Amex Platinum cards come loaded with high end perks: Hundreds of dollars per year in various credit reimbursements, access to multiple types of airport lounges, hotel and car elite status, and much more. All of this goodness comes at a steep price:

- Consumer Platinum Card: $695

- Business Platinum Card: $695

There are multiple versions of the consumer Amex Platinum card. In addition to the regular card, there are Platinum cards branded by Morgan Stanley and Schwab. These cards are mostly the same, but they do each have a few unique benefits that can make one or the other a better fit for you.

The Business Platinum card is different in a number of ways. It offers different point earning bonuses and some different perks.

Annual Fees

Primary user

- Consumer Platinum Cards: $695 per year

- Business Platinum Card: $695

Authorized users for Platinum cards

It is possible to add authorized users for free by giving them Green or Gold cards instead of Platinum cards. In this case, the authorized users get very few perks. And it’s important to understand that the Gold card available as an authorized user card has none of the perks of the stand-alone Amex Gold Card. If you want your authorized users to get lounge access and other top end perks, they will need authorized user Platinum cards. These cost money to add to your account:

- Business Platinum: $350 per year for each Platinum employee card.

- Morgan Stanley Platinum: First Platinum authorized user card is free. Each additional authorized user is $195 per year.

- Other consumer Platinum cards: $195 per year for Platinum authorized users.

How to save money by sharing Amex Platinum benefits

If you have family or friends that you trust, consider sharing the cost of renewing your Platinum card each year by adding them as authorized users. The best card to do this with is the Morgan Stanley Platinum card since it offers the first authorized user free. Other Platinum cards will charge $195 for the first authorized user,

A Delta SkyClub membership alone costs $545 for 12 months. You can give friends the same access when flying Delta by adding them as authorized users. How much would your friends pay you for this benefit?

This table shows the total cost of card membership depending on how many authorized users are involved:

| Number of Platinum Cards | Consumer Platinum | Morgan Stanley | Business Platinum |

|---|---|---|---|

| 1 (Primary Only) | $695 | $695 | $695 |

| 2 (Primary + 1 AU) | $890 | $695 | $895 |

| 3 (Primary + 2 AUs) | $1085 | $890 | $1195 |

Amex Platinum Perks

Access to high end perks is the reason to hold an Amex Platinum card.

Perks for all Platinum cards

| Benefit | How to access or enroll | Available to Platinum Authorized users? |

|---|---|---|

| 5X points at amextravel.com: Earn 5X points for prepaid hotel and airline bookings at Amextravel.com | This benefit is automatic. | Yes. Points and bonus points are added to the primary card holder's account. |

| $200 airline fee credit: Amex will automatically reimburse up to $200 per calendar year for airline fees for your selected airline only. Eligible fees include: baggage fees, flight-change fees, in-flight food and beverage purchases, and airport lounge day passes. | Log in and go to Benefit page and click “Select a Qualifying Airline”. For tips on using this benefit, please see: Amex airline fee reimbursements. What still works? | No. Spend on authorized user cards does count, but only $200 per year will be reimbursed altogether. |

| Airport Lounge Access - Centurion Lounges, Airspace Lounges, Escape Lounges: Cardholder is allowed free in Centurion Lounges. In most cases guests will be charged $50 each (details here). Cardholder plus two guests are allowed free in Escape and Airspace Lounges. | No need to enroll. Simply show your Platinum card when visiting a Centurion Lounge. | Yes |

| Airport Lounge Access - Delta Sky Clubs: Cardholder is allowed free when flying Delta same day. Extra charge for guests. Starting Feb 2025: limited to 10 Sky Club visit-days per year (unless cardmember has spent $75K in a calendar year) | No need to enroll. Simply show your Platinum card and same day boarding pass when visiting a Delta Sky Club. | Yes |

| Airport Lounge Access - Plaza Premium Lounges: Cardholder plus one guest are allowed free when flying the same day. | No need to enroll. Simply show your Platinum card and same day boarding pass when visiting a Plaza Premium Lounge. See full list of lounges here. | Yes |

| Airport Lounge Access - Priority Pass Select Lounges: Priority Pass Select member plus two guests are allowed free entrance. Unfortunately, this membership does not include Priority Pass restaurants. | You must sign up for Priority Pass Select. Go to benefit page and click “Enroll in Priority Pass”. You will receive a membership card by mail. Present Priority Pass card and boarding pass at lounge entrance. | Yes. Each authorized user must sign up for Priority Pass Select. |

| Airport Lounge Access - select Lufthansa Lounges | Free access to Lufthansa Business Lounges (with confirmed ticket) or to Senator Lounges (with Business Class ticket) in the satellite building of Terminal 2 at Munich Airport and in Terminal 1, Departure Area B, at Frankfurt Airport. Valid only when flying Lufthansa, SWISS or Austrian Airlines. | Yes |

| Cell Phone Protection: Max $800 per claim, $50 deductible. | No need to enroll. Pay your cell phone bill with your Platinum card. | Yes |

