| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

Following the news that referrals for some Chase credit cards can be generated through the Chase Mobile app, we’ve noticed that some signup bonuses on offer via referral are different to the standard signup bonus.

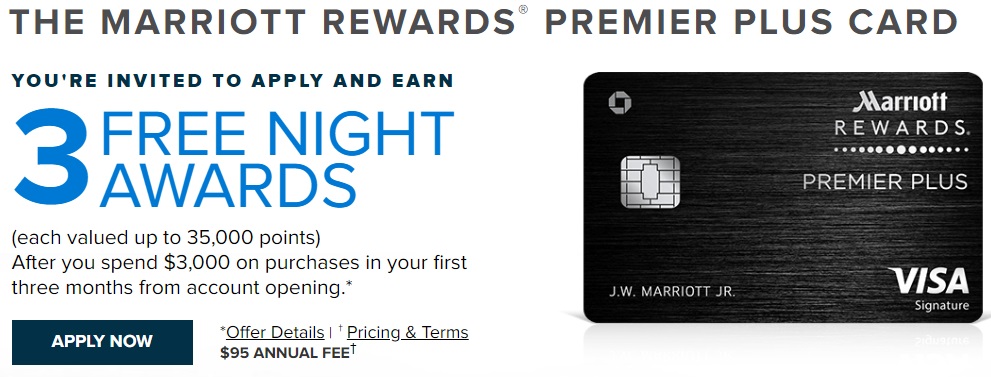

One of those is the Marriott Premier Plus credit card. The standard signup bonus is 75,000 bonus points, but the bonus generated via referrals offers three free nights valid for up to 35,000 points per night when spending $3,000 within the first three months.

The Offer

| Card Offer |

|---|

3 x 50K Free Night Certificates ⓘ Friend-Referral Earn three 50K free night certificates after $3K spend in 3 months$95 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Recent better offer: 5 x 50K free night certificates after $5K in spend (expired 1/9/24) |

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

$95 Annual Fee Earning rate: ✦ 6X Marriott Bonvoy ✦ 3X gas stations, grocery stores, and dining on up to $6K in combined purchases each year ✦ 2X everywhere else Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Earn Gold status when you spend $35K each year ✦ 1 Elite Night Credit towards elite status for every $5K spent Noteworthy perks: ✦ Annual free night certificate for 1 night at a hotel redemption level up to 35K ✦ Automatic Silver status ✦ 15 nights of elite credit each year ✦ 1 Elite Night Credit for every $5K spent See also: Marriott Bonvoy Complete Guide |

Quick Thoughts

This offer for three free nights has the potential to offer better value than the standard signup bonus. That’s because the free nights can be used at hotels charging up to 35,000 points per night, making this offer nominally worth 105,000 bonus points.

This type of signup bonus offers less flexibility than the 75,000 point signup bonus though. For starters, the free night certificates will expire in a year, whereas a bonus awarded in the form of straight points won’t expire so long as you continue having activity on your account. You can also take advantage of the 5th night free benefit on award nights with the points offer, whereas that’s not possible when using free night certificates.

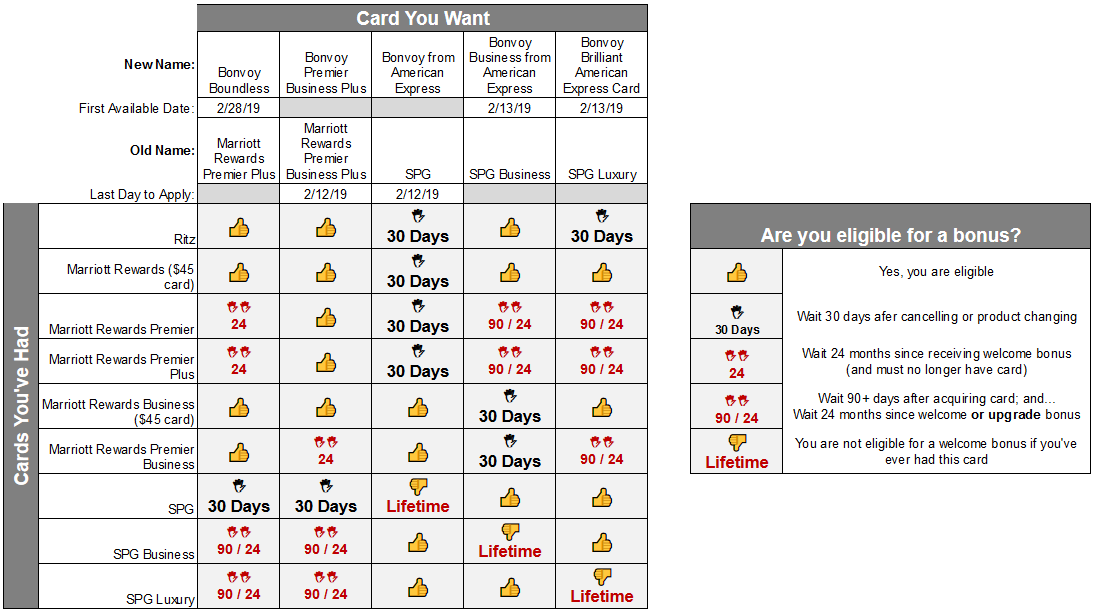

This card is subject to Chase’s 5/24 rule and there are other restrictions (see below) depending on what other Marriott and SPG credit cards you currently hold.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |