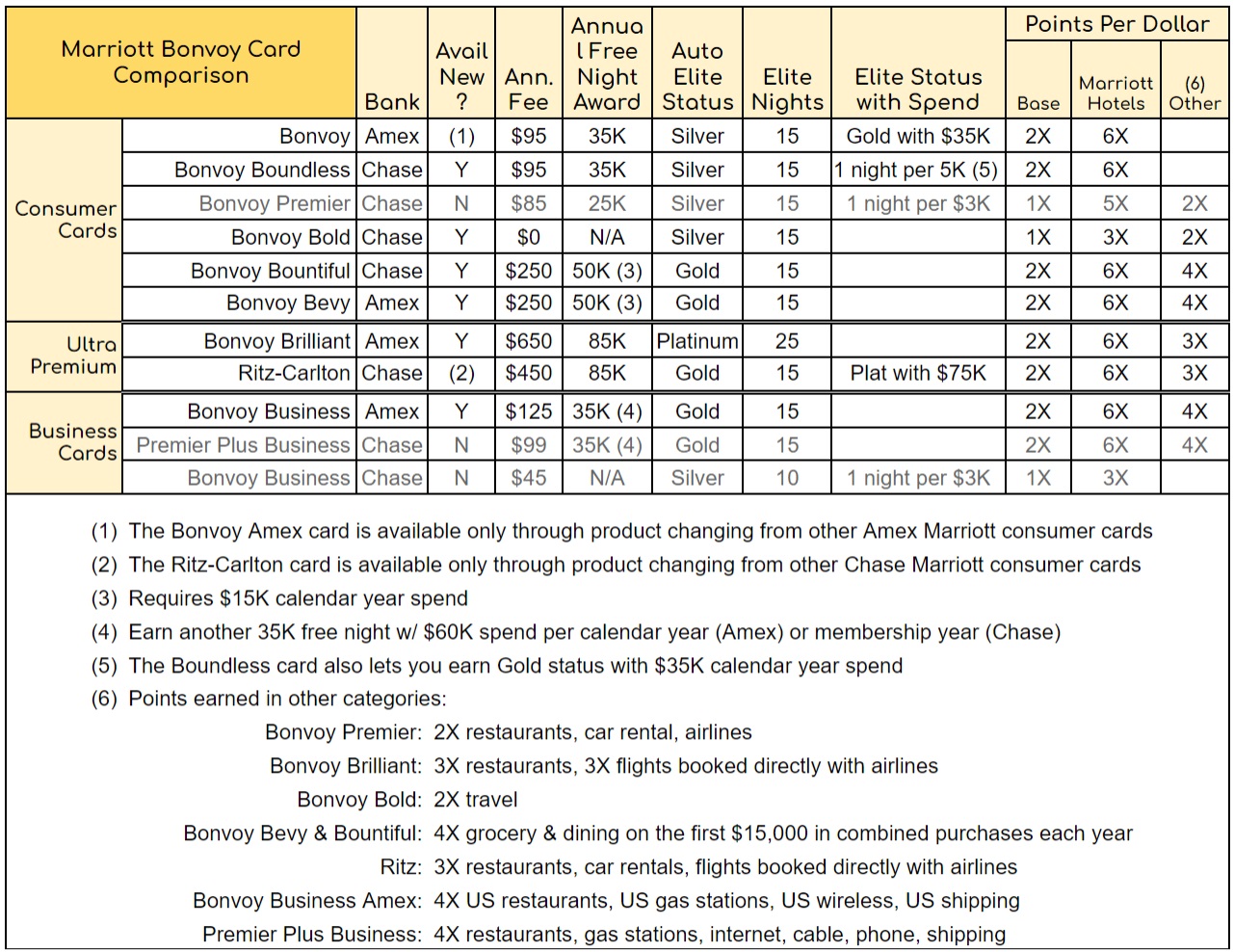

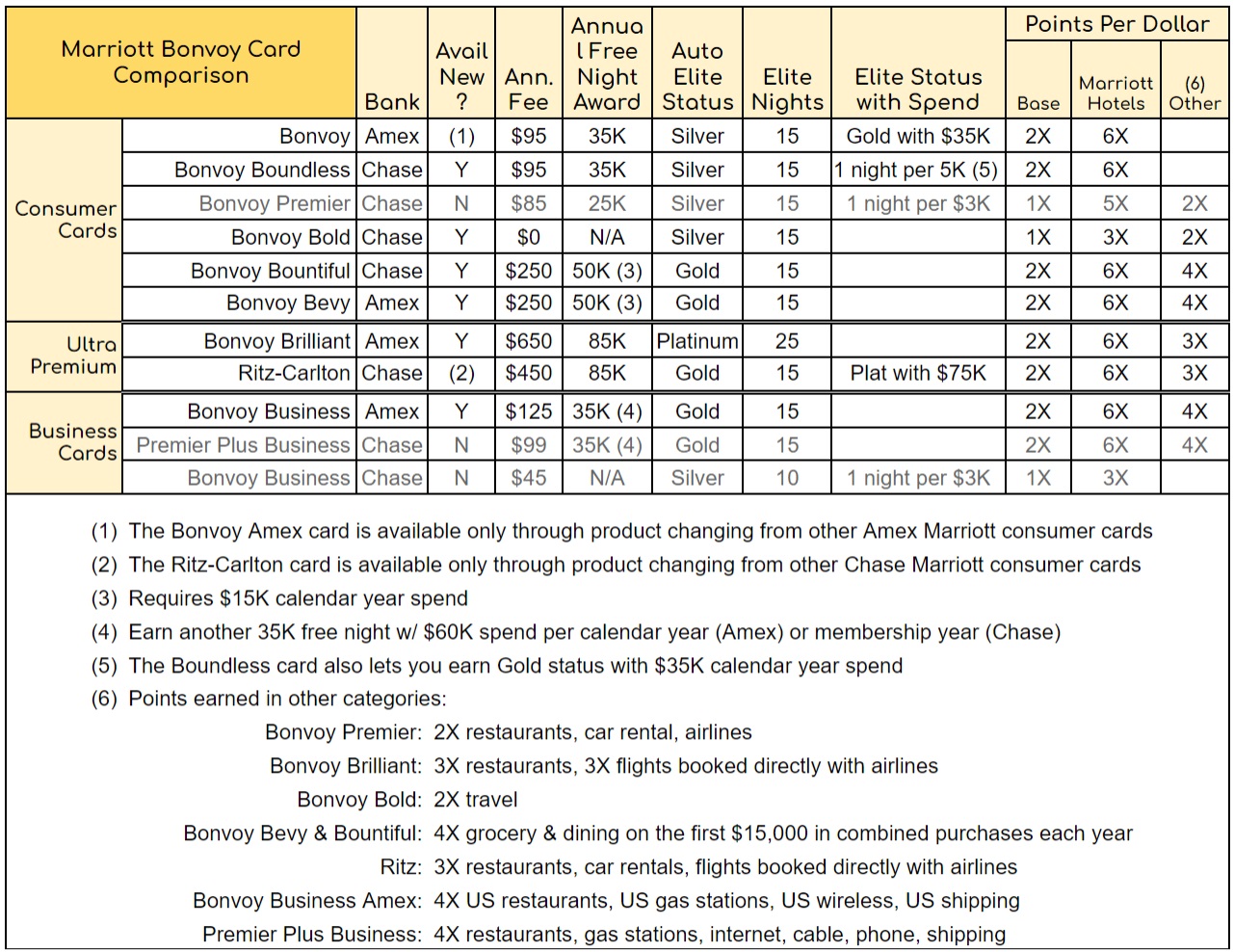

Bonvoy Brilliant Compared to other Marriott Cards

Below are all of the Marriott cards available today. Click a card’s name for more details:

| Card Offer and Details |

|---|

30K points ⓘ Friend-Referral 30K points after $1K in the first 3 months. Terms apply. No Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 50K points after $1K in the first 3 months and 50K points after 6 eligible paid nights at Bonvoy hotels. (expired 8/9/23) FM Mini Review: The best use for this card is probably to downgrade from the Ritz or Boundless card to avoid the annual fee. That way, you can always upgrade again when you need the annual free night or other perks Earning rate: ✦ 3X Marriott Bonvoy ✦ 2X travel ✦ 1X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Silver status ✦ 15 nights of elite credit each year See also: Marriott Bonvoy Complete Guide |

85K Points ⓘ Friend-Referral 85K points after $4K spend in 3 months$250 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: 6X Marriott.✦ 4X restaurants & grocery on up to $15K spend per year ✦ 2X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: One 50K Free Night Award after $15K calendar year spend. Noteworthy perks: 15 night credit towards elite status every year upon account anniversary ✦ 1,000 bonus points with each qualifying stay ✦ Gold elite status See also: Marriott Bonvoy Complete Guide |