| CLEAR credit: Get up to $189 per year reimbursed for CLEAR subscriptions. | No need to enroll. Pay for CLEAR with your Platinum card. See also: 5 ways to get CLEAR for less. | No. Spend on authorized user cards does count, but only $189 per year will be reimbursed altogether. |

| Global Entry or TSA Pre fee credit: Full reimbursement for signup fee once every 5 years, per card. Note: signup for Global Entry since that includes TSA Pre. | Sign up for Global Entry here. Pay with your Platinum card. Reimbursement should happen automatically. | Yes. Pay with the authorized user card in order to get reimbursed. Terms state “Additional Cards on eligible Consumer and Business accounts are also eligible for the $100 statement credit”. This works with no fee Green and Gold authorized user cards too. |

| Emergency Medical Transportation Assistance | Call the Premium Global Assist Hotline: 1-800-333-Amex (toll free), or 1-715-343-7977 (direct-dial collect) | Yes |

| Hilton HHonors Gold Status: Hilton Gold members receive free breakfast, room upgrades when available, and other perks at Hilton hotels. | Go to benefit page, find the Hilton HHonors Gold benefit, and click “Enroll Now”. | Yes. Authorized users may have to call Amex to enroll. |

| Marriott Gold Status: Marriott Gold members receive a points welcome gift with each stay, room upgrades when available, 2pm late checkout, and other perks (details here). | Go to benefit page, find the Marriott Gold benefit, and click “Enroll in Marriott Gold”. | Yes. Authorized users may have to call Amex to enroll. |

| International Airline Program: Save money when booking premium cabin international flights originating in the US or Canada. | Book your flight on amextravel.com. Make sure to log into your Amex account to see flight discounts. | Yes |

| Fine Hotels & Resorts: Book high-end hotels through Amex Fine Hotels & Resorts and get: room upgrade, daily breakfast for 2, 4pm late checkout, noon check-in, free wifi, and unique property amenity. Also: Earn 5X Membership Rewards for prepaid bookings. | Browse to www.americanexpressfhr.com and log into your Platinum account. | Yes |

| Fiesta Rewards Platinum Status | Use the Spanish language page: http://www.fiestarewards.com/inscripcion and enter code: AMEXPLATINUM | Yes |

| National Car Rental Executive status: Book midsize cars and select any car from the Executive Aisle for no extra charge. | Enroll here. | Yes |

| Hertz Rental Car Privileges: President's Circle Status, discounts, plus four hour grace period for rental car returns. | Details and enrollment form found here. | Yes |

| Cruise Benefits: Pay for your cruise with your Platinum card and receive $100 to $300 per stateroom shipboard credit plus additional amenities unique to each cruise line | Detailed terms can be found here. | Yes |

| Premium Private Jet Program: 20% off plus one time $500 credit towards Wheels Up Connect or 40% off plus one time $2K towards Wheels Up Core memberships. | Sign up here. | Yes |

| ShopRunner: Free shipping at a number of merchants. | Sign up here. | Yes |

| Neiman Marcus In-Circle | Call 1-800-525-3355 to enroll | Yes |

Perks for Business Platinum cards only

| Benefit | How to access or enroll | Available to Platinum Employee Cards? |

|---|---|---|

| 1.5X points per dollar: Earn 1.5X on individual purchases of $5000 or more; and on select categories: Construction material & hardware, Electronic goods retailers and software & cloud system providers, and Shipping providers | Automatic | Yes. Points and bonus points are added to the primary card holder's account. |

| $400 in Dell Credits: Up to $200 in credits each year from January through June; and another $200 July through December. | Go to benefit page to enroll. | No. Employee cards do not receive their own Dell credits. |

| $120 in Wireless Credits: Up to $10 per month when you use your card to pay for wireless telephone service. | Go to benefit page to enroll. | No. Employee cards do not receive their own wireless credits. |

| $360 in Indeed Credits: Up to $90 per quarter for purchases with Indeed | Go to benefit page to enroll. | No. Employee cards do not receive their own Indeed credits. |

| $150 Adobe Credits: Up to $150 per year on annual prepaid plans for Creative Cloud for teams and Acrobat Pro DC with e-sign for teams | Go to benefit page to enroll. | No. Employee cards do not receive their own Adobe credits. |

| 35% points rebate on airfare: Pay with points for airfare on your selected airline or for business or first class with any airline and get 35% of your points back. | Book flights through AmexTravel.com and select to pay with points. | No. |

Perks for Consumer Platinum cards only

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| $200 in Uber / Uber Eats Credits: Amex will reimburse $15 per month ($35 in December) for Uber charges. You will also get Uber VIP status. | Add your Platinum card number to your Uber account as a payment method. You do not have to pay with the Platinum card in order to get this benefit. Important: when requesting a ride, select Uber Cash for payment in order to use your credits. | No. Authorized user cards do not receive their own $200 in Uber credits or VIP status. |

| $200 Hotel Credit: Get $200 back per calendar year towards prepaid Fine Hotels + Resorts or The Hotel Collection bookings | No need to enroll. Book through Amex Travel and pay with your Platinum card. Hotel Collection bookings require a minimum two-night stay. | No. Spend on Authorized user cards does count, but only $200 per year will be reimbursed altogether. |

| $240 Digital Entertainment Credit: Up to $20 per month rebate for select digital entertainment services (Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, SiriusXM, The New York Times and The Wall Street Journal) | Enroll here. Enroll in any of the listed services and pay with your Platinum card. | No. Spend on Authorized user cards does count, but only $20 per month will be reimbursed altogether. |

| $100 in Saks Fifth Avenue Credits: Up to $50 in credits each year from January through June; and another $50 July through December. | Enroll here. Pay with your consumer Platinum card at Saks Fifth Avenue online or at locations in the US and US Territories. | No. Spend on Authorized user cards does count, but only $50 per 6 months will be reimbursed altogether. |

| Free Walmart+ Subscription: Get back the full cost, including taxes, for a Walmart+ monthly subscription. | No need to enroll. Use your Platinum card to pay for a monthly Walmart+ subscription. | No. You can use an Authorized user card to pay, but you won't get more than one credit per month. |

| $300 Equinox Credit: Get $300 back per year in statement credits for a digital or club membership at Equinox. There is a yearly option for Equinox+ (the app) membership that is $300 annually. | Enroll here. Use your Platinum card to pay for a digital or club membership at Equinox. | No. Spend on Authorized user cards does count, but only $300 will be reimbursed altogether. |

| $300 SoulCycle Rebate: Charge the full price of a SoulCycle at-home bike and get $300 back in statement credits. | Must join Equinox first (see above). | Sort of: Each Platinum account can get $300 back on each of 15 bikes purchased per year. |

| 5X points on flights booked directly with airlines. With business cards you must book through Amex Travel to get 5X. | Automatic benefit | Yes. Points and bonus points are added to the primary card holder's account. |

| Active Military Fee Waiver: Amex will waive consumer card fees (including annual fees) for US active military personnel. | Call the number of the back of your card and tell them you are serving on active duty military and had heard that AMEX offers to handle your account in accordance with the Military Lending Act (MLA) | Yes (primary user must call and can get fees waived for additional cardholders) |

Perks for Morgan Stanley Platinum cards only

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| First authorized user free: Add one Platinum authorized user for free. Additional AU's are $195 each. | Simply add an authorized user to your account | N/A |

| Invest with rewards: Liquidate Membership Rewards points for 1 cent each when deposited to your Morgan Stanley brokerage account. | Log into your account to redeem points to your brokerage account. | No. |

| $500 anniversary spend award: Spend $100K in a cardmember year to get $500. If you spend exactly $100K per year, that amounts to a bonus of half of 1 cent per dollar spent. | This benefit is automatic | Not really. Authorized user card spend does contribute towards the required $100K spend, but authorized users do not get their own $500. |

| $695 Annual Engagement Bonus: Platinum CashPlus clients can get a $695 Annual Engagement Bonus. | Details here: Morgan Stanley Platinum Card Fee Free (how to earn the Annual Engagement Bonus) | No |

Perks for Charles Schwab Platinum cards only

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| Invest with Rewards: Liquidate Membership Rewards points for 1.1 cents each when deposited to your eligible Schwab account. | Log into your account to redeem points to your Schwab account. | No. |

| $100 to $200 statement credit | Receive a $100 Card statement credit if your qualifying Schwab holdings are equal to or greater than $250,000 or receive a $200 Card statement credit if your qualifying Schwab holdings are equal to or greater than $1,000,000, when measured following Card account approval and annually thereafter. | No. |

Which Platinum card is best for me?

Your first decision point should be consumer vs. business:

- A business Platinum card is best if you highly value the 35% Pay with Points rebate, $120 in wireless credits, and $400 in Dell credits.

- A consumer Platinum card is best if you highly value Uber credits, hotel credits, Digital Entertainment credits, Equinox credits, Saks credits, Walmart Plus credits, and the ability to earn 5X directly with airlines.

Which consumer Platinum card is best?

If you decide that a consumer card, rather than a business card, is right for you (see above), then consider these decision points:

- The Morgan Stanley Platinum card is best if you want to add a Platinum authorized user (since the first AU is free), or if you qualify for $695 annual engagement bonus.

- The Charles Schwab Platinum card is best if you prefer cash back over travel rewards since it lets you cash out points at 1.1 cents each; or if you have a lot of money invested with Schwab since you’ll get an annual kickback ($100 for $250K invested, or $200 for $1M invested).

Amex Platinum Application Tips

Should you apply?

Platinum card welcome bonuses are usually worth considerably more than the card’s annual fee. So, as long as you can make use of some of the card’s perks, and as long as you can meet the offer’s minimum spend requirements, it makes sense to sign up for at least one year. You can always cancel (or downgrade to a less expensive card) once the annual fee comes due in year 2 so as to avoid paying for the second year.