Earn 3 Free Night Awards - Valued at up to 50K points each, up to 150K points total. ⓘ Affiliate Earn three 50k free night certificates after $6K spend in the first 6 months. Redemption level up to 50,000 Marriott Bonvoy(R) points for each bonus Free Night Award, at hotels participating in Marriott Bonvoy(R). Certain hotels have resort fees. Terms apply. (Rates & Fees)$125 Annual Fee Recent better offer: 5x50K free night certificates after $8K in spend (expired 3/20/24) Earning rate: 6x at Marriott Bonvoy properties ✦ 4x at restaurants worldwide, U.S. gas stations, wireless telephone services purchased from U.S. suppliers and on U.S. purchases for shipping ✦ 2x on all other eligible purchases. Terms Apply. (Rates & Fees) Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Earn an additional 35k free night certificate (can be topped-up with up to 15k additional points, subject to resort fees) after you spend $60K on purchases in a calendar year Noteworthy perks: Complimentary Marriott Gold elite status ✦ 15 Elite Night Credits each calendar year ✦ 35k Free Night Award every year after card renewal (subject to resort fees) ✦ Complimentary premium Internet access at Marriott properties ✦ Terms Apply (Rates & Fees) See also: Marriott Bonvoy Complete Guide |

3 x 50K Free Night Certificates ⓘ Friend-Referral Earn three 50K free night certificates after $3K spend in 3 months$95 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 5 x 50K free night certificates after $5K in spend (expired 1/9/24) Earning rate: ✦ 6X Marriott Bonvoy ✦ 3X gas stations, grocery stores, and dining on up to $6K in combined purchases each year ✦ 2X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn Gold status when you spend $35K each year ✦ 1 Elite Night Credit towards elite status for every $5K spent Noteworthy perks: ✦ Annual free night certificate for 1 night at a hotel redemption level up to 35K ✦ Automatic Silver status ✦ 15 nights of elite credit each year ✦ 1 Elite Night Credit for every $5K spent See also: Marriott Bonvoy Complete Guide |

Limited Time Offer - 155K Points ⓘ Affiliate 155K points after $5K spend in the first 6 months. Terms apply. (Rates & Fees) (Offer Expires 5/1/2024)$250 Annual Fee Recent better offer: None. this is the best that we've seen. Earning rate: 6X Marriott.✦ 4X restaurants & U.S. Supermarkets on up to $15K spend per year ✦ 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: One 50K Free Night Award after $15K calendar year spend. Noteworthy perks: 15 night credit towards elite status every year upon account anniversary ✦ 1,000 bonus points with each qualifying stay ✦ Gold elite status See also: Marriott Bonvoy Complete Guide |

Limited Time Offer - 185K Points ⓘ Affiliate 185k points after $6K spend within the first 6 months. Terms apply. (Rates & Fees) (Offer Expires 5/1/2024)$650 Annual Fee Recent better offer: None. this is the best that we've seen. FM Mini Review: Decent ultra-premium option for Marriott fans, especially those aiming for lifetime status tiers Earning rate: 3X airfare -on flights booked directly with airlines; 3X restaurants worldwide, 6X Marriott; 2X on all other eligible purchases Card Info: Amex Credit Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: Annual Choice Award with $60K calendar year spend Noteworthy perks: ✦ 85K Free Night Award each year upon renewal ✦ $300 dining credit per membership year ($25/mo) ✦ Platinum Elite status ✦ 25 elite nights credit ✦ Priority Pass membership (Lounges only) with 2 guests ✦ Global Entry fee credit ✦ Free premium internet at Marriott properties Note: Enrollment required for some benefits. See also: Marriott Bonvoy Complete Guide |

Are you eligible for this card?

If you already have any Marriott cards, you might not be eligible for a welcome bonus with the Brilliant card. That is, you can still get the card, but you might not earn a welcome bonus.

The following table shows the crazy rules in place for those seeking a second or third (or fourth, or fifth…) Marriott card:

| Card You Want | |||||||

| Cards You've Had (Or Recently Applied For) | Chase Bonvoy Bold | Chase Bonvoy Boundless | Chase Bonvoy Bountiful | Amex Bonvoy Business | Amex Bonvoy Brilliant | Amex Bonvoy Bevy | |