Are you eligible?

Anyone with decent credit is eligible for the regular consumer Platinum card. Other cards do have requirements:

- Morgan Stanley Platinum: To get this card you must have a Morgan Stanley account. Fortunately, a low-end Morgan Stanley Access Investing account works fine.

- Schwab Platinum: To get this card you must have a Charles Schwab account. Fortunately, even a no-fee checking account is fine. And, incidentally, Schwab has one of the best no-fee debit cards around with no foreign transaction fees and it reimburses ATM fees.

It’s not possible to earn welcome offers on all three cards. You’re only eligible for a welcome offer on the regular and Schwab Platinum cards if you’ve never held any of three cards previously. The Morgan Stanley Platinum card doesn’t have the same restrictions (yet).

More:

You must have a business (but you probably do): In order to apply for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so.

How to apply for an Amex Platinum card

Simply click through to the appropriate application page and fill out the details. Here are the current welcome bonus offers. Click the offer you are interested in for more details and then click through to the application page. Note that some people find an even better offer for the generic consumer Platinum card by checking the CardMatch Tool.

| Card Offer |

|---|

80K points ⓘ Non-Affiliate 80K after $8K spend in first 6 months. Terms apply. (Rates & Fees)$695 Annual Fee This card is only available to clients that maintain an eligible Schwab brokerage account. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 100K points + 10x when you Shop Small in the US & at restaurants worldwide [Expired 1/20/22] |

80K points ⓘ Non-Affiliate 80kK after $6K spend in first 6 months. Terms apply. (Rates & Fees)$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 125K points after 6k spend [Expired 11/8/23] |

100K Points ⓘ Non-Affiliate 100K points after $8K spend in 6 months + 10x on dining for 6 months (on up to $25K in purchases). Terms apply.$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 175K after $8k spend (referral only, expired 4/8/24) |

150K points ⓘ Affiliate 150K points after $20K spend in the first 3 months. Terms apply. (Rates & Fees)$695 Annual Fee Alternate Offer: Targeted online offer of 170K points after $15K spend in the first 3 months See this post for details. |

After you apply, you can check application status here.

Amex Platinum reconsideration

If denied, call reconsideration: 877-399-3083 (new account holders); 866-314-0237 (current account holders)

How to Earn Membership Rewards Points

Credit card welcome bonuses

The easiest and quickest way to earn Membership Rewards points is through Amex credit card welcome bonuses.

Most Amex welcome offers stipulate that you can’t get the bonus if you’ve ever had that card before. Additionally, you’re only eligible for a welcome offer on the regular and Schwab Platinum cards if you’ve never held any of three Platinum cards previously. The Morgan Stanley Platinum card doesn’t have the same restrictions (yet). So, if you wanted to earn welcome offers on more than one card, it’s best to get the regular or Schwab Platinum first, then move on to the Morgan Stanley. Additionally, targeted offers sometimes do not have that once per lifetime language. In those cases, you can get the bonus even if you’ve had the card before. See: 8 ways to get the best targeted Amex welcome bonus offers.

Below are the Amex cards with the best current and public Membership Rewards welcome offers.

| Card Offer |

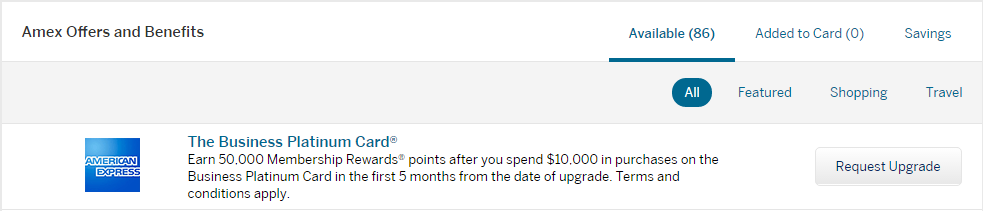

Credit card upgrade bonuses

Amex frequently offers bonus points for upgrading from one card to another. For example, we’ve seen 50,000 point offers for upgrading from the Business Gold Rewards card to the Business Platinum card. Even better, these upgrade offers often do not have the once per lifetime language. That is, if you are targeted for an upgrade offer, you may be able to earn the bonus points even if you’ve had the card before. It is best to accept these offers only after you have earned a signup bonus for the higher end card.

One strategy to try with Platinum cards is to downgrade to the lower priced Green card when your second year annual fee comes due. Then wait and hope to get an upgrade offer to go back to Platinum.

Credit card category bonuses

The next best way to earn Membership Rewards points is by using the best card for each category of spend. If you spend a lot personally or through your business on any of the below categories, you can do very well. Particularly noteworthy is the no-annual-fee Blue Business Plus Credit Card which offers 2 points per dollar for all spend, up to $50K spend per calendar year (then 1X thereafter). That’s fantastic.

| Spend Category | Best Options |

|---|---|

| US Supermarkets |

American Express Gold 4X (up to $25K per year, then 1X) EveryDay Preferred Up to 4.5X* (max $6K per year) |

| US Gas Stations |

Business Gold Rewards Up to 4X** EveryDay Preferred Up to 3X* |

| Restaurants | American Express Gold 4X American Express Green 3X Business Gold Rewards Up to 4X** |

| Travel (Broadly Defined) | American Express Green 3X |

| Flights |

Platinum consumer cards 5X Business Platinum (via Amex Travel) 5X Business Gold Rewards Up to 4X** American Express Gold 3X American Express Green 3X |

| Prepaid Hotels |

Platinum cards (via Amex Travel) 5X American Express Green 3X |

| Select Car Rental Companies | American Express Green 3X Morgan Stanley Credit Card 2X |

| US Shipping | Business Gold Rewards Up to 4X** |

| US Advertising in select media | Business Gold Rewards Up to 4X** |

| US Computer related purchases |

Business Gold Rewards Up to 4X** |

| Rakuten portal shopping | Rakuten Visa 3X + portal rewards |

| Everywhere else | Blue Business Plus 2X EveryDay Preferred 1.5X* |

* The Amex EveryDay Preferred card earns a 50% bonus every billing period in which the card was used for 30 or more transactions. Before the 50% bonus, the card has the following bonus categories: 3x points at US supermarkets on up to $6,000 per year in purchases (then 1x); 2x points at US gas stations; 1x points on other purchases. After the 50% bonus, it offers: 4.5x points at US supermarkets on up to $6,000 per year in purchases (then 1.5x); 3x points at US gas stations; 1.5x points on other purchases.

** The Business Gold Card offers 4X on the two categories where your business spends the most each billing cycle from the following categories: ⚬ US purchases at restaurants ⚬ Airfare purchased directly from airlines ⚬ U.S. purchases for advertising in select media ⚬ U.S. purchases at gas stations ⚬ U.S. purchases for shipping ⚬ U.S. computer hardware, software, and cloud computing purchases made directly from select providers. 4X applies to first $150,000 in combined purchases in your two categories each calendar year, 1X point per dollar thereafter and on other purchases. Terms apply.

Credit card referrals

Another great way to earn Membership Rewards points is by referring friends and relatives. In some cases referral bonuses are really big. However, if you want to keep your friends, then make sure that the offer they get is as good as the best available public offer (compare to our Best Offers page).

Log into your account to check for any special referral offers.

Note that this option is especially powerful since you can now refer friends to other cards — even to cards you do not have. See this post for full details: Maximizing value from Amex multi-referrals.

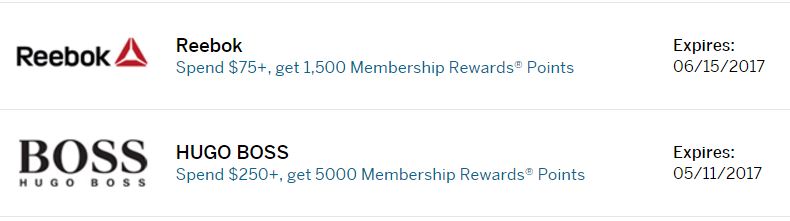

Amex Offers

Amex Offers are usually best for saving cash. But, sometimes Amex Offers provide terrific opportunities for point earning instead. One (now expired) example was an offer for Reebok: Spend $75 or more, Get 1,500 Membership Rewards points. And one for Hugo Boss: Spend $250 or more, Get 5,000 points.

Sometimes Amex Offers are longer term and act more like a new category bonus. For example, you’ll often see offers to earn 2X rewards at various merchants.

Log into your account and check the section titled “Amex Offers and Benefits” to look for offers like these.

Other options to earn Membership Rewards

FX International Payments

Amex offers businesses the ability to earn 1 Membership Rewards point per $30 of foreign wire payments (max 4,000 points per transaction). Even better, you may receive a welcome bonus offer like the one shown above (keep an eye out for this in your mailbox or email!).

Where to Redeem Membership Rewards Points

In general, Membership Rewards points are worth up to 1 cent each when redeemed for merchandise or gift cards. Fortunately, there are three ways in which it is possible to get more value: redeem points for flights, transfer points to hotel or airline partners, or invest rewards. More on each below…

Redeem points for travel

The Business Platinum Card offers a 35% Airline Bonus: Get 35% of your points back when you redeem points through Amex Travel for either a First or Business class flight on any airline, or for any flights with your selected airline.

After you receive the 35% rebate, the value works out to 1.54 cents per point. That's very good, but it does require owning this ultra-premium card.

Transfer points to travel partners

The best use of Membership Rewards points, in my opinion, is to transfer points to airline and hotel partners in order to book high value awards. Your best bet is usually to wait until you find a great flight or night award before transferring points. One exception: Amex often offers 30% or higher transfer bonuses to certain programs (Virgin Atlantic and British Airways are two recent examples). If you’re confident that you’ll use the points for good value, it may make sense to transfer points when those bonuses are in effect.

For specific examples of great ways to use points transferred to airline miles, please see: Amex Membership Rewards sweet spots.