| Chase | Ritz Carlton | ✅ | ✅ | ✅ | ✅ | ⚠30 | |

| Bonvoy ($45 card) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |

| Bonvoy Premier | ⚠24 | ✅ | ✅ | ✅ | ✅ | ||

| Bonvoy Bold | ✅ | ⚠90 ⚠24 | ⚠30 ⚠90 ⚠24 | ||||

| Bonvoy Boundless | ✅ | ||||||

| Bonvoy Bountiful | ✅ | ✅ | ⚠24 | ||||

| Bonvoy Business ($45 card) | ✅ | ✅ | ✅ | ⚠30 | ✅ | ✅ | |

| Bonvoy Premier Plus Business | ✅ | ✅ | ✅ | ⚠90 ⚠24 | ⚠30 | ||

| Amex | Bonvoy | ⚠30 | ⚠30 ⚠90 ⚠24 | ✅ | ✅ | ✅ | |

| Bonvoy Business | ⚠90 ⚠24 | ⛔ | ✅ | ✅ | |||

| Bonvoy Bevy | ✅ | ✅ | ⛔ | ||||

| Bonvoy Brilliant | ✅ | ⛔ | ⛔ | ||||

| Eligibility Key | |

| ✅ | You are eligible for this card and welcome bonus |

| ⚠30 | Your are not eligible for a welcome bonus if you have had the card on the left within the past 30 days |

| ⚠24 | You will not be approved if you currently have or if you've received a welcome bonus in the past 24 months for the card on the left |

| ⚠90 ⚠24 | You are not eligible for a welcome bonus if you were approved for the card on the left within the past 90 days; or if you've received a welcome or upgrade bonus in the past 24 months. |

| ⚠30 ⚠90 ⚠24 | You are not eligible for a welcome bonus if you've had the card on the left within the past 30 days; or if you were approved for it within the past 90 days; or if you've received a welcome bonus or upgrade bonus for it in the past 24 months. |

| ⛔ | You are not eligible for a welcome bonus if you've ever had this card before (but the system seems to "forget" that you've had the card about 5 to 7 years after you cancel) |

Amex Application Tips

- Safe to Apply: Amex is usually the safest bank for trying your luck at earning a new welcome offer. Most of the time, they won’t issue a hard pull when denying your application or when approving you if you already have at least one Amex card. Plus, they’ll warn you during the application process if you’re not eligible for the bonus.

- Once in a Lifetime Rule: If you've ever had a card before, you are most likely prohibited from earning a welcome offer for that same card if you apply now. Fortunately you'll be warned during the application process if this is the case. Amex is known to "forget" that you've had a card after about 5-7 years. Note that there are frequently offers with no lifetime language (NLL) that aren't bound by this restriction.

- "Family" Rules: In addition to the "once in a lifetime" rule, Amex now applies additional "family" rules to several groups of consumer cards. These rules don't apply to business cards.

- Platinum/Gold/Green: You may not be able to get a welcome offer on the Green, Gold, Platinum, Charles Schwab Platinum or Morgan Stanley Platinum if you've previously had any of the Platinum cards previously.

- Everyday: You may not be able to get a welcome offer on the Everyday card if you've previously had the Everyday Preferred card.

- Cash back cards: You may not be able to get a welcome offer on the Blue Cash Everyday card if you've previously had the Cash Magnet, Blue Cash Preferred or Morgan Stanley Blue Cash Preferred cards. You're not eligible for a welcome offer on the Blue Cash Preferred card if you've previously had the Morgan Stanley Blue Cash Preferred card.

- Delta cards: You can get a welcome offer on any of the Delta cards provided you've never had a more expensive Delta card than the one you are applying for. So, for example, you're eligible for a welcome offer on the Delta Reserve if you've had the Delta Gold, but you may not be eligible for a welcome offer on the Delta Gold if you've previously had the Reserve.

- 2 per 90 days: You can get at most two credit cards within 90 days. This rule usually does not apply to Pay Over Time (charge) cards.

- Marriott cards: Approval for any Marriott card is governed by a labyrinthine set of unintuitive rules. You can see the full eligibility chart here.

- Card Limits: Amex normally only allows customers to have five credit cards and ten charge cards at one time. Both personal and business cards count towards the respective five and ten card limits. There are some instances where certain customers have been allowed to go above those limits.

- Application Status: Call (877) 239-3491 to check your application status or use this link.

- Reconsideration: If denied, you can call (800) 567-1083 and ask for your application to be reconsidered.

Bottom Line

The Bonvoy Brilliant card is super expensive and it’s not very rewarding to use for spend. So why consider it at all? The reason to consider the Brilliant card is for its perks. The card’s $25 per month dining credits help reduce the card’s overall cost, and the card’s free night certificate and elite benefits offer significant value. Under the right circumstances, the free night certificate (which you get each year after renewal) alone can be used to book a hotel night that costs as much as the card’s annual fee. And for those who stay in Marriott hotels often, Platinum Elite status can be extremely valuable (but keep in mind that at some properties Platinum status can be nearly worthless).