Current Amex transfer bonuses

Here are the currently available transfer bonuses from Amex Membership Rewards (this table will update automatically when new offers are found):

| Transfer Bonus Details | End Date |

|---|---|

| 30% transfer bonus from Amex Membership Rewards to Virgin Atlantic Flying Club | 05/31/24 |

Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user or employee on the account.

Amex transfer partners

It is free to transfer Membership Rewards points to foreign airlines. For transfers to US airlines, however, Amex charges an “excise tax offset fee” of $0.0006 per point (with a maximum fee of $99). Airlines subject to this fee are noted below.

| Rewards Program | Amex Transfer Ratio | Best Uses |

|---|---|---|

| Aer Lingus Avios | 1 to 1 | Fuel surcharges are sometimes lower when booking with Aer Lingus (Avios.com) rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| AeroMexico ClubPremier | 1 to 1.6 | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. |

| Air Canada Aeroplan | 1 to 1 | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | 1 to 1 | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| ANA Mileage Club | 1 to 1 | Redeem for Star Alliance flights. Multiple stopovers allowed. ANA offers many great sweet-spot awards, including flying around the world in business class for as few as 115K miles! See also: ANA - a terrific Membership Rewards gem. |

| Avianca LifeMiles | 1 to 1 | Avianca LifeMiles can be great for Star Alliance awards. They offer reasonable award prices and no fuel surcharges on awards. They also offer shorthaul awards within the US (for flying United, for example) for as few as 7,500 miles one-way. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. |

| British Airways Avios | 1 to 1 | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Cathay Pacific Asia Miles | 1 to 1 | Cathay Pacific has a decent distance based award chart, but they no longer allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. |

| Choice | 1 to 1 | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. |

| Delta SkyMiles | 1 to 1 plus excise tax | Delta no longer charges change or cancellation fees on awards originating in North America. Flash award sales and flights to/from locations other than the U.S. or Canada can offer great value. See: Best uses for Delta miles. |

| Emirates Skywards | 1 to 1 | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. See: Emirates Sweet Spot Awards - First class from 30K miles round trip. |

| Etihad Guest | 1 to 1 | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. |

| Hawaiian Miles | 1 to 1 plus excise tax | Hawaiian Airlines’ award prices tend to be quite high, but there are some not-terrible uses: fly to neighboring islands for 7.5K miles, fly first class round-trip from Hawaii to South Pacific islands for as few as 95K miles, fly first class round-trip from Hawaii to Australia for as few as 130K miles, or use miles to upgrade paid flights. |

| Hilton | 1 to 2 | 5th Night Free awards. Best value is usually found with very low end or very high end Hilton hotels. Bonus: award nights are not subject to resort fees. |

| Iberia Avios | 1 to 1 | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| JetBlue | 250 to 200 plus excise tax | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 1 to 1 | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Qantas Frequent Flyer | 1 to 1 | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. I recommend comparing award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) |

| Qatar Privilege Club Avios | 1 to 1 | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | 1 to 1 | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Virgin Atlantic Flying Club | 1 to 1 | Virgin Atlantic offers a few great sweet spot awards including US to Europe on Delta One business class for 50K points one-way. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

Cash back

Other options for redeeming Membership Rewards

You can also redeem points for gift cards or merchandise. At most, with this approach you’ll get 1 cent per point value, but usually you’ll get quite a bit less.

You can also use points to pay some merchants directly (Amazon.com, for example). Don’t do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your Ultimate Rewards points – causing you a headache in getting your points reinstated).

Managing Membership Rewards Points

Combine Points

Amex automatically pools all of your points together. When you earn points with different cards, the point total shown when viewing either card is the total across cards.Share Points

Unlike Chase and Citibank, Amex doesn’t allow members to move points from one person’s account to another. That said, it is possible to transfer one person’s points to another person’s loyalty program account. The key is that the person who receives the points must be an authorized user or employee on the other person’s account. For example, my wife can transfer Membership Rewards points to my Virgin Atlantic account as long as I’m an authorized user (or employee) on any of her Membership Rewards cards.An authorized user card must be active for 90 days before it will unlock the ability to transfer your points to the authorized user’s loyalty program account.

How to Keep Points Alive

Thankfully, it is very easy to keep Amex Membership Rewards points alive. Simply keep any Membership Rewards card open. For example, if you are about to close your one and only Membership Rewards card, then open another Membership Rewards card account first in order to preserve your points. Amex offers some no-fee Membership Rewards cards, such as the Blue Business Plus and the Amex Everyday, so this shouldn't be much of a burden.Amex Platinum: Should I Keep or Cancel?

Deciding whether to keep or cancel Amex Platinum cards can be a tough decision. Given the card’s very high annual fee, it’s a significant investment to keep the card year after year. If you make good use of the card’s perks, though, it can be well worth it. For example, a Delta SkyClub membership alone currently costs $545 for 12 months, but you get the same access when you’re a Platinum cardholder. Plus, the Platinum card gives you access to many other lounges including Amex Centurion Lounges and Escape Lounges, both of which are arguably the best domestic airport lounges in the US.