You guys need to update this one

Done

I used the Amex messaging customer support for Amex Bonvoy Brilliant card. Told them I was considering to close the account. They gave me a nice retention offer. Spend $2000 in the next 90 days, and get 75000 Marriott Points. I accepted it! Will try again when the annual fee hits next year 🙂

[…] Marriott Bonvoy Brilliant: 125K + Platinum Status […]

I am still unclear on this.

I have the AMEX Bonvoy personal card (the original SPG card). Can I now get the AMEX Brilliant card as well? I would have thought not, but your “rules” don’t seem to say that.

Yes I believe you can

Thanks for the reply. Now I see your notes say (Offer Expires 1/13/2021).

Do you know what the “normal” or previous offer was?

No, I don’t remember for sure. It might have been 100K points before. Definitely didn’t offer Platinum status before

OKAY, thanks. I am working on 3 other bonus spend requirements right now, but I will try to get this one in early January when I can pre-spend more if need be to meet the requirements.

Of course this all hinges on whether or not we can travel safely in the second half of 2021. I have now 30 free Marriott nights and the Platinum status will help a lot. Plus we (P1 & P2) should also have Hyatt Globalist for 2021 and 2022 with 10 free nights there as well.

Wish us luck!

I tried applying but got the warning message saying I would not be eligible for the bonus. Darn it. They did say the reason may be something else. I cheked again and according to your charts above and my careful reading of their terms and conditions I should be eligible as far as the Bonvoy cards are concerned (I have kept a sheet of every card – and that’s quite a lot to be modest – that we have applied for, received, denied, kept, cancelled since 2012). They did mention something about taking advantage of Amex offers (I have hardly got any in the last 4 years, and something else but I cleared the screen too quickly and don’t remember what that was. Maybe too many cards …. though I have only 1 business card and 3 personal ones all with little use. I suspect I can get the card, just no 100,000 to 125,000 point bonus, but I don’t think I want to just do it for the Platinum status. I have 2 cards I could cancel in case they think I have too many (one I am cancelling next month anyway after claiming some credits).

To add insult to injury, as soon as I’d decided to not go ahead with the application, my wife received a pre-appoved offer for the exact same card (even though our “troubles” with the issuer 4 years ago were identical and she has more of their cards than I do). That does us no good as I am the one with 30 free night certificates and she has only 2.

Do you think I could do better by calling?

Now it appears I can only upgrade to the Brilliant from my regular Bonvoy (old SPG) card. That seems to be the hangup and why I cannot get the bonus. I suppose I could call and ask if I cancel that one and then apply for the Brilliant would I get the bonus – but I doubt I could do it before 1/13/2021. Thats seems to be the reason my wife got the offer and I didn’t (she dropped her SPG card some time ago).

Hmm, it is my oldest AMEX card though. Any suggestions?

That’s a tough one. If you cancel there’s no guarantee that the pop-up will go away.

Yes, I think I will play it safe. That was my only way to get Platinum status … oh well. I will try again in January and see once more. Or I could just keep the new card and get an upgraded “free” night each year.

[…] Amex Bonvoy Brilliant offers automatic Gold status. […]

[…] to get it: Sign up for the $450 Marriott Bonvoy Brilliant™ American Express® Card, wait until the second year annual fee comes due, then call to request a product change to the $95 […]

[…] See more about the Bonvoy Brilliant here. […]

[…] apart from the currently-available Amex Marriott business credit card. In other words, both the Marriott Bonvoy Brilliant and the no-longer-available Marriott Bonvoy American Express card (the old SPG card) will also earn […]

I just got an emailed upgrade offer from the $95 Bonvoy to this card for 100K points for $5K spend in 3 months. Expires Apr 29 2020. With the current extension of the minimum-spend time, that is actually 6 months to meet the spend. I was thinking about cancelling that Bonvoy card when the AF comes due, but now I am wondering …

[…] night certificates good for any hotel that is available for 50,000 points or less. One is the Bonvoy Brilliant Amex Card. The other is the Ritz Card from Chase. The Ritz card is no longer available to apply new, but […]

FYI referral link is now 100k points instead of 75k valid through 4/24/2019.

[…] him, he had earned over 700,000 points from signup bonuses and was considering applying for the SPG Luxury Card (now called Bonvoy Brilliant): Over 700K and slowing down. Should Ben go for 125K more? Since […]

[…] card Gold status. The SPG Luxury Card and the Ritz-Carlton Card (no longer available to new applicants) both offer automatic Marriott […]

[…] card Gold status. The SPG Luxury Card and the Ritz-Carlton Card (no longer available to new applicants) both offer automatic Marriott […]

[…] SPG Lux (Starwood Preferred Guest Luxury Card from American Express) […]