Summary of All Amex Platinum Cards

Here’s summary information about each currently available Amex Platinum card variation. Click through any of the links for more details:

| Card Offer and Details |

|---|

150K points ⓘ Affiliate 150K points after $20K spend in the first 3 months. Terms apply. (Rates & Fees)$695 Annual Fee Alternate Offer: Targeted online offer of 170K points after $15K spend in the first 3 months See this post for details. FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Click here for our complete card review Earning rate: 5X flights and prepaid hotels at AmexTravel.com ✦ 1.5X points per dollar on eligible purchases of $5000 or more (on up to $2 million of those purchases per year) ✦ 1.5x on US construction/hardware stores, US electronic goods, and US shipping ✦ 1X elsewhere ✦ Terms apply. Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Select one qualifying airline and receive up to $200 in statement credits per calendar year for qualifying charges ✦ Up to $400 a year in statement credits for Dell purchases ($200, twice-yearly) ✦ Up to $120 in wireless services credits per year ($10 per month) ✦ $100 Global Entry fee reimbursement.✦ Priority Pass membership (Lounges only) with 2 guests and other airport lounge benefits (Centurion and Delta) ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Gold status. ✦ $189 CLEAR fee reimbursement annually ✦ 35% Airline Bonus: Get 35% points back after you Pay With Points for flights with your selected airline (or premium cabin with any airline). Enrollment required for select benefits See also: Amex Platinum Guide |

100K Points ⓘ Non-Affiliate 100K points after $8K spend in 6 months + 10x on dining for 6 months (on up to $25K in purchases). Terms apply.$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 175K after $8k spend (referral only, expired 4/8/24) FM Mini Review: This card is absolutely loaded with high end perks. Depending upon your situation, those perks may be worth the annual fee or much more. Earning rate: 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $200 a year in statement credits for incidental fees at one qualifying airline per calendar year ✦ $200 prepaid hotel credit per calendar year valid on Fine Hotels & Resorts and The Hotel Collection bookings ✦ Up to $20 per month rebate for Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, SiriusXM, and/or The Wall Street Journal ✦ $15 monthly Uber or Uber Eats credit ($20 in December, use it or lose it each month) ✦ $189 CLEAR fee reimbursement per calendar year ✦ $12.95 (+tax) monthly credit for Walmart+ monthly membership subscription credit when you pay with Platinum card ✦ Up to $100 in credits annually for purchases at Saks Fifth Avenue (up to $50 in credits semi-annually) ✦ Priority Pass membership (Lounges only) with 2 guests and other airport lounge benefits (Centurion and Delta) ✦ Rental car elite status ✦ Marriott Gold status ✦ Hilton Honors Gold status Enrollement required for some benefits. Terms Apply. (Rates & Fees) See also: Amex Platinum Guide |

80K points ⓘ Non-Affiliate 80kK after $6K spend in first 6 months. Terms apply. (Rates & Fees)$695 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 125K points after 6k spend [Expired 11/8/23] FM Mini Review: In my opinion, this is the best of the consumer Amex Platinum cards when you need two cards thanks to Morgan Stanley offering one free authorized user. Unfortunately you do need to have a Morgan Stanley account to apply. Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X prepaid hotels booked with American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Big spend bonus: $500 after $100K cardmember year spend Noteworthy perks: This card includes all of the great perks that come with the American Express Platinum Card, plus: ✦ 1 Free Authorized User ✦ Redeem points for 1 cent each into your Morgage Stanley account ✦ $695 Annual Engagement Bonus for Platinum CashPlus accounts See also: Amex Platinum Guide |

80K points ⓘ Non-Affiliate 80K after $8K spend in first 6 months. Terms apply. (Rates & Fees)$695 Annual Fee This card is only available to clients that maintain an eligible Schwab brokerage account. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 100K points + 10x when you Shop Small in the US & at restaurants worldwide [Expired 1/20/22] Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: This card includes all of the great perks that come with the American Express Platinum Card, plus: ✦ Use Membership Rewards® points for deposits by Schwab to your eligible brokerage account. (For example, 10,000 points = $110) ✦ $100 credit with Schwab holdings of $250,000+ or $200 credit with holdings of $1,000,000+ on approval & each year. See also: Amex Platinum Guide |

[…] Frequent Miler – Amex Platinum Complete Guide […]

Here’s an amusing data point. I’ve had an American Express Platinum Business card since before the pandemic, which was originally for a business my wife and I were running together. However, during the pandemic this business mostly went on pause, and I wanted to cancel/downgrade the card but they waived the annual fee, then in the next year they upped the benefits so it was worth keeping. But finally this year I wanted to downgrade it, since I didn’t really need the overlapping benefits with my personal Amex Platinum card. The CSR talked me into downgrading to a Business Gold card since I actually could use the multipliers and I could justify the annual fee, and I was working on another signup bonus so wasn’t really ready to do another business card signup to try to get the welcome bonus again. The alternative was a paltry 60K retention offer.

Fast forward a month later, I have the Business Gold card and was actually using it for spend, but lo and behold I get an UPGRADE offer back to a Business Platinum for 140,000 points with $10K spend over 3 months! Since I’ve finished my signup spending on the other card, I could hardly turn down this offer, given the large value of 140,000 points, which combined with my existing bank of MR would give us enough points to fly my whole family to Japan next summer in business class (though I think we’ll probably use it for Premium Economy instead, since we all sleep pretty well in economy). Pretty amazing.

Nice resource. But can you please clarify one point? Regarding the Priority Pass you wrote: “Yes. Each authorized user must sign up for Priority Pass Select.” I enabled this benefit but I don’t see how to sign up separately for the AU. Will they just mail two cards for each user or do I need to call Amex?

I called in and get the answer. You need to create a login for the AU and sign into their account to activate this benefit. You reeive the PP # immediately on the screen and you are able to create a login on the app, so it seems you can use the card electronically before you receive it physically.

I called in and got the answer.

You need to create a login for the AU and sign into their account to activate this benefit. You receive the PP # immediately on the screen and you are able to use it to create a login on the app, so it seems you can use the card electronically before you receive it physically.

I just applied for Schwab platinum and got pop-up saying I wasn’t eligible for the welcome offer. I have never had a Schwab platinum. I have not opened a new Amex account in over 5 years. I do have a 5 year old vanilla Platinum, a 7 year old blue business plus, and Bonvoy (converted from old SPG card). I also closed Gold card and Hilton card in 2018.

I was surprised I am ineligible for the signup bonus based on your info here. Any ideas?

That’s crazy. We do hear stories like that every now and then. You could try calling to apply and see if that gets you through without a warning.

Guests can I use all 5 of the guest passes at the same time. I ha be the plattnum membership

Thanks amex! As an infrequent traveler with a fam, I was irrationally attracted to the lounge benefit. No worries now.

We have a Amex Platinum card and have added an authorized user for $175…we called to add another AU and they said it would be another $175 but above it says we should get three AU’s….help please

I think it’s $175 per card up to 3 AU cards. Obviously not 3 cards for $175.

It is a flat $175 for up to three additional AU cards. I would either HUCA or just trust the I go you were given by the customer service agent was wrong and that AmEx will bill it correctly.

Thanks!!!

I added a second user long after the first and was not charged an additional fee.

Appreciate it!!!

I believe that the “Preferred Hotels & Resorts Lifetime Elite Status” benefit is an error of some sort. When I registered using the link, I only received basic membership and there is no reference to it on Amex’s Platinum Travel Benefits page.

Sorry about that. I’ll take it out of the chart. It was always only supposed to work in India, but it used to work in the U.S.

Hi Greg. I couldn’t seem to find if you mentioned Plaza Premium lounges in your excellent write-up. They are relevant because I believe that are accessible with a Consumer Platinum card but not accessible with Priority Pass (an advantage of AMEX vs. Chase). Also, I’m not positive, but I think that Plaza Premium lounges will be available to guests without paying the new AMEX Platinum guest fee.

Greg, in the referral section, you might want to note that the referral bonuses received by holders of the Charles Schwab and Morgan Stanley versions of the Platinum Card are not attractive. $100 per referral (up to $550 per year) as opposed to *YMMV* Membership Rewards points (up to 55k or 100k MR per year, depending). While the CS and MS have their unique perks, the referral bonus difference is a major shortcoming for some.

Three questions I’d really appreciate help with:

1) I added an AU to my personal platinum in September and paid the $175 then. Can I add two more now for free?

2) I have an offer for 10K points to add an AU on my Platinum. Will that work, if I already have one AU and have already paid the $175?

3) Can I add someone as an authorized user while they have a Platinum card? (My mother is about to cancel hers, but has a trip before the new card would come.)

1) Yes

2) Yes, add another one. They also don’t have to be Platinum – you can have Gold AUs, but they won’t get the Platinum AU benefits.

3) Yes

Thanks so much!

Used the link in your article for Elite status at Preferred Hotels and Resorts and followed the sign-up instructions, however when checking my status on the Preferred website, no status has been given. Is this benefit still available?

I had the same problem. Perhaps it’s no longer active? Anyone have any success with the Preferred Hotels Elite Status Benefit?

Just a caveat regarding the FHR benefits. Although Amex permits booking an FHR for only one night, in practice some properties require a two night stay to get the benefit. These same properties however do permit one night stays using their own website on the variety of dates I checked. I feel AMEX should remove the offending properties from their list.

There are two different programs bookable thorugh Amex Travel. One is Fine Hotels and Resorts, the other is The Hotel Collection. FHR properties only require one night, but THC properties require two. I imagine that’s probably what you’re noticing?

Many clubs allow use of the spa without a membership – do you think paying for a couple of massages would trigger the $300? That would be terrific if so.

I heard Equinox was not accepting new customers as of 1/1/23